UAE Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

UAE Advertising Market Overview:

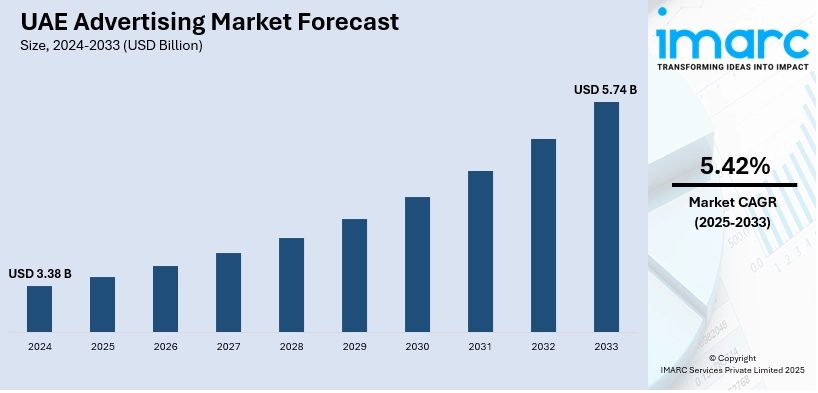

The UAE advertising market size reached USD 3.38 Billion in 2024. The market is projected to reach USD 5.74 Billion by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The market is growing steadily, fueled by digitalization, rising brand competition, and changing consumer trends. Companies are utilizing both conventional and digital marketing mediums to gain exposure and interaction. The market is influenced by innovation, local growth, and heavy emphasis on targeted marketing strategies. With the dynamic nature of the media environment and growing demand for personalized campaigns, the industry continues to be competitive and responsive. All these components together add to the growing UAE advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.38 Billion |

| Market Forecast in 2033 | USD 5.74 Billion |

| Market Growth Rate 2025-2033 | 5.42% |

UAE Advertising Market Trends:

Surge in Digital Ad Spend

In January 2025, advertising spend on digital in the UAE surpassed a major threshold, reflecting a rapid movement away from traditional brand marketing budget allocation. Prioritization of new digital media like social media, search engines, and online video streaming continues to increase in response to pressure for measurable, targeted, and cost-efficient campaigns. Marketers increasingly use automation, programmatic purchase, and localized content to reach the UAE's multilingual audience, using Arabic and English messaging as needed for universal appeal. The nation's high internet penetration and active social media adoption allow for real-time optimization of campaigns, supporting brands in increasing engagement and maximizing returns. Mobile-first methods are the norm, mirroring shifting consumer patterns as smartphones become the first point of online content access. This fluid landscape compels advertisers to pay attention not only to spending more but rather to wiser investments that are highly relevant and personalized. Overall, these advances reflect the changing character of the digital marketing environment in the region and underscore the ongoing strength of the UAE advertising market growth.

To get more information on this market, Request Sample

Enduring Power of TV Advertising

Even with the acceleration of digital media, television is a dominant advertising vehicle in the UAE, particularly for industries like banking, healthcare, automotive, and real estate. In 2025, the MENA region's digital ad spend is expected to reach in billions, indicating an ongoing growth of online budgets but TV's wide reach and trusted narrative still produce unparalleled brand effect. Advertisers appreciate TV for its power to evoke emotions and build brand trustworthiness, something digital platforms struggle to replicate. Additionally, the development of Connected TV (CTV) and Over-The-Top (OTT) services in the UAE provides the opportunity for a converged approach, synthesizing TV's broad reach with digital's targeted effectiveness and measurable results. The convergence supports brands communicating with varied audiences across various screens and still providing the engagement offered by traditional TV commercials. These changes prove that the advertising landscape of the UAE is changing but not overtaking the traditional ways. These factors clearly reflect the ongoing UAE advertising market trends, where traditional and digital advertising coexist to drive effective marketing strategies.

AI Drives Personalized Advertising Campaigns

By 2025, AI is revolutionizing the UAE's digital advertising environment, empowering brands to serve hyper-personalized and data-driven campaigns. AI technologies are speeding up content production, from automated copywriting to real-time ad optimization, so that marketers can connect with consumers in personalized communications across platforms. AI-created content, for example, is increasing user engagement through timely and relevant advertisements. Additionally, chatbots and virtual assistants powered by AI are enhancing customer engagement through quick responses and tailored experiences. All these are not only enhancing efficiency but also deepening consumer-brand relationships. As AI keeps evolving, it's transforming the creative process to be more reactive and quicker to the needs of consumers. This revolution says a lot about the rising impact of AI in driving innovation and efficiency in UAE advertising. The application of AI in new ways reflects the innovative trajectory of the UAE advertising industry trends, pointing toward a future when technology and creativity go hand in hand.

UAE Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

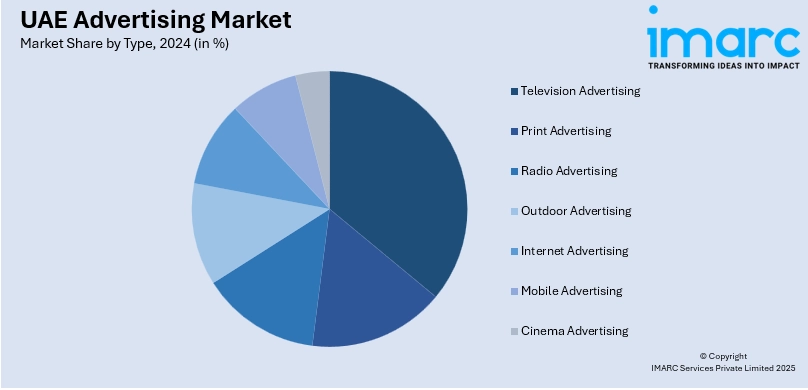

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Advertising Market News:

- September 2024: Dubai has launched Mada Media Company, a new private joint-stock firm to manage and operate advertising sites across the city. Established under a recent law, the company will oversee the development and operation of advertising platforms and invest in related technologies. Mada Media is also authorized to form partnerships and handle contracts to support its goals. Key authorities, including Dubai’s Roads and Transport Authority and Municipality, will collaborate by delegating advertising functions to the company for streamlined management.

- March 2024: The Advertising Business Group (ABG) has partnered with Ad Net Zero to reduce emissions in the UAE's advertising sector. This initiative, announced at Dubai Lynx, aims to decarbonize industry and promote sustainable behavior through advertising. The UAE chapter will serve as the regional hub for MENA, with founding supporters including Google, Meta, Unilever, GroupM, Dentsu, Publicis Groupe, and Omnicom Media Group. The collaboration aligns with the UAE's net-zero goals and encourages responsible consumption and production.

UAE Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE advertising market on the basis of type?

- What is the breakup of the UAE advertising market on the basis of region?

- What are the various stages in the value chain of the UAE advertising market?

- What are the key driving factors and challenges in the UAE advertising market?

- What is the structure of the UAE advertising market and who are the key players?

- What is the degree of competition in the UAE advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)