UAE Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

UAE Foreign Exchange Market Overview:

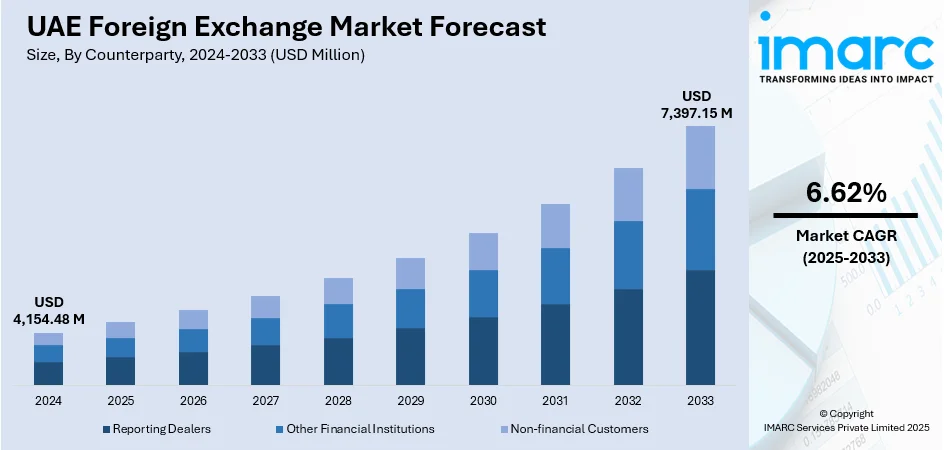

The UAE foreign exchange market size reached USD 4,154.48 Million in 2024. The market is projected to reach USD 7,397.15 Million by 2033, exhibiting a growth rate (CAGR) of 6.62% during 2025-2033. The market is propelled by the nation's position as an international trade and tourism center, which guarantees a regular flow of foreign currency and cross-border transactions. Moreover, substantial economic diversification strategies, especially in industries like real estate, aviation, and finance, also increase demand and liquidity. Furthermore, the nation's sound monetary policy and sophisticated banking infrastructure promote investor confidence, which also augments the UAE foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,154.48 Million |

| Market Forecast in 2033 | USD 7,397.15 Million |

| Market Growth Rate 2025-2033 | 6.62% |

UAE Foreign Exchange Market Trends:

Growing Role of Remittances in Forex Flows

The market is significantly shaped by the country's position as a major hub for expatriate labor. With a 10.4 Million expatriate population, remittance outflows represent a substantial portion of foreign exchange activity. The consistent and high volume of remittances, particularly to South Asia and Africa, influences daily forex liquidity and currency exchange volumes. Moreover, exchange houses play a pivotal role in facilitating these flows, often operating parallel to traditional banking channels and contributing to competitive rates and dynamic currency pair movements. Besides, the emergence of digital remittance platforms and real-time money transfer services has increased transaction volumes while improving transparency and regulatory oversight. In addition, regulatory bodies like the UAE Central Bank have introduced enhanced compliance frameworks to monitor cross-border money transfers and prevent illicit financial activities. As remittances remain stable even during economic fluctuations, they act as a reliable driver of forex demand. This enduring trend ensures sustained market activity, especially for currencies like the Indian Rupee, Philippine Peso, and Egyptian Pound.

To get more information on this market, Request Sample

Rising Influence of Oil Prices on Currency Stability

The foreign exchange market in the country is closely intertwined with fluctuations in global oil prices due to the reliance on hydrocarbon exports for fiscal revenue and trade balance stability. When oil prices rise, government revenues and foreign currency inflows increase, strengthening economic confidence and improving liquidity in the forex market. Conversely, sustained low oil prices can pressure fiscal budgets and reduce capital inflows, prompting tighter liquidity conditions. The oil-dollar correlation indirectly shapes expectations and currency market behavior, especially among traders and institutional investors who assess macroeconomic risk based on energy market trends. Furthermore, the UAE's sovereign wealth funds, which manage substantial offshore assets, rebalance currency exposures in response to energy price cycles, influencing forex flows across global markets. These structural linkages make oil prices a defining variable in understanding the UAE's forex dynamics.

Expansion of Digital Forex Platforms and Fintech Integration

The integration of fintech and the proliferation of digital trading platforms are positively impacting the UAE foreign exchange market growth. Additionally, regulatory support from the Central Bank of the UAE and the Dubai Financial Services Authority (DFSA) has facilitated the entry of advanced forex trading technologies, enabling real-time access to currency markets for both retail and institutional participants. Digital platforms offer enhanced transparency, tighter spreads, and AI-driven analytics, making forex trading more efficient and data-centric. In parallel, digital wallets and blockchain-enabled payment systems are streamlining cross-border transfers, reducing settlement times, and lowering costs. Fintech adoption is particularly pronounced among younger, tech-savvy investors seeking diversified asset classes. Additionally, UAE-based forex brokers are increasingly aligning with global regulatory standards to attract international clientele, contributing to market sophistication and broader liquidity. The growing fintech ecosystem in hubs like Abu Dhabi Global Market (ADGM) and Dubai International Financial Centre (DIFC) further strengthens the infrastructure for digital forex services, marking a decisive shift toward innovation-driven currency exchange in the region.

UAE Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

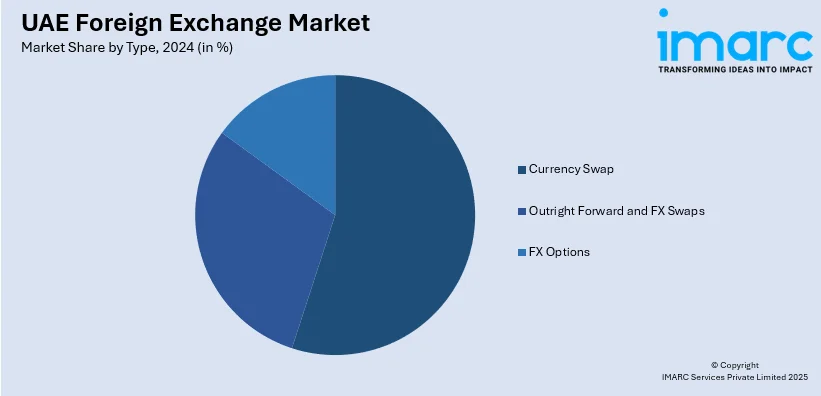

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Foreign Exchange Market News:

- June 2025: Al Ansari Exchange, UAE-based remittance and foreign exchange provider, announced the launch of instant digital issuance for its TravelCard and FlexiblePay prepaid cards via its mobile application. This new feature allows UAE residents to obtain a 16-digit Visa co-branded digital card within seconds of application approval, with immediate usability. The TravelCard is tailored for international travelers, offering multi-currency support and competitive exchange rates, while the FlexiblePay card is designed for everyday transactions, including online shopping and easy reloads—supporting broader financial inclusion and advancing the UAE’s shift toward a cashless economy.

UAE Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE foreign exchange market on the basis of counterparty?

- What is the breakup of the UAE foreign exchange market on the basis of type?

- What is the breakup of the UAE foreign exchange market on the basis of region?

- What are the various stages in the value chain of the UAE foreign exchange market?

- What are the key driving factors and challenges in the UAE foreign exchange market?

- What is the structure of the UAE foreign exchange market and who are the key players?

- What is the degree of competition in the UAE foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)