UAE Health and Fitness Club Market Size, Share, Trends and Forecast by Facility, Trainer Type, Membership Type, Gender, and Region, 2025-2033

UAE Health and Fitness Club Market Overview:

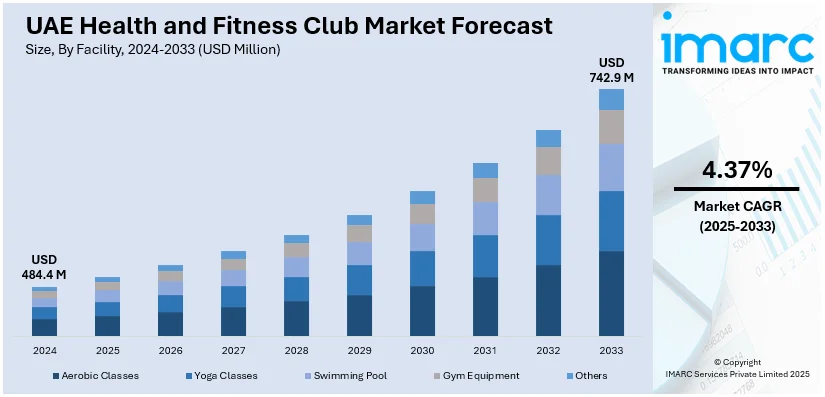

The UAE health and fitness club market size reached USD 484.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 742.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. Rising health consciousness, a young and fitness-aware population, and government-led fitness campaigns are propelling the market growth. Increasing lifestyle diseases, urbanization, and higher disposable incomes are encouraging residents to invest in structured wellness activities. The influx of expatriates, expansion of real estate with built-in gyms, and growth of wellness tourism are creating new business opportunities. Apart from this, social media influence, fitness tech adoption, growing female participation, and demand for personalized training services are accelerating UAE health and fitness club market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 484.4 Million |

| Market Forecast in 2033 | USD 742.9 Million |

| Market Growth Rate 2025-2033 | 4.37% |

UAE Health and Fitness Club Market Trends:

Rising Health Awareness Due to Lifestyle-Related Diseases

The rising incidence of lifestyle diseases like obesity, diabetes, and hypertension is making more people in the UAE pay closer attention to their health. According to the sources, in December 2024, the UAE demonstrates minimal progress on diet-related NCD targets, where 44.2% of adult women and 30.9% of adult men are obese, and diabetes impacts 17.4% of women, 17.3% of men. Moreover the majority of residents are now realizing the long-term consequences of physical inactivity and poor diets, and this has initiated a shift towards prevention. Gyms and fitness clubs are becoming the go-to destination for those who wish to get into shape or stay fit. This is not just limited to the older generation; even the younger population is now paying greater attention to the amount of physical activity in their lives. As there are more health campaigns and social conversations about the risks associated with ignoring physical fitness, people are turning to professional fitness services for help. Health clubs are returning with customized plans, easier sign-ups, and timings that suit their convenience, which is further driving the UAE health and fitness club market growth.

To get more information on this market, Request Sample

Young and Fitness-Conscious Population Driving Demand

The UAE has a growing youth consumer base, especially in the major cities of Dubai and Abu Dhabi. They are extremely health-conscious and look for ways to be actively fit. This group is also more likely to view gym membership as part of their lifestyle and not an occasional activity. Fitness is typically linked to status, and being seen as fit is regarded as a desirable trait. Younger professionals are generally in the market for gyms that have cutting-edge equipment, group classes, and personal trainers. High-intensity training, cross-training, and boutique studios are being spurred by this demographic. Social media is also at work, as younger members will share fitness success or gym selfies and urge others to do the same, which is further propelling the market growth.

Government Support and Public Fitness Campaigns

Government initiatives have played a key role in shaping the fitness culture of the UAE. Initiatives like the Dubai Fitness Challenge have attracted thousands of people and put fitness in the mainstream. These campaigns are usually a blend of social media promotions, street workouts, and local gym participation, and as such, they make it easy for people to take the first step. The government also invests in public amenities like parks, running tracks, and cycle lanes to encourage exercise. Public support of this kind instills a culture in which physical fitness is not just encouraged but also anticipated. Schools and workplaces are catching up, most of the time having their own fitness schemes or affiliating with local clubs. These efforts are changing the mindset from reactive care to preventive health, further boosting the market growth.

UAE Health and Fitness Club Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on facility, trainer type, membership type, and gender.

Facility Insights:

- Aerobic Classes

- Yoga Classes

- Swimming Pool

- Gym Equipment

- Free Weight

- Cardiovascular Equipment

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the facility. This includes aerobic classes, yoga classes, swimming pool, gym equipment (free weight, cardiovascular equipment, others), and others.

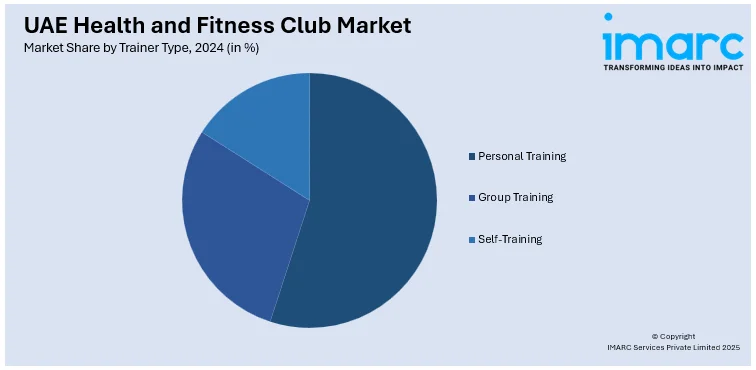

Trainer Type Insights:

- Personal Training

- Group Training

- Self-Training

A detailed breakup and analysis of the market based on the trainer type have also been provided in the report. This includes personal training, group training, and self-training.

Membership Type Insights:

- Monthly

- Annually

The report has provided a detailed breakup and analysis of the market based on the membership type. This includes monthly and annually.

Gender Insights:

- Men

- Women

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes men and women.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Health and Fitness Club Market News:

- In March 2025, Lift Brands took back control of the Snap Fitness master franchise in the UAE. The company plans to refurbish existing clubs and expand its presence, aiming to capitalize on the projected growth of the UAE fitness market to over USD 5 billion by 2030.

- In December 2024, GymNation invested approximately USD 19 million (AED 70 million) to acquire and expand its Motor City facility, which included taking over a Fitness First branch. This move supports GymNation’s strategy to strengthen its footprint and reinforce its position as the largest gym chain in the UAE.

- In December 2024, Arada acquired FitnGlam, The Platform Studios, and FITCODE, integrating them into its Wellfit division. This move expanded Arada's fitness portfolio to 15 gyms, with 11 more planned, positioning it as a leading operator in the UAE's fitness sector.

UAE Health and Fitness Club Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Facilities Covered |

|

| Trainer Types Covered | Personal Training, Group Training, Self-Training |

| Membership Types Covered | Monthly, Annually |

| Genders Covered | Men, Women |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE health and fitness club market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE health and fitness club market on the basis of facility?

- What is the breakup of the UAE health and fitness club market on the basis of trainer type?

- What is the breakup of the UAE health and fitness club market on the basis of membership type?

- What is the breakup of the UAE health and fitness club market on the basis of gender?

- What is the breakup of the UAE health and fitness club market on the basis of region?

- What are the various stages in the value chain of the UAE health and fitness club market?

- What are the key driving factors and challenges in the UAE health and fitness club market?

- What is the structure of the UAE health and fitness club market and who are the key players?

- What is the degree of competition in the UAE health and fitness club market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE health and fitness club market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE health and fitness club market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE health and fitness club industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)