UAE IoT (Internet of Things) Market Size, Share, Trends and Forecast by Component, Application, Vertical, and Region, 2025-2033

UAE IoT (Internet of Things) Market Overview:

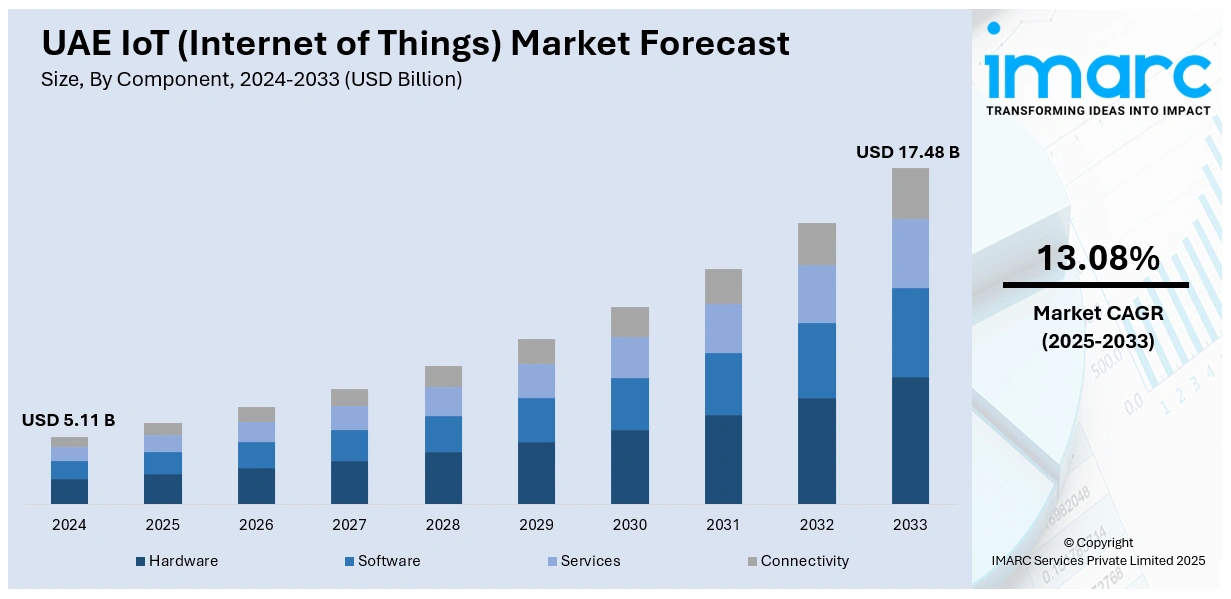

The UAE IoT (Internet of Things) market size reached USD 5.11 Billion in 2024. The market is projected to reach USD 17.48 Billion by 2033, exhibiting a growth rate (CAGR) of 13.08% during 2025-2033. The market is evolving across multiple dimensions components such as devices, integration platforms, and blockchain platforms are advancing alongside diverse applications spanning smart cities, healthcare, logistics, and energy. Each market segment from hardware to services continues to mature, supported by rapid digital transformation and infrastructure development. Within verticals like construction and 5G‑enabled systems, specialized offerings are gaining traction, while regional deployment reflects strategic national initiatives. The dynamics collectively position the UAE favorably in the UAE IoT (Internet of Things) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.11 Billion |

| Market Forecast in 2033 | USD 17.48 Billion |

| Market Growth Rate 2025-2033 | 13.08% |

UAE IoT (Internet of Things) Market Trends:

Expanding IoT Connectivity Infrastructure

The UAE continues to strengthen its IoT foundation by enhancing network coverage and readiness for nationwide deployments. Building on NB‑IoT and LTE‑M rollout, public infrastructure now supports expansive device connectivity across urban and suburban areas. A notable milestone occurred in February 2025, when the civil aviation authority began mapping air corridors for air taxis and cargo drones, signalling integration plans for connected aerial systems into broader IoT frameworks. This development underscores how physical and digital infrastructure are merging to facilitate next‑generation mobility and data exchanges. As low‑power networks grow more robust and aerial pathways become part of the ecosystem, IoT services can span from ground systems to airspace platforms with confidence in seamless connectivity. Such comprehensive infrastructure investments are vital in supporting broad device deployment, resilient communication, and the reliability required for mission‑critical applications. This trend illustrates how foundational capacity enhancements are fostering an enabling environment for UAE IoT (Internet of Things) market growth.

To get more information on this market, Request Sample

Smart Urban Governance and Real‑Time Services

The UAE is advancing its use of IoT to enable smart urban governance, making real-time responsiveness a standard across public systems. This includes the deployment of sensor-based platforms that monitor traffic, utilities, public safety, and environmental data in real time. The technology enables authorities to make informed decisions quickly, improving both operational efficiency and service quality. In April 2025, Dubai reached a significant milestone by activating over one thousand automated government services powered by IoT infrastructure. These services span various functions, including digital permits, smart waste collection, and intelligent utility management. The result is more streamlined interaction between citizens and the state, with reduced wait times and improved service transparency. Additionally, IoT applications are supporting sustainability by optimizing energy usage and water management in real time. As more functions become automated and data-driven, cities within the UAE are evolving into interconnected ecosystems. This transformation is a core component of UAE IoT (Internet of Things) market trends, as public sector innovation drives widespread digital integration.

Automotive and Mobility IoT Integration

Connected mobility is emerging as a significant IoT frontier in the UAE, where smart transport systems and connected vehicles are increasingly interwoven into broader urban networks. A key milestone took place in October 2024, when authorities signed agreements to pilot scalable IoT solutions tailored for smart city infrastructure, including mobility and geospatial tracking systems. The initiatives anticipate deploying sensor-driven frameworks for transport monitoring and operational efficiency in logistics and municipal services. By integrating IoT capabilities in mobility planning, the UAE is paving the way for real‑time monitoring, adaptive routing, and seamless system coordination. This approach not only enhances traffic and fleet operations but also primes the mobility ecosystem to become both a contributor to and beneficiary of wider IoT adoption across urban infrastructure. In this context, the smart mobility revolution exemplifies a critical pillar of UAE IoT (Internet of Things) market, where transport acts as a dynamic catalyst in the evolving ecosystem.

UAE IoT (Internet of Things) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and vertical.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity.

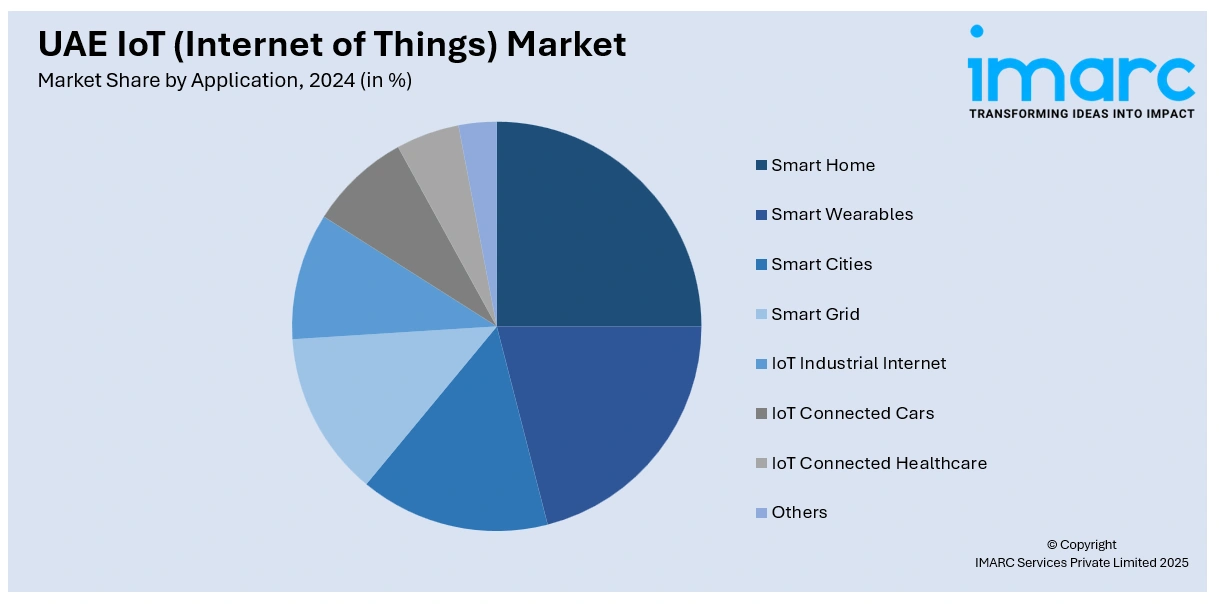

Application Insights:

- Smart Home

- Smart Wearables

- Smart Cities

- Smart Grid

- IoT Industrial Internet

- IoT Connected Cars

- IoT Connected Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart home, smart wearables, smart cities, smart grid, IoT industrial internet, IoT connected cars, IoT connected healthcare, and others.

Vertical Insights:

- Healthcare

- Energy

- Public and Services

- Transportation

- Retail

- Individuals

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes healthcare, energy, public and services, transportation, retail, individuals, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE IoT (Internet of Things) Market News:

- November 2024: Siemens has secured a significant agreement to equip numerous United Arab Emirates government buildings with advanced IoT sensors and intelligent infrastructure. The initiative aims to modernize the nation’s facilities by implementing HVAC upgrades, centralized building management systems, and sensor-driven enhancements in spaces such as healthcare and education. Through integration of AI-powered analytics and smart sensing, Siemens strengthens the UAE’s commitment to sustainable innovation and operational excellence, positioning the country at the cutting edge of efficient and future-ready infrastructure.

- May 2025: Qualcomm Technologies is set to open a cutting-edge engineering center in Abu Dhabi, integrating into its global innovation network with an emphasis on artificial intelligence, industrial IoT, and data center technologies. The new facility will support strategic collaborations with regional and international partners, advancing intelligent infrastructure across sectors such as energy, logistics, manufacturing, retail, and smart mobility. Through this initiative, Qualcomm aims to foster local talent and contribute to the UAE’s evolving technology ecosystem.

UAE IoT (Internet of Things) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| Applications Covered | Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, Others |

| Verticals Covered | Healthcare, Energy, Public and Services, Transportation, Retail, Individuals, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE IoT (Internet of Things) market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE IoT (Internet of Things) market on the basis of component?

- What is the breakup of the UAE IoT (Internet of Things) market on the basis of application?

- What is the breakup of the UAE IoT (Internet of Things) market on the basis of vertical?

- What is the breakup of the UAE IoT (Internet of Things) market on the basis of region?

- What are the various stages in the value chain of the UAE IoT (Internet of Things) market?

- What are the key driving factors and challenges in the UAE IoT (Internet of Things) market?

- What is the structure of the UAE IoT (Internet of Things) market and who are the key players?

- What is the degree of competition in the UAE IoT (Internet of Things) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE IoT (Internet of Things) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE IoT (Internet of Things) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE IoT (Internet of Things) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)