UAE Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

UAE Fintech Market Overview:

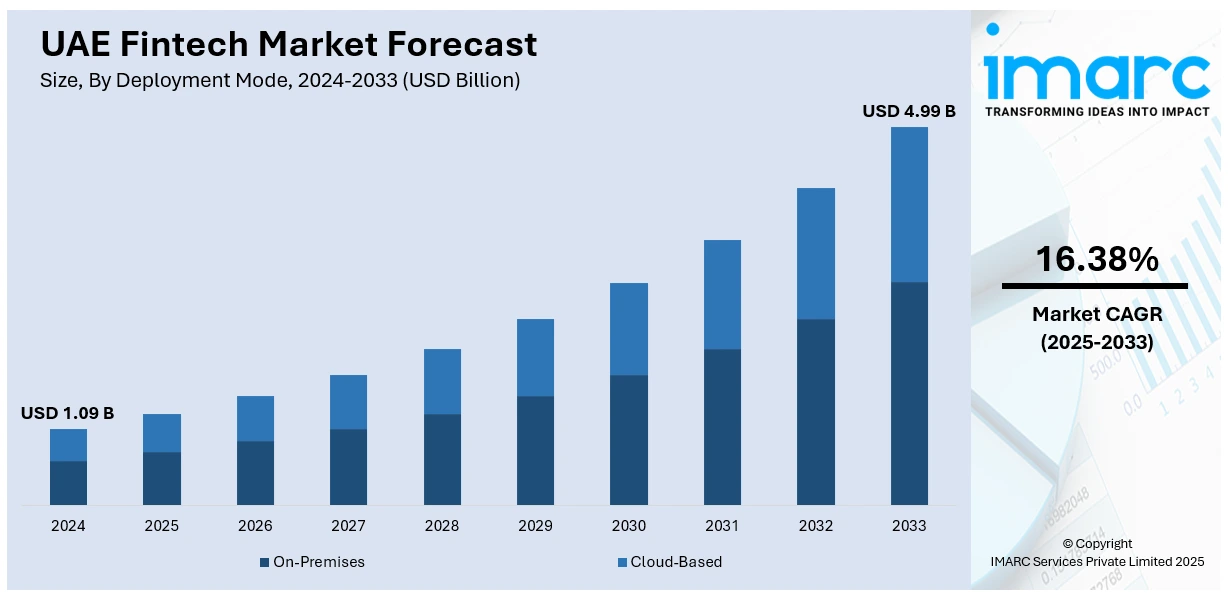

The UAE fintech market size reached USD 1.09 Billion in 2024. The market is projected to reach USD 4.99 Billion by 2033, exhibiting a growth rate (CAGR) of 16.38% during 2025-2033. The market is advancing rapidly, driven by technological adoption, open architecture, and regulatory support across regions like Dubai and Abu Dhabi. Innovations such as AI, blockchain, digital payments, insurtech, and mobile banking are reshaping financial services. Government-backed fintech sandboxes, economic free zones, and high internet penetration fosters an enabling environment for startups and traditional institutions to collaborate and innovate. The vibrant ecosystem reinforces the UAE’s position as a regional fintech powerhouse, shaping the evolving UAE fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.09 Billion |

| Market Forecast in 2033 | USD 4.99 Billion |

| Market Growth Rate 2025-2033 | 16.38% |

UAE Fintech Market Trends:

Shift Toward Open Banking and API Ecosystems

The rising implementation of open banking frameworks and the establishment of strong application programming interface (API) ecosystems are emerging as key factors propelling the industry growth. Open banking enables financial organizations to share client information with external fintech companies, fostering a collaborative and innovative atmosphere. This transparency promotes the creation of innovative financial products, like budgeting applications, tailored loan options, and different credit evaluation methods, which can more effectively address the requirements of individuals and companies. APIs allow fintech companies to seamlessly merge their offerings with banks, payment processors, and various financial institutions, promoting a more cohesive and vibrant ecosystem. In 2024, Fintech Galaxy launched its FINX Comply platform in the UAE, offering Open Banking compliance services with a cloud-based API gateway for account information and payment initiation services. This move supported banks and financial institutions in meeting Open Banking and Open Finance regulations, enhancing financial inclusion and innovation in the region. The launch aligned with the UAE's push toward Open Finance, following global trends in financial services.

To get more information on this market, Request Sample

Technological Advancements and Evolving User Expectations

The swift rise of advanced technologies, such as artificial intelligence (AI), blockchain, big data, and machine learning (ML), is greatly altering the functions of financial institutions and redefining their engagements with clients. These innovative technologies enable the provision of more tailored, effective, and secure financial services, thus improving client interaction and overall contentment. With individual expectations evolving towards smooth, instantaneous, and user-friendly digital experiences, fintech firms are progressively integrating these technological innovations to meet the changing needs of the market. Additionally, the growing presence of the Internet of Things (IoT) and biometric security systems are enhancing the effectiveness, safety, and ease of digital transactions, providing users with a more secure and seamless experience. This technological evolution not only addresses the diverse needs of both individuals and businesses but also fosters a dynamic and increasingly competitive environment for ongoing fintech innovation and development.

Attractive Regulatory Environment for International Fintech Expansion

The Central Bank of the UAE provides a favorable environment for foreign fintech companies aiming to enter the market, featuring transparent regulations for licensing and operations. This clear regulation lowers entry barriers, establishing the UAE as an optimal starting point for international fintech firms seeking to expand their international presence. The simplicity of setting up operations, combined with a flourishing digital economy and robust infrastructure, allows international companies to innovate and expand quickly. The dedication of UAE to establishing a transparent, secure, and business-friendly climate establishes it as a regional fintech center, encouraging heightened competition, innovation, and user options. This favorable regulatory framework aids in attracting international fintech companies, thereby propelling the market growth. In 2025, UK-based fintech Revolut received in-principle approval from the UAE Central Bank to launch its services in the region. The digital bank aims to expand its footprint in the UAE with a focus on empowering individuals with innovative financial tools. Revolut plans to become one of the top three financial apps in every market it enters.

UAE Fintech Market Growth Drivers:

Growing Focus on Cybersecurity and Trust in Digital Financial Services

With the global increase in cyber threats and data breaches, the need for strong cybersecurity solutions in the fintech industry is becoming an essential focus. Fintech firms are progressively allocating resources to sophisticated encryption technologies, biometric verification techniques, and AI-driven fraud prevention systems to protect financial transactions and sensitive user information. Implementing these proactive strategies is vital for guaranteeing the security of digital financial services and reducing the dangers linked to data breaches and cyberattacks. Alongside the increased demand for security in the sector, regulatory agencies are establishing more stringent data protection and privacy regulations, further driving the need for secure fintech solutions that adhere to these legal standards. With individuals and businesses attaching greater importance to the security and privacy of their financial dealings, fintech companies in the UAE are adapting by incorporating advanced security measures that safeguard user information and transactions. This increasing focus on cybersecurity not only safeguards individuals but also greatly enhances client trust in utilizing digital financial services.

Strong Infrastructure and Smart City Initiatives

The growing investment by the governing body in upgrading its physical and digital infrastructure, guaranteeing that UAE possesses high-speed internet access, cutting-edge data centers, and sophisticated telecommunications networks. These enhancements not only foster the expansion of diverse sectors but also create an ideal setting for fintech companies to initiate, grow, and manage their services with improved efficiency and strong security. Additionally, the UAE’s bold initiative for smart cities is accelerating the incorporation of advanced technologies like the IoT, big data analytics, and automation. These smart city projects provide fintech firms with an excellent environment to experiment, improve, and implement cutting-edge solutions that effortlessly align with city infrastructure. With the UAE's ongoing transformation of its cities into worldwide centers of innovation and sustainability, it draws in international talent and investment, further propelling the growth of the fintech industry. The combination of robust digital infrastructure and smart city development establishes a vibrant ecosystem that encourages technological advancements and establishes the UAE as a crucial player in the global fintech arena.

Growing E-commerce and Digital Trade Landscape

The swift transition to a digital-centric economy in the UAE is catalyzing the demand for secure, effective, and advanced payment solutions. With the rise of online retail, cross-border commerce, and digital services, both businesses and individuals are looking for sophisticated digital payment gateways, e-wallets, and instantaneous settlement solutions to facilitate their transactions. Fintech firms are reacting by creating tailored solutions that improve transaction safety and streamline e-commerce processes, while also addressing the specific requirements of small enterprises and individual users. With the UAE’s e-commerce sector projected to reach USD 776.2 Billion by 2033, the need for digital financial services is anticipated to increase significantly. With the rise of international companies creating a digital footprint in the area, fintech firms will be essential in facilitating quicker, smoother financial transactions, fostering innovation and market growth within the digital commerce environment.

UAE Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

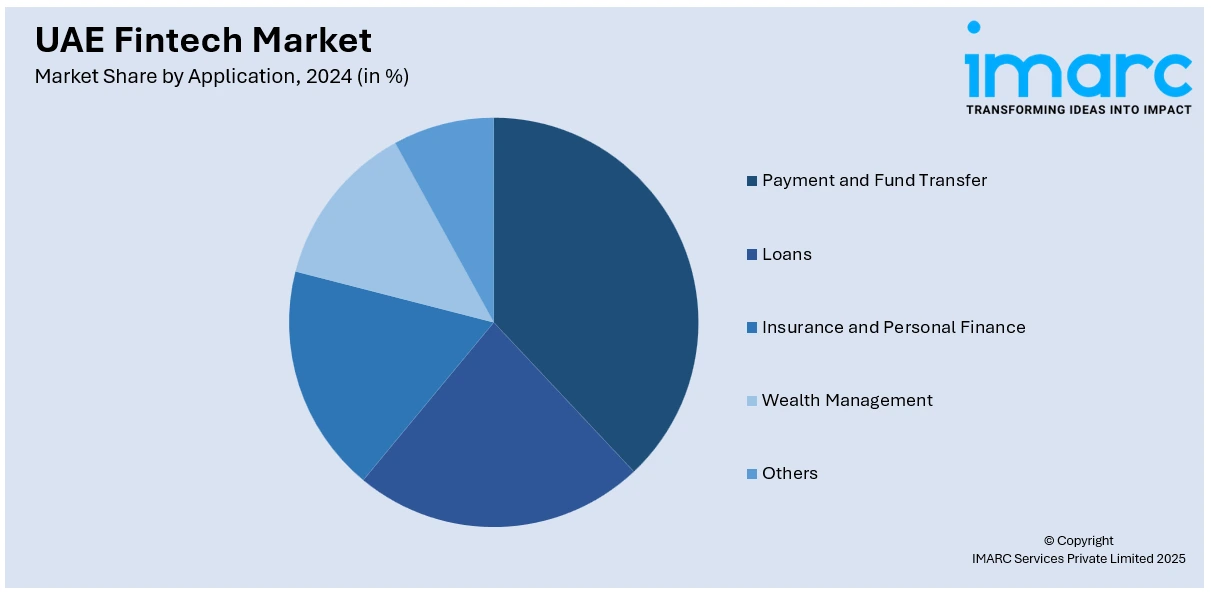

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Fintech Market News:

- July 2025: Mawarid Finance and Arab Financial Services (AFS) launched an integrated Fintech Enablement Hub in the UAE. This platform streamlines fintechs' access to regulated infrastructure, enabling them to launch card programs in as little as 15 days. The collaboration uses Mastercard Product Express to accelerate innovation and growth for digital-first companies.

- May 2025: Botim partnered with Mbank to launch the UAE’s first fintech-integrated Jaywan card, a national prepaid card system. The initiative supports the UAE's cashless payment strategy and allows users to make digital payments without a traditional bank account. The partnership aims to enhance financial inclusion and align with the country's digital transformation goals.

- October 2024: Fintech Surge 2024, the largest fintech event in the MENA region, took place at Dubai Harbour from October 13-16, 2024. The event hosted over 100 exhibitors, 1,200 investors, and 120+ speakers from 70+ countries, showcasing innovations in digital banking, embedded finance, and AI. It also highlighted the UAE's role as a global fintech hub.

- August 2025: Ant International has entered a strategic partnership with the Abu Dhabi Investment Office, signing a Memorandum of Understanding to advance financial technology innovation in the UAE. Simultaneously, it received in‑principle approval from the Central Bank of the UAE for key payment regulatory licenses. These milestones pave the way for Ant International to introduce services such as payment aggregation, e‑wallet issuance, and merchant acquiring, aligning with the nation’s digitalisation strategy and supporting the UAE’s evolving fintech ecosystem.

- January 2025: NPCI International Payments Ltd (the international arm of India’s leading digital payments organization) has partnered with UAE-based fintech Magnati to bring Unified Payments Interface (UPI) payments to the Emirates. Under this collaboration, Indian visitors will be able to use UPI via QR codes at point-of-sale terminals across the UAE, initially beginning at Dubai Duty Free. The move promises to streamline and modernize the payment experience for Indian travelers and NRIs by integrating a widely used digital payment method into the UAE’s retail landscape.

UAE Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech market in UAE was valued at USD 1.09 Billion in 2024.

The UAE fintech market is projected to exhibit a CAGR of 16.38% during 2025-2033, reaching a value of USD 4.99 Billion by 2033.

The growth of the UAE fintech market is driven by a supportive regulatory environment, fostering innovation and attracting investment. Increased adoption of digital payments, coupled with a rising demand for financial inclusion and accessible financial services, is further propelling the market growth. Moreover, technological advancements in blockchain and AI are enhancing operational efficiencies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)