UAE Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2026-2034

UAE Board Games Market Summary:

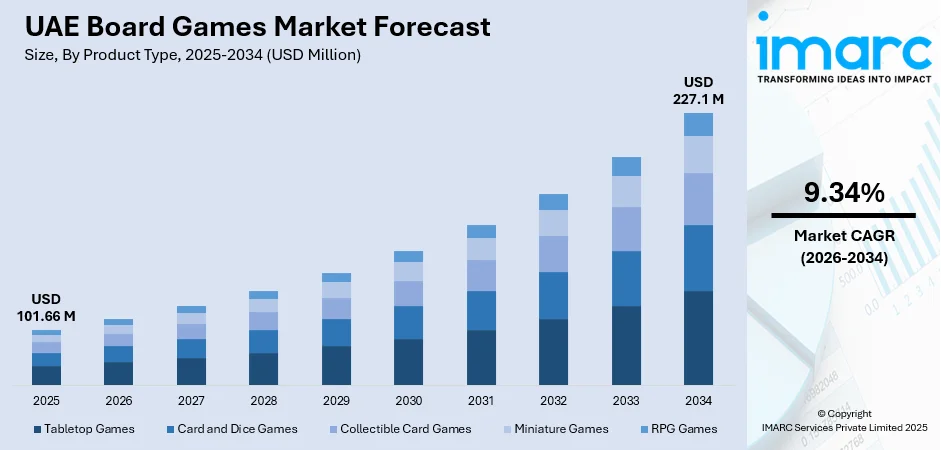

The UAE board games market size was valued at USD 101.66 Million in 2025 and is projected to reach USD 227.1 Million by 2034, growing at a compound annual growth rate of 9.34% from 2026-2034.

The market expansion is propelled by the UAE's growing emphasis on family-oriented entertainment experiences, rising disposable incomes among its diverse expatriate and local populations, and the emergence of board game cafes and specialty retail outlets across Dubai and Abu Dhabi. The convergence of social gaming culture, digital detox trends among younger demographics, and increasing availability of international and Arabic-language titles is fundamentally reshaping the competitive landscape and creating substantial opportunities for market participants.

Key Takeaways and Insights:

- By Product Type: Tabletop games dominate the market with a share of 40% in 2025, driven by growing family-oriented entertainment preferences and social gaming culture.

- By Game Type: Strategy and war games lead the market with a share of 30% in 2025, owing to high engagement levels and popularity among adult gaming enthusiasts.

- By Age Group: 5-12 years represents the largest segment with a market share of 48% in 2025, supported by parental focus on educational and developmental gaming products.

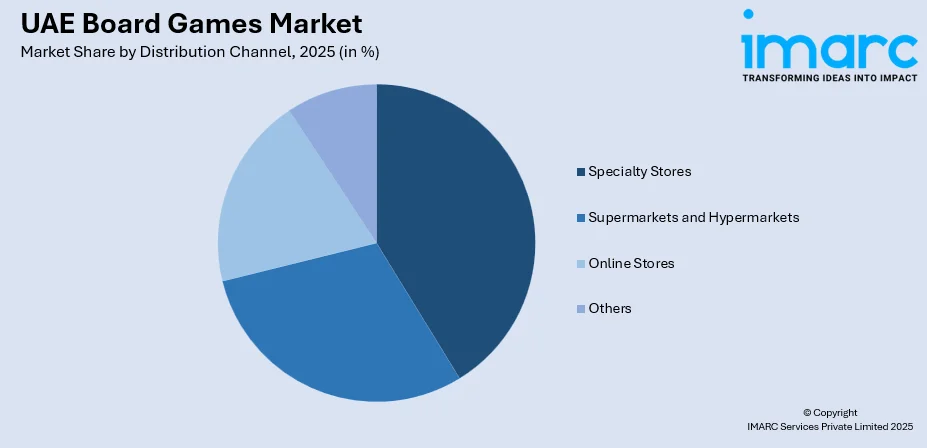

- By Distribution Channel: Specialty stores hold the largest share of 34% in 2025, attributed to curated product selections and expert guidance for gaming enthusiasts.

- Key Players: The UAE board games market exhibits moderate competitive intensity, characterized by international gaming publishers competing alongside regional specialty retailers and distributors. Market dynamics are shaped by product innovation, localization efforts for Arabic content, and experiential retail strategies.

To get more information on this market, Request Sample

The UAE represents one of the most dynamic board games markets in the Middle East and North Africa region, driven by a unique combination of demographic advantages and cultural shifts toward family-oriented entertainment. The country's young and diverse population, comprising both Emirati nationals and a substantial expatriate community from various cultural backgrounds, creates robust baseline demand for tabletop gaming products spanning multiple languages and themes. Rising disposable incomes and growing preference for offline social activities have positioned board games as an attractive leisure alternative to screen-based entertainment. The cultural emphasis on family gatherings and communal activities aligns naturally with tabletop gaming, which fosters meaningful face-to-face interactions across generations. This convergence of favorable demographics, economic prosperity, and evolving entertainment preferences establishes a strong foundation for sustained market growth.

UAE Board Games Market Trends:

Rising Popularity of Board Game Cafes and Social Gaming Venues

The UAE is witnessing a proliferation of dedicated board game cafes across major emirates, transforming tabletop gaming into a mainstream social activity. These establishments offer extensive game libraries, trained game masters, and food and beverage services, creating immersive experiences that attract families, young professionals, and gaming enthusiasts. Unwind Cafe in Al Barsha, recognized as the UAE's first specialty board game cafe, maintains a collection exceeding 800 international titles and employs experienced game masters to guide newcomers through unfamiliar games, eliminating traditional barriers to entry.

Growing Demand for Arabic-Language and Culturally Adapted Games

Local distributors and publishers are increasingly focusing on Arabic localization and culturally relevant adaptations of popular international titles. Boardgame Space, a UAE-based publisher and distributor, has localized more than 55 board game titles for the regional market. The upcoming tabletop.me convention in Dubai will feature over 70 Arabic-language games, reflecting growing industry recognition of the regional market's potential and consumer demand for accessible gaming content in native languages.

Integration of Educational and STEM-Focused Gaming Products

Parents and educators in the UAE increasingly prioritize board games that combine entertainment with educational value, particularly those promoting STEM learning and cognitive development. The government's expanding AI curriculum across schools creates structured demand for age-appropriate learning tools including educational board games. Building and construction sets represent the largest product segment in the UAE's educational toys market, with STEM toys registering the fastest growth trajectory during the forecast period.

Market Outlook 2026-2034:

The UAE board games market demonstrates strong growth potential throughout the forecast period, underpinned by favorable demographic trends, rising disposable incomes, and evolving consumer preferences toward offline entertainment. The expansion of specialty retail infrastructure and the emergence of dedicated gaming venues are expected to further accelerate market penetration. Dubai's record-breaking tourism performance, welcoming 18.72 million international overnight visitors in 2024 according to the Dubai Department of Economy and Tourism, creates additional opportunities for gaming-focused entertainment venues. The market generated a revenue of USD 101.66 Million in 2025 and is projected to reach a revenue of USD 227.1 Million by 2034, growing at a compound annual growth rate of 9.34% from 2026-2034.

UAE Board Games Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Tabletop Games | 40% |

| Game Type | Strategy and War Games | 30% |

| Age Group | 5-12 Years | 48% |

| Distribution Channel | Specialty Stores | 34% |

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The tabletop games segment dominates with a market share of 40% of the total UAE board games market in 2025.

Tabletop games encompass traditional board games, strategy games, and modern designer games that promote face-to-face social interaction among players. This segment benefits from the UAE's cultural emphasis on family gatherings and social entertainment, with games ranging from classic titles to contemporary European-style strategy games. The growing availability of diverse tabletop options through specialty retailers and online channels has significantly expanded consumer access to quality gaming experiences.

The segment's leadership is supported by the expanding retail infrastructure, exemplified by Back to Games, the UAE's first specialty board game retailer, which now operates three stores across Dubai and Abu Dhabi according to its 2024 expansion announcement. The presence of dedicated gaming venues with trained staff who demonstrate games and provide guidance has removed traditional entry barriers, encouraging more families to explore tabletop gaming as a preferred leisure activity.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

The strategy and war games segment leads with a share of 30% of the total UAE board games market in 2025.

Strategy and war games appeal to players seeking intellectually challenging experiences that require tactical thinking, resource management, and long-term planning. These games typically feature complex mechanics and extended play sessions, attracting dedicated hobbyists and gaming enthusiasts who value depth and replayability. The segment benefits from strong community engagement through gaming clubs and tournament events.

The segment's popularity is further validated by the participation of major international publishers in regional gaming events. Leading global gaming companies including Games Workshop, Wizards of the Coast, Stonemaier Games, and Leder Games are exhibiting or represented at UAE conventions, underscoring the strategic importance of the market for international brands. This publisher engagement reflects growing commercial interest in the Middle East's expanding tabletop gaming community and consumer base.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The 5-12 years age group leads the largest share with 48% of the UAE board games market in 2025.

Children aged 5-12 years represent the primary target demographic for educational and developmentally appropriate board games. Parents in the UAE increasingly recognize board games as valuable tools for cognitive development, social skill building, and screen-free entertainment. Games designed for this age group typically feature age-appropriate complexity, colorful components, and themes that engage young minds while promoting learning outcomes.

The UAE government's emphasis on educational development and STEM learning initiatives supports growing demand for skill-building games in this segment. National strategies prioritizing innovative teaching methods and interactive learning align naturally with the pedagogical benefits of educational board games. Schools and educational institutions increasingly incorporate tabletop games into curricula as effective tools for cognitive development and social skill building. This governmental focus on gamified education creates a favorable environment for educational board game adoption among UAE families.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The specialty stores segment holds the largest share of 34% of the total UAE board games market in 2025.

Specialty stores serve as the primary distribution channel for board games in the UAE, offering curated selections, expert product knowledge, and experiential retail environments. These retailers cater to both casual consumers and dedicated hobbyists, providing guidance on game selection and opportunities to try products before purchase. The personalized shopping experience and community-building aspects of specialty retail differentiate these channels from mass-market alternatives.

These specialty retailers provide dedicated gaming tables where customers can learn new games, trained staff who demonstrate product features and gameplay mechanics, and regular community events including tournaments and themed gaming nights that foster customer loyalty and repeat purchases. The experiential nature of specialty retail addresses key barriers to board game adoption, particularly the challenge of understanding complex rulebooks, by offering accessible introductions to new titles through guided demonstrations.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai leads the UAE board games market due to its position as the country's commercial and entertainment hub. The emirate's diverse population of approximately 3.65 million residents according to Dubai Statistics Centre, combined with its robust tourism sector and well-developed retail infrastructure, creates substantial demand for gaming products and venues.

Abu Dhabi represents a significant market driven by family-oriented entertainment preferences and strong government support for educational initiatives. The emirate hosts major educational gaming events and benefits from high disposable incomes among its resident population.

Sharjah's family-focused demographics and cultural emphasis on educational activities create opportunities for developmentally appropriate gaming products. The emirate's growing retail sector supports expansion of specialty gaming retail.

Other emirates including Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain represent emerging markets with growth potential as gaming culture expands beyond primary urban centers.

Market Dynamics:

Growth Drivers:

Why is the UAE Board Games Market Growing?

Young and Diverse Population Driving Family Entertainment Demand

The UAE's demographic composition featuring a young population and diverse expatriate communities creates substantial demand for family-oriented entertainment activities including board games. The country's emphasis on family values and social gatherings aligns naturally with tabletop gaming as a preferred leisure activity. In 2025, 11 million people are predicted to be living in the UAE, a population rise over the last half century that is estimated to be the largest in the world who constitute a primary target demographic for age-appropriate gaming products. This demographic foundation combined with rising disposable incomes enables sustained growth in discretionary spending on entertainment products including board games. The multicultural population also drives demand for games spanning diverse themes and languages, including Arabic-localized versions of international titles.

Expansion of Digital Infrastructure Supporting E-commerce Growth

The UAE's advanced digital infrastructure and high internet penetration rates facilitate online discovery and purchase of board games, expanding market accessibility beyond traditional retail channels. E-commerce platforms enable consumers to access international titles and specialty products that may not be available through physical retail. The UAE e-commerce market reached USD 125.0 Billion in 2024 and is expected to reach USD 776.2 Billion by 2033, exhibiting a growth rate (CAGR) of 21.4% during 2025-2033. This digital commerce growth supports specialty gaming retailers in reaching broader audiences while enabling international publishers to directly serve UAE consumers. The country's near-universal internet connectivity and high smartphone adoption rates further accelerate online shopping for gaming products.

Government Initiatives Supporting Educational Gaming and STEM Learning

UAE government policies emphasizing educational development, STEM skills, and screen-time reduction create favorable conditions for educational board game adoption. National initiatives promoting innovative learning methods align with the pedagogical benefits of tabletop gaming. These governmental investments in gamified education validate board games as legitimate learning tools and encourage parental adoption of educational gaming products. Schools and educational institutions increasingly incorporate tabletop games into curricula as effective teaching aids.

Market Restraints:

What Challenges the UAE Board Games Market is Facing?

Competition from Digital Gaming and Screen-Based Entertainment

The widespread availability of mobile games, video games, and streaming entertainment presents significant competition for consumer leisure time and discretionary spending. Digital gaming offers convenience and instant gratification that traditional board games cannot match, particularly among younger demographics accustomed to technology-based entertainment.

High Import Costs and Limited Local Manufacturing

The reliance on imported board games from international publishers’ results in higher retail prices compared to digital alternatives. Limited local manufacturing capabilities mean products must be shipped from Europe, North America, or Asia, adding logistics costs and extending delivery timeframes for new releases.

Space Constraints in Urban Living Environments

Apartment living predominant in UAE urban centers presents challenges for storing extensive board game collections and hosting gaming sessions requiring table space. Limited residential space may discourage consumers from purchasing larger games or building substantial collections, constraining per-household spending potential.

Competitive Landscape:

The UAE board games market exhibits moderate competitive intensity characterized by the presence of international gaming publishers alongside regional specialty retailers and distributors. Market dynamics are shaped by product innovation, experiential retail strategies, and localization efforts for Arabic-speaking consumers. Specialty retailers emphasize curated product selections, expert guidance, and community-building activities to differentiate from mass-market channels. The competitive landscape is increasingly influenced by e-commerce capabilities, event hosting, and partnerships with international publishers seeking regional market entry. Distribution networks connecting publishers to diverse retail channels remain critical competitive factors.

Recent Developments:

- February 2024: Times Square Center Dubai announced the expansion of Back to Games, the UAE's leading board game specialty retailer, to a larger location on the ground floor. The expanded store now stocks over 1,500 games and features enhanced space for hosting themed events and community activities.

UAE Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE board games market size was valued at USD 101.66 Million in 2025.

The UAE board games market is expected to grow at a compound annual growth rate of 9.34% from 2026-2034 to reach USD 227.1 Million by 2034.

Tabletop games dominated the UAE board games market with a share of 40% in 2025, driven by family-oriented entertainment preferences, expanding specialty retail infrastructure, and growing board game cafe culture across the emirates.

Key factors driving the UAE board games market include the young and diverse population creating family entertainment demand, expanding digital infrastructure supporting e-commerce growth, government initiatives promoting educational gaming and STEM learning, and growing specialty retail presence.

Major challenges include competition from digital gaming and screen-based entertainment platforms, high import costs due to limited local manufacturing capabilities, and space constraints in urban living environments that limit storage and gaming space availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)