UAE Ceramic Tiles Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

UAE Ceramic Tiles Market Overview:

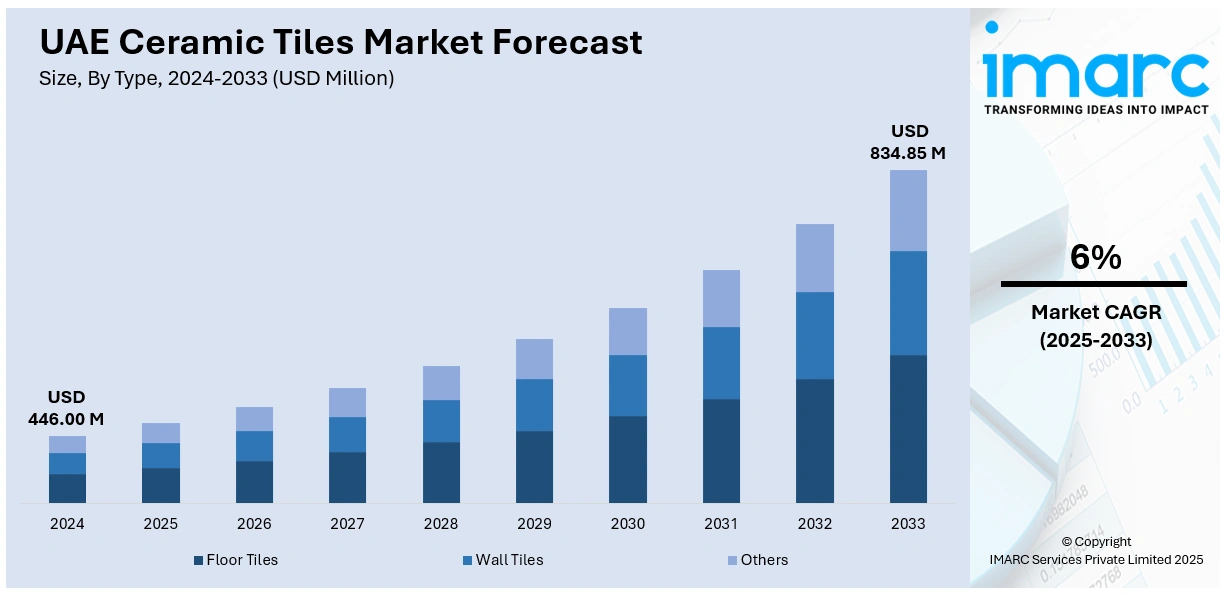

The UAE ceramic tiles market size reached USD 446.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 834.85 Million by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. Strong demand in real estate, infrastructure expansion, and rising urbanization are some of the factors contributing to the UAE ceramic tiles market share. Increasing consumer preference for premium flooring, growth in renovation projects, and investments in hospitality and commercial construction also fuel market growth. Government housing initiatives further support steady demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 446.00 Million |

| Market Forecast in 2033 | USD 834.85 Million |

| Market Growth Rate 2025-2033 | 6% |

UAE Ceramic Tiles Market Trends:

Government Initiatives and Regulatory Support

The UAE government's active involvement in improving the construction and real estate sectors is positively influencing the market. Regulatory backing and initiatives like free trade zones, urban revitalization projects, and extensive infrastructure programs are essential in catalyzing the demand for construction materials, such as ceramic tiles. In 2025, Abu Dhabi's Executive Council approved a $22.5 billion investment in 14 new housing projects, aimed at enhancing family stability and social cohesion. The initiative will provide 35,000 housing benefits, including 26,000 units and 9,000 land plots for UAE nationals over five years. Additionally, reforms to the housing loan system will ease financial burdens for Emirati families, including subsidies, extended loan periods, and new deferred-payment options. Besides this, the establishment of construction standards and regulations that promote the utilization of high-grade, long-lasting, and eco-friendly materials is fostering a favorable environment for the ceramic tiles market growth.

To get more information on this market, Request Sample

Growing Popularity of Interior and Exterior Aesthetics

In the UAE, where luxury design and architectural innovation play a crucial role in residential and commercial areas, ceramic tiles are becoming an essential element for crafting visually appealing settings. Ceramic tiles can be used on walls, floors, or facades, providing numerous design options, featuring an extensive selection of striking patterns, textures, and colors, which makes them exceptionally adaptable to various design requirements. Their capability to mimic the look of natural substances like marble, wood, and stone further boosts their attractiveness, providing the aesthetic of high-end materials without the related expenses or upkeep difficulties. Moreover, the capability to produce intricately detailed, customized designs is making ceramic tiles a favored option for architects and interior designers aiming to enhance the visual appeal of their projects. With the growing demand for architectural quality in the UAE, advancements in ceramic tile manufacturing are driving the demand throughout various sectors, including upscale residential projects, commercial buildings, and luxury hotels.

Demand in Tourism and Hospitality Sector

The UAE's increasing status as an international travel and leisure center, along with a consistent rise in foreign visitors, is driving the need for premium ceramic tiles, especially in the hospitality industry. With the ongoing efforts to establish itself as a prime location for high-end tourism, there is a higher emphasis on developing aesthetically appealing and long-lasting settings in luxury hotels, resorts, and commercial areas. Ceramic tiles, known for their adaptability and strength, are becoming more popular in high-traffic spaces like hotel lobbies, bathrooms, and dining areas, where both appearance and longevity are crucial. These tiles provide a diverse selection of designs, textures, and finishes, enabling architects and designers to craft custom interiors that reflect worldwide design trends. The UAE hospitality sector is expected to hit USD 37.7 Billion by 2033, driving the need for high-quality building materials like ceramic tiles. This increase in market demand highlights the essential importance of ceramic tiles in improving the luxury and function of UAE’s hospitality infrastructure.

UAE Ceramic Tiles Market Growth Drivers:

Rising Construction and Infrastructure Development

The continual progress of housing, business, and hotel projects in large urban areas, coupled with the government's bold urbanization goals, is catalyzing the demand for ceramic tiles. Renowned for their strength, visual attractiveness, and adaptability, ceramic tiles are becoming more popular for various uses, such as flooring, wall coverings, and ornamental surfaces. Significant government funding for major infrastructure initiatives, including new airports, vast residential developments, and contemporary commercial structures, are influencing this demand, as these constructions necessitate superior materials for both performance and aesthetics. In 2025, real estate developer Casagrand announced its entry into the UAE market with a major project in Dubai Islands. The company plans to develop over 6 million sq ft of premium residential and mixed-use properties over the next three years. Casagrand aims to bring its 22 years of expertise to the UAE's thriving real estate market, offering resort-style living and world-class amenities. As a result, ceramic tile producers are facing heightened production demands, as the market for these products continues to grow alongside the country's changing urban environment and infrastructure requirements.

Technological Advancements in Ceramic Tile Manufacturing

The adoption of new manufacturing methods is leading to the creation of tiles that not only feature improved visual attractiveness but also provide greater durability, resistance to wear, and simplicity of upkeep. Enhanced production methods, such as digital printing, advanced glazing techniques, and better firing technologies, are greatly improving the design versatility and overall quality of ceramic tiles. These advancements allow manufacturers to create tiles with diverse textures, patterns, and sizes, making them ideal for a broad array of design uses. This adaptability is especially important in addressing the evolving requirements of contemporary architecture, particularly in luxury residential and commercial properties where appearance and functionality are crucial. Furthermore, as buyer preferences progressively lean towards high-performance and low-maintenance materials, these technological innovations establish ceramic tiles as the preferred choice for architects, interior designers, and builders.

Increased Demand for Sustainable and Eco-Friendly Building Materials

With the worldwide movement towards green building certifications and the heightened focus on energy-efficient and eco-friendly structures, there is a rise in the demand for ceramic tiles made with limited environmental impact. Ceramic tiles produced from recycled materials, along with energy-efficient production methods, align with the dedication of UAE to sustainability and its bold objectives for minimizing the environmental impact of construction. Moreover, the fundamental characteristics of ceramic tiles, such as their minimal maintenance needs, energy efficiency in controlling indoor climates, and remarkable durability, make them an excellent option for sustainable design. These features not only lessen the frequency of replacements but also aid in energy conservation, decreasing total energy use in structures. Additionally, the extended durability of ceramic tiles aligns with the increasing need for materials that offer both short-term and lasting environmental advantages. With governments and individuals placing greater importance on environment-friendly materials due to ecological issues, the need for ceramic tiles made through sustainable methods is growing.

UAE Ceramic Tiles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Floor Tiles

- Wall Tiles

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes floor tiles, wall tiles, and others.

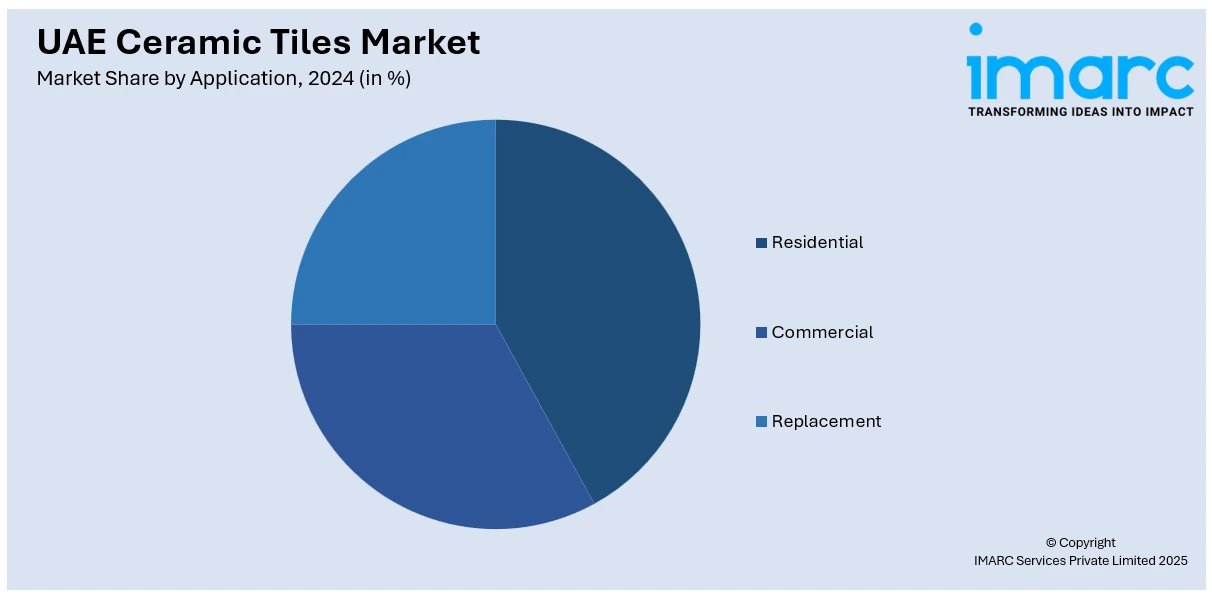

Application Insights:

- Residential

- Commercial

- Replacement

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and replacement.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Ceramic Tiles Market News:

- In August 2025, Manoj Ceramic Limited (MCPL) launched a flagship Display Centre in Dubai as part of its global expansion, targeting the GCC and African markets. The center showcases MCPL's ceramic tiles, designer surfaces, and modular systems, aligning with Dubai's booming real estate sector.

- In August 2025, the UAE’s green construction drive boosted demand for Spanish ceramic tiles, with the 24th edition of the ASCER Tile of Spain Awards now open, offering a unique opportunity for the nation’s architects and designers. As the UAE advances toward its 2050 net-zero goal, Spanish tiles stand out for sustainability, durability, and design versatility, already showcased in landmark projects like Abu Dhabi’s Al Qana.

- In December 2024, Danube Home launched its new Milano tile collection, inspired by Italian craftsmanship and modern design trends. The collection, featuring ceramic, porcelain, and wooden tiles, catered to the growing demand for luxury tiles in the UAE's booming real estate market. Milano aimed to expand its international footprint, offering both aesthetic appeal and long-lasting functionality for residential and commercial spaces.

UAE Ceramic Tiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Tiles, Wall Tiles, Others |

| Applications Covered | Residential, Commercial, Replacement |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE ceramic tiles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE ceramic tiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE ceramic tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ceramic tiles market in UAE was valued at USD 446.00 Million in 2024.

The UAE ceramic tiles market is projected to exhibit a CAGR of 6% during 2025-2033, reaching a value of USD 834.85 Million by 2033.

The UAE ceramic tiles market is driven by growing user demand for high-quality, aesthetically appealing products in residential and commercial spaces. Advancements in manufacturing technologies, coupled with a rising focus on sustainable construction materials, are also influencing the market. Additionally, the increasing popularity of interior design trends and home renovation projects are bolstering the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)