Turkey Virtual Data Room Market Size, Share, Trends and Forecast by Component, Deployment Type, Enterprise Size, Business Function, Vertical, and Region, 2025-2033

Turkey Virtual Data Room Market Overview:

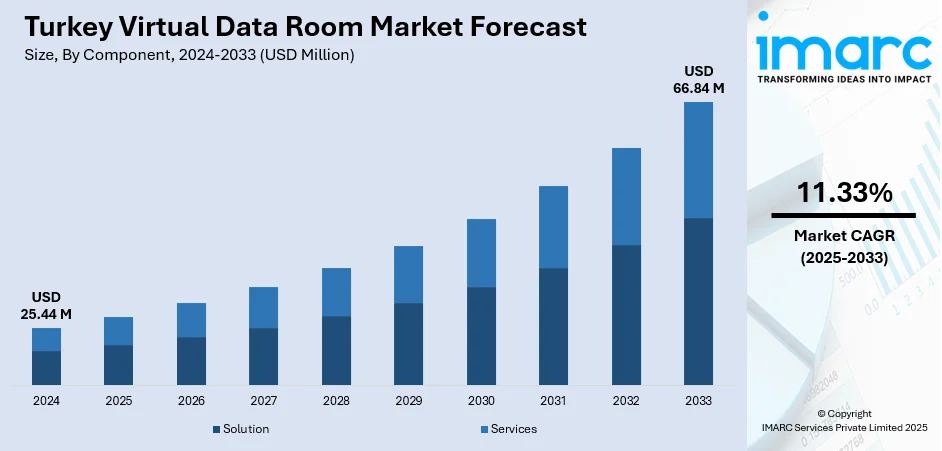

The Turkey virtual data room market size reached USD 25.44 Million in 2024. The market is projected to reach USD 66.84 Million by 2033, exhibiting a growth rate (CAGR) of 11.33% during 2025-2033. Infrastructure projects involve collaborations among multiple stakeholders like contractors, investors, government agencies, and financial institutions, requiring centralized platforms for real-time communication and document sharing. Besides this, the growing adoption of artificial intelligence (AI), which aids in enhancing efficiency and security, is contributing to the expansion of the Turkey virtual data room market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.44 Million |

| Market Forecast in 2033 | USD 66.84 Million |

| Market Growth Rate 2025-2033 | 11.33% |

Turkey Virtual Data Room Market Trends:

Rising number of real estate and infrastructure deals

Increasing number of real estate and infrastructure deals is fueling the growth of the market in Turkey, as these sectors involve extensive documentation, due diligence, and regulatory compliance requirements. As per the IMARC Group, the Turkey real estate market size reached USD 64,776.2 Million in 2024. Real estate transactions, such as property sales, commercial leasing, and land acquisitions, demand the secure exchange of sensitive information, including ownership titles, lease agreements, zoning permits, and valuation reports. Similarly, infrastructure projects involve collaborations among multiple stakeholders like contractors, investors, government agencies, and financial institutions, requiring centralized platforms for real-time communication and document sharing. Virtual data rooms (VDRs) streamline these processes by offering advanced security, controlled user access, audit trails, and seamless storage of confidential records. This minimizes the risk of data breaches and accelerates deal closures. Additionally, cross-border investments in real estate and large-scale infrastructure projects are catalyzing the demand for VDRs, as they enable remote access and compliance with diverse international regulations.

To get more information on this market, Request Sample

Increasing adoption of AI

The ongoing adoption of AI is impelling the Turkey virtual data room market growth by enhancing efficiency, security, and intelligence in managing complex transactions. In 2024, the count of companies in Turkey creating AI products rose to 1,195, as stated in a report from the Strategic Research Center (İTOSAM) of the Istanbul Chamber of Commerce (İTO). AI-based VDRs enable automated document classification, smart search, and predictive analytics, which significantly reduce the time spent on due diligence and contract reviews. AI can quickly scan thousands of documents, identify relevant clauses, flag anomalies, and generate insights for decision-making, thus improving the speed and accuracy of deal processes. In addition, AI-oriented threat detection systems strengthen cybersecurity by identifying unusual user activities and preventing unauthorized access. Natural language processing (NLP) and machine learning (ML) algorithms also support automated translations and contextual analysis, particularly valuable in cross-border deals. With businesses handling vast volumes of data, AI integration in VDRs is not just improving usability but also reshaping deal management into a more proactive and insight-driven process.

Growing remote working arrangements

Businesses increasingly rely on secure digital platforms to manage sensitive information outside traditional office setups. Rising internet penetration is further supporting the shift towards remote working arrangements by enabling seamless access to cloud-based VDRs from any location. As per the DataReportal, at the beginning of 2024, Turkey had 74.41 Million internet users, with internet penetration at 86.5%. With geographically dispersed teams, investors, and advisors, organizations need centralized platforms that ensure data confidentiality, streamline collaboration, and support real-time decision-making. VDRs offer features like multi-factor authentication, encrypted file sharing, and detailed audit trails that make them ideal for remote transactions and due diligence processes. Moreover, the flexibility of remote working has reduced dependency on physical data rooms, making virtual solutions more cost-effective and efficient.

Turkey Virtual Data Room Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, enterprise size, business function, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium enterprises.

Business Function Insights:

- Marketing and Sales

- Legal

- Finance

- Workforce Management

A detailed breakup and analysis of the market based on the business function have also been provided in the report. This includes marketing and sales, legal, finance, and workforce management.

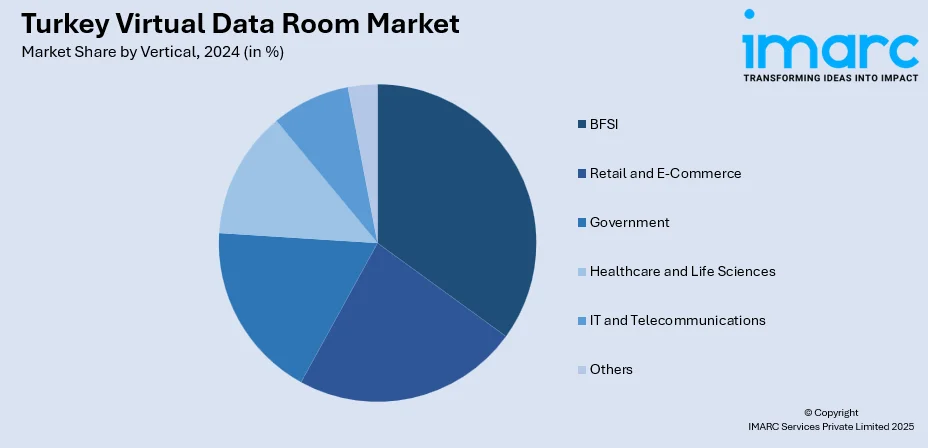

Vertical Insights:

- BFSI

- Retail and E-Commerce

- Government

- Healthcare and Life Sciences

- IT and Telecommunications

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, retail and e-commerce, government, healthcare and life sciences, IT and telecommunications, and others.

Regional Insights:

- Marmara

- Central Anatolia

- Mediterranean

- Aegean

- Southeastern Anatolia

- Black Sea

- Eastern Anatolia

The report has also provided a comprehensive analysis of all the major regional markets, which include Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Turkey Virtual Data Room Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Business Functions Covered | Marketing and Sales, Legal, Finance, Workforce Management |

| Verticals Covered | BFSI, Retail and E-Commerce, Government, Healthcare and Life Sciences, IT and Telecommunications, Others |

| Regions Covered | Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, Eastern Anatolia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Turkey virtual data room market performed so far and how will it perform in the coming years?

- What is the breakup of the Turkey virtual data room market on the basis of component?

- What is the breakup of the Turkey virtual data room market on the basis of deployment type?

- What is the breakup of the Turkey virtual data room market on the basis of enterprise size?

- What is the breakup of the Turkey virtual data room market on the basis of business function?

- What is the breakup of the Turkey virtual data room market on the basis of vertical?

- What is the breakup of the Turkey virtual data room market on the basis of region?

- What are the various stages in the value chain of the Turkey virtual data room market?

- What are the key driving factors and challenges in the Turkey virtual data room market?

- What is the structure of the Turkey virtual data room market and who are the key players?

- What is the degree of competition in the Turkey virtual data room market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Turkey virtual data room market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Turkey virtual data room market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Turkey virtual data room industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)