UAE Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2025-2033

UAE Automotive Wiring Harness Market Overview:

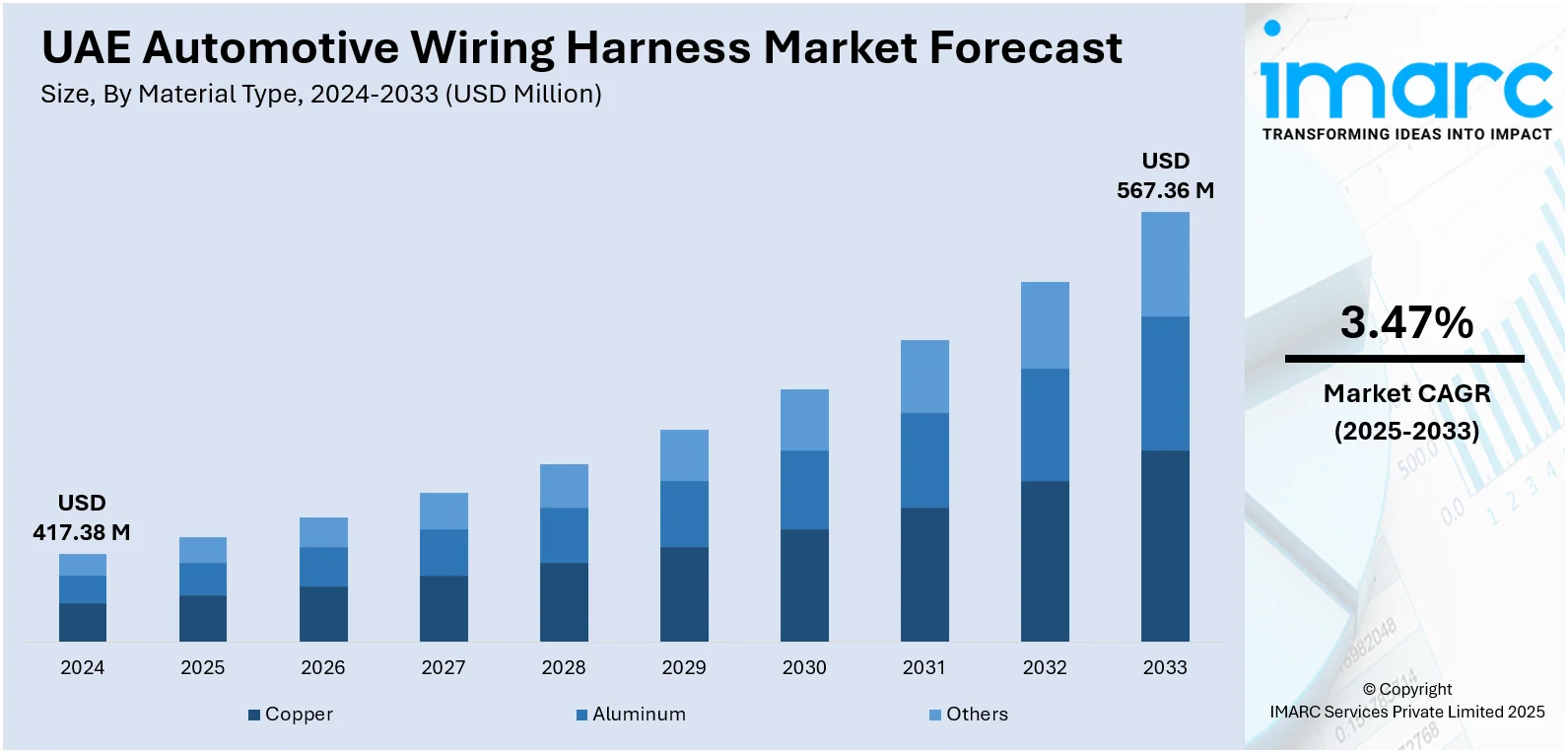

The UAE automotive wiring harness market size reached USD 417.38 Million in 2024. Looking forward, the market is expected to reach USD 567.36 Million by 2033, exhibiting a growth rate (CAGR) of 3.47% during 2025-2033. The market continues to benefit from growing EV adoption, increased demand for luxury and connected vehicles, and substantial public investment in transport infrastructure. Supplier strategies are shaped by localization efforts and collaborations with premium OEMs. Terminal components and EV harness modules contribute significantly to UAE automotive wiring harness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 417.38 Million |

| Market Forecast in 2033 | USD 567.36 Million |

| Market Growth Rate 2025-2033 | 3.47% |

UAE Automotive Wiring Harness Market Trends:

Electric and Luxury EV Harness Development

The UAE has converted 20% of its federal government fleet to electric vehicles and originally set goals for 30% of public sector and 10% of total vehicles to be electric or hybrid by 2030. In 2023, this goal was revised, with the new aim of reaching 50% electric and hybrid vehicle adoption by 2050. In the UAE, growth in EV adoption, particularly luxury and performance models, drives demand for advanced wiring harnesses that support bespoke infotainment, battery management, and thermal systems. Harness solutions must cater to high-power charging, ambient conditions, and customized cabin electronics. Suppliers partner with OEMs producing premium vehicles to deliver harnesses with integrated multimedia, sensor arrays, and EV-specific power distribution. Modules incorporate lightweight materials, high-temperature insulation, and moisture-resistant sheathing to withstand desert climate. These demands elevate the complexity and revenue per unit. The luxury and EV segment thus accelerates UAE automotive wiring harness market growth.

To get more information on this market, Request Sample

Localization and Supplier Alliances

To meet demand from regional assembly facilities, UAE harness manufacturers are forming partnerships with global tier‑1 suppliers. Joint ventures bring automation equipment, quality systems (ISO/TS), and technical training to local production lines. Facilities adopt lean manufacturing and automated testing for connector insertion and crimp validation. Localized supply chains reduce lead times and import dependency. Collaboration fosters innovation in lightweight harness design and materials suited to Gulf climate. Governments support such industrialization through investment zones. A recent example is the inauguration of Motherson’s new wiring harness facility at RAKEZ’s Al Hamra Industrial Zone in Ras Al Khaimah by H.H. Sheikh Saud bin Saqr Al Qasimi. This marks Motherson’s eighth facility in the UAE and further boosts the manufacturing sector, which accounts for nearly 30% of the Emirate’s GDP. This enhanced capacity-building and knowledge transfer underpin scalable production and consistent standards across OEM lines, reinforcing UAE automotive wiring harness market growth.

UAE Automotive Wiring Harness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on application, material type, transmission type, vehicle type, category, and component.

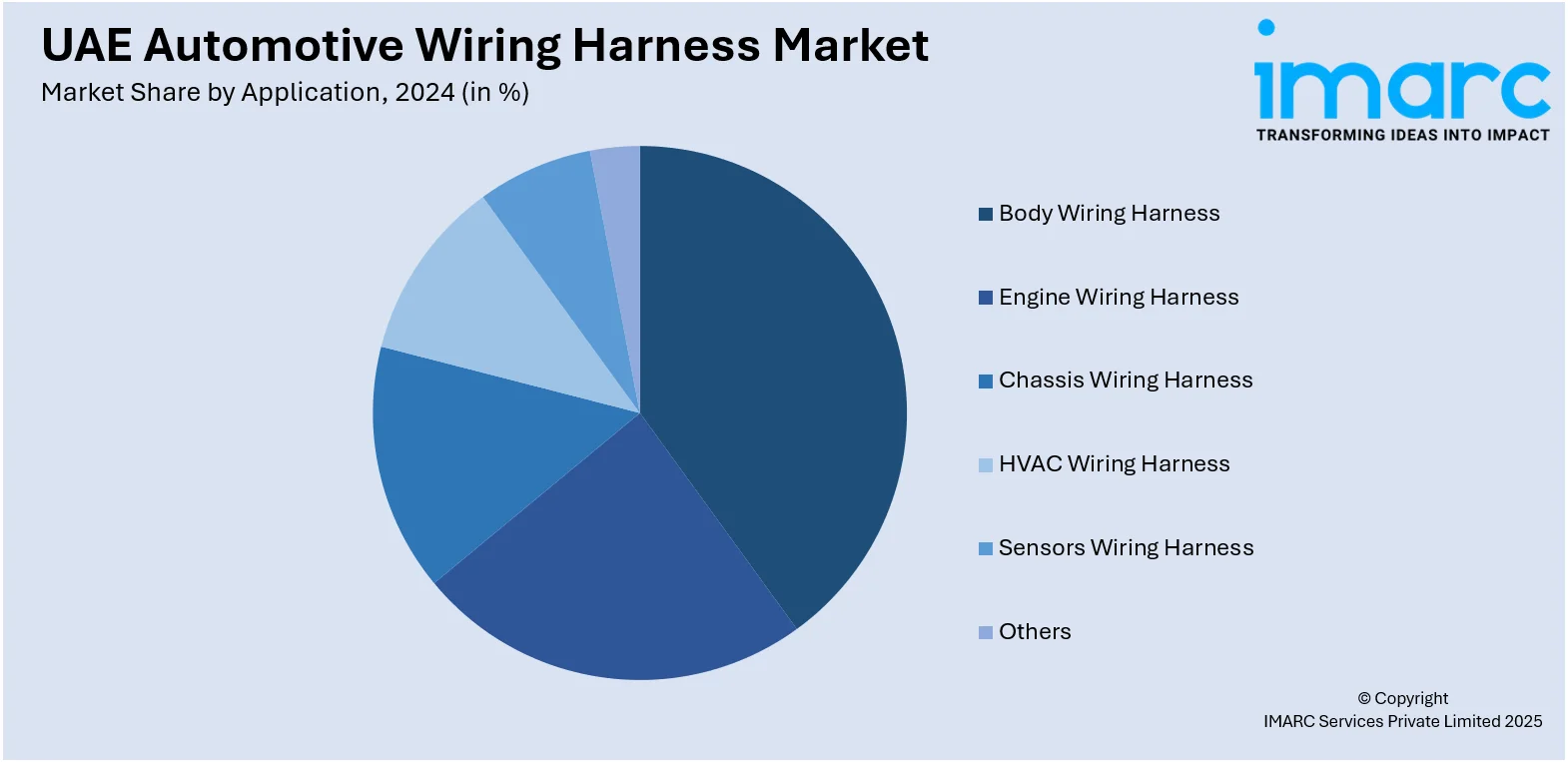

Application Insights:

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes body wiring harness, engine wiring harness, chassis wiring harness, HVAC wiring harness, sensors wiring harness, and others.

Material Type Insights:

- Copper

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes copper, aluminum, and others.

Transmission Type Insights:

- Data Transmission

- Electrical Wiring

The report has provided a detailed breakup and analysis of the market based on the transmission type. This includes data transmission and electrical wiring.

Vehicle Type Insights:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type has also been provided in the report. This includes two wheelers, passenger cars, and commercial vehicles.

Category Insights:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

The report has provided a detailed breakup and analysis of the market based on the category. This includes general wires, heat resistant wires, shielded wires, and tubed wires.

Component Insights:

- Connectors

- Wires

- Terminals

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes connectors, wires, terminals, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Automotive Wiring Harness Market News:

- In May 2024, Yazaki and Toray Industries collaborated to develop a recycled polybutylene terephthalate (PBT) resin made for application in automotive wiring harness connectors. The resin, produced from post-manufacturing scrap, offers similar performance to new material and supports emission reduction.

UAE Automotive Wiring Harness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE automotive wiring harness market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE automotive wiring harness market on the basis of application?

- What is the breakup of the UAE automotive wiring harness market on the basis of material type?

- What is the breakup of the UAE automotive wiring harness market on the basis of transmission type?

- What is the breakup of the UAE automotive wiring harness market on the basis of vehicle type?

- What is the breakup of the UAE automotive wiring harness market on the basis of category?

- What is the breakup of the UAE automotive wiring harness market on the basis of component?

- What is the breakup of the UAE automotive wiring harness market on the basis of region?

- What are the various stages in the value chain of the UAE automotive wiring harness market?

- What are the key driving factors and challenges in the UAE automotive wiring harness market?

- What is the structure of the UAE automotive wiring harness market and who are the key players?

- What is the degree of competition in the UAE automotive wiring harness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE automotive wiring harness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE automotive wiring harness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE automotive wiring harness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)