UAE Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

UAE Carbon Black Market Overview:

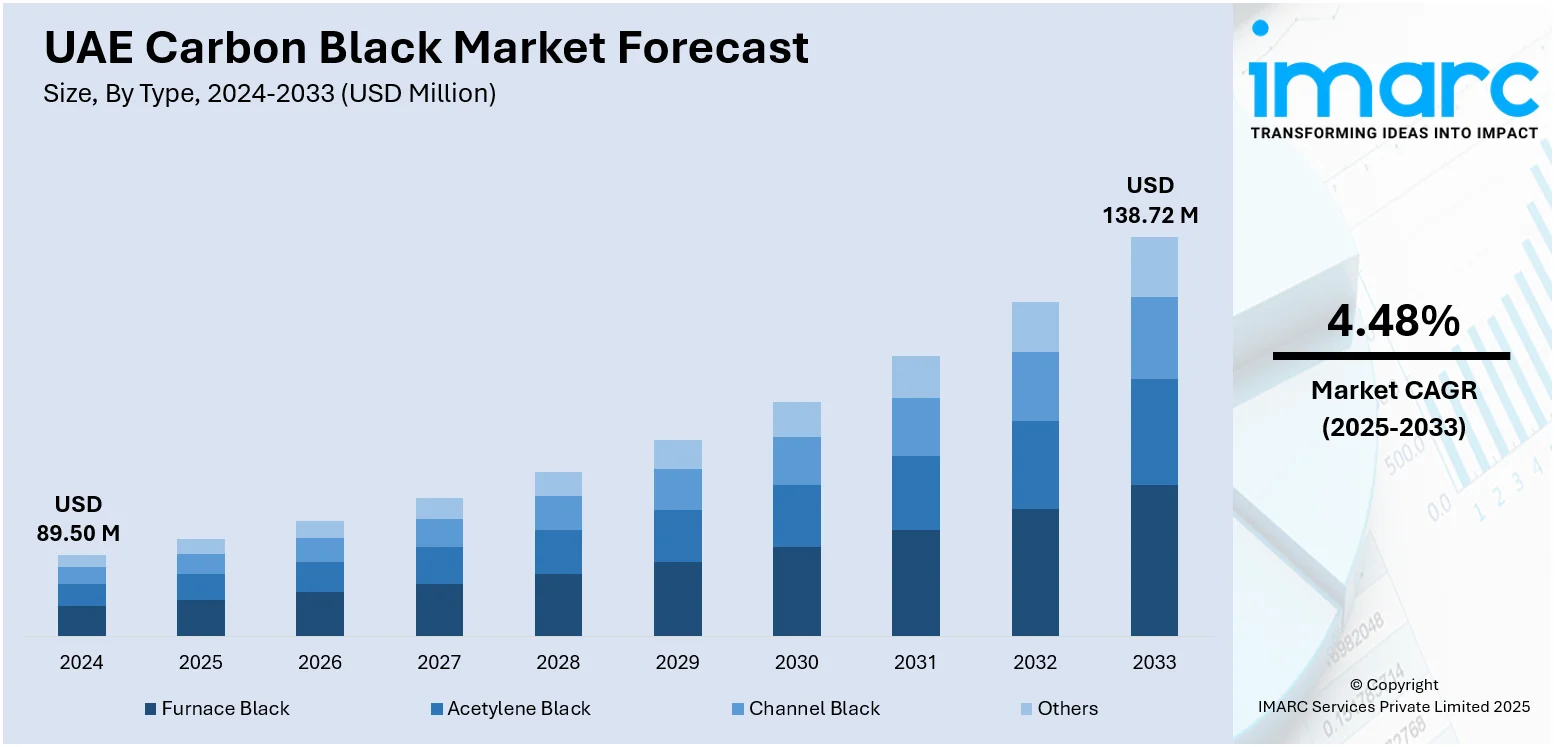

The UAE carbon black market size reached USD 89.50 Million in 2024. Looking forward, the market is projected to reach USD 138.72 Million by 2033, exhibiting a growth rate (CAGR) of 4.48% during 2025-2033. The market is expanding through heightened demand in plastics, coatings, adhesives, and advanced electrical applications. Increased electrification initiatives and growing use of conductive polymers are reshaping product requirements across infrastructure, automotive, and electronics. Simultaneously, manufacturers are aligning with international sustainability benchmarks, favoring high-purity and compliant grades for food, packaging, and industrial use, further augmenting the UAE carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 89.50 Million |

| Market Forecast in 2033 | USD 138.72 Million |

| Market Growth Rate 2025-2033 | 4.48% |

UAE Carbon Black Market Trends:

Advanced Applications Across Non-Tire Sectors

The UAE is witnessing an uptick in carbon black usage across diverse non-tire industries such as plastics, coatings, adhesives, and printing. The country’s infrastructure and real estate development cycles require exterior-grade pipes, sheets, and films with UV resistance, pushing demand for high-dispersion carbon black variants. Plastic processors prioritize grades that provide superior coloration, thermal stability, and outdoor durability, especially in consumer packaging and rigid containers. In the coatings sector, formulators rely on treated grades to ensure long-lasting jetness, heat insulation, and chemical resistance, particularly for use in construction and marine applications. The growing use of carbon black in adhesives and sealants has also become prominent, where it functions as a strengthening filler and pigmentation agent for construction chemicals and weatherproofing membranes. In June 2025, H.B. Fuller opened a new adhesives and sealants manufacturing facility in the Ras Al Khaimah Economic Zone, UAE, with a 15,000 m² production area. This facility is designed to meet the growing demand for construction-related adhesives and sealants, including applications in building envelopes and roofing. The strategic location aims to enhance regional supply chains, with H.B. Fuller planning to expand its operations to further strengthen its presence in the MENA region. In the printing sector, commercial and digital presses increasingly incorporate carbon black inks that offer excellent contrast and drying performance for high-volume substrates. Customization and local blending support the expanding application base and reduce dependency on generic imports, which are closely tied to the UAE carbon black market growth.

To get more information on this market, Request Sample

Push for Electrification and Conductive Polymers

The UAE’s ambition to become a regional clean technology and electrification hub is influencing demand for specialty carbon black across electrical and energy-focused segments. Conductive and antistatic grades are being utilized in polymer enclosures, cable shielding, and packaging solutions for sensitive electronic components. Key players are expanding their operations into the UAE in response. In April 2024, Aptera announced its expansion into the UAE market, aiming to introduce its solar-powered electric vehicle (sEV), the BinC, in response to increasing demand for clean mobility solutions. The company plans to produce 1 million sEVs by 2030, with a special "Union Edition" set for exclusive delivery to the UAE in 2026, featuring advanced solar technology and unique design elements. The increasing volume of electric vehicle (EV) parts and solar photovoltaic modules being assembled or distributed through UAE free zones has created a need for advanced polymer components with consistent conductivity, electromagnetic shielding, and UV performance. Carbon black plays an essential role in achieving these specifications, especially in battery housing, automotive under-hood components, and power storage insulation. Furthermore, the electronics sector uses fine particle carbon black to maintain tight conductivity thresholds across printed circuit boards and smart sensors. The country’s commitment to logistics and electronics re-export activities has resulted in the localization of compounding and formulation activities, where tailored carbon black dispersions enhance processing efficiency and consistency. These trends illustrate how functional-grade materials are aligned with the country’s long-term industrial technology goals.

UAE Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

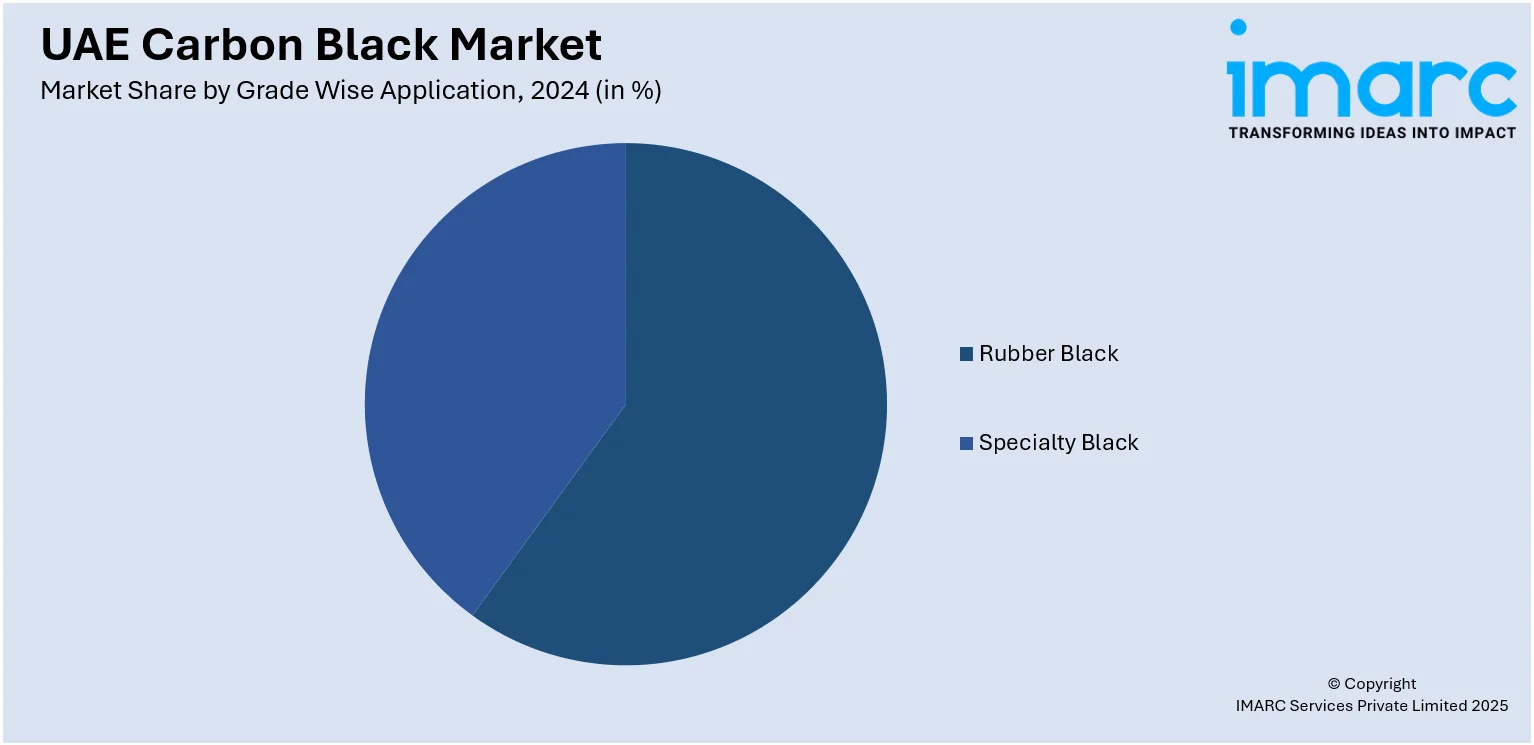

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE carbon black market on the basis of type?

- What is the breakup of the UAE carbon black market on the basis of grade wise application?

- What is the breakup of the UAE carbon black market on the basis of region?

- What are the various stages in the value chain of the UAE carbon black market?

- What are the key driving factors and challenges in the UAE carbon black market?

- What is the structure of the UAE carbon black market and who are the key players?

- What is the degree of competition in the UAE carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)