UAE Cat Food Market Size, Share, Trends and Forecast by Product Type, Ingredient Type, and Distribution Channel, 2026-2034

UAE Cat Food Market Summary:

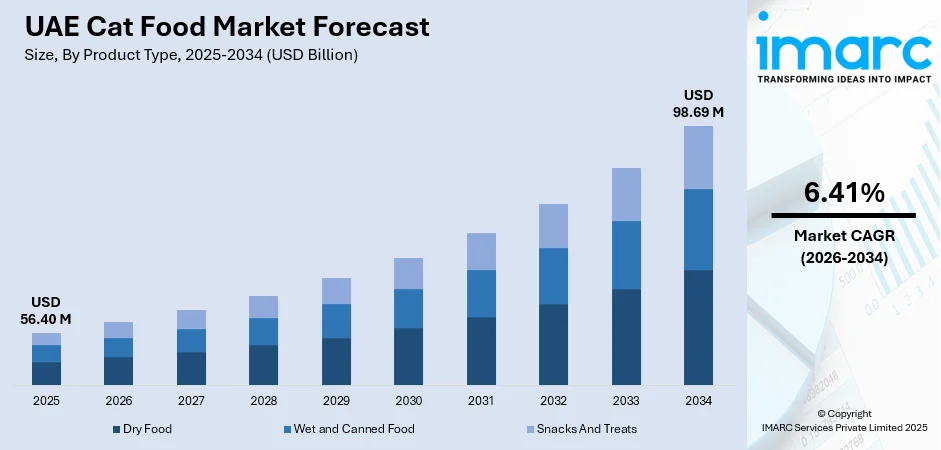

The UAE cat food market size was valued at USD 56.40 Million in 2025 and is projected to reach USD 98.69 Million by 2034, growing at a compound annual growth rate of 6.41% from 2026-2034.

The UAE cat food market is experiencing robust expansion driven by rising pet humanization trends and increasing disposable incomes among urban populations. Growing expatriate communities, cultural acceptance of cats as household companions, and heightened awareness regarding pet nutrition are strengthening demand. Premiumization trends, expanding retail accessibility, and the proliferation of specialized pet care products are reshaping consumer preferences, positioning the UAE as a dynamic regional hub for premium pet food solutions and driving UAE cat food market share.

Key Takeaways and Insights:

- By Product Type: Dry food dominates the market with a share of 44.65% in 2025, reflecting consumer preference for convenient, shelf-stable, and cost-effective feeding solutions that support daily nutritional needs.

- By Ingredient Type: Animal derivative leads the market with a share of 72.94% in 2025, driven by protein-rich formulations that align with cats’ natural carnivorous dietary requirements and nutritional standards.

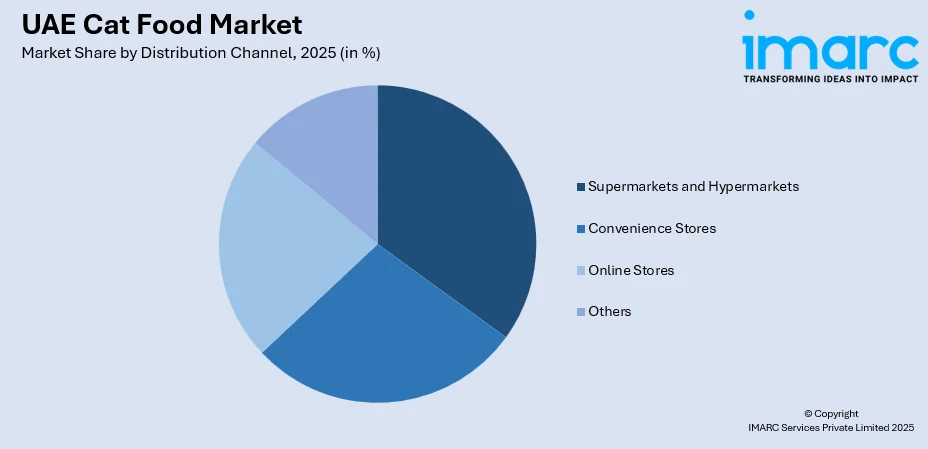

- By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 23.56% in 2025, owing to widespread accessibility, product variety, and consumer preference for one-stop shopping experiences.

- Key Players: The UAE cat food market exhibits a moderately competitive landscape, with multinational pet food corporations alongside regional distributors actively expanding product portfolios, investing in premium offerings, and strengthening retail partnerships to capture growing consumer demand across diverse price segments.

To get more information on this market Request Sample

The UAE cat food market is advancing as pet ownership continues to rise among single-person households, young professionals, and families seeking low-maintenance companion animals. Cats hold particular cultural significance in the region, being viewed favorably within Islamic traditions as clean and suitable household pets. The country’s pet-friendly infrastructure is expanding, with veterinary clinics, pet stores, and grooming facilities increasingly accommodating feline care needs. For instance, in April 2025, A new ready-to-eat pet food brand, Zabeel Pets, is set to debut at Pet World Arabia this year. The announcement comes from event organizers, who noted that Zabeel Feed, a facility producing 300 MT of animal feed, will operate Zabeel Pets as a distinct division of the company. Originally established in 1985 by His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, Zabeel Feed has built a strong reputation through its successful equine operations. This retail expansion reflects growing consumer sophistication and willingness to invest in specialized nutrition for their feline companions.

UAE Cat Food Market Trends:

Rising Demand for Premium and Specialized Cat Food

Pet owners in the UAE are increasingly prioritizing high-quality nutrition for their cats, driving demand for premium and specialized formulations. Grain-free options, organic ingredients, and breed-specific diets are gaining popularity among affluent consumers. In March 2024, a leading Dubai-based pet retailer reported that sales of premium cat food products increased substantially year-over-year, with grain-free varieties accounting for a significant portion of total cat food revenue. This premiumization trend reflects the broader pet humanization movement, reshaping the UAE cat food market growth.

Expansion of E-commerce and Digital Pet Retail

Online pet food sales are rapidly expanding in the UAE, driven by evolving consumer habits and enhanced logistics capabilities. E-commerce platforms provide convenience through home delivery, subscription services, and easy access to a wide range of products, appealing especially to busy urban professionals. The UAE e-commerce market size reached USD 125.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 776.2 Billion by 2033, exhibiting a growth rate (CAGR) of 21.4% during 2025-2033. The growth of dedicated digital pet food categories is reshaping purchasing behavior, making it simpler for consumers to access premium and specialized cat food options while supporting broader market expansion and modern retail trends across the country.

Growth of Functional and Health-Focused Formulations

Cat food manufacturers are increasingly focusing on functional formulations that address specific feline health needs, such as hairball management, urinary care, and weight control. UAE pet owners are becoming more conscious of preventive health nutrition, driving demand for specialized products. Health-oriented innovations are influencing product development strategies, with brands creating veterinary-inspired formulations to support overall well-being. This shift toward functional nutrition is shaping the UAE cat food market, encouraging the introduction of premium, targeted solutions that cater to the evolving expectations of health-conscious pet owners.

Market Outlook 2026-2034:

The UAE cat food market is set for steady growth, driven by urbanization, rising living standards, and evolving consumer attitudes toward pet care. Increasing demand for premium and functional nutrition products is creating new opportunities across categories. Wider retail networks and the rise of e-commerce are improving product accessibility, while greater awareness of cats’ specific dietary needs is encouraging the adoption of higher-quality, specialized diets, further supporting market premiumization and long-term expansion. The market generated a revenue of USD 56.40 Million in 2025 and is projected to reach a revenue of USD 98.69 Million by 2034, growing at a compound annual growth rate of 6.41% from 2026-2034.

UAE Cat Food Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Dry Food |

44.65% |

|

Ingredient Type |

Animal Derivative |

72.94% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

23.56% |

Product Type Insights:

- Dry Food

- Wet and Canned Food

- Snacks and Treats

Dry food dominates the UAE cat food market with a share of 44.65% in 2025.

Dry cat food continues to dominate the UAE market, valued for its convenience, long shelf life, and cost efficiency compared to wet options. Its ease of use appeals to busy urban pet owners, while the kibble’s texture also aids dental health through chewing. Retailers are increasingly expanding offerings to include specialized formulations for indoor cats and senior felines, catering to growing consumer demand for tailored nutrition that addresses specific lifestyle and life-stage needs, reinforcing the format’s strong market position.

The segment continues benefiting from product innovation, with manufacturers introducing varied protein sources, enhanced palatability, and improved nutritional profiles. Packaging innovations, including resealable bags and portion-controlled formats, address consumer convenience preferences. The competitive pricing of dry food relative to wet alternatives makes it accessible across various income segments, supporting broad market penetration throughout the Emirates.

Ingredient Type Insights:

- Animal Derivative

- Plant Derivative

- Cereals Derivative

- Others

Animal derivative leads the UAE cat food market with a 72.94% share in 2025.

Animal-based ingredients continue to dominate cat food formulations in the UAE, aligning with cats’ obligate carnivore dietary needs and consumer awareness of proper feline nutrition. Proteins such as chicken, fish, lamb, and beef remain the primary components of most commercial products. Manufacturers are increasingly offering single-source protein options and limited-ingredient diets to meet rising consumer demand for simplified, high-quality nutrition, reflecting a trend toward transparency, dietary precision, and tailored formulations for cats in the UAE market.

The preference for animal-based formulations aligns with premium positioning strategies, as high-quality protein content serves as a key differentiator in the competitive marketplace. Marine-sourced proteins, particularly fish-based formulations, show strong appeal among UAE consumers, reflecting regional culinary influences and perceptions of seafood as a premium ingredient. Manufacturers continue investing in novel protein sources and sustainable sourcing practices to address evolving consumer preferences.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets represent the highest revenue share at 23.56% of the UAE cat food market in 2025.

Supermarkets and hypermarkets remain the leading distribution channels for cat food in the UAE, providing a wide product variety, competitive prices, and convenient one-stop shopping. Major chains offer dedicated pet food sections that showcase both mainstream and premium brands. Retailers are also enhancing the shopping experience through specialized pet zones with improved merchandising and knowledgeable staff, making it easier for consumers to access a broad range of cat food options while receiving guidance on product selection and nutrition.

The organized retail sector benefits from established supply chain infrastructure, promotional capabilities, and consumer trust in branded retail environments. Hypermarkets particularly appeal to bulk purchasers and price-conscious consumers seeking value through multi-pack offerings and promotional discounts. The physical retail experience allows consumers to compare products, examine packaging, and make informed purchasing decisions.

Market Dynamics:

Growth Drivers:

Why is the UAE Cat Food Market Growing?

Increasing Pet Ownership and Humanization Trends

Pet ownership in the UAE is steadily increasing as cultural perceptions shift and more households treat companion animals as family members. Pet ownership in the UAE has surged by over 30% since the pandemic, with young singles and senior citizens showing the highest adoption rates, particularly of cats and dogs. This increase has propelled the pet care industry to exceed $360 million, with projections indicating the market could reach $2 billion by 2025, reflecting strong growth driven by rising pet ownership and consumer spending on pet health, nutrition, and overall care. This humanization trend encourages consumers to choose high-quality nutrition for their cats, comparable to human food standards. Single-person households, young professionals, and nuclear families are increasingly investing in dedicated care for their feline pets. The growing preference for pet-friendly lifestyles is driving sustained demand for commercial cat food across all price ranges, supporting market growth and product diversification.

Rising Disposable Incomes and Premium Spending

The UAE’s strong economy and high-income levels allow consumers to spend on premium pet care products, with affluent pet owners increasingly opting for specialized nutrition such as veterinary-recommended diets and imported high-quality brands. The expatriate population, influenced by pet-centric Western cultures, further drives demand for premium offerings. Rising consumer preference for superior products is encouraging trade-up behavior toward specialized and high-end formulations. This focus on premiumization supports overall market value growth, as owners prioritize quality and health benefits for their cats, even as volume growth remains steady, shaping the evolution of the UAE cat food market.

Expanding Retail Infrastructure and Accessibility

The UAE’s advanced retail infrastructure offers consumers broad access to a wide range of cat food products across multiple channels. Expansion of supermarket chains, specialty pet stores, and e-commerce platforms is enhancing availability and convenience for diverse consumer segments. Modern retail initiatives improve product presentation, stock variety, and consumer awareness. Specialty retailers are increasingly introducing exclusive international brands, broadening the market offering. These developments in distribution channels strengthen market penetration, support consumer choice, and contribute to the overall growth and sophistication of the UAE cat food sector.

Market Restraints:

What Challenges the UAE Cat Food Market is Facing?

High Import Dependency and Cost Pressures

The UAE cat food market is heavily reliant on imports, making it vulnerable to currency fluctuations, supply chain disruptions, and high logistics costs. Limited domestic production restricts pricing flexibility, potentially affecting affordability for price-sensitive consumers. Additionally, import duties and regulatory compliance requirements add further cost pressures. These factors collectively influence product pricing, availability, and competitiveness, shaping the dynamics of the commercial cat food sector in the region.

Limited Consumer Awareness in Certain Segments

The UAE cat food market mainly depends on imports, which are susceptible to fluctuation in currency, disruption in the supply chain and high cost of logistics. The domestic production is low, resulting in a lack of flexibility in pricing, which may impact affordability among the price-sensitive consumers. Also, there are cost pressures in terms of import duties and the regulatory compliance requirements. All these aspects affect the prices of products, their supply and competitiveness, which determines the dynamics of the commercial cat food market in the region.

Competition from Alternative Feeding Practices

Raw diets, homemade meals and natural nutrition philosophies are some of the alternative feeding trends that compete with commercial cat food in the UAE. The issue of processed products, additives, and the quality of food in general has an impact on the buying habits of some consumers. Manufacturers need to respond to such trends by increasing information disclosure, superior formulations, and adjusting products to respond to changing needs without compromising the safety and convenience of pet owners.

Competitive Landscape:

The UAE cat food market features a moderately concentrated competitive environment dominated by multinational pet food corporations alongside regional distributors and specialty retailers. Leading international brands maintain strong market positions through established distribution networks, brand recognition, and extensive product portfolios spanning economy to super-premium segments. Competition intensifies through product innovation, marketing investments, and retail partnership development. Companies are expanding functional nutrition offerings, introducing locally-relevant formulations, and strengthening e-commerce capabilities to capture evolving consumer preferences. Strategic partnerships with veterinary networks and pet specialty retailers provide competitive differentiation, while private label development by major retailers introduces additional competitive dynamics.

Recent Developments:

- November 2025: Furchild launched a new production facility in Dubai, built to comply with human-grade food manufacturing standards. Spanning 15,000 square feet, the facility reflects an investment exceeding US$5 million. Established in 2016, Furchild specializes in producing complete, balanced raw meals for dogs and cats, crafted from high-quality, human-grade ingredients and free from fillers, preservatives, or artificial additives.

- August 2025: Hurayra officially entered the UAE market through a partnership with Euro Gulf, led by Mr. Juan Antonio Blanco Rodriguez. This collaboration represents a key step in the company’s goal to provide premium, halal-certified pet nutrition to Muslim pet owners across the GCC, expanding its presence and reinforcing its commitment to high-quality, culturally aligned pet food offerings.

UAE Cat Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dry Food, Wet and Canned Food, Snacks and Treats |

| Ingredient Types Covered | Animal Derivative, Plant Derivative, Cereals Derivative, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE cat food market size was valued at USD 56.40 Million in 2025.

The UAE cat food market is expected to grow at a compound annual growth rate of 6.41% from 2026-2034 to reach USD 98.69 Million by 2034.

Dry food represents the largest market share at 44.65% in 2025, driven by consumer preference for convenient, shelf-stable, and cost-effective feeding solutions that offer extended storage life and support daily feline nutritional requirements.

Key factors driving the UAE cat food market include rising pet ownership rates, increasing disposable incomes, growing pet humanization trends, expanding retail infrastructure, premiumization preferences, and heightened awareness of feline nutritional requirements.

Major challenges include high import dependency, creating cost pressures, limited consumer awareness in certain segments regarding feline nutrition, competition from alternative feeding practices, and supply chain vulnerabilities affecting product availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)