UAE Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2025-2033

UAE Children’s Entertainment Centers Market Overview:

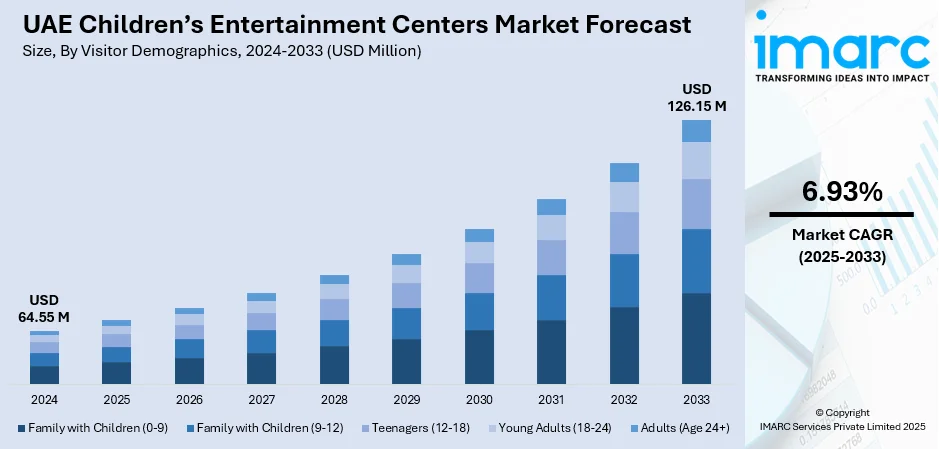

The UAE children’s entertainment centers market size reached USD 64.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 126.15 Million by 2033, exhibiting a growth rate (CAGR) of 6.93% during 2025-2033. Rising disposable income, increasing urbanization, and government initiatives to promote family leisure activities are some of the factors contributing to the UAE children’s entertainment centers market share. Growth in tourism, demand for interactive and educational experiences, and expansion of indoor theme parks further fuel market development and investment opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.55 Million |

| Market Forecast in 2033 | USD 126.15 Million |

| Market Growth Rate 2025-2033 | 6.93% |

UAE Children’s Entertainment Centers Market Trends:

Growing Focus on Early Childhood Media and Learning

Children’s entertainment in the UAE is shifting toward content that supports early development and creativity. The launch of dedicated preschool channels offering round-the-clock programming in multiple languages highlights the rising demand for safe and educational media. Parents are increasingly seeking platforms that blend entertainment with learning, encouraging curiosity and imagination in younger audiences. Interactive storytelling, age-appropriate shows, and creative learning content are shaping how entertainment centers and media platforms engage children. This emphasis on meaningful, high-quality programming reflects a broader move to provide enriching experiences that complement early education, ensuring both fun and developmental value for children. Expansion across regional markets suggests a growing interest in curated content tailored to cultural and linguistic preferences. These factors are intensifying the UAE children’s entertainment centers market growth. For example, in January 2025, evision, the media and entertainment arm of e&, introduced ‘Bloom,’ a 24/7 preschool TV channel in English and Arabic for children aged 2–5. The channel, launched at Dubai’s Museum of the Future, emphasizes safe, educational content that supports early learning and creativity. Bloom aims to enhance children’s entertainment offerings in the UAE and is set to expand across the Middle East and North Africa.

To get more information on this market, Request Sample

Family-Oriented Recreational Experiences

Outdoor festivals and interactive events designed for children are gaining popularity across UAE entertainment centers. Recent large-scale activities tailored to kids aged 3–12 showcase a mix of fun and learning, often included with general entry tickets to enhance accessibility. Extended multi-week programs with free educational sessions, engaging games, and vibrant outdoor experiences are creating an inviting atmosphere for families. Interactive zones for toddlers, along with giant play structures, are becoming central attractions, drawing repeat visits. Such initiatives highlight a growing focus on offering memorable, safe, and family-friendly environments that combine entertainment with educational value, driving increased demand for diversified children’s recreational activities in the region. For instance, in January 2025, Global Village successfully hosted the 10th edition of “The Wonderers’ Kids Fest” from 17 January to 28 February 2025 during Season 29. Aimed at children aged 3–12, the 45-day festival featured free entertainment and educational activities, included with the park’s entry ticket. Families enjoyed outdoor experiences, giant games, and engaging activities for toddlers, creating memorable moments in a vibrant and family-friendly environment.

UAE Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

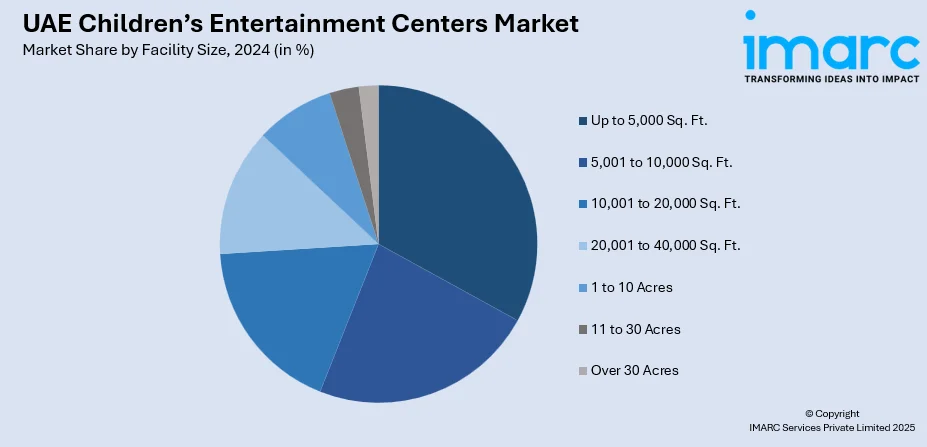

Facility Size Insights:

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

A detailed breakup and analysis of the market based on the activity area have also been provided in the report. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Children’s Entertainment Centers Market News:

- In May 2025, the Walt Disney Company and Miral partnered to develop a major Disney theme park resort on Yas Island, Abu Dhabi. Positioned as the seventh Disney resort worldwide, it would integrate Disney’s renowned characters and attractions with Abu Dhabi’s culture and architecture. This waterfront destination aims to strengthen the region’s entertainment landscape, drawing families and travelers from the Middle East, Africa, Asia, Europe, and beyond.

- In May 2024, Mattel, in partnership with iPS Operations of Al Hokair Group, launched the first Mission: Play! family entertainment center in Abu Dhabi. Spanning 4,000 square meters at The Galleria, Al Maryah Island, the center features interactive zones themed around Barbie, Hot Wheels, and Mega Brands. It also includes event spaces, celebration rooms, a café, and a retail store offering Mattel toys and exclusive merchandise for visitors.

UAE Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family With Children (0-9), Family With Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE children’s entertainment centers market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE children’s entertainment centers market on the basis of visitor demographics?

- What is the breakup of the UAE children’s entertainment centers market on the basis of facility size?

- What is the breakup of the UAE children’s entertainment centers market on the basis of revenue source?

- What is the breakup of the UAE children’s entertainment centers market on the basis of activity area?

- What is the breakup of the UAE children’s entertainment centers market on the basis of region?

- What are the various stages in the value chain of the UAE children’s entertainment centers market?

- What are the key driving factors and challenges in the UAE children’s entertainment centers market?

- What is the structure of the UAE children’s entertainment centers market and who are the key players?

- What is the degree of competition in the UAE children’s entertainment centers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE children’s entertainment centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)