UAE Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UAE Diaper Market Overview:

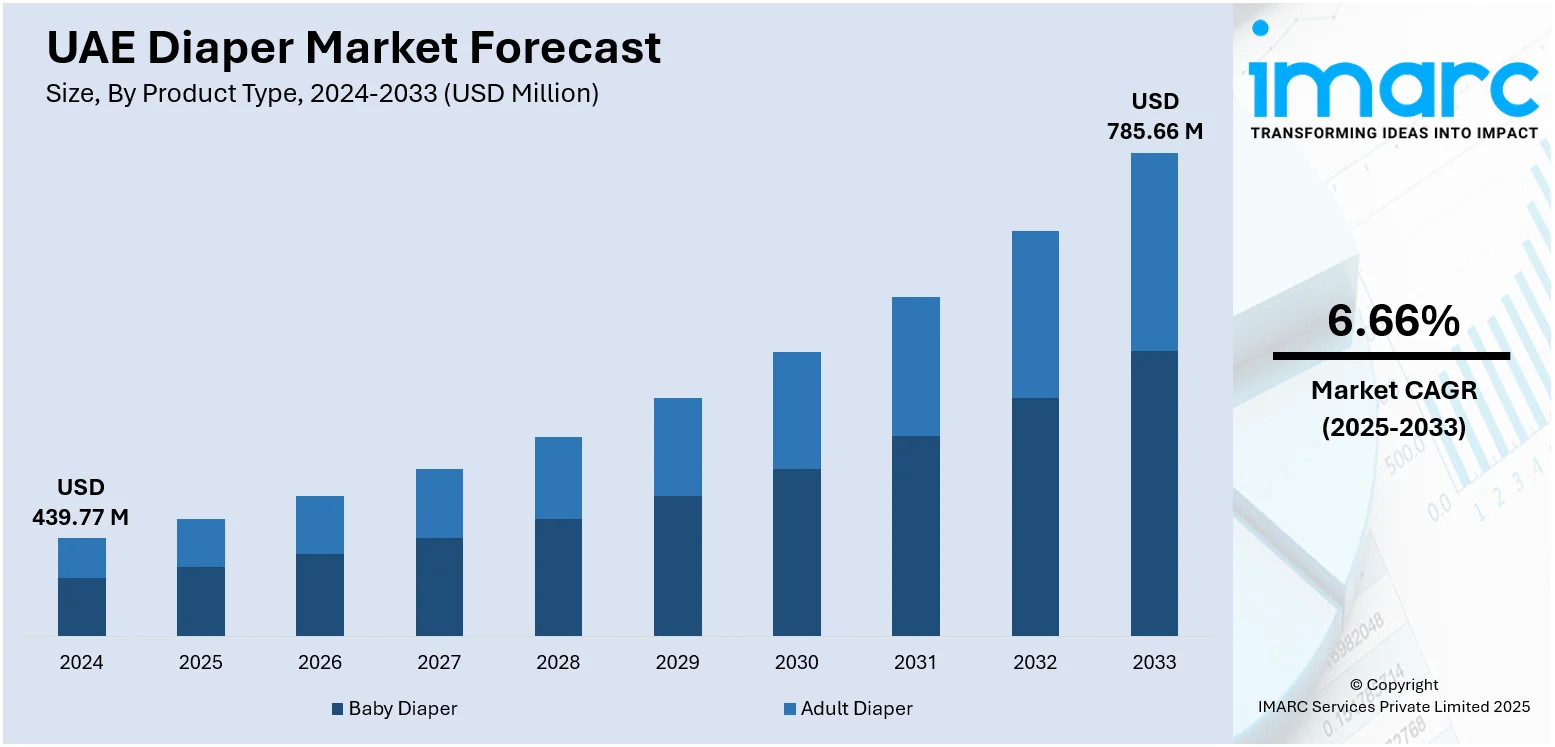

The UAE diaper market size reached USD 439.77 Million in 2024. The market is projected to reach USD 785.66 Million by 2033, exhibiting a growth rate (CAGR) of 6.66% during 2025-2033. The market is witnessing consistent growth driven by rising awareness regarding personal hygiene, increasing number of infants, and growing elderly population. Rising demand for high-quality, skin-friendly, and eco-conscious diapers is also shaping consumer preferences. The market is further influenced by innovations in product design and the rising popularity of online retail channels, offering greater convenience and variety, which in turn contributes positively to the UAE diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 439.77 Million |

| Market Forecast in 2033 | USD 785.66 Million |

| Market Growth Rate 2025-2033 | 6.66% |

UAE Diaper Market Trends:

Rising Demand for Eco-friendly Diapers

The rising environmental awareness in the UAE has created a higher demand for environmentally friendly diapers. Consumers have become increasingly aware of the role disposable products play on the environment, and this has driven demand for biodegradable and sustainable diapers. Brands have been adapting to this trend by launching diapers using organic cotton, plant-based, and chlorine-free production processes, minimizing the environmental footprint. For instance, in November 2024, Ecoma launched eco-friendly, plant-based diapers in the UAE, prioritizing comfort and sustainability. Made from biodegradable materials, these diapers offer up to 12 hours of leakproof protection and are free from harmful chemicals. Available at various retailers, prices start at AED 49, promoting responsible parenting and environmental care. This trend is also conforming to global sustainability movements, providing comfort and a reduced environmental footprint. Moreover, increased awareness regarding plastic waste and landfill concerns is pushing parents and guardians towards greener options. Consequently, the UAE diaper market is experiencing increased offerings of eco-friendly products, which is driving the overall market growth. The transition towards green diapers is part of the overall trend towards environmentally friendly consumer behavior, which will keep driving the UAE diaper market growth through the years to come.

To get more information on this market, Request Sample

Shift to Adult Diapers

With the rapid growth in aging population in the UAE the need for adult diapers has risen sharply. According to the data published by the United Nations Population Fund, the United Arab Emirates is experiencing a demographic shift, with the population aged 60 and older projected to rise from approximately 311,000 in 2020 to 2 million by 2050, increasing from 3.1% to 19.7% of the total population. With a significant increase in the elderly population the demand for incontinence and mobility aid products is on the rise. Adult diapers are increasingly becoming a part of healthcare and hygiene solutions with more awareness on comfort and dignity among the elderly. This change is driven by product design improvements, such as increased absorbency, quietness, and skin-friendliness. Furthermore, changes in society, such as an active and health-oriented aging population, are driving this growth. Consequent to this, adult diapers are now widely available in supermarkets, pharmacies, and websites, thereby supporting the UAE diaper market as a whole. The need for adult diapers will continue to increase, mirroring the larger trends of aging and shifting healthcare requirements across the region.

UAE Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diaper (pad type, flat type, and pant type).

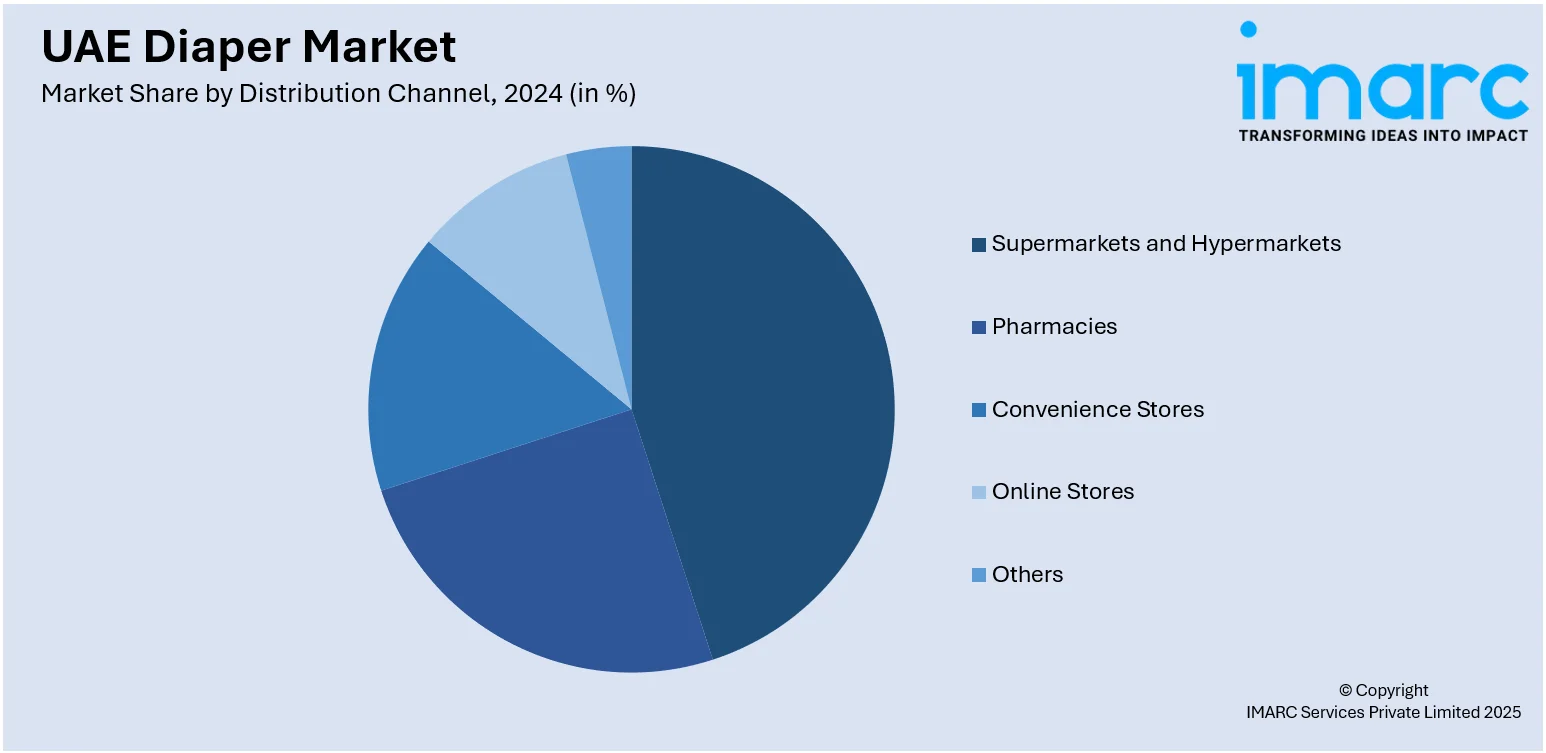

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Diaper Market News:

- In December 2024, Pampers launched a Preemie campaign in partnership with HAVAS Red Middle East, Union Coop, and Al Jalila Foundation, donating 110,000 AED to support premature babies in the UAE. The initiative includes educational efforts, special lullabies, and in-store promotions featuring Pampers Preemie diapers to raise awareness and provide essential resources.

- In January 2024, PureBorn, a UAE baby care brand known for its bamboo-based diapers launched a European website following its partnership with Swiss distributor Laboratoire Naturel. The site offers easy access for families across Europe, aiming for a 3-5% market share and increased repeat purchases through a subscription model.

UAE Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE diaper market on the basis of product type?

- What is the breakup of the UAE diaper market on the basis of distribution channel?

- What is the breakup of the UAE diaper market on the basis of region?

- What are the various stages in the value chain of the UAE diaper market?

- What are the key driving factors and challenges in the UAE diaper market?

- What is the structure of the UAE diaper market and who are the key players?

- What is the degree of competition in the UAE diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)