UAE Amusement Parks Market Size, Share, Trends and Forecast by Rides, Revenue Source, Age Group, and Region, 2026-2034

UAE Amusement Parks Market Summary:

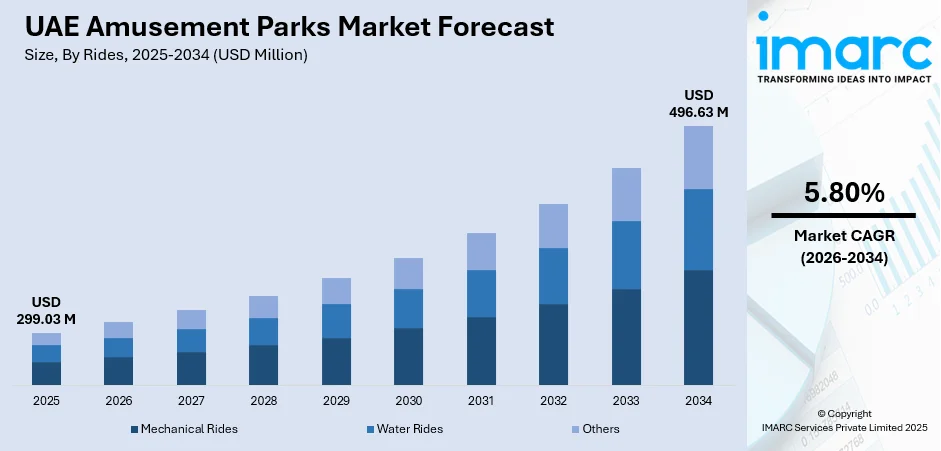

The UAE amusement parks market size was valued at USD 299.03 Million in 2025 and is projected to reach USD 496.63 Million by 2034, growing at a compound annual growth rate of 5.80% from 2026-2034.

The market growth stems from strategic geographic positioning, government tourism infrastructure investments totaling Dh100 billion targeting 40 million annual visitors and rising regional visitation with GCC travelers increasing to Yas Island attractions. The market benefits from hybrid indoor-outdoor park developments addressing extreme climate challenges, digital transformation initiatives including facial recognition payment systems and artificial intelligence (AI)-powered customer service platforms, and major international brand partnerships establishing world-class entertainment destinations across Dubai and Abu Dhabi, thereby expanding the UAE amusement parks market share.

Key Takeaways and Insights:

- By Rides: Mechanical rides dominate the market with a share of 55% in 2025, driven by world-record attractions including Formula Rossa and Mission Ferrari featuring the world's first sideways coaster drop.

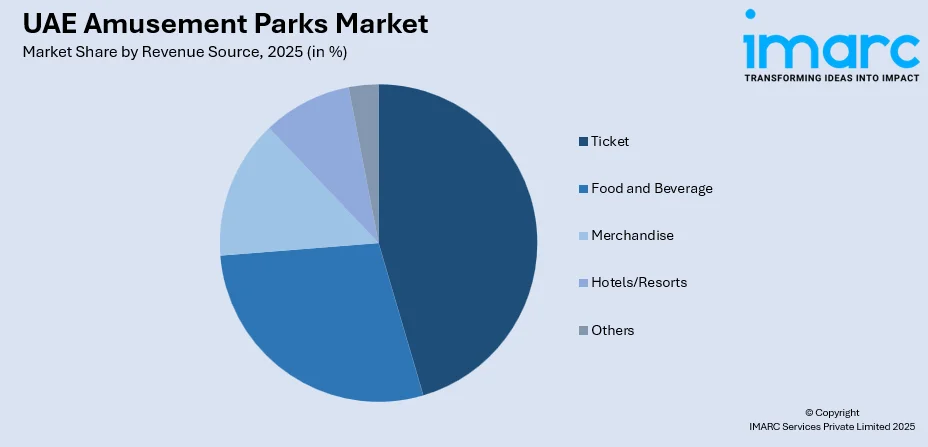

- By Revenue Source: Ticket leads the market with a share of 45% in 2025, supported by multi-park bundled passes and premium pricing strategies for indoor climate-controlled year-round attractions.

- By Age Group: 19 to 35 years represents the largest segment with a market share of 38% in 2025, fueled by thrill-seeking preferences and social media-driven experiential entertainment demand.

- Key Players: The UAE amusement parks market exhibits strong competitive intensity with international entertainment corporations operating licensed properties alongside state-backed destination developers across premium segments.

To get more information on this market Request Sample

The UAE amusement parks market demonstrates remarkable growth trajectory anchored by strategic developments across Yas Island and Dubai entertainment zones. The market capitalizes on aviation connectivity with 120 million passengers transiting through airports annually, positioning the Emirates as crossroads destination. Indoor attractions mitigate seasonality constraints with climate-controlled environments enabling year-round operations, while outdoor venues optimize peak periods. Dubai has achieved the top position worldwide for attracting foreign direct investment (FDI) in the creative and cultural sectors of its economy. In 2024, the city drew in 971 projects, with total capital investments hitting AED18.86 billion ($5.1 billion), leading to the creation of 23,517 new jobs in the sector. Regional source markets contribute significant visitation volumes, complemented by rising international arrivals in 2024. Government initiatives supporting tourism infrastructure, visa facilitation programs, and cultural diversification strategies underpin sustained momentum across family entertainment, thrill attractions, and marine life experiences segments.

UAE Amusement Parks Market Trends:

Digital Innovation Transforming Guest Experiences

The UAE amusement parks sector embraces cutting-edge technologies creating seamless, personalized visitor journeys. Yas Island attractions implemented FacePass facial recognition technology enabling contactless entry and payment systems across multiple theme parks, eliminating physical tickets and reducing queue times. Destination operators partnered with technology corporations to deploy generative AI-powered chatbots providing personalized guidance, conducting 1,700 successful chat operations within the first week of launch. The International Association of Amusement Parks and Attractions (IAAPA) teamed up with Miral, a well-known IAAPA Member specializing in immersive experiences and destinations, along with the Abu Dhabi Exhibition Convention and Exhibition Bureau to host a trade summit on Yas Island, Abu Dhabi in January 2024. Educational sessions addressed a range of topics, including AI, the hurdles of digital transformation, and the development of sustainable destinations and attractions.

Sustainability Initiatives Driving Park Operations

Environmental consciousness reshapes amusement park development and operations across the Emirates. Major attractions invest substantially in renewable energy infrastructure with rooftop solar photovoltaic systems generating significant portions of operational power requirements. Warner Bros World Abu Dhabi operates a 7-megawatt peak solar installation producing 40% of annual energy demand through 16,000 modules spanning 36,000 square meters of roof area. Sustainable construction materials and waste reduction initiatives including comprehensive recycling and composting programs minimize environmental footprint while educational exhibits raise visitor awareness about ecosystem preservation and marine conservation efforts.

Hybrid Indoor-Outdoor Concepts Addressing Climate Challenges

Strategic architectural innovations enable year-round park accessibility despite extreme summer temperatures. Developers increasingly adopt hybrid designs combining climate-controlled indoor sections with seasonally-optimized outdoor zones maximizing operational flexibility. Major upcoming projects announced hybrid configurations featuring both indoor and outdoor areas allowing attractions to remain viable during scorching June-September months when outdoor-only facilities experience dramatic attendance declines. The UAE also faced a severe heatwave during August with temperatures soaring to 46°C in Dubai and Abu Dhabi. Existing successful indoor venues demonstrate viability with air-conditioned environments housing comprehensive attraction portfolios including thrill rides, character experiences, and dining facilities. This model attracts investment from international entertainment corporations seeking Middle East expansion, recognizing indoor climate control as essential differentiators.

Market Outlook 2026-2034:

The UAE amusement parks market exhibits robust expansion potential driven by accelerating tourism infrastructure investments and strategic international brand partnerships. Global Village's achievement of 10.5 million visitors in Season 29, ranking among the world's top five most-visited attractions, demonstrates the sector's capacity to deliver world-class attendance volumes. Continued government commitment to economic diversification, coupled with hybrid indoor-outdoor developments and digital transformation initiatives, positions the market for sustained growth. The market generated a revenue of USD 299.03 Million in 2025 and is projected to reach a revenue of USD 496.63 Million by 2034, growing at a compound annual growth rate of 5.80% from 2026-2034.

UAE Amusement Parks Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Rides | Mechanical Rides | 55% |

| Revenue Source | Ticket | 45% |

| Age Group | 19 to 35 Years | 38% |

Rides Insights:

- Mechanical Rides

- Water Rides

- Others

Mechanical rides dominate with a market share of 55% of the total UAE amusement parks market in 2025.

The mechanical rides segment maintains its commanding position through strategic investments in record-breaking attractions that generate international media attention and drive destination appeal. Ferrari World Abu Dhabi's Formula Rossa remains the world's fastest roller coaster, reaching speeds of 240 kilometers per hour and creating bucket-list appeal for thrill-seekers globally. These signature attractions establish competitive differentiation and justify premium pricing strategies while attracting repeat visitation from regional markets seeking novel adrenaline-pumping experiences that cannot be replicated domestically.

The segment's growth trajectory benefits from continuous technological advancement in ride systems, enhanced safety protocols meeting international ASTM standards, and integration of storytelling elements that elevate traditional mechanical experiences. Warner Bros World Abu Dhabi leverages intellectual property from DC Comics and Looney Tunes franchises across 29 rides, while maintaining fully air-conditioned indoor environments that enable year-round operations despite extreme external temperatures. The mechanical rides category also captures family demographics through graduated thrill levels, from child-friendly attractions in themed zones to extreme coasters appealing to young adults.

Revenue Source Insights:

Access the comprehensive market breakdown Request Sample

- Ticket

- Food and Beverage

- Merchandise

- Hotels/Resorts

- Others

Ticket leads with a share of 45% of the total UAE amusement parks market in 2025.

Ticket admissions constitute the primary revenue stream for UAE amusement parks, reflecting the destination-focused nature of facilities that attract both regional tourists and local residents seeking entertainment experiences. Multi-park Yas Island passes offering two, three, or four-day access across SeaWorld Abu Dhabi, Warner Bros World, Ferrari World, and Yas Waterworld demonstrate sophisticated bundling strategies that increase visitor spending while encouraging exploration across the integrated entertainment complex. Premium admission tiers incorporating express access, VIP experiences, and exclusive encounters command significant price premiums from affluent demographics seeking enhanced convenience and personalized services that differentiate from standard entry options.

Seasonal pricing fluctuations respond to demand patterns, with November through April commanding higher admission rates during peak tourist seasons when moderate temperatures enhance outdoor experiences. Weekend premiums reflect concentrated local demand, while weekday discounts stimulate attendance from price-sensitive segments and educational groups. International visitor packages bundled with hotel accommodations and transportation create comprehensive tourism products that simplify planning for overseas markets while generating higher aggregate revenues through integrated offerings across accommodation, entertainment, and ancillary services.

Age Group Insights:

- Up to 18 Years

- 19 to 35 Years

- 36 to 50 Years

- 51 to 65 Years

- More than 65 Years

19 to 35 years exhibits a clear dominance with a 38% share of the total UAE amusement parks market in 2025.

Young adults between 19 and 35 years represent the dominant visitor demographic for UAE amusement parks, attracted by high-adrenaline attractions, social media-worthy experiences, and technologically advanced installations that align with digital native expectations. This cohort demonstrates strong propensity for thrill-seeking behavior, with attractions like IMG Worlds of Adventure's Velociraptor coaster and Ferrari World's extreme rides generating substantial appeal among adventure-oriented visitors. The segment's disposable income growth within Gulf Cooperation Council markets, coupled with increasing international youth travel to Dubai and Abu Dhabi, supports premium pricing strategies.

Young professionals within this demographic also drive group visitation patterns, with corporate team-building events, social gatherings, and milestone celebrations creating consistent mid-week demand that complements family-focused weekend attendance. The 19 to 35 years segment shows heightened receptivity to innovative experiences including virtual reality attractions at VR Park Dubai, immersive dark rides incorporating intellectual property narratives, and interactive gaming elements that blur traditional entertainment boundaries. Extended operating hours during peak seasons particularly appeal to this demographic, which demonstrates greater flexibility in visit timing and willingness to engage during evening periods that align with social entertainment patterns.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai capitalizes on established international tourism reputation, world-class infrastructure, and diverse attraction portfolio spanning indoor megaparks, water parks, and entertainment complexes. IMG Worlds of Adventure operates as largest indoor theme park featuring Marvel superheroes, Cartoon Network characters, and dinosaur attractions across 1.5 million square feet of climate-controlled space ensuring year-round accessibility. Motiongate Dubai delivers Hollywood-themed experiences across Columbia Pictures, DreamWorks, Smurfs Village, and Lionsgate zones, while Dubai Parks and Resorts complex integrates multiple branded attractions including Legoland, water parks, and newly opened Real Madrid-themed venue creating destination cluster effect.

Abu Dhabi emerges as rapidly growing amusement destination anchored by Yas Island entertainment cluster. Ferrari World houses Formula Rossa world's fastest roller coaster alongside extensive Ferrari-themed attractions, while Warner Bros World Abu Dhabi operates as world's second-largest indoor theme park featuring DC Comics superheroes and Looney Tunes characters across six themed lands. Strategic government backing through Miral's development initiatives and announced Disney waterfront resort partnership signal ambitious expansion trajectory positioning Abu Dhabi as serious competitor to established global theme park markets through sustained infrastructure investment and international brand collaborations.

Sharjah maintains growing presence through family-oriented entertainment offerings emphasizing cultural alignment and accessible pricing. Attractions cater primarily to regional families and GCC visitors seeking affordable leisure options with strong emphasis on educational components. Al Montazah Parks and cultural entertainment venues serve local populations and neighboring emirate residents through community-focused programming, seasonal festivals, and school partnership initiatives creating steady regional demand outside major tourism corridors.

Others category encompasses remaining emirates including Ajman, Fujairah, Ras Al Khaimah, and Umm Al Quwain featuring smaller-scale attractions, water parks, and family entertainment centers. These regional venues serve local communities and domestic tourism markets with emphasis on accessibility and value pricing. Adventure tourism opportunities in northern emirates complement theme park offerings through natural attractions, water sports facilities, and seasonal festival programming diversifying entertainment landscape beyond major metropolitan concentration areas.

Market Dynamics:

Growth Drivers:

Why is the UAE Amusement Parks Market Growing?

Strategic Geographic Positioning and Aviation Connectivity

The UAE's exceptional location creates unparalleled market access serving massive population catchment area within short flight times. The Emirates, having a favorable position welcomes potential visitors capable of affording theme park experiences. Airports throughout the UAE are expected to accommodate a historic 159 million passengers by the conclusion of 2025, marking a rise of approximately 8% from the 147.8 million passengers noted in 2024, based on the most recent data from the General Civil Aviation Authority (GCAA). This geographic advantage combined with visa facilitation policies, modern airport infrastructure, and competitive airline pricing establishes foundation for sustained international visitor growth supporting premium park development and operational viability across diverse seasonal patterns and market cycles.

Government Tourism Infrastructure Investments and Diversification Initiatives

Substantial government commitment to economic diversification away from hydrocarbon dependence drives strategic investments in tourism and entertainment sectors. Abu Dhabi authorities announced Dh100 billion infrastructure investment program targeting 40 million annual tourists by 2040 creating policy environment favorable to theme park development. Regulatory frameworks provide tax incentives, land allocation, and partnership facilitation encouraging private sector participation and international brand licensing agreements. Tourism promotion campaigns position UAE as family-friendly destination through global marketing initiatives highlighting entertainment offerings alongside cultural attractions. Visa on arrival policies, electronic visa systems, and recently introduced long-term residency programs reduce entry barriers encouraging tourist flows.

Rising Regional Visitation and Experiential Entertainment Demand

Demographic and cultural shifts across Middle East drive substantial attendance growth particularly from neighboring GCC markets. Yas Island recorded 38 million visitors in 2024 reflecting strengthened regional travel patterns as Gulf populations seek proximate leisure destinations. Cultural acceptance of theme parks as family-appropriate leisure activities overcomes previous entertainment sector constraints, while growing expatriate populations within UAE create resident visitor base seeking regular entertainment access through annual memberships and local promotions creating sustained demand beyond seasonal tourism patterns.

Market Restraints:

What Challenges the UAE Amusement Parks Market is Facing?

Extreme Climate and Pronounced Seasonality Constraints

The UAE's harsh summer conditions with temperatures regularly exceeding 100°F from June through September create substantial operational challenges for outdoor attractions. Heat intensity forces outdoor park closures during peak summer months or results in dramatically reduced attendance affecting annual revenue projections. Optimal visiting season confined to November-April six-month window creates pronounced demand concentration requiring parks to generate majority annual revenue within limited timeframe. Seasonality complicates staffing models, inventory management, and maintenance scheduling as facilities experience feast-or-famine attendance patterns rather than steady year-round utilization.

High Development Costs and Capital-Intensive Infrastructure Requirements

Theme park development demands extraordinary financial commitments with successful indoor venues requiring billion-dollar plus investments exemplified by SeaWorld Abu Dhabi's construction cost. Indoor climate control infrastructure significantly increases building expenses compared to outdoor facilities while ongoing operational costs for cooling massive spaces add substantial overhead. Land acquisition in prime locations near airports and tourism hubs commands premium pricing, while specialized ride equipment, theming elements, and licensed intellectual property involve substantial upfront and recurring licensing fees. Long development timelines spanning five to seven years from planning to opening delay revenue generation while accumulating construction costs and financing expenses.

Intense Competition and Entertainment Alternatives

The UAE amusement parks market faces saturation concerns with multiple major attractions concentrated within small geographic area creating competitive pressures on attendance and pricing. Yas Island alone hosts four major theme parks within five-minute driving distance while Dubai maintains several significant venues fragmenting visitor spending across numerous options. Regional competition intensifies as Saudi Arabia develops entertainment infrastructure through Vision 2030 initiatives potentially capturing GCC visitors previously traveling to UAE. Entertainment alternatives including shopping malls, beach resorts, desert experiences, cultural attractions, and digital entertainment options compete for leisure time and discretionary spending.

Competitive Landscape:

The UAE amusement parks market demonstrates dynamic competitive environment characterized by strategic partnerships between international entertainment corporations and regional destination developers. Major players operate through capital-light licensing models where Abu Dhabi-based Miral and Dubai-based operators assume development and operational responsibilities while global brands provide intellectual property, design oversight, and operational guidance. This structure enables world-renowned franchises to establish regional presence without substantial capital exposure while local entities leverage international recognition attracting visitors. Competition intensifies through differentiation strategies emphasizing unique attractions, immersive theming, and exclusive intellectual properties ranging from motorsports heritage to Hollywood studios, superhero universes, and marine conservation focuses. Indoor venue operators maintain year-round operational advantages compared to seasonal outdoor facilities, while hybrid concepts emerging through upcoming developments seek optimal balance. Destination clustering on Yas Island creates cooperative competition where multiple parks within proximity drive extended multi-day visits through bundled pass offerings benefiting all participants through cross-promotion and shared infrastructure.

Recent Developments:

- In May 2025, The Walt Disney Company revealed a strategy to create a new Disney theme park in Abu Dhabi, United Arab Emirates, in collaboration with Miral. The resort featuring a waterfront theme park will be situated on Yas Island, recognized for its entertainment and recreational attractions such as Ferrari World and Warner Bros. World. This will be the seventh Disney theme park resort, featuring Disney storytelling intertwined with Abu Dhabi’s culture and renowned architecture.

UAE Amusement Parks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Rides Covered | Mechanical Rides, Water Rides, Others |

| Revenue Sources Covered | Ticket, Food and Beverage, Merchandise, Hotels/Resorts, Others |

| Age Groups Covered | Up to 18 Years, 19 to 35 Years, 36 to 50 Years, 51 to 65 Years, More than 65 Years |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE amusement parks market size was valued at USD 299.03 Million in 2025.

The UAE amusement parks market is expected to grow at a compound annual growth rate of 5.80% from 2026-2034 to reach USD 496.63 Million by 2034.

Mechanical Rides held the largest market share at 55% in 2025, driven by world-record roller coasters, innovative engineering attractions, and year-round indoor operational capabilities delivering high-thrill experiences across climate-controlled environments.

Key factors driving the UAE amusement parks market include strategic geographic positioning enabling massive addressable market access, substantial government tourism infrastructure investments totaling Dh100 billion targeting 40 million annual visitors supporting destination development, and rising regional visitation with GCC travelers increasing alongside international source market growth reflecting experiential entertainment demand and Middle East leisure sector expansion

Major challenges include extreme climate conditions with high summer temperatures creating pronounced seasonality requiring expensive indoor climate control infrastructure, high development costs with billion-dollar capital requirements and extended construction timelines increasing project risk, intense competition from multiple major attractions within concentrated geographic areas alongside entertainment alternatives fragmenting visitor spending, and historical project failures demonstrating market volatility and demand uncertainty affecting investor confidence and strategic planning.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)