UAE CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

UAE CCTV Camera Market Overview:

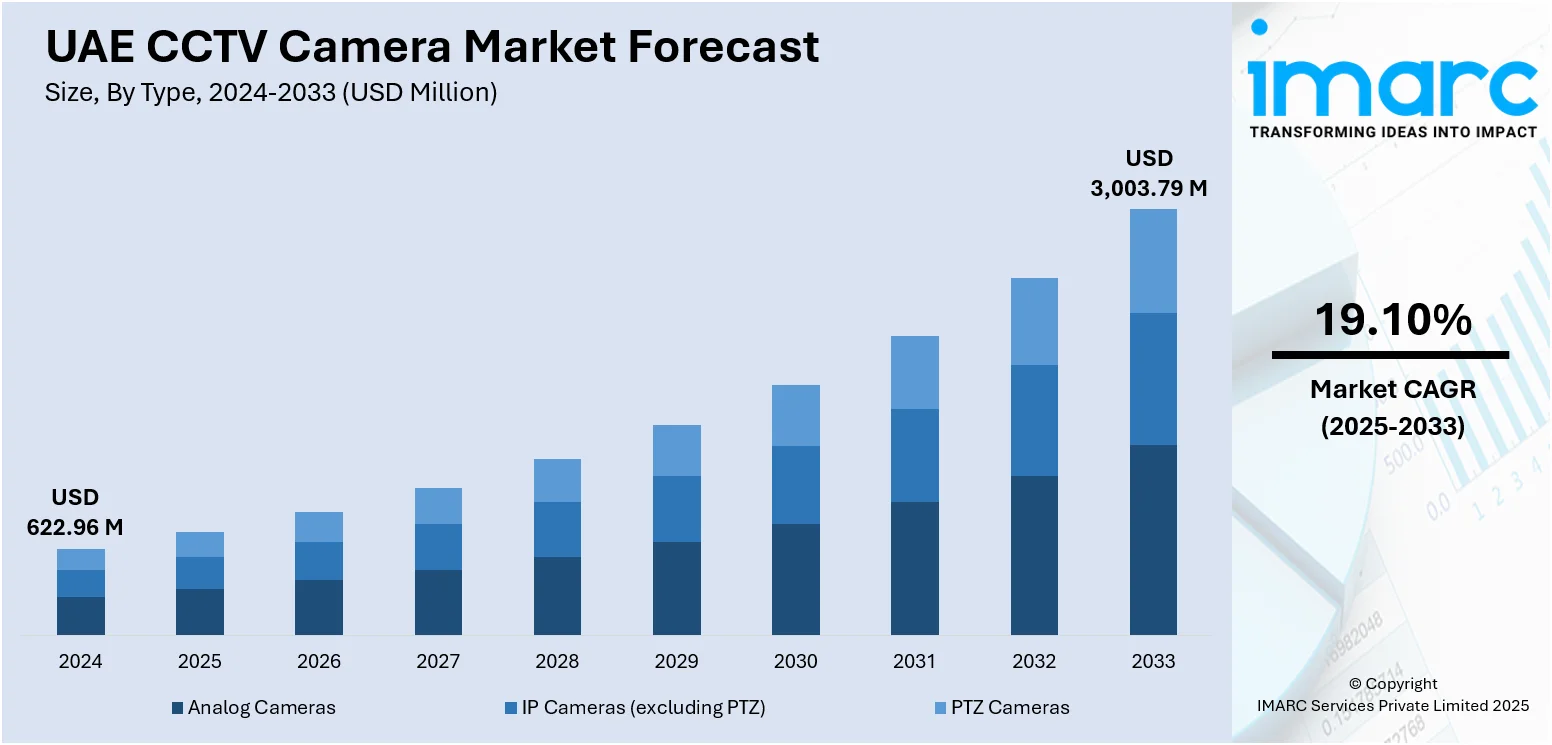

The UAE CCTV camera market size reached USD 622.96 Million in 2024. Looking forward, the market is projected to reach USD 3,003.79 Million by 2033, exhibiting a growth rate (CAGR) of 19.10% during 2025-2033. The market is experiencing robust expansion, fueled by significant investments in urban infrastructure, government-backed security initiatives, and widespread deployment of surveillance systems across residential, commercial, and public sectors. Demand for smart city integration, AI-driven camera analytics, and scalable IP‑based solutions is also rising. These advancements, combined with ongoing digital transformation efforts, are contributing notably to the UAE CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 622.96 Million |

| Market Forecast in 2033 | USD 3,003.79 Million |

| Market Growth Rate 2025-2033 | 19.10% |

UAE CCTV Camera Market Trends:

Cloud and Hybrid Storage Solutions

The adoption of cloud and hybrid storage models is gaining momentum in the UAE CCTV camera market. Businesses, public institutions, and city authorities are increasingly utilizing cloud platforms due to their scalability, remote accessibility, and cost-efficiency. Hybrid models combining on-site storage with cloud-based backup provide an ideal solution for managing video data securely and redundantly. For instance, in January 2024, March Networks unveiled its EL-Series Network Video Recorders (NVRs) at Intersec Dubai, providing a cost-effective solution for multi-site businesses. Fully compatible with cloud and on-premises systems, these models support advanced video management and analytics without maintenance fees, enhancing operational efficiency and security while delivering enterprise-class features. These systems allow for real-time monitoring, enable long-term archiving, and facilitate analytics integration without the need for extensive physical infrastructure. For municipalities engaged in smart city initiatives, cloud storage enables centralized control and quick data retrieval across vast areas. Additionally, these platforms comply with evolving cybersecurity and regulatory standards, making them a preferred option for sensitive environments such as transportation hubs, banks, and government facilities. Consequently, cloud-based storage adoption is significantly contributing to the acceleration of UAE CCTV camera market growth.

To get more information on this market, Request Sample

AI-Enabled Video Analytics

The adoption of AI-enabled video analytics is revolutionizing the capabilities of CCTV systems throughout the UAE. Advanced features like facial recognition, object detection, license plate reading, and real-time anomaly alerts are increasingly common in installations across both public and private sectors. For instance, in October 2024, Dubai Police and e& UAE launched an advanced smart home security system featuring AI-powered cameras and motion detectors, unveiled at Gitex Global. This initiative enhances residential safety by offering real-time alerts, 24/7 professional monitoring, and cutting-edge IoT integration, setting new standards in home protection within the emirate. These intelligent functionalities enhance situational awareness and facilitate quicker response times in critical settings such as airports, shopping malls, and government buildings. By automating threat identification and optimizing video review processes, AI lessens the reliance on manual monitoring, thereby improving operational efficiency and reducing security expenses. Businesses are utilizing these analytics for crowd management, monitoring employee behavior, and preventing theft or fraud. On the other hand, public institutions are employing AI tools for traffic regulation and crime deterrence. As the need for intelligent, proactive surveillance rises, AI-driven video analytics is anticipated to play a pivotal role in developing next-generation security frameworks.

UAE CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

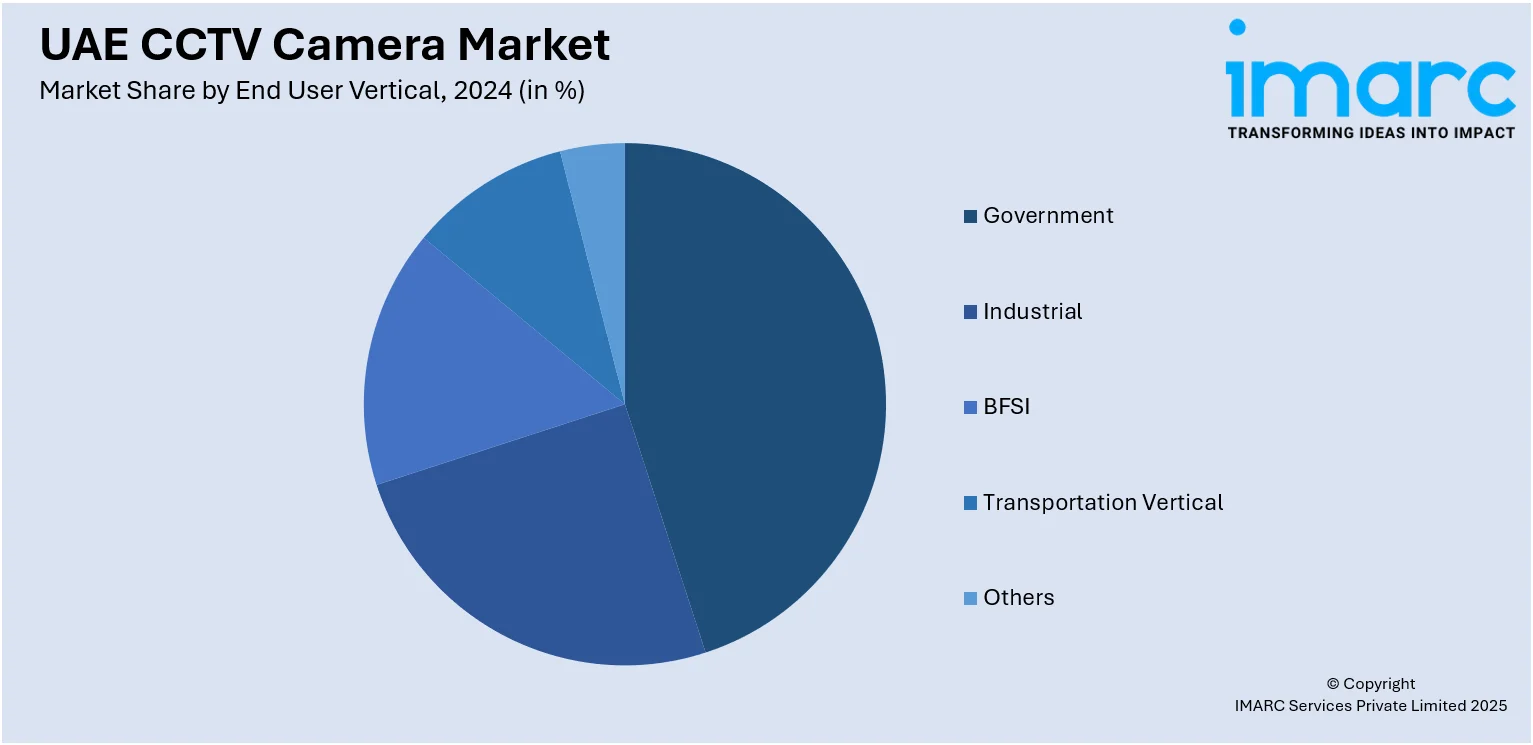

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE CCTV Camera Market News:

- In September 2024, Panasonic Marketing Middle East & Africa launched a new CCTV lineup featuring eight network cameras and two network video recorders, equipped with a mobile app for real-time monitoring. These advanced surveillance solutions ensure high image quality and intelligent threat detection, catering to SME and residential security needs in the region.

- In January 2024, Hanwha Vision showcased its AI-powered security solutions at Intersec Dubai 2024, emphasizing innovative products like the AI PTZ camera and multi-directional cameras. The event highlighted advancements in surveillance technology, addressing diverse security needs in Dubai and the UAE, reinforcing the region's growing significance in the global security industry.

UAE CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE CCTV camera market on the basis of type?

- What is the breakup of the UAE CCTV camera market on the basis of end user vertical?

- What is the breakup of the UAE CCTV camera market on the basis of region?

- What are the various stages in the value chain of the UAE CCTV camera market?

- What are the key driving factors and challenges in the UAE CCTV camera market?

- What is the structure of the UAE CCTV camera market and who are the key players?

- What is the degree of competition in the UAE CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)