UAE Building Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

UAE Building Materials Market Overview:

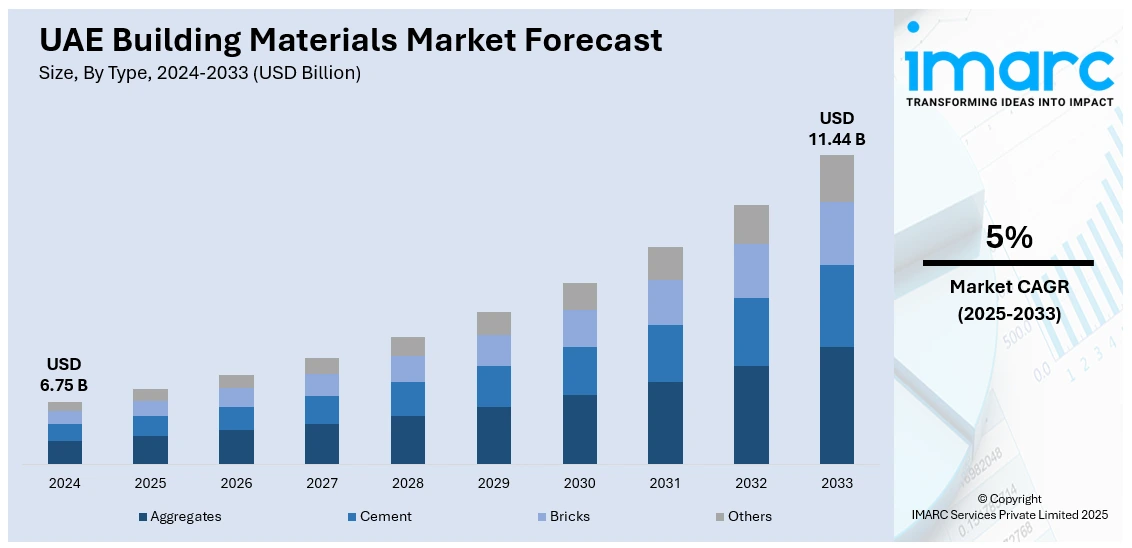

The UAE building materials market size reached USD 6.75 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.44 Billion by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. Rapid urbanization, infrastructure development, real estate growth, government initiatives like Expo 2020, and a booming construction sector are some of the factors contributing to the UAE building materials market share. Increased demand for sustainable materials, technological advancements in manufacturing, and rising investments in green buildings further support the market's expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.75 Billion |

| Market Forecast in 2033 | USD 11.44 Billion |

| Market Growth Rate 2025-2033 | 5% |

UAE Building Materials Market Trends:

Sustainable Building Materials Adoption

The UAE building industry has witnessed a significant shift toward sustainable construction materials, led by a growing focus on the environment. As the nation's ambitious goals of curbing its carbon impact and promoting green building codes, green materials are becoming more widely adopted in building work. Recycled steel, low-carbon concrete, and energy-saving insulation are becoming standard in new development. These products not only enhance sustainability but also align with government initiatives like the Estidama and Green Building Regulations. The public and commercial sectors are likely to have increased demand for these products since they prioritize low-impact and energy-efficient buildings. Therefore, producers of green building materials are seeing greater investment and innovation in products that conform to international environmental standards. In addition, this trend is driving the growth of green certification programs and promoting global investments in environmentally friendly infrastructure. Sustainable building materials are likely to become a more significant factor in the UAE's architectural and construction scene over the next decade. These factors are intensifying the UAE building materials market growth.

To get more information on this market, Request Sample

Technological Advancements in Building Materials

The UAE construction materials sector is also being revolutionized by tech innovations that enhance performance and efficiency. At the forefront are smart materials and 3D printing technologies, which enable shorter construction timetables and more precise designs. Smart materials like self-healing concrete and thermochromic glass are finding applications in new constructions to enhance durability as well as energy efficiency. 3D printing technology has now started changing the production of construction elements, eliminating waste and labor expenses. In addition, digital methods like Building Information Modeling (BIM) enhance planning, minimize errors, and maximize resource utilization. The UAE's focus on future urban projects like Dubai Expo 2020 and proposed smart cities drives the demand for high-tech materials. As they continue to develop, not only are they making buildings more functional, but also reducing the long-term maintenance costs and enhancing the productivity of the construction sector. Over the next few years, technological developments are likely to be a key driver of the UAE construction industry.

UAE Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Aggregates

- Cement

- Bricks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes aggregates, cement, bricks, and others.

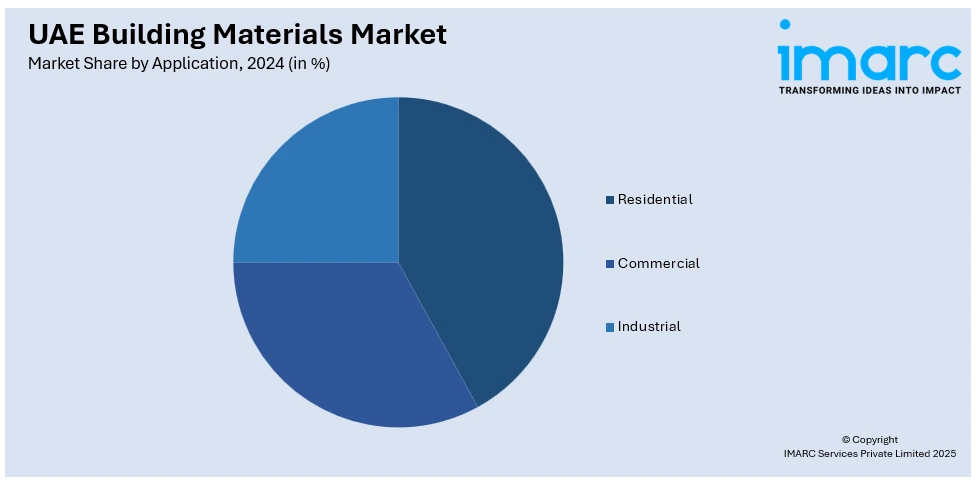

Application Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and industrial.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Building Materials Market News:

- In May 2025, Exeed Industries signed an MoU with Partanna Oasis to introduce carbon-negative cement technologies in the UAE. The collaboration aims to establish facilities in Abu Dhabi for producing Partanna’s next-generation cement alternatives. These materials, which don’t use Portland cement, actively remove CO₂ from the atmosphere, presenting an innovative approach to sustainable construction and reducing global CO₂ emissions linked to cement production.

UAE Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Aggregates, Cement, Bricks, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE building materials market on the basis of type?

- What is the breakup of the UAE building materials market on the basis of application?

- What is the breakup of the UAE building materials market on the basis of region?

- What are the various stages in the value chain of the UAE building materials market?

- What are the key driving factors and challenges in the UAE building materials market?

- What is the structure of the UAE building materials market and who are the key players?

- What is the degree of competition in the UAE building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)