UAE In-Vitro Diagnostics Devices Market Size, Share, Trends and Forecast by Application and End-User, 2025-2033

UAE In-Vitro Diagnostics Devices Market Size and Share:

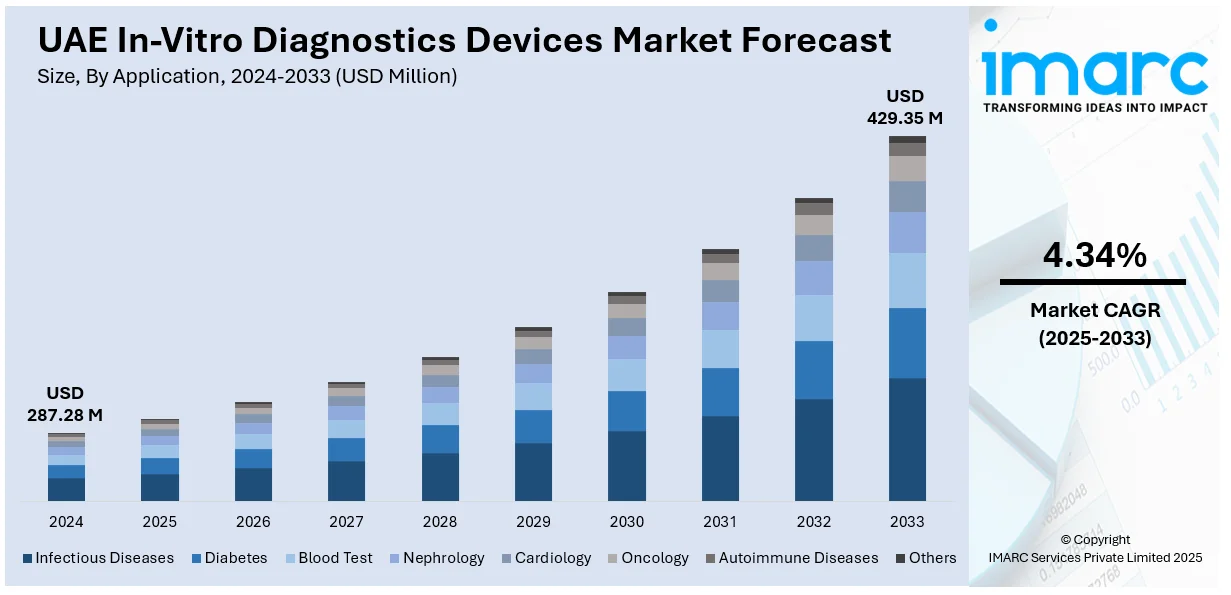

The UAE in-vitro diagnostics (IVD) devices market generated a revenue of USD 287.28 Million in 2024 and is expected to reach USD 429.35 Million by 2033. A compound annual growth rate (CAGR) of 4.34% is expected of the UAE in vitro diagnostics (ivd) market from 2025-2033. The market is fueled by rising prevalence of infectious and chronic diseases, advanced healthcare infrastructure, government initiatives, growing medical tourism, technological advancements in diagnostics, increased awareness, and the demand for rapid and automated testing solutions, enhancing early disease detection and patient care.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 287.28 Million |

|

Market Forecast in 2033

|

USD 429.35 Million |

| Market Growth Rate 2025-2033 | 4.34% |

The growing incidence of infectious diseases such as tuberculosis, hepatitis, and respiratory infections, along with chronic conditions like diabetes, cardiovascular diseases, and cancer, is a major driver of the UAE’s IVD market. According to industry report, in the United Arab Emirates, patients under 40 years of age accounted for 25.4% of all cancer cases diagnosed; this percentage was comparable for both men and women, as well as for Emirati and non-Emirati patients. The high burden of these diseases has increased demand for early diagnosis, routine screenings, and monitoring solutions, driving the adoption of advanced IVD technologies. Moreover, as a global medical tourism hub, the UAE attracts international patients seeking high-quality diagnostics and treatments. The expansion of hospitals, diagnostic laboratories, and specialized testing centers ensures increased adoption of advanced IVD solutions, reinforcing UAE in-vitro diagnostics devices market growth.

Innovations in molecular diagnostics, automation, artificial intelligence (AI), and point-of-care testing have significantly improved the efficiency and accuracy of diagnostics. The rise of PCR, immunoassays, next-generation sequencing (NGS), and AI-driven diagnostic tools has enhanced disease detection, enabling personalized and precision medicine. Additionally, the demand for rapid, home-based, and minimally invasive tests is rising, contributing to market expansion. For instance, in May 2024, a brand-new facility that provides immune profile testing and sophisticated molecular diagnostics has launched in the United Arab Emirates. The project was put into service by Burjeel Holdings, who teamed up with OncoHelix, a Canadian company, to handle the operational and technical facets.

UAE In-Vitro Diagnostics Devices Market Trends:

Rising Prevalence of Infectious and Chronic Diseases

The increasing incidence of infectious diseases like tuberculosis, hepatitis, and COVID-19, along with chronic conditions such as diabetes and cardiovascular diseases, is a major driver of the UAE in-vitro diagnostics (IVD) market. According to the Dubai Health Authority (DHA), almost 30% of people in the United Arab Emirates are either diabetic or pre-diabetic, making diabetes a very common global and regional health issue. According to a survey published by the International Diabetes Federation (IDF), 1.17 million people in the 20–79 age range may have diabetes by 2030. Early detection and disease management programs fuel demand for advanced diagnostic solutions. Government-led screening initiatives and public health awareness campaigns further drive the adoption of IVD devices. Furthermore, the growing senior population, which is more vulnerable to chronic diseases, demands regular diagnostic testing, which contributes to market expansion.

Technological Advancements in Diagnostics

Innovations in molecular diagnostics, automation, artificial intelligence (AI), and point-of-care testing represent the one of the major UAE in-vitro diagnostics devices market trends. AI-powered diagnostics enhance accuracy and efficiency, while automation improves lab throughput. For instance, in December 2024, The UAE's Technology Innovation Institute (TII) introduced a digital avatar driven by artificial intelligence (AI) that can decipher complicated multi-omics medical data, marking a revolutionary advancement in personalized healthcare. A major step toward precision medicine in the Middle East, this ground-breaking technology, which was demonstrated at Gitex Global 2024, delivers individualized health counsel by fusing TII's Falcon language model with genetic, epigenetic, and metabolic insights. Advanced PCR, immunoassay, and next-generation sequencing (NGS) technologies enable precise disease detection, driving adoption among healthcare providers. The growing demand for minimally invasive and home-based testing solutions, such as rapid antigen tests and wearable diagnostics, further accelerates market growth.

Growing Medical Tourism and Expanding Healthcare Facilities

The UAE is a global hub for medical tourism, attracting patients seeking high-quality healthcare services. According to industry reports, every year, more than 15,000 medical tourists visit Abu Dhabi to benefit from its medical facilities. The influx of international patients increases the demand for advanced diagnostics, as hospitals and laboratories invest in cutting-edge IVD technologies to maintain global standards. Additionally, the expansion of private hospitals, specialized diagnostic centers, and reference laboratories enhances accessibility to high-end diagnostic tests. This growing healthcare ecosystem supports the continuous growth of the UAE in-vitro diagnostics devices market. According to industry reports, Dubai has become one of the top healthcare destinations in the globe in recent years because of several elements that appeal to both patients and healthcare professionals. The Dubai Health Authority (DHA) revealed official figures for 2022, showing that the emirate has an astonishing 4,482 private medical facilities a 45% increase in just five years.

UAE In-Vitro Diagnostics Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE in-vitro diagnostics devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application and end-user.

Analysis by Application:

- Infectious Diseases

- Diabetes

- Blood Test

- Nephrology

- Cardiology

- Oncology

- Autoimmune Diseases

- Others

Infectious diseases hold the largest UAE in-vitro diagnostics devices market share because of several people getting infected with tuberculosis, hepatitis and respiratory infections which is driving the adoption of IVD devices. The demand for medical devices in the UAE is increasing due to government-funded early detection programs along with enhanced healthcare developments which coupled with increasing medical tourism volumes to create demand for complex diagnostic systems. The COVID-19 pandemic pushed investments rapidly toward both molecular diagnostic instruments and rapid screening systems. Market dominance results from an increasing number of diagnostic testing programs combined with growing public awareness, advanced PCR and immunoassay-based diagnostic technologies. Through its commitment to public health and strict disease control framework, the UAE has effectively strengthened the need for diagnostic devices to detect infectious diseases.

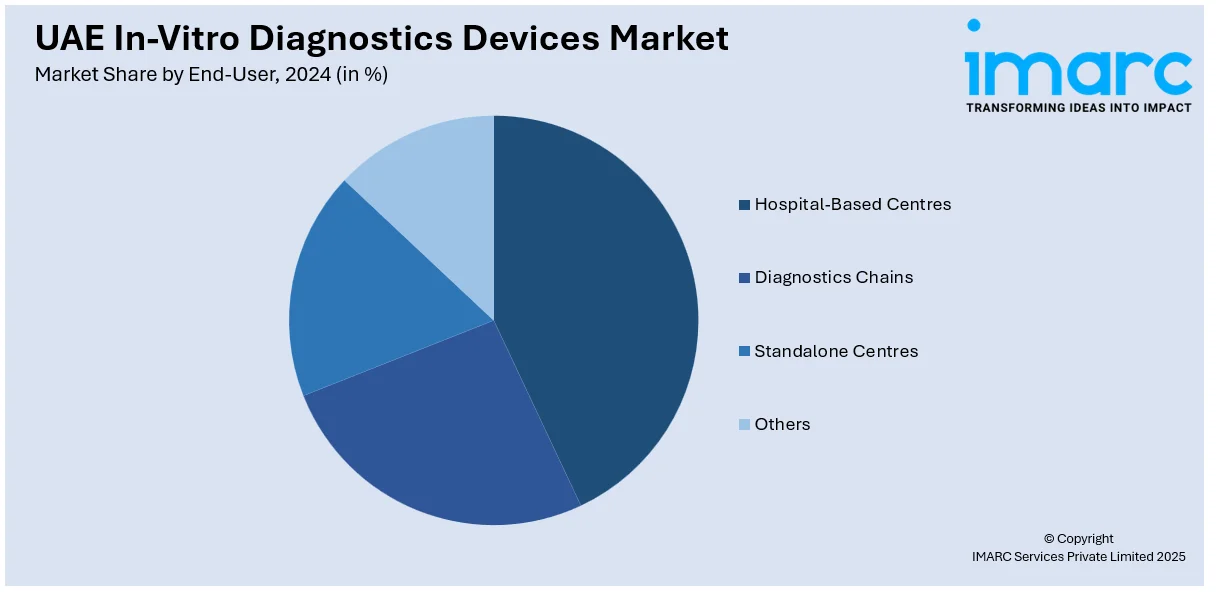

Analysis by End-User:

- Hospital-Based Centres

- Diagnostics Chains

- Standalone Centres

- Others

Hospital-based centers hold the largest share in the market as patients can easily access specialist diagnostic tests and benefit from advanced healthcare infrastructure through high patient traffic. These medical facilities operate advanced laboratory spaces which provide both accurate and effective disease diagnostic processes. Increased government healthcare investments along with expanding medical tourism activities and rising incidence of chronic and infectious diseases boost UAE in-vitro diagnostics devices market demand. Hospitals perform extensive screening procedures which target fundamental conditions including infectious diseases and cardiovascular diseases and diabetes. Additionally, the integration of advanced technologies, such as AI-driven diagnostics and automated lab equipment, enhances hospital-based diagnostics, making them the preferred choice for patients and healthcare providers.

Competitive Landscape:

The UAE in-vitro diagnostics devices market shows high competition where global and local players include Abbott, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific and BD (Becton, Dickinson and Company). Their leadership stems from diagnostic technology superiority combined with robust distribution infrastructure and perpetual advancement in molecular and point-of-care testing methods. Local healthcare providers and their community team up through partnerships supported by government health programs. Occupational safety is a driving factor in IVD market demand due to increasing requirements for infectious disease testing along with chronic disease monitoring and personalized medicine needs. Strategic alliances coupled with automation advancements and artificial intelligence adoption ensure fierce competition will continue to drive the United Arab Emirates' expanding IVD sector.

Latest News and Developments:

- In February 2024, Fapon, a prominent life sciences firm in the world, announced that it will be at Medlab Middle East 2024 in Dubai, UAE, from February 5 to February 8, where it intends to showcase its comprehensive one-stop IVD solutions and share the most recent industry insights with IVD specialists worldwide. To promote the expansion of the local IVD business and improve healthcare services locally while fortifying its worldwide diagnostics ecosystem, Fapon is committed to utilizing its state-of-the-art technology and extensive industry knowledge.

- In March 2023, The UAE-based AstraGene LLC and the Indian biotech company Mylab Discovery Solutions have partnered to create automated molecular diagnostics for the UAE and Kuwait. Co-developing molecular diagnostic solutions, such as reagents, kits, and fully automated equipment, will be a part of this collaboration.

UAE In-Vitro Diagnostics Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Infectious Diseases, Diabetes, Blood Test, Nephrology, Cardiology, Oncology, Autoimmune Diseases, Others |

| End-Users Covered | Hospital-Based Centres, Diagnostics Chains, Standalone Centres, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE in-vitro diagnostics devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE in-vitro diagnostics devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE in-vitro diagnostics devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-vitro diagnostics devices market in the UAE was valued at USD 287.28 Million in 2024.

The market is driven by rising prevalence of infectious and chronic diseases, technological advancements in molecular diagnostics and AI-driven testing, government initiatives supporting healthcare innovation, and expanding healthcare infrastructure with growing medical tourism, increasing demand for precision medicine, early disease detection, and high-quality diagnostic solutions. The factors, collectively, are creating a positive UAE in-vitro diagnostics devices market outlook, across the region.

The UAE in-vitro diagnostics devices market is projected to exhibit a CAGR of 4.34% during 2025-2033, reaching a value of USD 429.35 Million by 2033.

Infectious diseases dominate the UAE market due to high prevalence, government-led screening programs, advanced diagnostics, and rising healthcare investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)