UAE Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

UAE Lithium-ion Battery Market Overview:

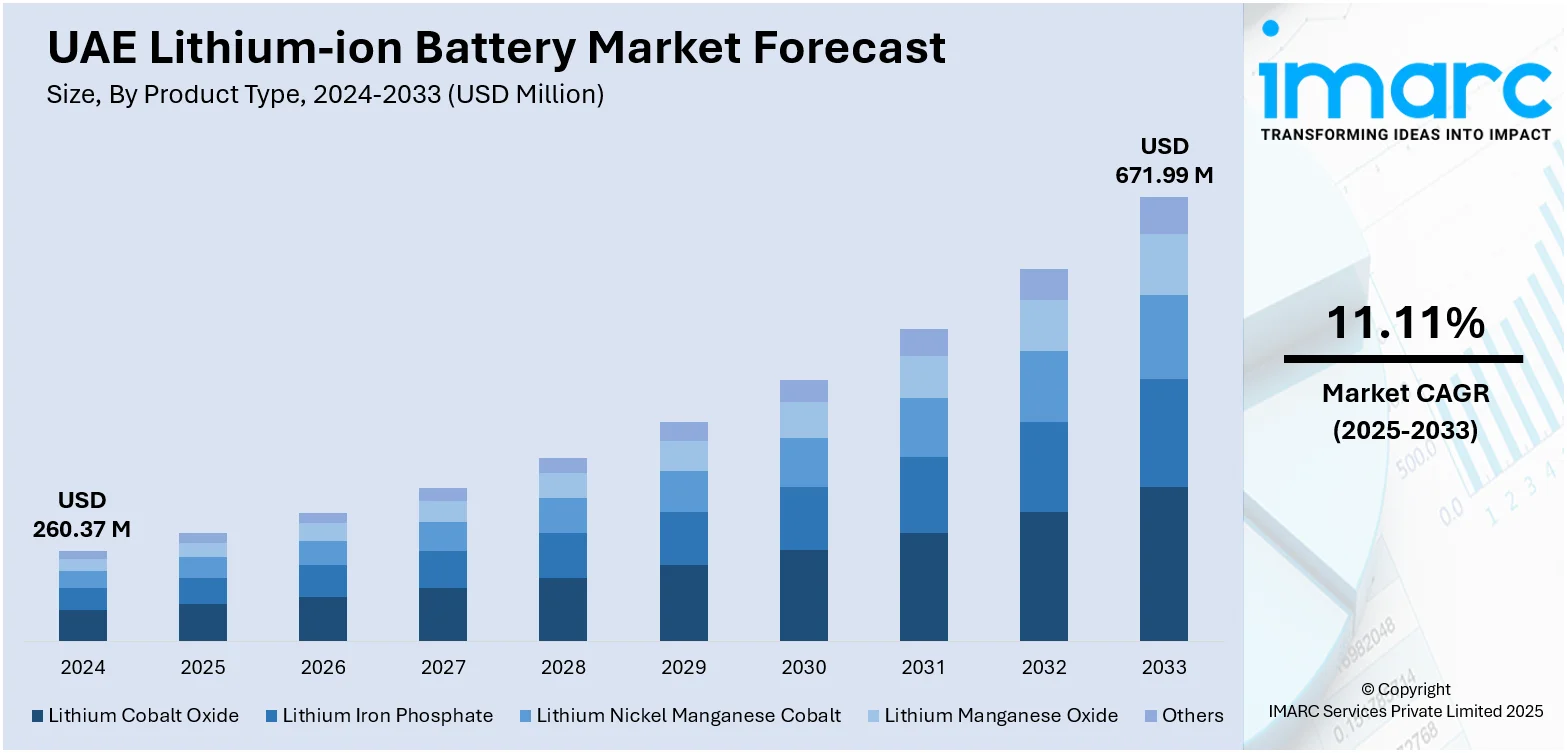

The UAE lithium-ion battery market size reached USD 260.37 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 671.99 Million by 2033, exhibiting a growth rate (CAGR) of 11.11% during 2025-2033. Government incentives, EV adoption, smart grid expansion, and rising demand for energy storage systems are some of the factors contributing to the UAE lithium-ion battery market share. The UAE’s decarbonization goals, infrastructure development, and strategic investments in renewable energy further support lithium-ion battery uptake across automotive, industrial, and utility sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 260.37 Million |

| Market Forecast in 2033 | USD 671.99 Million |

| Market Growth Rate 2025-2033 | 11.11% |

UAE Lithium-ion Battery Market Trends:

Fire Safety Integration in Battery Ecosystems

Fire suppression systems are being adapted to meet the growing safety demands of lithium-ion battery storage and usage across the UAE. Regulatory approvals for specialized extinguishers using proprietary fluids that target thermal runaway events show increasing institutional attention to risk mitigation. The approval process for these devices involves close coordination with national civil defence authorities and reflects a broader regional alignment, following similar certifications in other Gulf and Asian markets. As battery applications expand in energy storage, mobility, and electronics, support systems like fire protection are being re-engineered and localized to ensure safety infrastructure keeps pace with adoption. This points to a shift toward safety-led innovation within the battery supply and operational chain. These factors are intensifying the UAE lithium-ion battery market growth. For example, in June 2025, LifeSafe Holdings secured UAE Civil Defence approval for its 6-liter fire extinguisher designed for lithium-ion battery fires. The extinguisher uses Thermal Runaway Fluid (TRF) to stop fires and prevent reignition. Approval came via Lingjack Engineering, its Singapore-based partner. This follows earlier certifications in Qatar and the Philippines, reinforcing LifeSafe's expansion into lithium-ion battery fire safety in key Middle Eastern and Asian markets.

To get more information on this market, Request Sample

Rising Demand from Renewable Energy Storage Applications

One noticeable shift in the UAE lithium-ion battery market is the growing use of these batteries for renewable energy storage, especially in solar projects. With the UAE pushing toward energy diversification and clean power targets under its Energy Strategy 2050, battery storage has become essential for grid stability. The country receives high solar irradiance, making solar power a priority. However, to make solar energy viable at scale, consistent storage solutions are needed to manage supply fluctuations. This is where lithium-ion batteries are becoming a preferred option, due to their high energy density, fast response time, and longer life cycle compared to lead-acid alternatives. Government-backed initiatives like the Mohammed bin Rashid Al Maktoum Solar Park in Dubai are creating demand for advanced energy storage systems. At the same time, the private sector is adopting behind-the-meter battery solutions for commercial and industrial operations, helping to cut peak demand charges and boost energy independence. These trends are encouraging both domestic production and strategic imports of lithium-ion battery components. As storage continues to play a bigger role in renewables, lithium-ion demand is expected to grow steadily across utility-scale and distributed energy projects.

UAE Lithium-ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The report has provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

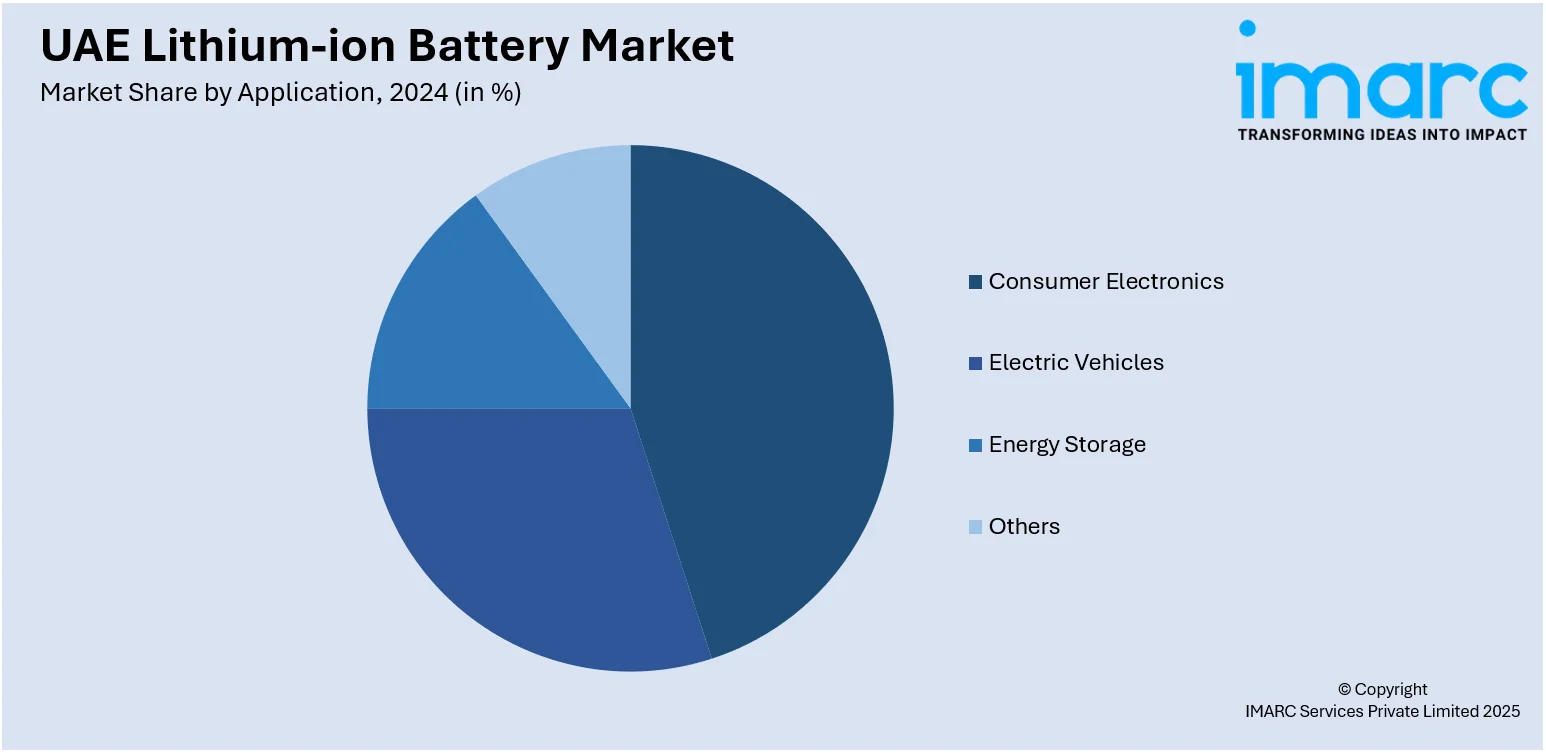

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Lithium-ion Battery Market News:

- In July 2025, KEZAD Group signed a 50-year land lease with Witthal Gulf Industries to develop a lithium-ion battery recycling facility in Taweelah. The USD 10.8 Million (AED 40 Million) plant will span 15,340 sqm and focus on recycling batteries from EVs, solar farms, and renewable systems. It will recover valuable materials like black mass, copper, and aluminium, offering sustainable alternatives to support the UAE’s clean energy goals.

UAE Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE lithium-ion battery market on the basis of product type?

- What is the breakup of the UAE lithium-ion battery market on the basis of power capacity?

- What is the breakup of the UAE lithium-ion battery market on the basis of application?

- What is the breakup of the UAE lithium-ion battery market on the basis of region?

- What are the various stages in the value chain of the UAE lithium-ion battery market?

- What are the key driving factors and challenges in the UAE lithium-ion battery market?

- What is the structure of the UAE lithium-ion battery market and who are the key players?

- What is the degree of competition in the UAE lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)