UAE Car Insurance Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, and Region, 2026-2034

UAE Car Insurance Market Summary:

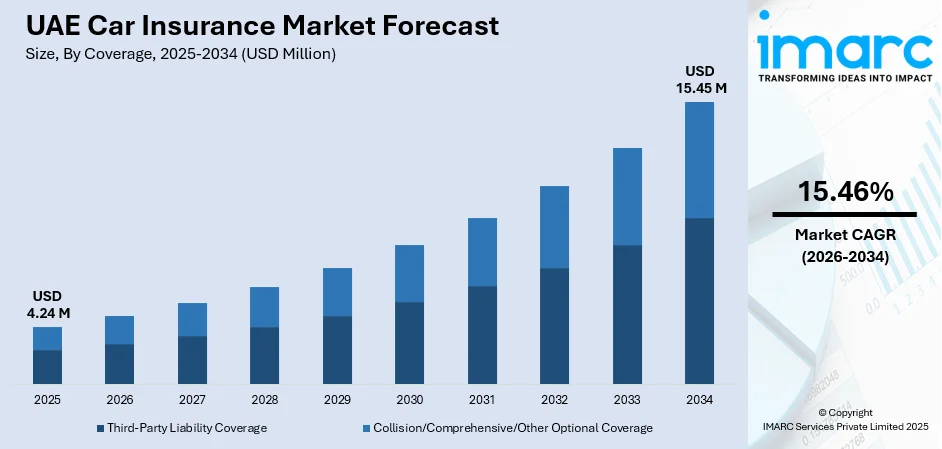

The UAE car insurance market size was valued at USD 4.24 Million in 2025 and is projected to reach USD 15.45 Million by 2034, growing at a compound annual growth rate of 15.46% from 2026-2034.

The UAE car insurance market is experiencing robust expansion driven by mandatory insurance regulations, rising vehicle ownership, and rapid digital transformation across insurance operations. The growing expatriate population and increasing disposable incomes are fueling vehicle purchases, directly boosting demand for both third-party liability and comprehensive coverage options. Advanced digital platforms, InsurTech innovations, and telematics-based insurance models are enhancing customer experiences while enabling personalized premium structures. The proliferation of electric vehicles and the emergence of specialized coverage products are creating new growth avenues, collectively strengthening the UAE car insurance market share across personal and commercial segments.

Key Takeaways and Insights:

-

By Coverage: Collision/comprehensive/other optional coverage dominates the market with a share of 63% in 2025, driven by growing consumer preference for wider protection plans that safeguard against accidents, natural disasters, theft, and electric vehicle-specific risks.

-

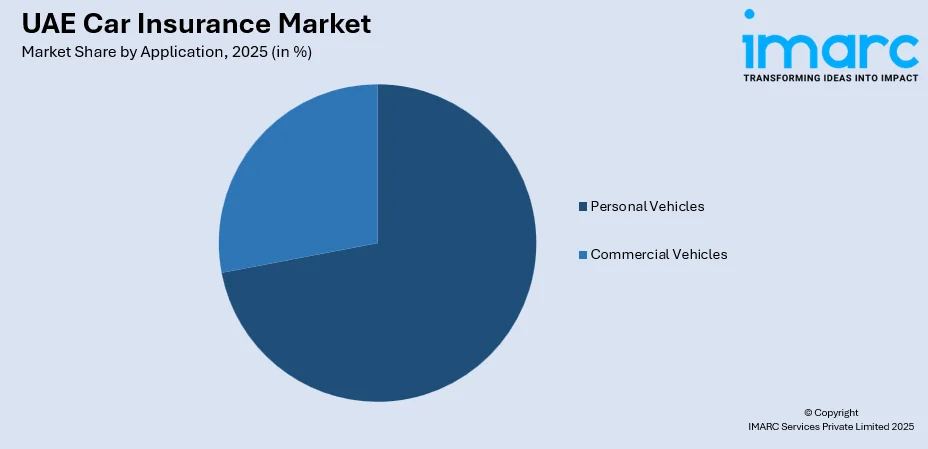

By Application: Personal vehicles lead the market with a share of 72% in 2025, reflecting the substantial number of private vehicles on UAE roads and the rising affordability through easy financing and EMI options.

-

By Distribution Channel: Brokers represent the largest segment with a market share of 50% in 2025, playing a crucial role in facilitating connections between insurance providers and customers through expert guidance and customized solutions.

-

By Region: Dubai leads the market with a share of 44% in 2025, owing to its position as the country's economic and commercial hub with the highest concentration of registered vehicles and high-value luxury car ownership.

-

Key Players: The UAE car insurance market exhibits intense competitive dynamics, with established national insurers competing alongside international players and emerging InsurTech companies. Market participants are investing heavily in digital platforms, AI-driven risk assessment tools, and customer-centric mobile applications to capture market share and enhance service delivery.

To get more information on this market Request Sample

The UAE car insurance market is evolving rapidly as regulatory frameworks strengthen consumer protections and technology reshapes traditional insurance operations. The Central Bank of the UAE, through Federal Decree-Law No. 48 of 2023, has consolidated insurance regulations to ensure transparency and policyholder protection. For instance, in August 2025, Shory partnered with Wio Bank to embed car insurance services directly into the Wio Personal app, enabling users to purchase and finance coverage with flexible installments. Digital transformation is accelerating, with internet penetration reaching nearly 99% and several UAE residents now preferring online transactions for insurance purchases. The unprecedented rainfall event in April 2024, which led to widespread vehicle damage, has prompted insurers to update pricing models and include natural disaster coverage within comprehensive car insurance policies.

UAE Car Insurance Market Trends:

Rise of Telematics and Usage-Based Insurance Models

Telematics technology is transforming the UAE motor insurance landscape by enabling personalized premium structures based on actual driving behavior. Insurers are deploying in-vehicle devices and mobile applications to monitor speed, braking patterns, and mileage, rewarding safe drivers with lower premiums. In July 2025, AutoData Middle East introduced AI-oriented intelligence tools aimed at refining pricing precision and enhancing risk assessment across the used car and insurance sectors. This data-driven approach supports the UAE car insurance market growth by offering fairer pricing and encouraging responsible driving practices.

Accelerated Digital Transformation and InsurTech Integration

Digital platforms are revolutionizing how UAE consumers research, compare, and purchase motor insurance policies. InsurTech companies like Shory, Policybazaar, and myAlfred have emerged as significant market disruptors, offering instant quotes, paperless policy issuance, and seamless claims processing through user-friendly mobile applications. In April 2025, Shory facilitated drivers to secure comprehensive vehicle insurance in under 90 seconds requiring only a plate number, addressing the region's growing demand for efficient and transparent insurance services. Online insurance sales have jumped from under 1% five years ago to 5-7% currently, signaling fundamental shifts in consumer purchasing behavior.

Emergence of Specialized Electric Vehicle Coverage Products

The rapid adoption of electric vehicles in the UAE is driving the development of specialized insurance products tailored to EV-specific risks. A recent survey covering more than 12,000 respondents across 33 countries revealed that a vast majority of EV owners in the GCC intend to purchase another electric vehicle, surpassing the global average. In the UAE, this intention is particularly strong, with 94% of electric car owners expressing plans to buy another, ranking second only to China. Insurers are introducing coverage for battery degradation, charging station incidents, and software malfunctions. EV insurance premiums currently average 20-35% higher than conventional vehicles due to expensive battery components accounting for up to 40% of vehicle value and limited specialized repair infrastructure. Insurers are now including battery protection clauses and roadside charging assistance in comprehensive policies.

Market Outlook 2026-2034:

The UAE car insurance market is positioned for sustained expansion as the country's vehicle ownership continues to rise and digital insurance adoption accelerates. Regulatory reforms, including the Insurance Brokers' Regulation 2024 effective from February 2025, are enhancing transparency and consumer protection while fostering healthy market competition. The proliferation of electric vehicles, expected to exceed 15% of all sales by 2030, will drive innovation in specialized coverage products. Additionally, new regulations requiring flood coverage in the Northern Emirates and increased minimum liability limits are expected to further reinforce the underlying strength of the market. The market generated a revenue of USD 4.24 Million in 2025 and is projected to reach a revenue of USD 15.45 Million by 2034, growing at a compound annual growth rate of 15.46% from 2026-2034.

UAE Car Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Coverage | Collision/Comprehensive/Other Optional Coverage | 63% |

| Application | Personal Vehicles | 72% |

| Distribution Channel | Brokers | 50% |

| Region | Dubai | 44% |

Coverage Insights:

- Third-Party Liability Coverage

- Collision/Comprehensive/Other Optional Coverage

The collision/comprehensive/other optional coverage dominates with a market share of 63% of the total UAE car insurance market in 2025.

The comprehensive coverage segment is seeing rapid growth as UAE motorists increasingly prioritize protection beyond basic third-party liability. Recent extreme weather events and rising incidents of theft and accidents have highlighted the importance of broader insurance protection. Additionally, the increasing number of luxury vehicle purchases and heightened awareness of potential risks are prompting drivers to choose premium coverage plans, reflecting a shift toward more extensive and personalized insurance solutions in the UAE automotive market.

Insurers are strengthening their comprehensive policies by introducing innovative add-ons such as zero depreciation coverage, driver protection, GCC-wide coverage, and specialized insurance for electric vehicle batteries. Regulatory changes requiring flood coverage in the Northern Emirates and higher minimum liability limits are further encouraging consumers to choose comprehensive plans. Growth in this segment is also supported by the inclusion of services like agency repair networks, personal accident protection, and roadside assistance, making comprehensive insurance increasingly attractive to motorists seeking extensive coverage and added convenience.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Personal Vehicles

- Commercial Vehicles

The personal vehicles lead the market with a share of 72% of the total UAE car insurance market in 2025.

The personal vehicles segment commands the largest market share due to the substantial and growing number of private vehicles on UAE roads. Rising disposable incomes, favorable financing options including easy EMI alternatives, and the expanding expatriate population are driving personal vehicle ownership. Official figures from Dubai’s toll operator, Salik, indicate that the total number of registered vehicles in the country rose to 4.56 million by June 2025, up from 4.17 million a year earlier. This represents a notable year-on-year increase, with approximately 390,000 additional vehicles added to the roads, reflecting continued growth in vehicle ownership across the emirate.

The UAE’s mandatory vehicle insurance requirement guarantees steady demand for personal auto coverage. Consumer preferences are increasingly favoring luxury and electric vehicles, prompting insurers to design specialized policies tailored for high-value and eco-friendly cars. The growing availability of digital comparison platforms and tools for instant policy issuance has streamlined the insurance purchasing process, making it more convenient for individual car owners. These developments are driving innovation in product offerings and enhancing accessibility, supporting the continued growth and modernization of the personal vehicle insurance market in the UAE.

Distribution Channel Insights:

- Direct Sales

- Individual Agents

- Brokers

- Banks

- Online

- Others

The brokers represent the largest share at 50% of the total UAE car insurance market in 2025.

Insurance brokers play a pivotal role in the UAE car insurance distribution landscape, contributing nearly 50% of premiums written in the non-life insurance sector. Brokers facilitate connections between insurers and customers by offering expert guidance, comprehensive product comparisons, and customized solutions tailored to individual requirements. Their ability to negotiate competitive rates and provide professional advice enhances consumer confidence in purchasing decisions.

The Insurance Brokers' Regulation 2024 has redefined broker operations to enhance transparency and minimize conflicts of interest. Under the new framework, insurers must make claim payments and premium refunds directly to policyholders, while brokers are obligated to respond to claims promptly, ensuring faster and more efficient service. The online distribution channel is emerging as the fastest-growing segment, with digital platforms enabling instant quote comparisons, paperless processing, and seamless policy management through mobile applications.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai leads with a share of 44% of the total UAE car insurance market in 2025.

Dubai leads the UAE car insurance market due to its role as the nation’s economic and commercial center, coupled with the highest concentration of registered vehicles. The emirate’s dense traffic, significant luxury car ownership, and large expatriate population create strong demand for both comprehensive and third-party liability coverage. These factors, combined with a thriving automotive environment, position Dubai as the primary hub for vehicle insurance, influencing market trends, product offerings, and consumer preferences across the country.

Dubai also serves as a base for insurers and InsurTech companies, fostering innovation, competitive pricing, and digital adoption. Online insurance platforms have gained traction, catering to tech-savvy consumers who prefer convenient comparison and purchase options. Other emirates, including Abu Dhabi, Sharjah, and the Northern Emirates, are experiencing rising insurance uptake, supported by regulatory developments and growing awareness of the benefits of comprehensive coverage, further expanding the overall UAE car insurance market.

Market Dynamics:

Growth Drivers:

Why is the UAE Car Insurance Market Growing?

Mandatory Insurance Regulations and Strengthened Compliance Framework

A major driver of the UAE car insurance market is the compulsory insurance mandate for all vehicle owners. Every car must carry at least third-party liability coverage to be legally operated, ensuring a consistent and growing customer base for insurers. Recent regulatory reforms have strengthened transparency and policyholder protection, while broker regulations now require direct insurer-to-policyholder payments and dedicated account systems. Strict enforcement by authorities and automatic linking of policies to vehicle registration minimize lapses and ensure compliance. Together, these measures create a well-regulated, secure environment supporting sustained market growth.

Rising Vehicle Ownership and Growing Expatriate Population

The rapid increase in vehicle ownership across the UAE is fueling demand for car insurance. Urbanization, higher disposable incomes, and strong interest in luxury and electric vehicles are driving sales, while financing and leasing options make vehicles more accessible to residents. The growing expatriate population, particularly in major cities, further contributes to rising vehicle numbers. This expansion is creating demand for specialized insurance products that cater to high-value and eco-friendly vehicles. Consequently, the overall insurance market is benefiting from both the volume of new registrations and evolving consumer preferences.

Digital Transformation and InsurTech Innovation

Digitalization is reshaping the UAE motor insurance industry, driving efficiency and enhancing customer experiences. Insurers are increasingly adopting online platforms for policy management, instant quotes, and AI-based risk assessment to meet the expectations of tech-savvy consumers. InsurTech solutions are streamlining processes, enabling faster policy issuance, and facilitating personalized pricing models through telematics and data analytics. Mobile-first platforms and digital innovations are improving accessibility and convenience, while blockchain and automated systems are enhancing transparency and operational efficiency. Collectively, these technological advancements are accelerating market expansion and transforming the way consumers interact with motor insurance. For instance, in September 2025, Policybazaar for Business, the B2B division of Indian insurtech Policybazaar.com, has expanded its reinsurance operations to the UAE, Qatar, Oman, and Sri Lanka. This initiative positions the company among the first India-based intermediaries to bring a technology-enabled reinsurance model to international markets, leveraging digital solutions to enhance efficiency and innovation across cross-border insurance services.

Market Restraints:

What Challenges the UAE Car Insurance Market is Facing?

Elevated Electric Vehicle Insurance Premiums

Insurance premiums for electric vehicles remain significantly higher than those for conventional cars, creating cost barriers for adoption. Factors contributing to elevated premiums include the high value of battery components, limited availability of specialized repair workshops, and increased claim frequencies. Additionally, the scarcity of authorized service centers for certain imported EV brands complicates maintenance and repair processes, prompting insurers to adjust coverage structures and pricing to manage risk effectively.

Intense Market Competition Affecting Profitability

Heightened competition among insurers is leading to aggressive pricing strategies, with companies lowering premiums to attract customers, sometimes at the cost of profitability. The rise of InsurTech companies has disrupted traditional business models, forcing established players to invest heavily in digital transformation. This competitive pressure can lead to reduced margins, making it challenging for insurers to maintain financial stability while delivering quality service.

Climate-Related Claims and Natural Disaster Exposure

Extreme weather events present substantial challenges for insurers in the UAE. Severe rainfall and flooding incidents have led to widespread vehicle damage, compelling insurers to revise pricing models and adopt robust risk management strategies. Rising claims from natural disasters increase operational complexity, necessitating advanced reinsurance arrangements and contingency planning. These developments can influence premium levels, as insurers seek to balance coverage, risk exposure, and financial stability while protecting policyholders.

Competitive Landscape:

The UAE car insurance market features a competitive landscape of regional and international insurers navigating an increasingly digital environment. Companies are investing in technology integration and innovative products to stay ahead, while the rise of InsurTech platforms has heightened competition and encouraged collaborations with digital aggregators. Market differentiation is being achieved through AI-driven risk assessment, instant policy issuance, telematics-based pricing, and specialized coverage for electric vehicles. Strategic partnerships between insurers and financial institutions are opening new distribution channels, improving customer accessibility, and enhancing service convenience. These trends collectively reflect a shift toward technology-enabled, customer-centric solutions in the UAE automotive insurance sector.

Recent Developments:

-

Dubai December 2025: Police launched a new digital service enabling motorists to secure a ‘To Whom It May Concern’ certificate for vehicle damage resulting from weather-related incidents, without the need to visit a police station physically. This certificate is typically necessary when submitting insurance claims for damages caused by heavy rainfall, flooding, or other natural events, streamlining the claims process and improving convenience for vehicle owners.

-

May 2025: Policybazaar.ae broadened its PB Advantage initiative to include car insurance customers, transforming how UAE residents handle motor coverage and claims with complimentary car washes, fixed-rate savings on maintenance and repairs, and exclusive deals on the Registration Readiness Package.

UAE Car Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Third-Party Liability Coverage, Collision/Comprehensive/Other Optional Coverage |

| Applications Covered | Personal Vehicles, Commercial Vehicles |

| Distribution Channels Covered | Direct Sales, Individual Agents, Brokers, Banks, Online, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE car insurance market size was valued at USD 4.24 Million in 2025.

The UAE car insurance market is expected to grow at a compound annual growth rate of 15.46% from 2026-2034 to reach USD 15.45 Million by 2034.

Collision/comprehensive/other optional coverage, representing the largest revenue share of 63% in 2025, dominates the UAE car insurance market as consumers increasingly seek comprehensive protection against accidents, natural disasters, theft, and specialized coverage for electric vehicles and luxury cars.

Key factors driving the UAE car insurance market include mandatory insurance regulations, rising vehicle ownership, growing expatriate population, digital transformation through InsurTech platforms, increasing electric vehicle adoption, and strengthened regulatory frameworks enhancing consumer protection.

Major challenges include elevated electric vehicle insurance premiums due to expensive battery components and limited repair infrastructure, intense market competition affecting profitability, climate-related claims from extreme weather events, and the need for continuous digital investment to remain competitive.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)