UAE Leisure Travel Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Expenditure Type, Sales Channel, and Region, 2025-2033

UAE Leisure Travel Market Overview:

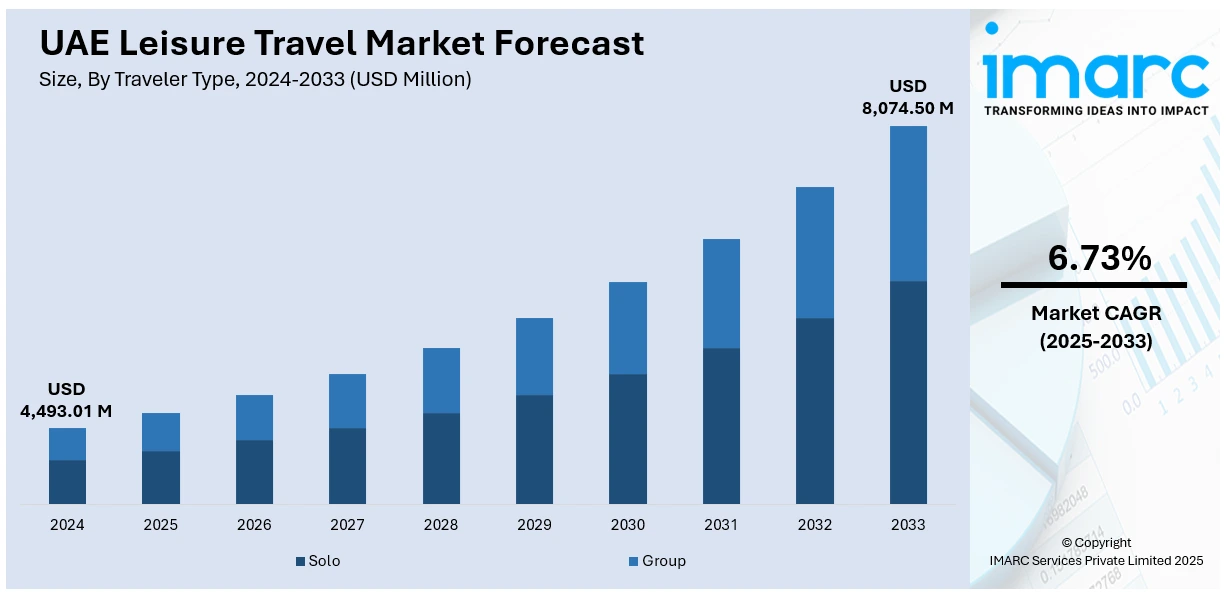

The UAE leisure travel market size reached USD 4,493.01 Million in 2024. Looking forward, the market is projected to reach USD 8,074.50 Million by 2033, exhibiting a growth rate (CAGR) of 6.73% during 2025-2033. The market is shaped by the UAE’s unmatched luxury experiences, from shopping festivals and premium resorts to architectural landmarks and private leisure services. Cultural tourism adds further depth, with museums, heritage districts, and traditional festivals enriching the visitor profile. World-class connectivity through major airports and airlines, alongside large-scale international events, ensures consistent global visibility, further augmenting the UAE leisure travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,493.01 Million |

| Market Forecast in 2033 | USD 8,074.50 Million |

| Market Growth Rate 2025-2033 | 6.73% |

UAE Leisure Travel Market Trends:

Luxury Tourism and Retail Experiences

The UAE has become synonymous with luxury-oriented leisure travel, offering visitors a combination of ultra-modern infrastructure, world-class retail hubs, and exclusive entertainment experiences. Dubai and Abu Dhabi dominate this segment with high-end resorts, Michelin-starred dining, and globally recognized shopping festivals. Iconic destinations such as The Palm Jumeirah, Burj Khalifa, and Yas Island provide travelers with premium attractions that blend architectural marvels with leisure facilities. The retail sector, anchored by The Dubai Mall and Mall of the Emirates, attracts millions of visitors annually with tax-free shopping and global luxury brands. Exclusive desert safaris, private yacht charters, and luxury spa retreats reinforce the UAE’s position as a hub for experiential and indulgent travel. This strong emphasis on personalized, high-value experiences ensures a steady influx of affluent tourists from Europe, Asia, and North America, cementing UAE leisure travel market growth. For instance, Dubai welcomed 18.72 million international visitors in 2024, a 9% year-on-year increase and the city's highest on record. In the first four months of 2025, Dubai attracted 7.15 million visitors (up 7% YoY).

To get more information on this market, Request Sample

Cultural Tourism and Heritage Preservation

While renowned for modern attractions, the UAE has increasingly invested in promoting its cultural heritage to diversify its leisure tourism offerings. In 2024, leisure was the primary purpose for 77% of Dubai visitors according to the official Dubai International Visitor Survey. The Louvre Abu Dhabi, Qasr Al Hosn, and Al Fahidi Historical District highlight the nation’s dedication to showcasing art, history, and Emirati traditions. UNESCO-listed Al Ain Oasis and Sharjah’s cultural institutions further attract visitors seeking authentic experiences. The government actively promotes heritage-based festivals, including the Al Dhafra Festival and Sharjah Light Festival, which highlight Emirati traditions and craftsmanship. Cultural tourism is supported by strong infrastructure, including museums, restored forts, and performance venues that enrich visitor engagement. This balance between modern luxury and heritage tourism has expanded the UAE’s leisure portfolio, ensuring that it appeals to both luxury seekers and culturally inclined travelers.

UAE Leisure Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on traveler type, age group, expenditure type, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Baby Boomers

- Generation X

- Millennial

- Generation Z

The report has provided a detailed breakup and analysis of the market based on the age group. This includes baby boomers, generation X, millennial, and generation Z.

Expenditure Type Insights:

- Lodging

- Transportation

- Food and Beverages

- Events and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the expenditure type. This includes lodging, transportation, food and beverages, events and entertainment, and others.

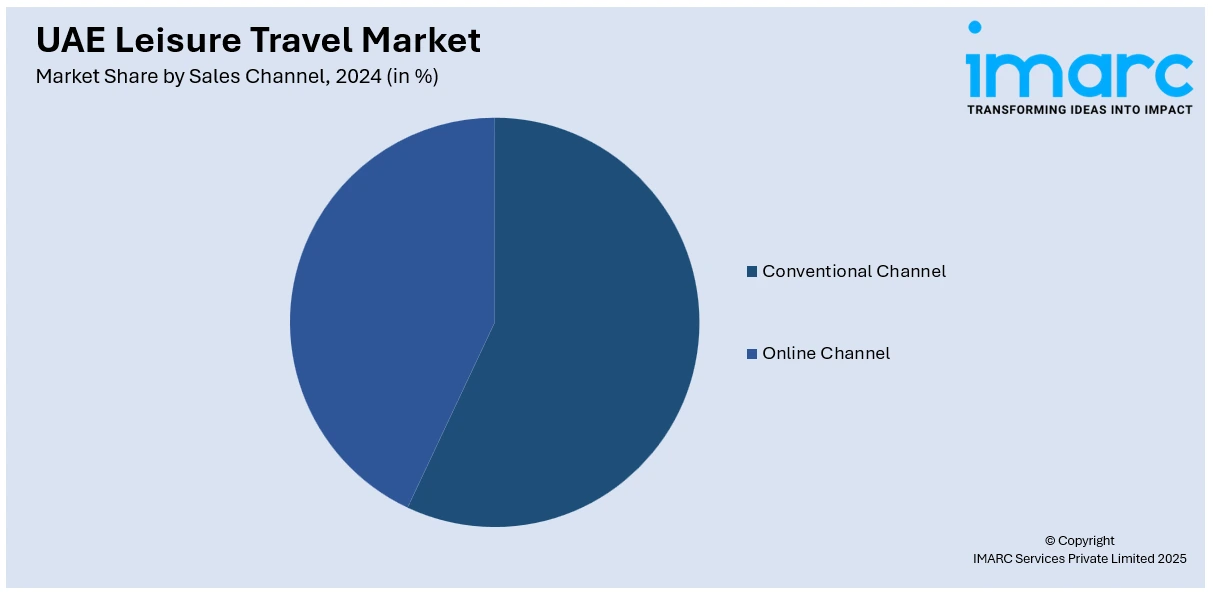

Sales Channel Insights:

- Conventional Channel

- Online Channel

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes conventional channel and online channel.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Leisure Travel Market News:

- In May 2024, dnata Travel Group, a part of Emirates Group, announced an enhanced partnership with Minor Hotels to drive global growth and enhance the travel experience. This collaboration will provide exclusive offers for both leisure and corporate travelers, with dynamic rates across Minor Hotels' 540+ properties and the addition of over 200 hotels by 2026. The partnership will also integrate dnata's destination management businesses, offering greater flexibility and new travel packages for customers in the UAE and beyond.

UAE Leisure Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Baby Boomers, Generation X, Millennial, Generation Z |

| Expenditure Types Covered | Lodging, Transportation, Food and Beverages, Events and Entertainment, Others |

| Sales Channels Covered | Conventional Channel, Online Channel |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE leisure travel market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE leisure travel market on the basis of traveler type?

- What is the breakup of the UAE leisure travel market on the basis of age group?

- What is the breakup of the UAE leisure travel market on the basis of expenditure type?

- What is the breakup of the UAE leisure travel market on the basis of sales channel?

- What is the breakup of the UAE leisure travel market on the basis of region?

- What are the various stages in the value chain of the UAE leisure travel market?

- What are the key driving factors and challenges in the UAE leisure travel market?

- What is the structure of the UAE leisure travel market and who are the key players?

- What is the degree of competition in the UAE leisure travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE leisure travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE leisure travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE leisure travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)