UAE Fuel Station Market Report by Fuel Type (Gasoline, LPG (Liquefied Petroleum Gas), and Others), Service Type (Self-Service, Full-Service), Location Type (Urban, Suburban), Payment Method (Cash, Credit/Debit Cards, Digital Payments), and Region 2025-2033

UAE Fuel Station Market Overview:

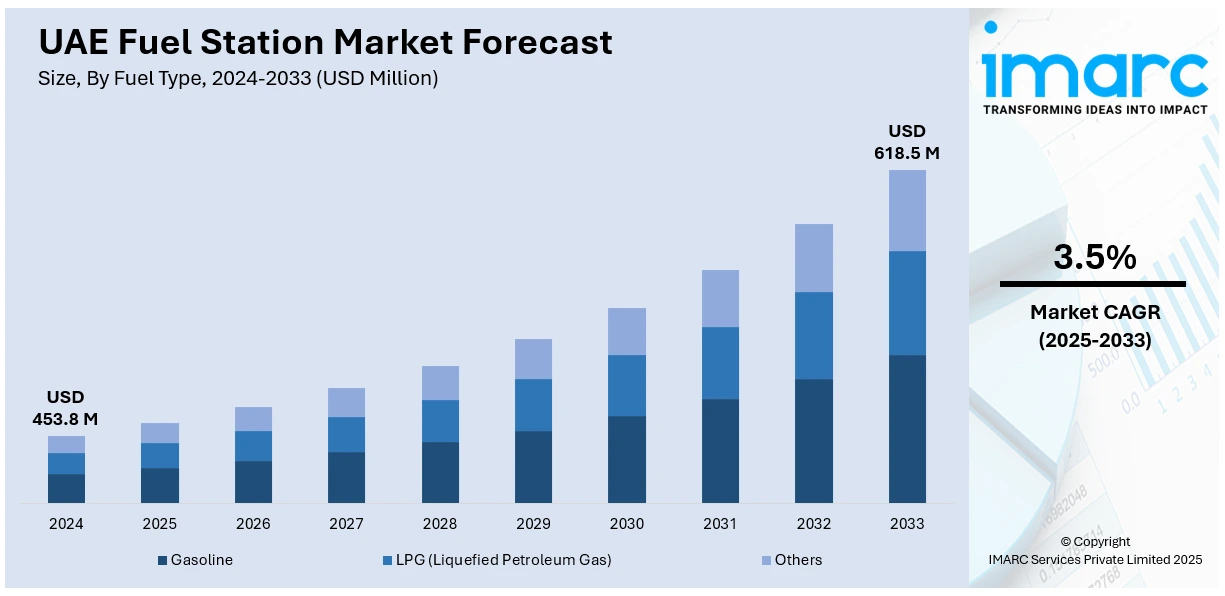

The UAE fuel station market size reached USD 453.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 618.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The market is driven by rapid urbanization and infrastructure development, growing focus on economic diversification, rising technological advancements, imposition of various government initiatives, heightened demand for convenience in refueling, and the strategic location of the region that enhances accessibility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 453.8 Million |

| Market Forecast in 2033 | USD 618.5 Million |

| Market Growth Rate (2025-2033) | 3.5% |

UAE Fuel Station Market Trends:

Expansion of Urbanization and Infrastructure Development:

The rapid urbanization and infrastructure development is a primary driver of the UAE fuel station market. There is a growing demand for accessible and efficient fuel stations as the UAE continues to modernize and expand its cities. Moreover, urbanization in the UAE is characterized by the development of new residential areas, commercial hubs, and industrial zones. These developments require a robust network of fuel stations to cater to the needs of residents, businesses, and industries. Along with this, the introduction of strategic plans by the government, such as the UAE Vision 2021 and the Abu Dhabi Vision 2030, that emphasize infrastructure development, including transportation networks, roads, and highways, is boosting the expansion of this industry. These plans aim to enhance connectivity, creating the need for fuel stations to ensure that motorists have convenient access to fuel.

To get more information on this market, Request Sample

Economic Diversification and Increased Vehicle Ownership:

The UAE government is actively pursuing economic diversification to reduce its reliance on oil revenues and promote sustainable growth. This shift towards a more diversified economy has led to the growth of various sectors, including tourism, retail, and logistics, which in turn drives the demand for fuel. Additionally, the establishment of numerous free zones, industrial parks, and business hubs that attract businesses and professionals from across the globe, thus contributing to an increase in vehicle ownership, is stimulating the market growth. Additionally, the UAE’s favorable business environment and strategic location, which make it a regional logistics and transportation hub, are catalyzing the market growth. Fuel stations play a crucial role in supporting the logistics industry by providing essential refueling services and amenities for long-haul drivers.

Rapid Technological Advancements:

The integration of advanced technologies in fuel stations to enhance operational efficiency, improve customer experience, and support sustainable practices is positively impacting the market growth. Along with this, the growing utilization of innovative technologies by fuel station operators to stay competitive and meet the evolving needs of consumers is boosting the market growth. Furthermore, the implementation of automated fueling systems that streamline the refueling process by allowing customers to pay for fuel and other services using contactless payment methods, mobile apps, or loyalty cards is a major market driver. Moreover, the adoption of the Internet of Things (IoT)-enabled fuel stations that monitor fuel levels, equipment status, and environmental conditions in real-time is fostering the market growth.

UAE Fuel Station Market News:

- In February 2023, Dubai-based Emirates National Oil Company (ENOC) joined forces with Dubai Electricity and Water Authority (DEWA) to develop and operate a joint integrated pilot project for the use of hydrogen in mobility. The project will take advantage of Dewa’s existing green hydrogen production facility in the Mohammed bin Rashid Al Maktoum Solar Park and Enoc's knowledge of the fuel market and customer base.

- In February 2023, ADNOC Distribution announced the introduction of its latest service, ADNOC ‘Fill & Go’ as the region’s first fuel distributor to introduce AI-backed innovative technology at its service stations. This solution utilizes the latest innovations in computer vision technologies, comprising machine learning (ML) models that allow computers to recognize vehicles and respond by offering a hyper-personalized fueling experience.

UAE Fuel Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on fuel type, service type, location type, and payment method.

Fuel Type Insights:

- Gasoline

- LPG (Liquefied Petroleum Gas)

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, LPG (liquefied petroleum gas), and others.

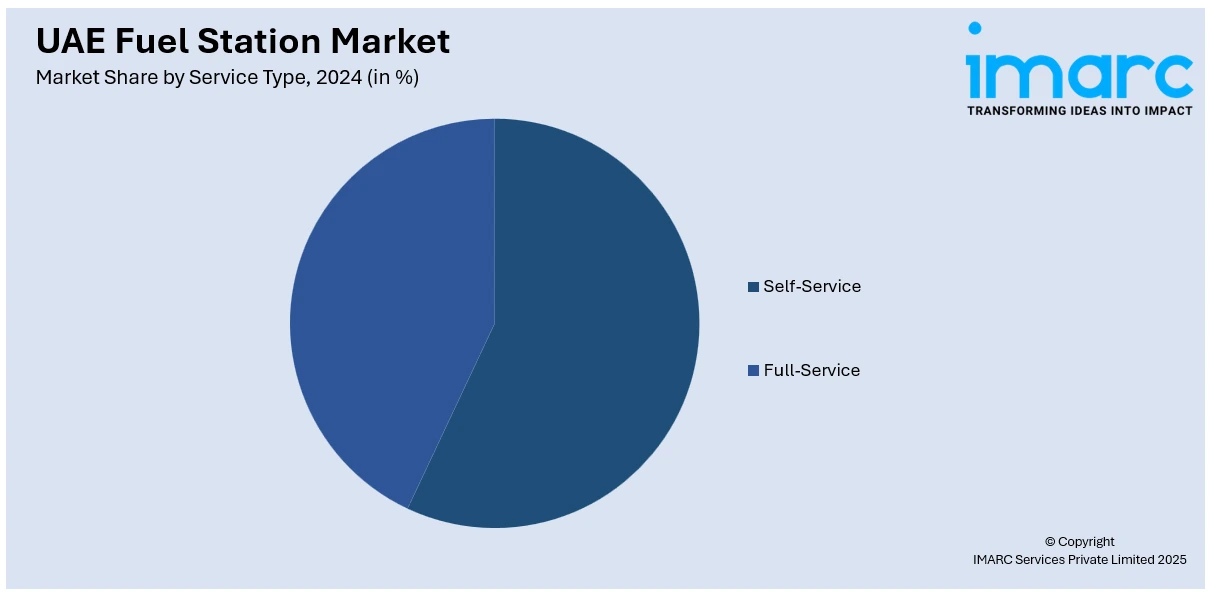

Service Type Insights:

- Self-Service

- Full-Service

The report has provided a detailed breakup and analysis of the market based on the service type. This includes self-service and full-service.

Location Type Insights:

- Urban

- Suburban

The report has provided a detailed breakup and analysis of the market based on the location type. This includes urban and suburban.

Payment Method Insights:

- Cash

- Credit/Debit Cards

- Digital Payments

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes cash, credit/debit cards, and digital payments.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Fuel Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fuel Types Covered | Gasoline, Diesel, LPG (Liquefied Petroleum Gas), Others |

| Service Types Covered | Self-Service, Full-Service |

| Location Types Covered | Urban, Suburban |

| Payment Methods Covered | Cash, Credit/Debit Cards, Digital Payments |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE fuel station market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE fuel station market?

- What is the breakup of the UAE fuel station market on the basis of fuel type?

- What is the breakup of the UAE fuel station market on the basis of service type?

- What is the breakup of the UAE fuel station market on the basis of location type?

- What is the breakup of the UAE fuel station market on the basis of payment method?

- What are the various stages in the value chain of the UAE fuel station market?

- What are the key driving factors and challenges in the UAE fuel station?

- What is the structure of the UAE fuel station market and who are the key players?

- What is the degree of competition in the UAE fuel station market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE fuel station market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE fuel station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE fuel station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)