UAE Green Data Center Market Size, Share, Trends and Forecast by Component, Data Center Type, Industry Vertical, and Region, 2026-2034

UAE Green Data Center Market Summary:

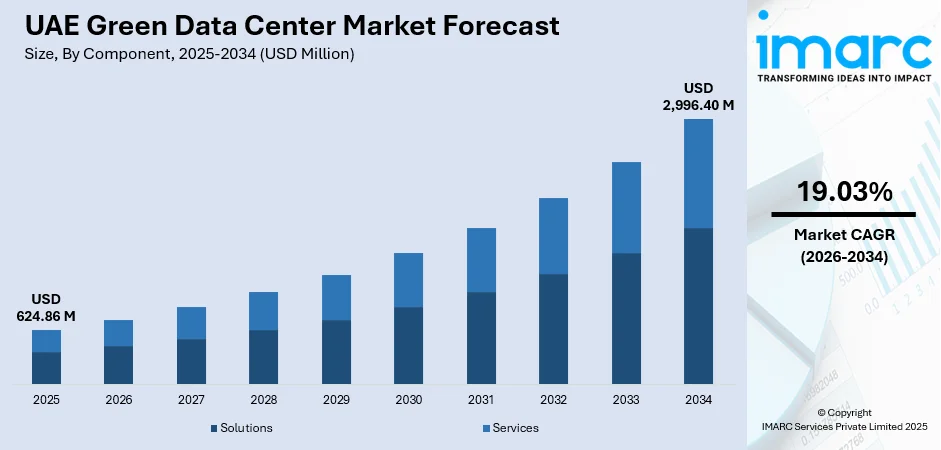

The UAE green data center market size was valued at USD 624.86 Million in 2025 and is projected to reach USD 2,996.40 Million by 2034, growing at a compound annual growth rate of 19.03% from 2026-2034.

The UAE green data center market is experiencing significant momentum as the country positions itself as the Middle East's premier digital infrastructure hub. Accelerating digital transformation initiatives, ambitious sustainability commitments, and strategic government investments are driving unprecedented demand for energy-efficient data infrastructure. The integration of renewable energy sources, adoption of advanced cooling technologies, and hyperscale cloud provider expansions are reshaping the market landscape, contributing to robust UAE green data center market share.

Key Takeaways and Insights:

- By Component: Solutions dominate the market with 65.04% revenue share in 2025, driven by comprehensive infrastructure requirements encompassing power systems, advanced cooling technologies, servers, networking equipment, and intelligent monitoring systems essential for sustainable data center operations.

- By Data Center Type: Enterprise data centers lead the market with 41.06% share in 2025, reflecting the growing demand from government entities, financial institutions, and large corporations requiring sovereign cloud compliance, dedicated infrastructure, and enhanced data security within national borders.

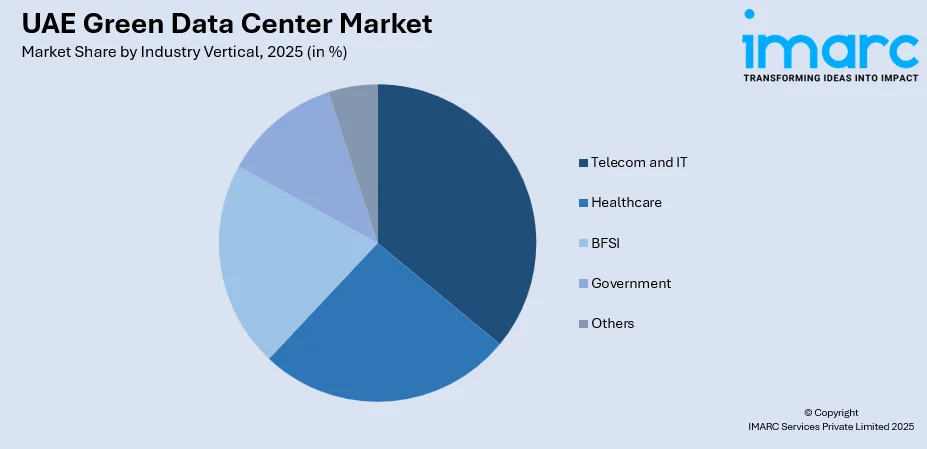

- By Industry Vertical: Telecom and IT holds the largest market share at 32.5% in 2025, positioning the UAE as the Gulf's digital gateway through extensive 5G deployments, cloud service expansions, and digital transformation initiatives across telecommunications infrastructure.

- Key Players: The UAE green data center market exhibits moderate competitive intensity, with regional leaders and global operators driving innovation through strategic partnerships, renewable energy integration, advanced cooling deployments, and capacity expansions across Dubai, Abu Dhabi, and emerging emirates.

To get more information on this market Request Sample

The UAE green data center market is advancing rapidly as the nation pursues its vision of becoming a global AI and digital infrastructure leader. Government-backed initiatives including the UAE Digital Government Strategy 2025 and Smart Dubai programs are catalyzing demand for sustainable computing infrastructure with stringent data residency requirements. The convergence of sovereign cloud mandates, accelerating digital transformation across industries, and growing adoption of artificial intelligence applications is driving unprecedented infrastructure investment. Hyperscale investments from global technology leaders, combined with regional operators' expansion strategies, are establishing the UAE as a critical node in global digital infrastructure networks while maintaining commitment to environmental sustainability goals. The integration of renewable energy sources and adoption of advanced cooling technologies further reinforce the market's trajectory toward sustainable, high-performance computing infrastructure capable of supporting next-generation workloads.

UAE Green Data Center Market Trends:

Accelerated Adoption of Advanced Liquid Cooling Technologies

The shift toward high-density AI workloads is driving rapid adoption of liquid cooling solutions across UAE data centers. Traditional air-based cooling systems are increasingly inadequate for managing heat generated by next-generation GPU clusters and AI infrastructure. In August 2024, Hewlett Packard Enterprise introduced the first managed data center hosting service with direct liquid cooling for AI in the UAE through its partnership with Khazna Data Centers, supporting the nation's AI strategy while achieving significant energy efficiency improvements and supporting UAE green data center market growth.

Integration of Renewable Energy Infrastructure

Data center operators are increasingly incorporating renewable energy sources to meet sustainability targets and reduce operational costs. The UAE's abundant solar resources and government commitment to clean energy are accelerating this transition. In November 2024, Microsoft signed a strategic agreement with ADNOC and Masdar to integrate renewable energy into its UAE cloud and data center operations, demonstrating the convergence of technology investment and sustainability commitment that characterizes the market's evolution toward carbon-neutral operations.

Rise of AI-Optimized Data Center Infrastructure

The proliferation of artificial intelligence applications is driving purpose-built data center developments designed specifically for AI workloads. These facilities feature enhanced power density, specialized cooling systems, and GPU-optimized architectures. Khazna Data Centers is developing a 100-megawatt AI-optimized facility in Ajman, representing the MENA region's first data center specifically designed to meet AI computing requirements with high-performance liquid cooling and scalable infrastructure.

Market Outlook 2026-2034:

The UAE green data center market is positioned for transformative growth, supported by unprecedented infrastructure investments and sovereign digital initiatives. Market revenue is expected to expand substantially as hyperscale operators deploy additional capacity and regional providers enhance sustainable infrastructure offerings. Continued integration of renewable energy, advancement in cooling technologies, and expansion across emerging emirates will drive sustained revenue growth and market maturation. The market generated a revenue of USD 624.86 Million in 2025 and is projected to reach a revenue of USD 2,996.40 Million by 2034, growing at a compound annual growth rate of 19.03% from 2026-2034.

UAE Green Data Center Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solutions | 65.04% |

| Data Center Type | Enterprise Data Centers | 41.06% |

| Industry Vertical | Telecom and IT | 32.5% |

Component Insights:

- Solutions

- Power Systems

- Servers

- Monitoring and Management Systems

- Networking Systems

- Cooling Systems

- Others

- Services

- System Integration Services

- Maintenance and Support Services

- Training and Consulting Services

Solutions lead with 65.04% share in the UAE green data center market in 2025.

The solutions segment encompasses comprehensive infrastructure components essential for sustainable data center operations, including advanced power systems with uninterruptible power supplies and energy-efficient generators, high-performance servers optimized for AI and cloud workloads, intelligent monitoring and management systems enabling real-time energy optimization, robust networking infrastructure supporting high-bandwidth connectivity, and sophisticated cooling systems ranging from traditional CRAC units to cutting-edge liquid immersion technologies. The dominance of solutions reflects the capital-intensive nature of green data center development, where infrastructure investments form the foundation for sustainable operations.

Data Center Type Insights:

- Colocation Data Centers

- Managed Service Data Centers

- Cloud Service Data Centers

- Enterprise Data Centers

Enterprise data centers dominate with 41.06% share in the UAE green data center market in 2025.

Enterprise data centers serve organizations requiring dedicated, privately-operated infrastructure to meet specific security, compliance, and operational requirements. Government entities, financial institutions, and large corporations in the UAE increasingly invest in enterprise facilities to maintain data sovereignty, ensure regulatory compliance, and support mission-critical applications with guaranteed performance and availability levels.

The segment's leadership position reflects stringent data localization requirements imposed by the Central Bank of the UAE and the Telecommunications and Digital Government Regulatory Authority. Major government initiatives and the establishment of dedicated innovation zones for digital infrastructure further reinforce demand for enterprise-grade sustainable facilities.

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Healthcare

- BFSI

- Government

- Telecom and IT

- Others

Telecom and IT holds 32.5% share in the UAE green data center market in 2025.

The telecom and IT sector's leadership reflects the UAE's strategic positioning as the Gulf's digital gateway and connectivity hub. Major telecommunications operators have deployed extensive 5G networks across the country, driving substantial demand for supporting data center infrastructure. Cloud service providers, technology companies, and digital platform operators require scalable, energy-efficient facilities to serve regional and international markets.

The sector's dominance is reinforced by global technology leaders establishing significant regional presence. The ongoing digital transformation across industries, proliferation of IoT applications, and growth of AI-powered services continue expanding demand from this vertical.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai maintains its position as the leading data center hub, hosting the highest concentration of colocation facilities and carrier hotels in the UAE. The emirate's first-mover advantages in digital infrastructure, strategic proximity to submarine cable landing points, pro-business regulatory frameworks, and green building mandates continue attracting multinational technology companies and hyperscale operators.

Abu Dhabi is emerging as the fastest-growing region, driven by landmark sovereign digital initiatives and substantial government-backed investments in AI infrastructure. Strategic programs supported by sovereign wealth funds are positioning the emirate as the region's artificial intelligence capital, with significant capacity additions planned across dedicated technology zones and innovation districts.

Sharjah is gaining momentum as data center development expands beyond traditional hubs, supported by competitive land availability and favorable infrastructure costs. The emirate offers strategic advantages for operators seeking expansion opportunities outside congested metropolitan areas while maintaining connectivity to major business centers and benefiting from the UAE's unified regulatory environment.

Market Dynamics:

Growth Drivers:

Why is the UAE Green Data Center Market Growing?

Strategic Government Digital Transformation Initiatives

The UAE Government's comprehensive digital transformation agenda is creating unprecedented demand for sustainable data infrastructure. The UAE Digital Government Strategy mandates transitioning government services onto digital channels while maintaining strict data residency requirements within national borders. Smart Dubai's cloud-first directive requires sovereign cloud footprints that meet stringent compliance standards, directly driving investment in domestic green data center facilities. These regulatory frameworks establish long-term demand visibility for sustainable infrastructure providers.

The establishment of dedicated innovation zones and technology free zones further accelerates market development. Dubai Silicon Oasis and similar initiatives provide favorable regulatory environments for data center operators while supporting the nation's broader economic diversification objectives. Government entities themselves represent significant anchor tenants, with public sector digital transformation projects requiring substantial computing capacity.

Hyperscale Cloud Provider Expansion and Investment

Global technology leaders are making substantial investments in UAE data center infrastructure, recognizing the country's strategic importance as a regional digital hub. These commitments support the deployment of advanced AI and cloud infrastructure while establishing long-term operational presence across the emirates. Major partnerships between international technology corporations and regional operators represent transformational investments that position the UAE to host world-leading AI infrastructure projects. Such investments create multiplier effects across the supply chain, driving demand for supporting infrastructure, skilled workforce development, and ancillary services. The sustained flow of hyperscale capital is establishing the UAE as a critical node in global digital infrastructure networks.

Commitment to Net-Zero Emissions and Renewable Energy Integration

The UAE's ambitious sustainability agenda is fundamentally reshaping data center development toward green infrastructure. The UAE Energy Strategy 2050 targets 44% clean energy contribution to the national power mix, while the Net Zero 2050 initiative commits the nation to carbon neutrality. The UAE announced a strategy to invest USD 54 Billion in renewables by 2030, creating favorable conditions for sustainable data center development with access to competitively priced clean energy. Data center operators are increasingly integrating renewable energy directly into their operations. Such innovations enable data centers to achieve operational sustainability while maintaining reliability requirements.

Market Restraints:

What Challenges the UAE Green Data Center Market is Facing?

High Initial Capital Expenditure for Sustainable Infrastructure

The deployment of green data center infrastructure requires substantial upfront investment in advanced technologies including liquid cooling systems, renewable energy integration, and energy-efficient equipment. These capital requirements can present barriers for smaller operators and may extend project development timelines as financing arrangements are secured.

Desert Climate Challenges and Specialized Cooling Requirements

The UAE's extreme summer temperatures, which can exceed 45°C, create significant challenges for data center cooling systems. Traditional evaporative cooling approaches face constraints due to water scarcity regulations, requiring operators to invest in alternative technologies such as closed-loop chillers and liquid immersion systems that increase both capital and operational complexity.

Grid Infrastructure and Power Availability Constraints

The rapid expansion of data center capacity is placing substantial demands on electrical grid infrastructure. Securing adequate power allocations for new facilities, particularly in established areas with limited spare capacity, can present challenges. The intermittency of renewable energy sources requires backup generation and storage solutions that add complexity to achieving fully sustainable operations.

Competitive Landscape:

The UAE green data center market exhibits moderate competitive intensity characterized by a mix of established regional operators and global technology leaders. Regional data center providers maintain market leadership through aggressive capacity expansion strategies and strategic positioning across key emirates. Global operators maintain significant presence alongside telecommunications providers that leverage existing network infrastructure advantages. Competition centers on capacity expansion, sustainability credentials, connectivity offerings, and strategic partnerships with hyperscale cloud providers. Market players are investing in cutting-edge technologies including advanced cooling systems and renewable energy integration to differentiate their offerings. New entrants are positioning to capture wholesale and hyperscale demand, intensifying competition and driving innovation across the sector.

UAE Green Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers |

| Industry Verticals Covered | Healthcare, BFSI, Government, Telecom and IT, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE green data center market size was valued at USD 624.86 Million in 2025.

The UAE green data center market is expected to grow at a compound annual growth rate of 19.03% from 2026-2034 to reach USD 2,996.40 Million by 2034.

Solutions, holding the largest revenue share of 65.04%, leads the UAE green data center market. This segment encompasses comprehensive infrastructure including power systems, cooling technologies, servers, and monitoring systems essential for sustainable data center operations.

Key factors driving the UAE green data center market include strategic government digital transformation initiatives, hyperscale cloud provider investments, commitment to Net Zero 2050 sustainability goals, growing AI and cloud computing adoption, and favorable regulatory frameworks supporting data localization.

Major challenges include high initial capital expenditure for sustainable infrastructure, desert climate requiring specialized cooling solutions, grid infrastructure constraints, water scarcity impacting traditional cooling approaches, and the complexity of achieving fully renewable-powered operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)