UAE Household Appliances Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

UAE Household Appliances Market Summary:

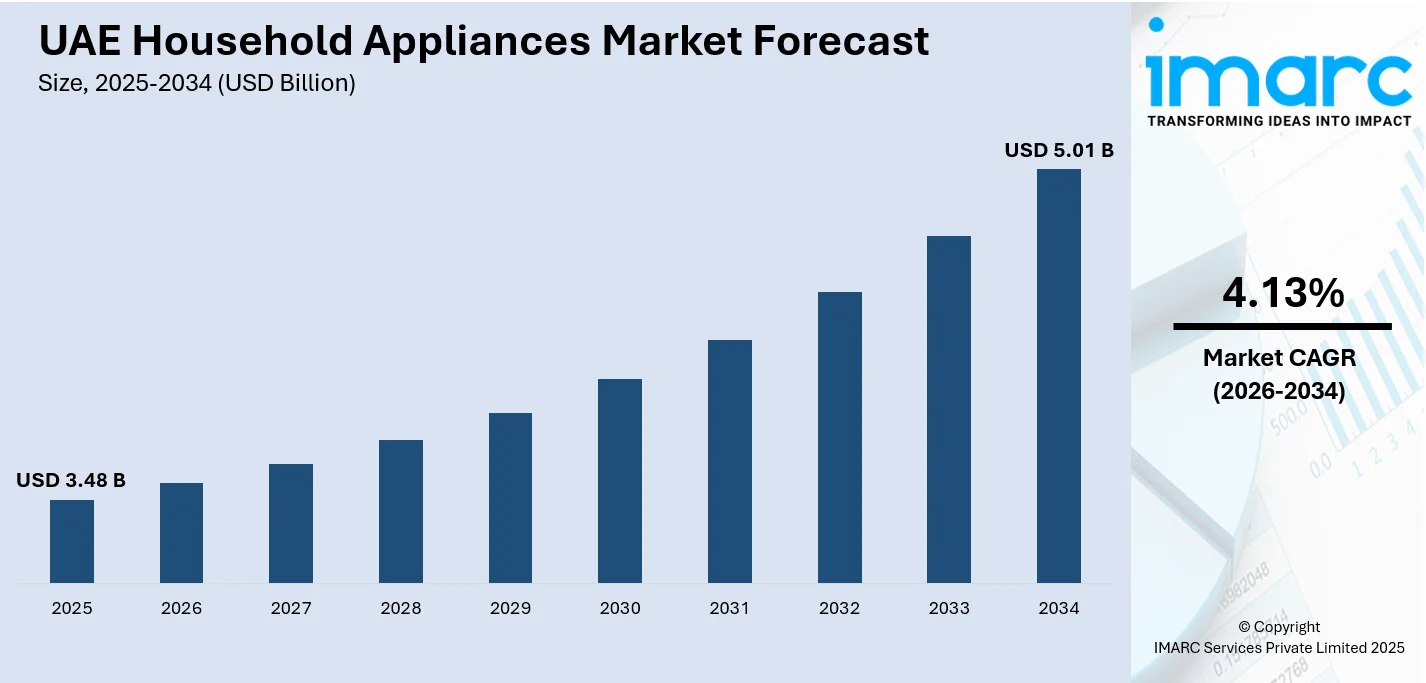

The UAE household appliances market size was valued at USD 3.48 Billion in 2025 and is projected to reach USD 5.01 Billion by 2034, growing at a compound annual growth rate of 4.13% from 2026-2034.

Demand surges from rapid urbanization transforming Emirates into dense residential zones requiring complete appliance suites, while government sustainability mandates accelerate replacement of legacy units with ESMA-certified energy-efficient models. Expatriate household formation drives bulk purchases across refrigerators, air conditioners, and washing machines, as tech-savvy consumers increasingly adopt internet of things (IoT)-enabled smart appliances offering remote control and predictive maintenance capabilities through platforms, thereby expanding the UAE household appliances market share.

Key Takeaways and Insights:

-

By Product: Air conditioner and heater dominate with a share of 22% in 2025, driven by desert climate necessitating year-round cooling and ESMA mandatory energy performance standards.

-

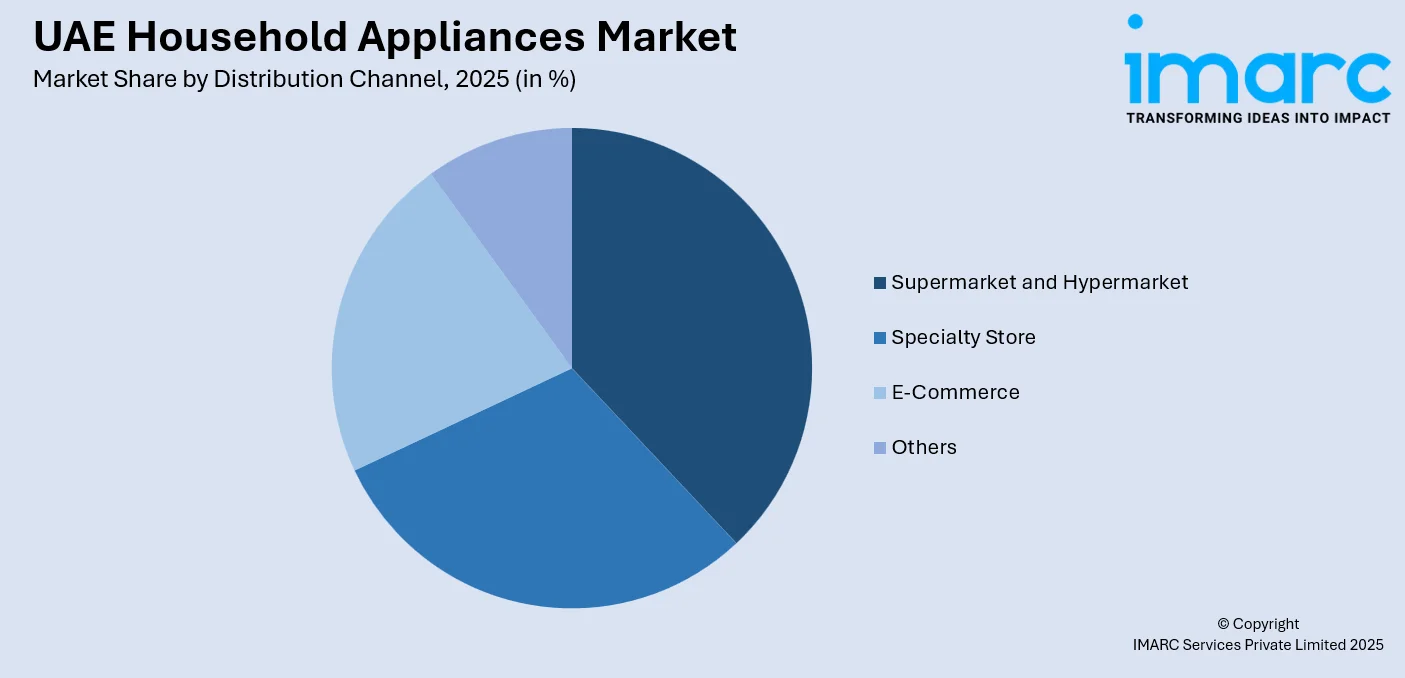

By Distribution Channel: Supermarket and hypermarket lead with a share of 38% in 2025, attributed to immediate product availability, personalized assistance, and extensive post-sale services.

-

By Region: Dubai represents the largest segment with a market share of 38% in 2025, fueled by expatriate concentration, continuous off-plan property launches, and heightened residential price growth in 2025.

-

Key Players: Key players in the UAE household appliances market are focusing on innovation, energy efficiency, expanding retail presence, leveraging e-commerce, and targeting premium segments to meet the growing demand for smart products.

To get more information on this market Request Sample

UAE household appliances demand is rising as residents trade up for smarter, more efficient products. Consumers want appliances that save energy and connect with other devices, pushing brands to update product lines faster. Retailers and manufacturers are strengthening both physical showrooms and online channels so customers can explore options in malls or click to buy with fast delivery. Competition is strong between global names and regional sellers, so pricing, warranties, and after‑sales service matter more than ever. In 2025, Hisense, a worldwide leader in smart technology and home appliances, is presenting its newest innovations at the Middle East Consumer Electronics Show (MECES) 2025, occurring from 26–28 November at the Festival Arena in Dubai Festival City. This year, Hisense unveils an engaging smart home exhibit with specialized experience areas such as a cinema space displaying the newest Laser TV technology, a Gaming Zone designed for top-tier screens, a contemporary smart kitchen showcase, and an artistic Canvas TV section aimed at design-oriented customers. At the heart of the exhibit, guests can explore the globe's largest 116-inch RGB Mini LED TV, a revolutionary advancement in next-gen display technology demonstrating Hisense's dedication to AI-driven connected lifestyles.

UAE Household Appliances Market Trends:

Smart Home Integration Acceleration

Connected refrigerators, washing machines, and air conditioners gain substantial traction as consumers demand remote monitoring, automated energy optimization, and predictive maintenance through smartphone applications. IoT connectivity enables seamless communication between devices, allowing unified control through integrated platforms that transform traditional homes into responsive living environments. Advanced AI algorithms embedded in premium appliances learn user preferences, automatically adjusting temperature settings, wash cycles, and energy consumption patterns to maximize efficiency while minimizing operational costs. In 2024, Yango Group, a technology firm that converts global innovations into daily services, announced the launch and immediate availability of the Yasmina Midi and Yasmina Mini smart speakers. The speakers include a bilingual, human-like AI helper designed specifically for the Middle East. Yasmina speakers are for sale throughout the UAE, providing a distinctive experience with an assistant capable of holding lively and enjoyable conversations in both Khaleeji Arabic and English, resembling a chat with a real individual.

E-Commerce Distribution Expansion

Digital retail channels extend product assortment depth beyond flagship malls through sophisticated omnichannel strategies featuring same-day delivery, augmented reality product visualization, and bundled installation services that replicate in-store experiences. National broadband coverage exceeding 98% smartphone penetration, secure payment infrastructure, and efficient last-mile logistics convert occasional online buyers into habitual shoppers of large appliances including refrigerators, washing machines, and air conditioners. E-commerce giants alongside regional platforms integrate web-based checkout with physical store consultation and deferred-payment plans through buy-now-pay-later schemes, ensuring service assurance traditionally found only in brick-and-mortar retail. IMARC Group predicts that the UAE e-commerce market is projected to attain USD 776.2 Billion by 2033.

Energy Efficiency Mandate Adoption

Stricter ESMA efficiency labels combined with UAE's ambitious Net-Zero 2050 agenda accelerate systematic replacement of older, power-hungry appliances with five-tick refrigerators and inverter air conditioners offering 30 to 40% superior energy savings compared to legacy models. Government clean-energy mandates require all new installations to meet minimum performance standards, driving pronounced consumer preference for premium models featuring advanced insulation materials, variable-speed compressors, and smart sensors that automatically enhance energy efficiency according to usage trends and environmental factors. Property developers face mounting compliance pressure from Dubai's Green Building Regulations, compelling installation of high-efficiency HVAC systems and ESMA-certified appliances that reduce electricity bills while shortening replacement cycles across residential and commercial buildings. The UAE has achieved notable advancements in enhancing its renewable energy portfolio, attaining a 27.83 percent contribution from clean energy in 2023, aiming for 32 percent by 2030, as stated by Suhail bin Mohammed Al Mazrouei, Minister of Energy and Infrastructure. Al Mazrouei disclosed to local media during the 'World Utilities Conference 2024', set for September 16-18 in Abu Dhabi, that the UAE increased its renewable energy capacity twofold from 2019 to 2022, in line with the UAE Energy Strategy 2050.

Market Outlook 2026-2034:

Forward momentum stems from expanded real estate development with 60% of Dubai transactions comprising off-plan sales that bundle complete appliance packages, while tech-savvy expatriate influx sustains demand for premium smart appliances offering app-based controls and energy monitoring. The market generated a revenue of USD 3.48 Billion in 2025 and is projected to reach a revenue of USD 5.01 Billion by 2034, growing at a compound annual growth rate of 4.13% from 2026-2034. Government economic diversification successes stabilize employment, encouraging postponed upgrades to energy-saving refrigerators, advanced washers, and smart cooking ranges.

UAE Household Appliances Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Air Conditioner and Heater |

22% |

|

Distribution Channel |

Supermarket and Hypermarket |

38% |

|

Region |

Dubai |

38% |

Product Insights:

- Refrigerator

- Air Conditioner and Heater

- Entertainment and Information Appliances

- Washing Machine

- Dish Washer

- Wall Oven

- Microwave

- Cooking Appliances

- Coffee Machine

- Blender

- Juicer

- Canister

- Deep Cleaners

- Steam Mop

- Others

Air Conditioner and heater dominate with a market share of 22% of the total UAE household appliances market in 2025.

Air conditioners and heating systems dominate the UAE household appliances landscape due to the desert climate's extreme temperatures that make cooling essential year-round. Dubai's Green Building Regulations drive rapid upgrades to Emirates Authority for Standardisation and Metrology five-tick rated inverter air conditioners, reducing energy bills and shortening replacement cycles as consumers seek compliance with government sustainability targets. The segment benefits from technological advancements including smart thermostats that learn household routines, while Barakah Nuclear Energy Plant's capacity to supply one-quarter of national electricity boosts grid stability and enables adoption of high-performance cooling systems at scale.

Premium brands are introducing AI-driven climate control that adjusts temperature based on occupancy and weather forecasts, appealing to affluent households and commercial enterprises concentrated in Dubai and Abu Dhabi. Corporate business-to-business tender sales complement retail demand, as large residential projects and hotels specify five-tick equipment packages for green building certification, reinforcing the segment's structural advantages within the market. Dubai's Green Building Regulations mandate high-efficiency HVAC installations in new construction projects, accelerating market penetration of premium models with advanced features like self-cleaning filters, dehumidification modes, and remote diagnostic capabilities that reduce maintenance costs and extend equipment lifespan beyond conventional seven-year replacement cycles.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarket and Hypermarket

- Specialty Store

- E-Commerce

- Others

Supermarket and hypermarket lead with a share of 38% of the total UAE household appliances market in 2025.

Supermarkets and hypermarkets maintain market leadership through extensive product variety, trusted brand presence, and immediate availability that resonates with consumers seeking reliability before significant purchases. These large-format retailers offer hands-on product examination, personalized assistance from trained staff, and comprehensive post-sale services including installation and extended warranties. Competitive pricing strategies, frequent promotional campaigns, and well-established locations across urban and suburban areas throughout Dubai, Abu Dhabi, and Sharjah further cement their dominance despite rising e-commerce adoption.

Major chains like Carrefour and Lulu Hypermarket leverage physical footprints to showcase flagship appliances through live demonstrations and chef-led cooking sessions that elevate perceived value, while exclusive brand stores within these retail environments enable manufacturers to control merchandising and customer experience. The channel also captures walk-in traffic from families conducting weekly shopping, creating cross-selling opportunities that online platforms struggle to replicate, particularly for consumers preferring tactile evaluation of build quality and features before committing to high-ticket appliance investments.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai exhibits a clear dominance with a 38% share of the total UAE household appliances market in 2025.

Dubai remains the largest and most dynamic region in the UAE’s household appliances market, driven by a combination of its economic prosperity, high disposable income, and tech-forward consumer base. The city’s status as a global trade and tourism hub ensures that demand for modern, energy-efficient, and smart appliances continues to grow. With its rapidly expanding urban population, residents of both luxury apartments and middle-class homes are investing in high-end products, from smart refrigerators to energy-saving washing machines. This demand is also driven by the city’s evolving infrastructure, including smart cities and sustainable living initiatives, which push consumers toward more advanced appliances.

Dubai’s retail environment supports this trend, with large-scale shopping malls such as The Dubai Mall and Mall of the Emirates hosting flagship stores for major global appliance brands. These locations showcase the latest in smart technology and eco-friendly products, giving customers access to cutting-edge appliances. Moreover, the city’s increasing reliance on e-commerce platforms, including Amazon.ae and Noon, offers consumers convenience and competitive pricing, making it easier to buy appliances online. A prime example of Dubai’s market dominance is the rise of smart home technology in residential properties. With an increasing number of Dubai's luxury homes featuring integrated smart appliances, the city continues to set trends in the region's household appliances market.

Market Dynamics:

Growth Drivers:

Why is the UAE Household Appliances Market Growing?

Rising Disposable Income and Accelerating Urbanization

Increasing earnings across the UAE population are empowering people to invest in modern, energy-efficient, and premium household appliances that enhance comfort and convenience in daily living The GDP of the UAE is expected to increase by 5% annually, consumer expenditure is anticipated to grow by 4.3%, and consumer price inflation is forecasted to hit 2.3%. Rapid urbanization concentrates population in high-rise apartments across Dubai, Abu Dhabi, and Sharjah, creating sustained demand for space-optimized appliances with advanced functionality. Changing lifestyles marked by busy professional schedules and smaller nuclear families drive preference for time-saving automated solutions including robotic vacuum cleaners and smart washing machines, while improved financial capacity encourages innovation adoption and replacement of outdated models with technologically advanced alternatives that deliver enhanced performance and lower operating costs over extended lifecycles.

Government Sustainability Initiatives and Energy Efficiency Mandates

The UAE's commitment to achieving net-zero emissions by 2050 is accelerating consumer replacement of legacy appliances with high-efficiency models that comply with stricter regulatory standards. The Emirates Authority for Standardisation and Metrology has expanded mandatory energy labeling from air conditioners to encompass refrigerators and washing machines, with five-star rated products delivering significantly lower electricity consumption that reduces household utility bills. In 2024, UAE and US partners are achieving remarkable advancements to tackle the ecological effects of agriculture. Although food production is responsible for a third of global emissions, efforts to address climate issues in this vital sector frequently receive less attention. The Agriculture Innovation Mission for Climate (AIM4C), spearheaded by both nations, is altering this by implementing more sustainable methods for food production and consumption.

Expanding Expatriate Population and Robust Housing Development

Expatriates comprise a major portion of UAE residents, creating a structural demand base that purchases complete appliance suites when forming new households rather than waiting for individual unit failures. As of 2025, expats make up over 88% of the UAE’s population. That equals approximately 9.2 million foreign residents. This demographic pattern generates predictable recurring demand as international professionals relocate to the Emirates for employment opportunities in finance, technology, and energy sectors. The concentration of high-income households in Dubai and Abu Dhabi, where penetration rates for refrigerators, air conditioners, and fully automatic washers now exceed 90 percent in affluent districts, drives replacement cycles as consumers upgrade to smart connected models rather than basic functional equivalents, sustaining market momentum through premiumization trends.

Market Restraints:

What Challenges the UAE Household Appliances Market is Facing?

High Upfront Costs and Consumer Price Sensitivity

Despite economic recovery and rising disposable incomes, price sensitivity remains a significant barrier for lower and middle-income households hesitant to invest in premium or smart appliances due to elevated upfront costs. Moreover, potential buyers defer purchases when facing budget constraints, particularly impacting adoption of advanced features including Internet of Things (IoT) connectivity and artificial intelligence (AI) integration that command price premiums over conventional models. Inflation has emerged as a concern affecting purchasing power, leading consumers toward more affordable value-driven alternatives rather than flagship products. Value-added tax and import duties on fully assembled appliances raise landed costs, especially for budget models, while premium brands extend appliance lifespans to twelve to fourteen years, stretching beyond the seven to ten year replacement benchmark and reducing near-term upgrade frequency among existing owners.

Supply Chain Disruptions and Rising Raw Material Costs

Global supply chain disruptions continue affecting product availability and pricing structures across the household appliance sector in the UAE. Manufacturing slowdowns stemming from factory closures, transportation bottlenecks, and shipping delays create inventory challenges for distributors attempting to meet consumer demand during peak purchasing periods. Rising costs of raw materials and components, driven by inflation and international trade complexities, directly increase manufacturing expenses that manufacturers pass through to end consumers via higher retail prices.

Market Saturation and Intense Competitive Pressure

The UAE household appliances market exhibits high saturation with numerous established international brands competing for consumer attention alongside aggressive Chinese manufacturers seeking Gulf footholds. Penetration rates exceeding 90 percent for core appliances like refrigerators, air conditioners, and washing machines in affluent Dubai and Abu Dhabi districts signal limited growth potential from first-time purchases, shifting competitive dynamics toward replacement cycles and premiumization strategies. Continuous innovation requirements to differentiate products amid intense rivalry demand substantial research and development investments that strain smaller players lacking scale economies. Global giants are sharpening technology differentiation through proprietary smart home platforms, while local and regional assemblers respond by situating production closer to demand through joint ventures, creating additional competitive pressure that compresses margins and necessitates aggressive promotional spending to maintain market share.

Competitive Landscape:

The UAE household appliances market demonstrates moderate competitive intensity characterized by global multinational manufacturers competing alongside regional distributors and specialty retailers. Leading international brands dominate major appliance categories through extensive distribution networks and substantial marketing investments. These players leverage brand equity, technological innovation, and comprehensive after-sales service infrastructure to capture premium segments while defending market share against aggressive pricing from Chinese competitors. Regional distributors operate physical store networks complemented by robust e-commerce platforms, creating omnichannel customer experiences. Competition extends beyond product features to encompass installation services, extended warranties, and flexible financing options including buy-now-pay-later schemes that lower entry barriers for price-sensitive buyers.

Recent Developments:

-

In November 2025, Samsung Gulf Electronics has unveiled the world's first Micro RGB TV in the UAE, establishing a new standard for high-end home entertainment. Integrating advanced Micro RGB technology, cinematic AI processing, and high-end design, the latest flagship TV transforms the way individuals watch, play, and engage in their homes, showcasing Samsung’s dedication to innovation and staying at the forefront of intelligent, connected experiences.

-

In April 2025, LG Electronics (LG) has officially introduced the LG MoodUP™ refrigerator in the Middle East, delivering a striking and customizable appliance to residences throughout the UAE. The launch marks the beginning of a new age in contemporary kitchen design, merging intelligent technology with customized aesthetics. With an increasing number of UAE homeowners seeking home solutions that align with their lifestyle, LG’s MoodUP™ refrigerator provides a distinctive degree of personalization. This product reflects LG’s emphasis on user-centered innovation and enhances its dominance in merging intelligent appliances with visual appeal.

UAE Household Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Refrigerator, Air Conditioner and Heater, Entertainment and Information Appliances, Washing Machine, Dish Washer, Wall Oven, Microwave, Cooking Appliances, Coffee Machine, Blender, Juicer, Canister, Deep Cleaners, Steam Mop, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Specialty Store, E-Commerce, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE household appliances market size was valued at USD 3.48 Billion in 2025.

The UAE household appliances market is expected to grow at a compound annual growth rate of 4.13% from 2026-2034 to reach USD 5.01 Billion by 2034.

Air conditioner and heater dominated the product segment with 22% market share in 2025, driven by the desert climate's essential cooling requirements and government green building regulations mandating energy-efficient systems that reduce utility costs while supporting the Emirates' sustainability targets.

Key factors driving the UAE household appliances market include rising disposable incomes enabling premium appliance purchases, government sustainability initiatives including Net Zero 2050 targets and stricter Emirates Authority for Standardization and Metrology efficiency labels, expanding expatriate population creating structural demand for complete appliance suites, and accelerating smart home adoption supported by nationwide 5G deployment and IoT integration.

Major challenges include high upfront costs and price sensitivity constraining adoption of premium smart appliances among middle-income households, supply chain disruptions and rising raw material costs affecting product availability and pricing, market saturation with penetration rates for core appliances in affluent districts limiting first-purchase growth, and intense competitive pressure from global brands and aggressive Chinese manufacturers compressing margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)