UAE Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

UAE Animal Health Market Overview:

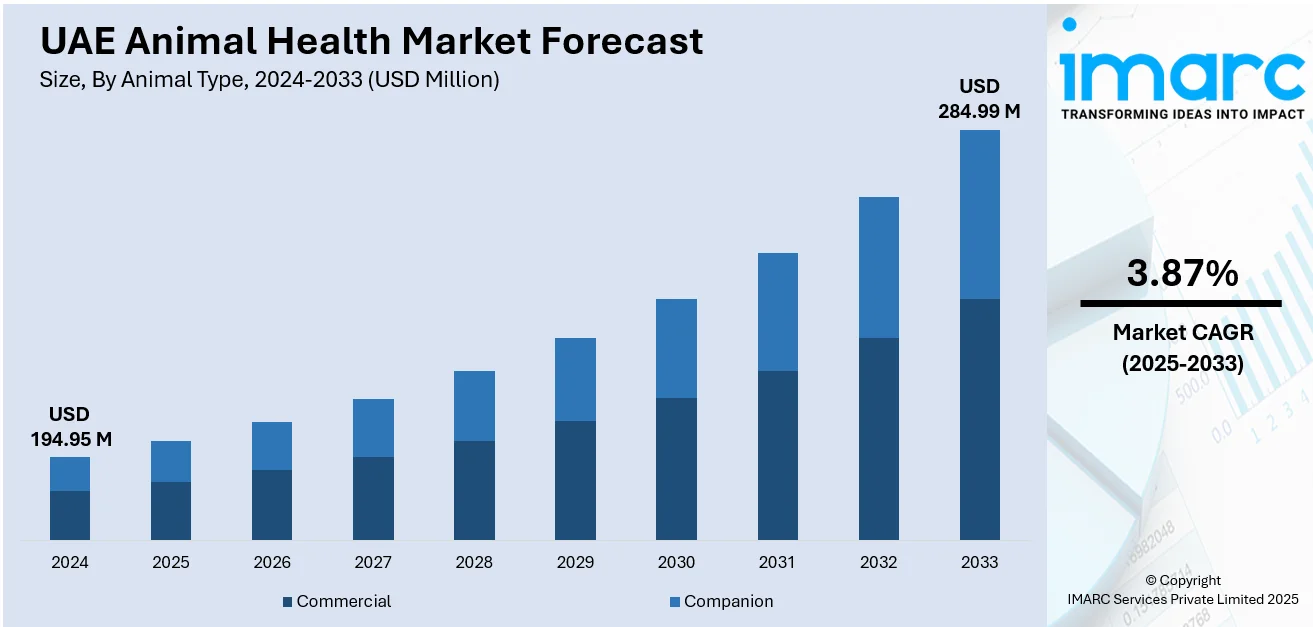

The UAE animal health market size reached USD 194.95 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 284.99 Million by 2033, exhibiting a growth rate (CAGR) of 3.87% during 2025-2033. At present, the increasing pet population trend, with families keeping pets as companions, is impelling the market growth. Moreover, the heightened emphasis on food security and self-sufficiency is supporting the market growth. Apart from this, the government policies and changing regulatory conditions are expanding the UAE animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 194.95 Million |

| Market Forecast in 2033 | USD 284.99 Million |

| Market Growth Rate 2025-2033 | 3.87% |

UAE Animal Health Market Trends:

Government Initiatives and Regulatory Developments

Government policies and changing regulatory conditions are greatly influencing the animal health industry in the UAE. The regulatory agencies regularly implement policies that enhance animal health levels and the safety of animal products. These regulations are promoting compliance with global best practices in veterinary services, animal welfare, and disease control. The government of the UAE is also spending on animal health infrastructure and research, which is making innovative and effective health solutions available. The government's emphasis on disease control, particularly in the backdrop of emerging global health issues, is also propelling demand for vaccines, diagnostic solutions, and treatments to safeguard livestock as well as companion animals. These efforts not only improve animal welfare but also help overall industry growth of the animal health sector through building confidence and penetration of new markets and technologies. In 2024, the Abu Dhabi Agriculture and Food Safety Authority (ADAFSA) unveiled its 'One Health' biosecurity initiative, designed to encourage the collaboration of human, animal, plant health, and environmental factors. The initiation of the program aligned with the directives of the wise leadership and the global standards specified in the Joint International Action Plan on the One Health Approach for 2022-2026.

To get more information on this market, Request Sample

Growing Pet Ownership and Care of Companion Animals

The UAE animal health sector is driven by the increasing pet population trend, with families keeping pets as companions. With urbanization increasing and living standards improving, pet owners are giving greater importance to the well-being and health of their pets. This is leading to an increased demand for veterinary care, pet food, and health products. Pet owners are in pursuit of sophisticated care, preventive medicine, and routine check-ups for their pets, which is contributing to the growth of the animal health industry. Veterinary hospitals and clinics are continually upgrading their facilities and services to accommodate the needs of this growing pet population. As awareness about the significance of animal health grows, so does demand for preventive products like vaccinations, supplements, and diagnostics. These are pushing competition and innovation in the UAE animal health market.

Increased Livestock Farming and Agricultural Operations

The heightened emphasis on food security and self-sufficiency is supporting the UAE animal health market growth. Initiatives aimed at increasing local livestock farming and agricultural activities are placing greater demand for animal health products and services. The government is also heavily investing in new farming methods, which involve enhancing livestock health and productivity using advanced veterinary practices. Farmers are increasingly embracing more efficient animal nutrition, disease control, and management practices to produce quality meat and dairy. This change is also creating the demand for expert veterinary services, vaccines, and drugs for livestock such as cattle, sheep, and poultry. The government's continued backing of sustainable farming practices and the push for biosecurity interventions are keeping the market strong and, in tandem with agricultural innovation, leading to a high demand for animal health solutions. In 2024, the British Veterinary Centre in Abu Dhabi proudly declared a landmark accomplishment in veterinary medicine, as it became the first facility in the MENA region to successfully conduct canine mitral valve repair surgeries in Spring 2024. Guided by a team of esteemed veterinarians and backed by state-of-the-art technology, this achievement represents a major progression in canine heart treatment in the UAE and surrounding regions.

UAE Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

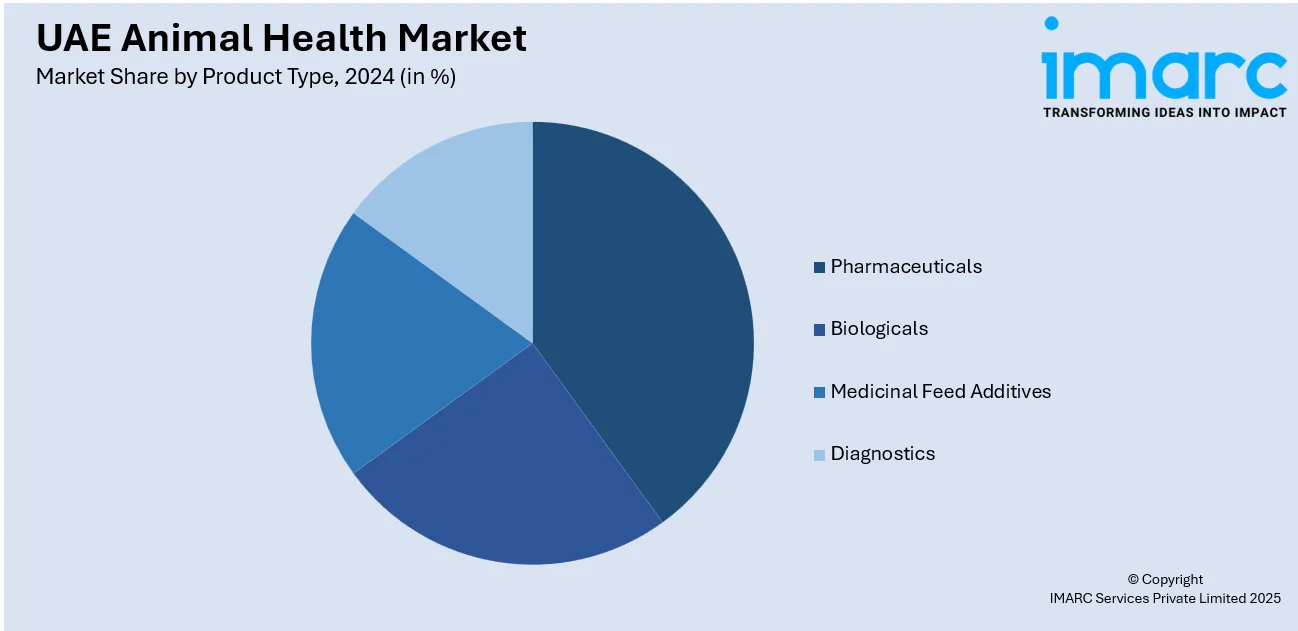

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE animal health market on the basis of animal type?

- What is the breakup of the UAE animal health market on the basis of product type?

- What is the breakup of the UAE animal health market on the basis of region?

- What are the various stages in the value chain of the UAE animal health market?

- What are the key driving factors and challenges in the UAE animal health market?

- What is the structure of the UAE animal health market and who are the key players?

- What is the degree of competition in the UAE animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)