UAE Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2026-2034

UAE Drones Market Summary:

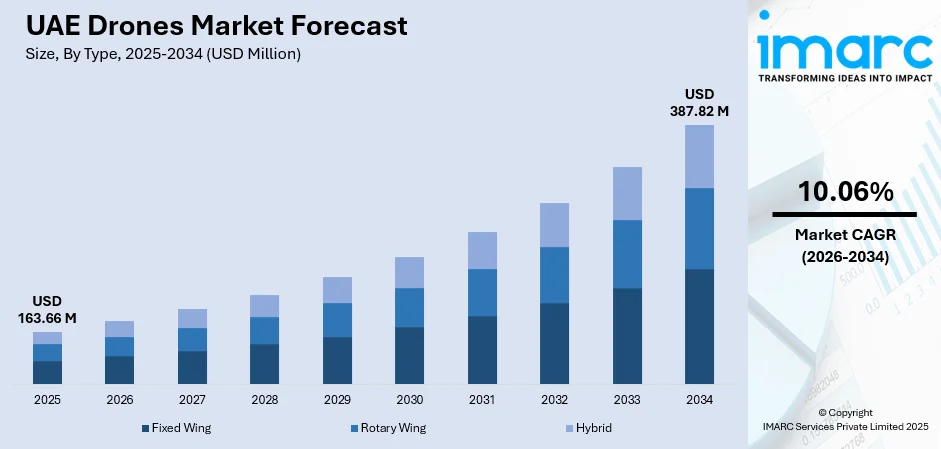

The UAE drones market size was valued at USD 163.66 Million in 2025 and is projected to reach USD 387.82 Million by 2034, growing at a compound annual growth rate of 10.06% from 2026-2034.

The market is driven by accelerating smart city initiatives integrating autonomous aerial systems into urban infrastructure, expanding military modernization programs requiring advanced surveillance capabilities, government regulatory frameworks enabling commercial deployment, infrastructure development demanding aerial monitoring solutions, and logistics transformation through innovative delivery mechanisms. These factors collectively position the emirate as a regional technology leader while enhancing operational efficiency across sectors, contributing significantly to the UAE drones market share.

Key Takeaways and Insights:

- By Type: Rotary wing dominates the market with a share of 52% in 2025, driven by vertical take-off for urban deployment, precise hovering for inspections, adaptable payloads, operational flexibility, and broad usage across military surveillance and commercial delivery applications.

- By Component: Hardware leads the market with a share of 58% in 2025, owing to propulsion systems, sensor technologies enabling autonomy, improved batteries extending range, durable yet lightweight airframes, and communication modules supporting real-time data transmission for diverse drone operations.

- By Payload: <25 kilograms represent the largest segment with a market share of 61% in 2025, driven by enhanced maneuverability in dense areas, longer flight times for comprehensive coverage, lower operational costs, easier regulatory compliance, and widespread adoption in surveillance and commercial applications.

- By Point of Sale: Original equipment manufacturers (OEM) dominate the market with a share of 70% in 2025, owing to strong government procurement ties, integrated quality assurance, customization for specialized needs, extensive warranties, and technical support infrastructure ensuring reliable, long-term drone performance.

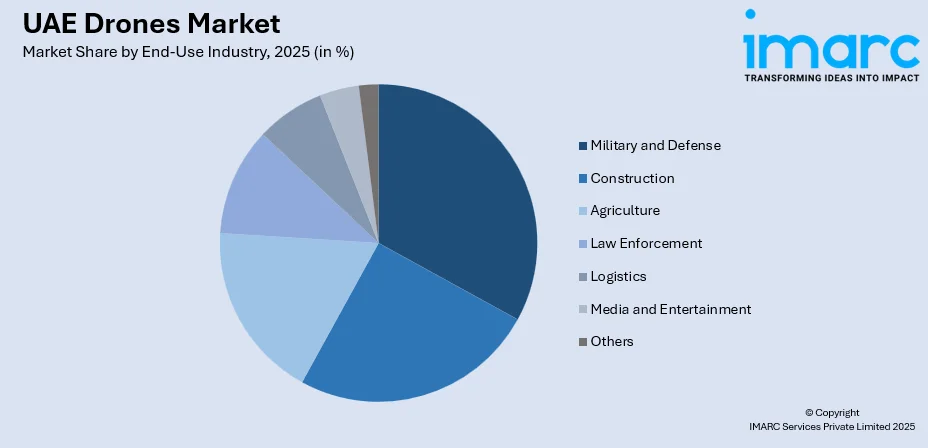

- By End-Use Industry: Military and defense lead the market with a share of 29% in 2025, owing to border surveillance, counter-terrorism intelligence, national security infrastructure, modernization of unmanned systems, and geopolitical requirements necessitating advanced reconnaissance and rapid response capabilities.

- By Region: Dubai dominates the market with a share of 39% in 2025, driven by smart city initiatives, strategic innovation positioning, regulatory sandboxes for testing, robust logistics networks for trials, and government investment in autonomous transport infrastructure.

- Key Players: The market demonstrates evolving competitive dynamics characterized by strategic partnerships between international technology providers and regional defense entities. Multinational aerospace corporations collaborate with domestic manufacturers to develop localized solutions addressing specific operational environments while emerging specialized providers focus on niche applications across commercial sectors.

To get more information on this market Request Sample

The UAE drones market experiences robust expansion propelled by transformative technological integration across civil and military domains. Government-led digital transformation initiatives embed unmanned aerial systems into smart city frameworks, revolutionizing urban management through real-time environmental monitoring, traffic optimization, and emergency response enhancement. According to sources, in May 2025, Abu Dhabi’s Technology Innovation Institute developed AI-powered drone swarms capable of autonomous, decentralized operations for disaster response, infrastructure monitoring, and commercial applications. Moreover, defense modernization programs prioritize autonomous platforms for intelligence gathering, border protection, and tactical operations, reflecting strategic investments in national security infrastructure. Commercial sectors increasingly adopt drones for precision agriculture, infrastructure inspection, construction site monitoring, and aerial surveying, recognizing operational efficiencies and safety improvements compared to traditional methodologies. Regulatory evolution through progressive frameworks established by aviation authorities facilitates beyond visual line of sight operations while maintaining safety standards, encouraging private sector innovation and international collaboration in developing advanced aerial mobility solutions serving diverse industrial applications throughout the emirates.

UAE Drones Market Trends:

Autonomous Delivery Infrastructure Transformation

Urban logistics undergoes fundamental restructuring as autonomous drone delivery systems transition from experimental pilots to operational networks integrated within metropolitan infrastructure. In June 2025, Abu Dhabi’s ADIO, LODD, and 7X conducted the first autonomous drone parcel delivery trial in Khalifa City, demonstrating secure, scalable, and future-ready aerial logistics. Moreover, smart city initiatives incorporate aerial delivery corridors enabling direct-to-consumer transportation of essential goods, medical supplies, and e-commerce parcels through automated flight paths managed by centralized traffic management platforms. Regulatory frameworks evolve to accommodate beyond visual line of sight operations while addressing safety protocols, privacy considerations, and airspace integration with traditional aviation. Retail partnerships expand as merchants recognize competitive advantages in rapid fulfillment capabilities, particularly serving high-density residential developments where conventional delivery faces congestion challenges.

Artificial Intelligence Integration Advancing Operational Autonomy

Drone capabilities expand significantly through embedded AI systems enabling sophisticated autonomous decision-making during complex operational scenarios. Machine learning algorithms process sensor data in real-time, facilitating dynamic obstacle avoidance, adaptive path planning adjusting to environmental conditions, and predictive maintenance identifying potential mechanical failures before critical component degradation. Computer vision technologies enhance object recognition accuracy for surveillance applications, infrastructure inspection identifying structural anomalies, and agricultural monitoring assessing crop health through multispectral analysis. Swarm coordination protocols emerge, allowing multiple units to operate collaboratively on interconnected missions, multiplying operational efficiency while reducing human oversight requirements. As per sources, in November 2025, ADNOC, TII, and ASPIRE launched a pilot integrating autonomous, swarm-enabled drones to provide real-time aerial intelligence for emergency response across Abu Dhabi’s critical infrastructure.

Defense Modernization Driving Military Procurement Expansion

National defense strategies increasingly prioritize unmanned aerial systems as force multipliers enhancing operational capabilities across reconnaissance, surveillance, and tactical domains. Military procurement programs emphasize indigenous development partnerships combining international aerospace expertise with domestic manufacturing capabilities, fostering technological transfer and establishing regional production facilities. In November 2025, the UAE Ministry of Defence and Abu Dhabi Police, via the Tawazun Council, finalized Dh25.455 Billion in contracts, including drone procurements to strengthen national defense and UAV capabilities. Further, tactical units deploy lightweight reconnaissance platforms providing real-time battlefield intelligence, while medium-altitude long-endurance systems conduct extended border monitoring missions and maritime surveillance operations. Electronic warfare capabilities integrate into platforms, enabling communication disruption, radar jamming, and signals intelligence gathering enhancing strategic advantage during operations.

Market Outlook 2026-2034:

The UAE drones market demonstrates exceptional growth trajectory as revenue expands substantially throughout the forecast period, driven by comprehensive government digitalization initiatives, defense procurement acceleration, and commercial sector adoption maturation. Smart city investments multiply autonomous system deployments across environmental monitoring, traffic management, and public safety applications while logistics transformation integrates aerial delivery networks throughout metropolitan areas. Military modernization programs sustain procurement momentum as defense strategies prioritize unmanned platforms for surveillance and tactical operations. The market generated a revenue of USD 163.66 Million in 2025 and is projected to reach a revenue of USD 387.82 Million by 2034, growing at a compound annual growth rate of 10.06% from 2026-2034.

UAE Drones Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Rotary Wing |

52% |

|

Component |

Hardware |

58% |

|

Payload |

<25 Kilograms |

61% |

|

Point of Sale |

Original Equipment Manufacturers (OEM) |

70% |

|

End-Use Industry |

Military and Defense |

29% |

|

Region |

Dubai |

39% |

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

Rotary wing dominates with a market share of 52% of the total UAE drones market in 2025.

Rotary wing leads market composition owing to vertical take-off and landing capabilities eliminating runway dependencies, enabling operations from constrained spaces including building rooftops and remote installations. Hovering precision facilitates detailed infrastructure inspections where stationary positioning ensures comprehensive visual documentation. Multi-rotor configurations provide redundancy enhancing safety profiles critical for operations overpopulated areas. Payload flexibility accommodates diverse equipment ranging from high-resolution cameras to delivery containers. Urban environments favor rotary platforms for delivery applications, surveillance missions, and emergency response scenarios demanding rapid deployment.

Technological advancements enhance performance through brushless motor efficiency improvements extending flight duration and composite airframe materials reducing weight while maintaining structural integrity. Military applications leverage tactical reconnaissance providing infantry units real-time battlefield awareness through man-portable systems. In January 2024, Edge Group signed a UAE MoD contract to supply 200 HT‑100 and HT‑750 rotary‑wing UAVs for ISR and logistics missions, marking the largest unmanned helicopter order in the UAE. Moreover, commercial sectors adopt rotary platforms for agricultural spraying, construction monitoring, and media production capturing aerial cinematography. Market leadership reflects widespread ecosystem development including standardized components and extensive operator training programs. Future growth anticipates hybrid propulsion systems extending endurance, swarm coordination enabling collaborative missions, and enhanced autonomous capabilities.

Component Insights:

- Hardware

- Software

- Accessories

Hardware leads with a share of 58% of the total UAE drones market in 2025.

Hardware constitutes foundational architecture determining operational capabilities and mission suitability across drone platforms. Propulsion systems including motors and propellers directly influence flight duration and payload capacity through efficiency optimization. Battery technologies represent critical limitations affecting operational range, with lithium-polymer and emerging solid-state chemistries offering energy density improvements. Airframe structures balance aerodynamic efficiency with structural integrity through advanced composite materials reducing weight while withstanding operational stresses. Navigation components integrate GPS modules and inertial measurement units providing precise positioning essential for autonomous flight operations. In February 2025, ADASI and VentureOne unveiled next‑gen GPS‑less navigation and secure flight control technologies, enhancing UAE UAV autonomy and resilience in challenging environments.

Sensor suites determine platform capabilities, with electro-optical cameras providing visual reconnaissance, thermal imagers detecting heat signatures, and multispectral sensors assessing agricultural health. Flight controllers represent computational cores processing sensor inputs and executing navigation algorithms through sophisticated software architectures. Gimbal stabilization systems isolate cameras from platform vibrations ensuring smooth footage capture during dynamic maneuvers. Hardware quality directly impacts operational reliability and total cost of ownership, with premium components commanding market preference through superior performance longevity. Manufacturing trends emphasize miniaturization enabling compact platforms, standardization facilitating component interoperability, and AI integration.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

<25 kilograms exhibits a clear dominance with a 61% share of the total UAE drones market in 2025.

<25 kilograms dominate market adoption owing to operational advantages across regulatory compliance and flight performance. Platforms carrying under threshold weight demonstrate enhanced maneuverability through reduced inertia enabling rapid directional changes essential for obstacle avoidance in complex environments. Extended flight duration results from reduced power requirements, with lighter configurations achieving significantly longer airborne time per battery charge enabling comprehensive area coverage. Regulatory frameworks typically impose less stringent operational restrictions on lightweight platforms, facilitating streamlined approval processes and broader deployment permissions.

<25 kilograms drives market preference, with surveillance missions prioritizing portability over heavy sensor payloads and inspection operations requiring agility navigating confined spaces. Cost efficiency attracts commercial adoption through lower acquisition prices and reduced maintenance expenses due to decreased component stress. Military tactical reconnaissance favors lightweight platforms providing infantry units immediate aerial awareness through man-portable systems deployable by individual operators. Training accessibility increases as lightweight platforms present reduced safety risks during operator certification. Technological maturation delivers capable sensor miniaturization, with high-resolution cameras achieving professional performance standards in compact form factors.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Original equipment manufacturers (OEM) lead with a market share of 70% of the total UAE drones market in 2025.

Original equipment manufacturers (OEM) dominate distribution channels owing to established procurement relationships, quality assurance integration, and comprehensive support infrastructure. Government entities and enterprise customers prioritize OEM acquisition paths ensuring platform authenticity, warranty coverage, and compliance with regulatory standards through certified supply chains. In November 2025, EDGE Group and Anduril Industries formed a UAE–US joint venture to develop autonomous systems, with the UAE acquiring 50 Omen drones, boosting local production and supply chains. Furthermore, military procurement follows structured processes emphasizing vendor reliability and long-term sustainment commitments favoring direct manufacturer relationships. Customization capabilities represent significant OEM advantages, with platforms configured precisely to operational requirements through payload integration and software customization.

Quality control processes embedded throughout OEM manufacturing ensure consistent performance meeting advertised specifications, with rigorous testing protocols validating flight characteristics before delivery. Warranty provisions protect investment value through coverage of manufacturing defects and component failures, providing financial risk mitigation important for capital-intensive deployments. Software updates delivered directly from manufacturers ensure platforms maintain cybersecurity standards and incorporate latest autonomous capabilities. Enterprise fleet management benefits from standardization achievable through OEM procurement, with identical platforms simplifying training requirements and maintenance procedures.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

Military and defense lead with a share of 29% of the total UAE drones market in 2025.

Military and defense constitute substantial market segment reflecting the strategic importance of unmanned aerial systems within national security infrastructure. Border surveillance operations deploy persistent monitoring capabilities across extensive territories where conventional patrol methods prove resource-intensive, with drones providing cost-effective aerial reconnaissance detecting unauthorized crossings and security threats. Intelligence gathering missions leverage sophisticated sensor suites including electro-optical cameras and infrared systems collecting actionable information during counter-terrorism operations and tactical reconnaissance. In November 2025, Tawazun Council and Saab UAE launched a joint R&D programme on advanced drone detection technologies, strengthening national defence capabilities and fostering local talent and innovation.

Tactical reconnaissance platforms integrate within military units providing immediate battlefield awareness, with man-portable systems offering on-demand aerial intelligence during operations where satellite imagery proves insufficient. Training applications prepare military personnel for unmanned system operations through simulation exercises and tactical employment doctrine development ensuring operational readiness. Maritime surveillance missions protect territorial waters, with coastal patrol operations monitoring shipping traffic and detecting illegal fishing activities. Critical infrastructure protection employs aerial monitoring safeguarding oil facilities and transportation networks against sabotage threats.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai dominates with a market share of 39% of the total UAE drones market in 2025.

Dubai leads regional market distribution owing to concentrated smart city initiatives, economic diversification strategies, and progressive regulatory environment fostering innovation adoption. Government investment prioritizes technology integration throughout urban infrastructure, with drone deployments supporting traffic management monitoring congestion patterns, environmental monitoring assessing air quality, and emergency response enhancing situational awareness during incidents. Logistics transformation incorporates aerial delivery pilots connecting retail partners with residential communities, establishing operational frameworks scalable across emirate through designated flight corridors. Innovation hubs including technology parks attract international aerospace companies establishing regional headquarters and research facilities leveraging favorable business environment.

Regulatory sandbox programs enable experimental deployments testing emerging technologies under controlled conditions, with aviation authorities collaborating with industry stakeholders refining operational standards. Infrastructure density including high-rise developments and concentrated commercial districts creates operational environment ideally suited for drone applications addressing urban challenges. Real estate development incorporates drone surveillance during construction monitoring progress and safety compliance, while completed properties employ aerial security patrols. Tourism sectors leverage aerial cinematography showcasing iconic skyline, and entertainment venues experiment with drone light shows.

Market Dynamics:

Growth Drivers:

Why is the UAE Drones Market Growing?

Smart City Infrastructure Integration Accelerating Deployment

Government-led digital transformation initiatives embed unmanned aerial systems throughout metropolitan infrastructure as foundational elements within smart city frameworks revolutionizing urban management. Municipalities deploy drone networks conducting environmental monitoring tracking air quality, temperature variations, and pollution concentrations providing actionable data informing policy decisions. As per sources, in November 2025, Dubai Municipality launched “Smart Municipality Eye,” deploying AI-enabled drones to monitor 52 Million m² of green spaces, enhancing environmental sustainability, predictive maintenance, and urban infrastructure management across the emirate. Furthermore, traffic management systems integrate aerial surveillance monitoring congestion patterns and infrastructure conditions enabling dynamic routing recommendations. Emergency response capabilities multiply through rapid deployment streaming real-time video to command centers facilitating resource allocation and damage assessment. Public safety applications include crowd monitoring during major events and search operations leveraging thermal imaging.

Defense Modernization Programs Driving Military Procurement

National defense strategies prioritize unmanned aerial system acquisitions as force multipliers enhancing operational capabilities across reconnaissance and tactical domains while reducing personnel exposure. Border security requirements drive persistent monitoring investments covering extensive territorial boundaries where conventional patrol methods prove resource intensive. Autonomous platforms conduct extended surveillance missions detecting unauthorized crossings and security threats through continuous airborne presence. Counter-terrorism operations leverage tactical reconnaissance providing military units real-time battlefield intelligence with sophisticated sensors identifying threats and supporting tactical planning. In February 2025, EDGE Group secured an AED 227 Million UAE Ministry of Defence contract at IDEX 2025 to supply GPS-PROTECT anti-jamming systems safeguarding UAV navigation across air, land, and sea platforms. Moreover, training infrastructure expands developing specialized operator cadres through simulation facilities and certification programs.

Commercial Sector Adoption Maturation Expanding Applications

Enterprise recognition of operational efficiencies drives commercial sector adoption across diverse industries. As per sources, in June 2025, Abu Dhabi launched its first drone parcel delivery test flight, transporting packages via autonomous UAVs under a partnership between ADIO, LODD, and 7X investment group. Moreover, construction management integrates aerial platforms documenting project progress through regular surveys with photogrammetry software processing imagery into three-dimensional models. Infrastructure inspection transitions from manual assessments to drone examinations of bridges and utility networks reducing costs and improving safety. Agriculture embraces precision farming with multispectral sensors assessing crop health and optimizing fertilizer application. Real estate deploys platforms capturing marketing imagery and conducting roof inspections. Insurance companies utilize drones expediting claims processing through rapid damage assessment. Media industries adopt platforms replacing expensive helicopter rentals for aerial cinematography.

Market Restraints:

What Challenges the UAE Drones Market is Facing?

Regulatory Complexity and Airspace Integration Challenges

Operational restrictions imposed by aviation authorities limit commercial deployment through stringent requirements governing flight operations. Beyond visual line of sight operations face extensive approval processes requiring comprehensive safety demonstrations. Airspace density around metropolitan regions creates constraints as authorities prioritize manned aircraft safety, restricting operations near airports. Certification requirements demand substantial time and financial investment deterring smaller enterprises while privacy concerns generate societal resistance.

Technical Limitations Constraining Operational Capabilities

Battery technology constraints fundamentally limit platform endurance, with current chemistries restricting flight duration typically under thirty minutes, necessitating frequent recharging disrupting operations. Payload capacity restrictions prevent certain applications with weight limitations excluding heavier sensors. Environmental sensitivity affects reliability, with adverse weather grounding platforms. Communication range limitations constrain operations with signal degradation reducing control ranges while autonomy limitations require substantial operator oversight.

Economic Barriers Limiting Market Accessibility

High acquisition costs for professional-grade platforms equipped with advanced sensors create significant capital barriers for small enterprises. Maintenance requirements including regular inspections, component replacements, and software updates add recurring expenses accumulating substantially over platform lifecycle. Operator training demands substantial time and financial investment developing proficiency. Insurance premiums add significant cost components particularly for operations overpopulated areas while infrastructure investments represent additional capital requirements.

Competitive Landscape:

The competitive environment demonstrates dynamic evolution characterized by strategic positioning across technology development and regional presence establishment. International aerospace corporations maintain strong positions through established product portfolios and proven operational track records attracting government procurement. Regional defense entities pursue domestic manufacturing partnerships combining foreign technological expertise with local production facilities. Emerging specialized providers target niche applications including agricultural services and infrastructure inspection leveraging focused expertise. Technology differentiation centers on autonomy advancement, sensor integration, and operational efficiency improvements. Innovation investments concentrate on artificial intelligence (AI) implementation, swarm coordination, and hybrid propulsion systems extending endurance.

Recent Developments:

- In April 2025, e& UAE launched AI-powered autonomous drones for telecom tower inspections, enhancing safety, efficiency, and sustainability. The drones, integrated with real-time analytics and the Drones Operations Centre, enable proactive maintenance, detect structural anomalies, support emergency response, and advance smart city infrastructure, reflecting the UAE’s commitment to innovation and digital transformation.

UAE Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Point of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE drones market size was valued at USD 163.66 Million in 2025.

The UAE drones market is expected to grow at a compound annual growth rate of 10.06% from 2026-2034 to reach USD 387.82 Million by 2034.

Rotary wing held the largest market share owing to vertical take-off capabilities enabling operations in constrained urban spaces, superior hovering precision for inspection applications, payload flexibility accommodating diverse equipment, and operational agility across military surveillance and commercial delivery missions throughout metropolitan environments.

Key factors driving the UAE drones market include comprehensive smart city infrastructure integration embedding autonomous systems throughout urban management, defense modernization prioritizing unmanned platforms for surveillance operations, commercial sector adoption recognizing operational efficiencies, and progressive regulatory frameworks facilitating beyond visual line of sight operations.

Major challenges include regulatory complexity imposing operational restrictions particularly for beyond visual line of sight missions, technical limitations constraining endurance through battery capacity, payload restrictions preventing certain applications, environmental sensitivity affecting reliability, economic barriers including high acquisition costs, and cybersecurity vulnerabilities requiring ongoing investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)