UAE Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

UAE Commercial Insurance Market Overview:

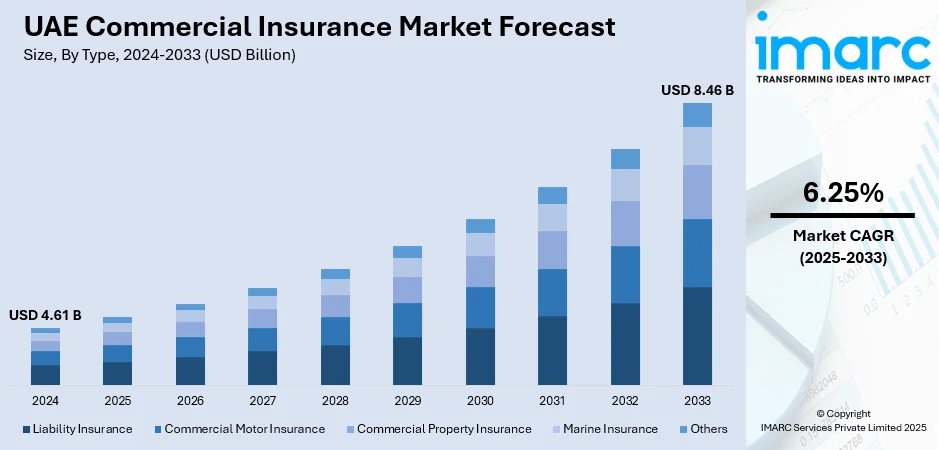

The UAE commercial insurance market size reached USD 4.61 Billion in 2024. The market is projected to reach USD 8.46 Billion by 2033, exhibiting a growth rate (CAGR) of 6.25% during 2025-2033. The market is expanding due to increased demand for tailored coverage across various industries. The growth is driven by regulatory changes, such as mandatory health insurance policies, and the rising adoption of digital platforms. These factors continue to support the UAE commercial insurance market share, with businesses increasingly securing property and health-related coverage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.61 Billion |

| Market Forecast in 2033 | USD 8.46 Billion |

| Market Growth Rate 2025-2033 | 6.25% |

UAE Commercial Insurance Market Trends:

Mandatory Health Insurance Policy Implementation

The mandatory introduction of health insurance for private-sector workers and domestic workers in the UAE is fueling significant demand for personal accident and health insurance. This policy shift has led to an acute spike in coverage adoption across businesses of varying sizes. In addition to the compulsory health insurance, increased property insurance premiums from higher demand in the property market and heightened natural disaster risk consciousness also play a role in this expansion. The expanding significance of acquiring property coverage to safeguard business assets is clear. Additionally, the move toward online platforms for insurance distribution is improving access. The mass uptake of online insurance products, especially via bancassurance, is easing the management of policies and widening insurance covers to more people. The UAE's growing infrastructural developments and sustained investments in different industries, such as tourism and construction, are also driving demand for more extensive covers. All these trends indicate a consistent fast-tracking of commercial insurance demand, which is sustained by regulatory reforms, changing consumer insights, and an easier market.

To get more information on this market, Request Sample

Artificial Intelligence Transforming Insurance Services

The incorporation of artificial intelligence (AI) and machine learning (ML) is reshaping the insurance industry by enhancing personalized services and automating key processes. AI-driven tools allow insurers to better assess risks, customize policies, and streamline the claims process, significantly improving operational efficiency. Moreover, the use of predictive analytics is making it easier for insurers to forecast potential risks and tailor premiums more accurately. Machine learning models are enhancing fraud detection and minimizing human error in claims processing, further improving service reliability. This shift towards automation is also reducing the time customers spend on administrative tasks, allowing them to focus on more strategic aspects of their businesses. Additionally, AI-powered chatbots and virtual assistants are revolutionizing customer support, providing clients with instant assistance and enhancing their overall experience. InsurTech startups are leveraging these technologies to innovate and offer more user-friendly digital platforms, making insurance more accessible and customer-centric. As AI and ML continue to evolve, they are set to further transform the way insurers deliver services, fostering efficiency, transparency, and improved customer satisfaction across the industry.

UAE Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

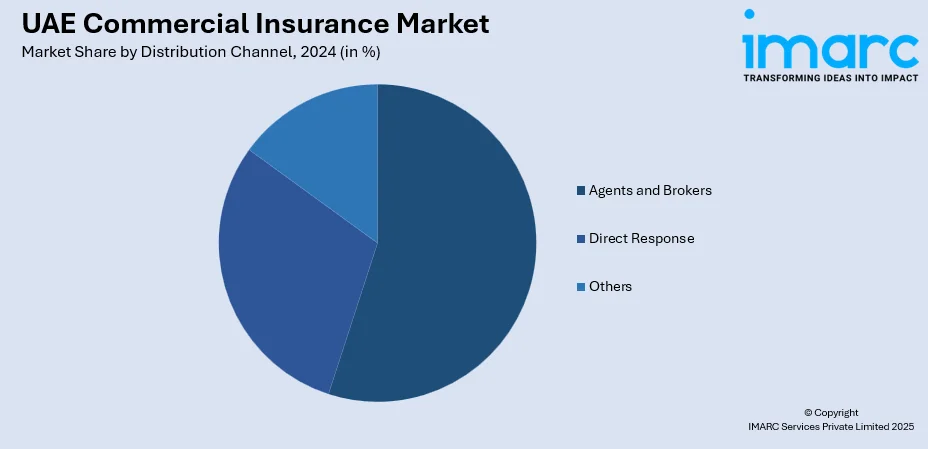

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Commercial Insurance Market News:

- May 2025: The International Holding Company (IHC) launched a USD 1 Billion+ reinsurance platform in Abu Dhabi, focusing on AI-driven underwriting. This development aimed to enhance the UAE's commercial insurance market by integrating advanced technology, boosting market efficiency, and positioning the region as a key financial hub.

- May 2025: HAYAH Insurance partnered with APRIL to introduce digital-first health insurance solutions in the UAE. This collaboration brought flexible, comprehensive International Private Medical Insurance (IPMI) options, enhancing coverage for individuals, families, and businesses, thereby expanding the UAE's commercial insurance market with innovative, customer-centric solutions.

UAE Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE commercial insurance market on the basis of type?

- What is the breakup of the UAE commercial insurance market on the basis of enterprise size?

- What is the breakup of the UAE commercial insurance market on the basis of distribution channel?

- What is the breakup of the UAE commercial insurance market on the basis of industry vertical?

- What is the breakup of the UAE commercial insurance market on the basis of region?

- What are the various stages in the value chain of the UAE commercial insurance market?

- What are the key driving factors and challenges in the UAE commercial insurance market?

- What is the structure of the UAE commercial insurance market and who are the key players?

- What is the degree of competition in the UAE commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)