Turkey Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Turkey Vegan Cosmetics Market Overview:

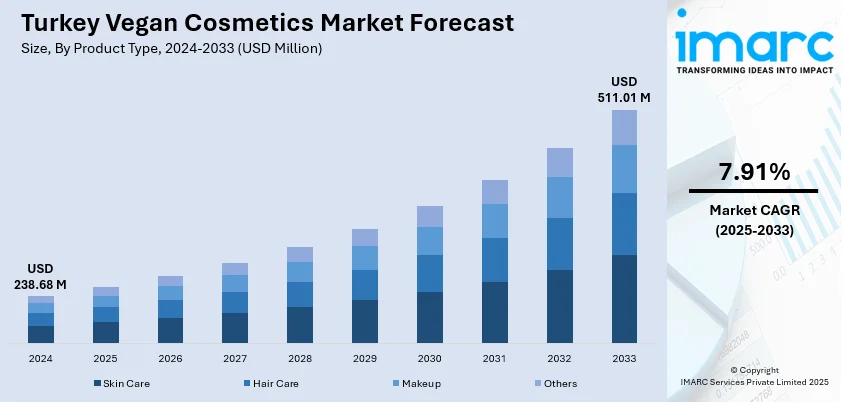

The Turkey vegan cosmetics market size reached USD 238.68 Million in 2024. Looking forward, the market is expected to reach USD 511.01 Million by 2033, exhibiting a growth rate (CAGR) of 7.91% during 2025-2033. The market is spurred by growing consumer sentiments around cruelty-free and plant-based products, the uptick in demand for halal-approved vegan alternatives, and an emerging appetite for locally sourced natural ingredients. Urban youth, inspired by social media and ethical lifestyle movements, are also driving the trend toward open, sustainable beauty. Turkish small and mid-size brands are at the forefront of introducing environmentally friendly packaging and minimalist formulations, winning over health-aware consumers. Such changing consumer attitudes are fueling consistent growth in the Turkey vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 238.68 Million |

| Market Forecast in 2033 | USD 511.01 Million |

| Market Growth Rate 2025-2033 | 7.91% |

Turkey Vegan Cosmetics Market Trends:

Emerging Halal-Vegan Synergy and Cultural Relevance

The dynamic, cross-cultural fusion of halal certification and vegan principles makes Turkey's cosmetic industry particularly distinctive, with far-reaching implications for the future of conscious beauty. Turkish consumers hold halal products that conform to religious dietary and moral standards in esteem, and interest is growing in plant-based, cruelty-free personal care products that conform to both halal standards and international vegan principles. Local companies are more frequently launching vegan variants alongside halal labelling, developing a product with both ingredient purity and religious suitability appealing to ethically conscious consumers. Such synergy reinforces confidence in brand identity, particularly in urban hubs such as Istanbul and Ankara where beauty consumers anticipate open sourcing and tracing of ingredients. The vegan-halal format is ideally suited to skincare ranges based on plant extracts such as olive oil, rosehip, and fig – all of which are region-specific and revered in Turkish culture. Consequently, vegan brands that provide halal credentials earn greater authenticity in the local markets, leveraging Turkey's distinct combination of modern ethics and cultural heritage to promote vegan cosmetics uptake, and further contributing to the Turkey vegan cosmetics market growth.

To get more information on this market, Request Sample

Revival of Indigenous Botanicals and Green Beauty Tradition

One of the trends among Turkey's vegan cosmetics industry is the renewed popularity of local botanical ingredients that respect traditional Turkish beauty practices while finding an audience among consumers who are in search of cruelty-free and plant-based products. Beauty brands are bringing attention to local jewels like olive leaf extract, black cumin seed oil, pomegranate husk, and Anatolian herbs, which are ingredients that are naturally vegan and regionally steeped. Local manufacturers are tapping into centuries-long practices of traditional centers such as Bursa and Gaziantep, containing them in bare, sustainable packaging that speaks of authenticity and sustainability. Most Turkish small brands focus on cold-pressed oils, waterless products, and natural preservatives, which speak volumes about green beauty innovation. This local botanical diversity paired with minimalist design and natural aesthetics resonates deeply with vegans concerned about locally sourced and eco-friendly products. This intersection of timeless beauty knowledge and contemporary vegan ethics signals a strong and locally relevant trend in Turkey's expanding cosmetics market.

Social Media Influence and Youth Ethos Driving Vegan Awakening

Growth in digital beauty culture among Turkish youth is driving vegan cosmetics interest, with influencers, micro‑creators, and wellness bloggers influencing ingredient knowledge and ethical purchasing. Social media platforms such as Instagram, YouTube, and native Turkish content platforms have engaged communities comparing cruelty-free labels, revealing cosmetic ingredient tables, and advocating for vegan lifestyle principles. The younger generation's values around conscious consumption is forcing brands to provide transparent labeling, vegan certification, and sustainable packaging. Turkish vegan cosmetics brands are reacting by introducing minimalist skincare regimens, cruelty‑free make‑up staples, and multi‑functional botanical serums that respect skin-first principles. Apart from this, most brands partner with regional influencers who highlight fair practices and ethical sourcing and produce viral moments around new vegan offerings based on local traditions such as rose water mists or olive kinesiology balm. This is strongest in urbanized cities like Istanbul, Izmir, and Antalya where digital literacy and levels of ethical consumerism are high. The outcome is a social media-driven vegan cosmetics movement and youth-encouraged cultural change within Turkey's beauty sector.

Turkey Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

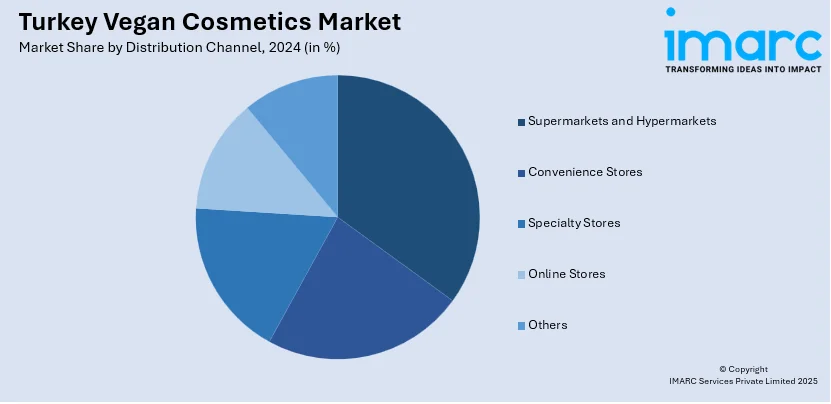

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey vegan cosmetics market on the basis of product type?

- What is the breakup of the Turkey vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Turkey vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Turkey vegan cosmetics market?

- What are the key driving factors and challenges in the Turkey vegan cosmetics market?

- What is the structure of the Turkey vegan cosmetics market and who are the key players?

- What is the degree of competition in the Turkey vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)