UAE Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

UAE Confectionery Market Overview:

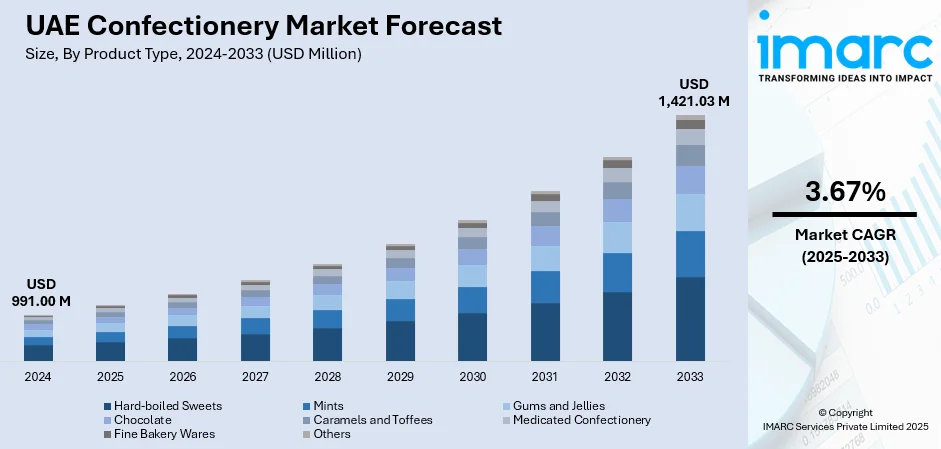

The UAE Confectionery market size reached USD 991.00 Million in 2024. The market is projected to reach USD 1,421.03 Million by 2033, exhibiting a growth rate (CAGR) of 3.67% during 2025-2033. The market is driven by growing consumer demand for premium, health-oriented, and culturally diverse products. Urbanization, growing disposable incomes, and changing dietary patterns are propelling innovation in the chocolate, sugar confectionery, and gum categories. The market also derives strength from the country's healthy tourism industry and growing retail landscape. With a focus on quality, health, and distinct flavors, manufacturers are in constant adjustment to changing consumer demands, ultimately adding up to the growth of the UAE confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 991.00 Million |

| Market Forecast in 2033 | USD 1,421.03 Million |

| Market Growth Rate 2025-2033 | 3.67% |

UAE Confectionery Market Trends:

Increased Demand for Premium and Artisanal Confectionery

The confectionery market in the UAE is experiencing a string shift towards premium and artisanal products. This is facilitated by the growing prosperity of consumers and their changing preferences toward higher-quality, distinctive, and gourmet products. Premium confectionery chocolates, hand-manufactured candies, and internationally exotic flavor blends are on the rise, especially among city residents and foreign visitors looking for luxury experiences. Moreover, products emphasizing authenticity, origin, and craftsmanship are favored, particularly when combined with sophisticated packaging and eco-friendly sourcing. According to the sources, in October 2024, Dubai’s confectionery market saw notable innovation, with brands like Al Nassma introducing camel milk chocolate, Vivel enhancing artistic packaging, BRIX offering chef-led dessert tasting menus, and Bateel promoting gourmet dates as luxury health products—all reflecting a shift toward experiential, artisanal, and health-conscious offerings. Moreover, the increasing presence of luxury retail chains, luxury hospitality venues, and specialty stores is also driving this trend. Global exposure via travel and digital media also fuels the interest of consumers, exposing them to global niche confectionery. Consequently, UAE Confectionery market growth remains fueled by innovations in presentation, ingredients, and texture that resonate with advanced palates and upscale lifestyle expectations.

To get more information on this market, Request Sample

Health-Conscious Choices Redesigning Product Portfolios

There is increasingly a trend among UAE consumers towards healthier confectionery choices, driving confectionery manufacturers to reformulate existing products and create alternatives that support wellness objectives. This encompasses the creation of low-sugar, sugar-free, organic, and functional confectionery with added vitamins, superfoods, or plant-based materials. The growing incidence of lifestyle conditions like diabetes and obesity has driven the need for awareness regarding sugar consumption, impacting demand for clean labels and low-calorie indulgences. This trend is complemented by the UAE's national initiative to advance public health through awareness drives and nutritional regulations. Moreover, younger consumers are also demonstrating a strong desire for guilt-free indulgence, resulting in higher market popularity of nutritional claims and open sourcing. These shifting lifestyles are driving a diversified and inclusive portfolio, shaping future UAE confectionery market dynamics towards health-centric innovation, without compromising on taste or looks.

Cultural Fusion and Flavor Innovation Driving Appeal

The UAE's ethnically diverse population and role as a tourism destination are creating a dynamic environment for flavor development in the confectionery industry. Local preferences are blending with global influences to produce fusion products reflecting various culinary backgrounds. This comprises confectionery products with regional ingredients like dates, cardamom, saffron, and rosewater infused with Western forms such as chocolate bars or gummies. Seasonal and limited-release products based on cultural celebrations like Ramadan, Diwali, or Christmas are also becoming popular, increasing consumer interest and brand uniqueness. Flavor innovation, paired with visual attractiveness and storytelling, is becoming crucial in grabbing the attention of both locals and visitors. Social media and the influencer trend are also important in speeding up these innovations through amplifying looks-attractive and culturally relevant products. These trends point to the way UAE confectionery market trends are shaped more and more by inclusivity, novelty, and cross-cultural creativity.

UAE Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

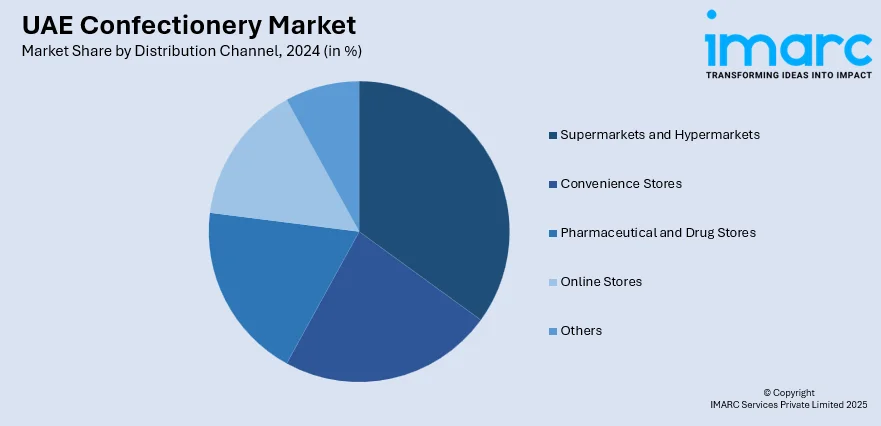

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Confectionery Market News:

- In May 2025, Mars Gulf launched its limited-edition Galaxy Pistachio Kunafa chocolate in the UAE created and manufactured locally in line with growing consumer demand. The bar combines smooth milk chocolate with rich pistachio and crunchy kunafa to tap into the increasing trend of "Dubai chocolate," now behind 45% of category growth.

- In May 2025, Lulu Group launcheda new range of UAE-produced goods, such as chocolates, coffee, and eggs, under its private label at the 'Make It in the Emirates Forum' in Abu Dhabi. The launch reflects the Group's dedication to local manufacturing support and helping drive the UAE's economic diversification agenda.

- In June 2025, Kreol Travel Retail launched a 470g Pistachio Kunafa Chocolate under its Petit Gourmet brand within Sharjah Duty Free. As a consequence of the viral Dubai chocolate trend, the launch provides a destination-themed, high-end gifting choice that further supports the base for innovative, made-in-UAE sweets in travel retail.

UAE Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE Confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE confectionery market on the basis of product type?

- What is the breakup of the UAE confectionery market on the basis of age group?

- What is the breakup of the UAE confectionery market on the basis of price point?

- What is the breakup of the UAE confectionery market on the basis of distribution channel?

- What is the breakup of the UAE confectionery market on the basis of region?

- What are the various stages in the value chain of the UAE confectionery market?

- What are the key driving factors and challenges in the UAE confectionery market?

- What is the structure of the UAE confectionery market and who are the key players?

- What is the degree of competition in the UAE confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)