UAE Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Emirates, 2025-2033

UAE Logistics Market Size and Share:

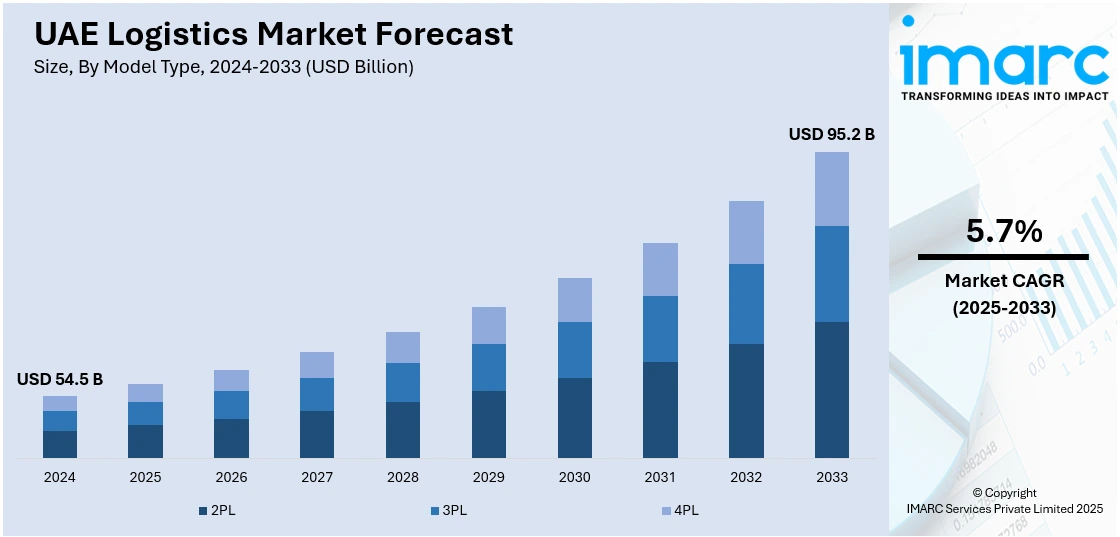

The UAE Logistics market size was valued at USD 54.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 95.2 Billion by 2033, exhibiting a CAGR of 5.7% from 2025-2033. Dubai holds a leading position in the market, supported by its strategic geographic location bridging Asia, Europe, and Africa, along with substantial investments in infrastructure and advanced technology. The rise of e-commerce has intensified the need for cost-effective logistics solutions, while government initiatives like the Dubai Logistics Master Plan 2040 aim to solidify the nation's status as a global logistics hub. These factors are driving the continued expansion of the UAE logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 54.5 Billion |

|

Market Forecast in 2033

|

USD 95.2 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

The UAE is a vital logistical hub for international trade because of its advantageous location at the intersection of Europe, Asia, and Africa. Positioned along major shipping routes, the country enables efficient import, export, and transshipment operations through key assets like Jebel Ali Port and Dubai’s major airports. In 2024, Jebel Ali Port achieved a record throughput of 15.5 million TEUs, accounting for nearly 18% of DP World’s global container volumes, highlighting its global significance. This centrality supports regional distribution and global connectivity, attracting multinational logistics firms. The UAE’s proximity to emerging markets and its role as a major re-export center continue to drive strong demand for logistics services and industry growth.

The UAE government has made significant investment in logistics infrastructure, including seaports, airports, and road networks on par with world standards, in support of its economic diversification drive. Programmes such as Dubai Industrial Strategy 2030 and Abu Dhabi Vision 2030 aim at developing free zones, smart platforms for logistics, and integrated customs. The development of Etihad Rail, a project to connect all emirates and neighboring states, is the most important undertaking to enhance regional connectivity and trade between emirates. Additionally, Dubai wants to double the economic contribution of the logistics sector to AED 16.8 billion, increase the adoption of technology by 75%, and reduce carbon emissions by 30%. These investments make supply chains more efficient, lower transit time, and invite global investors. Government-sponsored digitalization initiatives, including blockchain in customs, continue to make the UAE a logistics and supply chain global leader.

UAE Logistics Market Trends:

Significant Growth in the E-commerce Industry

E-commerce's explosive rise is one of the main factors propelling the UAE logistics market's expansion. Additionally, the need for effective and prompt logistics services due to the increasing number of online shopping websites and shifting consumer demands is also fueling the growth of the market. According to the report published by the International Trade Administration in November 2023, UAE was the highest-ranking e-commerce State within the Gulf Cooperation Council States; the market registered a 53% growth during the year 2020 and made a retail e-commerce record sales figure of US$ 3.9 Billion. Moreover, the Dubai Chamber of Commerce and Industry predicted that by 2025 the sector of e-commerce would reach $8 billion. Apart from this, the growth of advanced logistics solutions to serve last-mile deliveries and enable smooth order processing is further driving the UAE logistics market growth. In addition to this, integration of tracking tools, route planning software, and real-time visibility tools for managing large volumes of shipments and facilitating on-time delivery is also driving the market growth. Logistics service providers are heavily investing in digital tools to drive their operational efficiency and cater to the needs of the E-commerce industry throughout the region.

Implementation of Government Policies

Another significant factor bolstering the expansion of the UAE logistics business is the government's plan to expand trade and logistical networks. The UAE government is focusing on the significance of a highly efficient logistic network, thus adopting various policies and initiatives to establish a good business environment for the companies, which is generating a positive scenario for the logistics provider. For example, the Abu Dhabi Advanced Trade and Logistics Platform, which is overseen by the Abu Dhabi Department of Economic Development, will help support sea, land, and air trade by providing industrial and free zone services and improve the customer experience for logistics and trade facilitation customers. Additionally, the setting up of free trade zones and specialized economic zones, which provide tax relief and streamlined logistics processes are also supporting the demand for the UAE logistics market. The World Trade Organization, for example, states that the United Arab Emirates has an open trading regime with low tariffs and minimal non-tariff trade barriers.

Rapid Technological Advancements

The continuous technological innovations, including the integration of the Internet of Things (IoT), to improve supply chain visibility and control are serving as some of the leading logistics industry trends. In addition, the increasing use of sensors and radio frequency identification (RFID) tags to enable real-time information on the location and status of goods, enabling better tracking and inventory management, is driving a positive scenario for the overall market. Further, several major market players are increasingly investing in the implementation of advanced logistics technology to automate their operations and enable real-time tracking of shipments. For instance, in January 2024, Gulftainer, the large operator of Middle East ports and terminals and a leader in delivering custom supply chain and logistics solutions, announced that it would be transferring its core ERP to the cloud by adopting RISE with SAP and S/4HANA to serve its regional and global operations, as part of its overall digital transformation initiative. With the use of RISE with SAP, Gulftainer will be able to introduce new technologies, reduce operating costs, and reduce time to market with customized solutions. These technologies will further enhance market growth in the coming years.

UAE Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE logistics market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on model type, transportation mode, and end use.

Analysis by Model Type:

- 2PL

- 3PL

- 4PL

Third-Party Logistics (3PL) providers own the largest market share in the UAE logistics sector, led by growing demand for cost-effective, scalable, and specialized logistics services. Companies in all sectors—retail, e-commerce, manufacturing, and FMCG are outsourcing logistics to 3PL firms to consolidate operations, decrease capital investment, and concentrate on core functions. The UAE's sophisticated infrastructure, facilitatory regulatory framework, and high-technology warehousing infrastructure make it perfectly suited for the growth of 3PL. Online shopping growth and last-mile delivery pressure add to increased dependence on 3PL services. Moreover, 3PL service providers provide value-added services like inventory management, packaging, and reverse logistics, contributing to overall efficiency. Their agility and local knowledge enable businesses to respond promptly to market shifts, making 3PLs key players in the UAE's changing supply chain environment.

Analysis by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Roadways dominate the UAE logistics market growth owing to their critical role in domestic and regional transportation. The country has invested heavily in a modern and extensive road network that efficiently connects key logistics hubs, industrial zones, airports, and seaports across all emirates. This infrastructure enables fast, flexible, and cost-effective movement of goods, especially for last-mile delivery and intra-GCC trade. Road transport is particularly vital for e-commerce, retail, and FMCG sectors, where timely deliveries are crucial. Additionally, the UAE's ongoing development of the Etihad Rail network is expected to further integrate with road transport, boosting multimodal logistics capabilities. Favorable government regulations and consistent infrastructure upgrades ensure roadways remain the backbone of the logistics ecosystem, supporting seamless supply chain operations across the region.

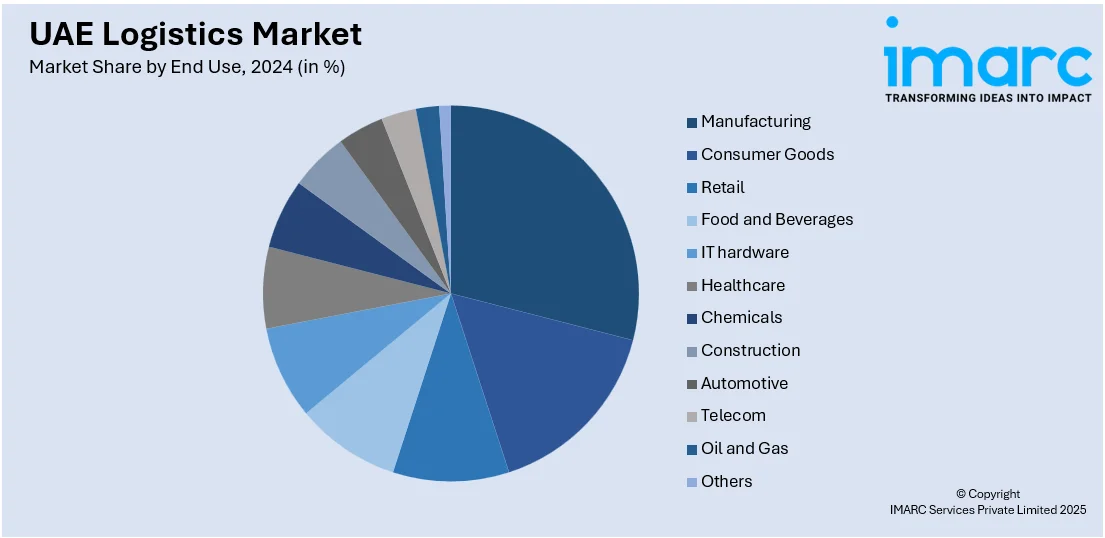

Analysis by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Manufacturing accounts for the largest share in the UAE logistics sector due to its key position in the diversification and industrial growth plans of the country. Under initiatives such as "Operation 300bn" and Dubai Industrial Strategy 2030, the UAE is proactively increasing manufacturing capacity across sectors like petrochemicals, pharmaceuticals, electronics, and food processing. This expansion generates high demand for effective supply chain and logistics services to facilitate manufacturing, warehousing, and distribution operations. Manufacturers depend significantly on logistics providers for raw material importation, finished goods storage, and export handling, particularly via highly linked ports and free zones. The incorporation of sophisticated technologies such as automation and real-time tracking within logistics further raises efficiency, making logistics a critical enabler of the manufacturing industry's growth.

Analysis by Emirates:

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Others

Dubai is the top player in the UAE logistics sector due to its favorable location, international-standard infrastructure, and business-friendly environment. Located at the intersection of key global trade routes, Dubai links Asia, Europe, and Africa, and thus is a prime location for global logistics. The city has world-class facilities such as Jebel Ali Port the Middle East's largest port and Dubai International Airport, one of the world's busiest cargo airports. Furthermore, free zones like JAFZA provide tax benefits, simplified customs procedures, and effective regulatory assistance, drawing in international logistics players. Government investments in intelligent logistics technologies and projects like Dubai Logistics City further reinforce the region's supremacy. These factors combined make Dubai a leading gateway for regional and international trade flows.

Competitive Landscape:

Today, major players in the industry are proactively adopting measures to cement their positions and stay competitive in the fast-changing environment. These measures involve various initiatives that are meant to improve operational effectiveness, increase services offered, adopt technology, and form strategic alliances. They are spending on cutting-edge technologies to maximize their operation and the extensive deployment of cutting-edge tracking and tracing systems, real-time visibility solutions, and data analytics for efficient supply chain processes, better inventory control, and customer satisfaction. Apart from this, automation, robotics, and artificial intelligence (AI) are also being implemented to fasten warehouse operations and maximize order fulfillment accuracy. Also, major players are expanding their portfolios of services in order to provide end-to-end logistics solutions inclusive of value-added services like customs clearance, freight forwarding, packaging, and reverse logistics by providing a full-range of services.

The report provides a comprehensive analysis of the competitive landscape in the UAE Logistics market with detailed profiles of all major companies, including:

- Al Furat LLC

- CEVA Logistics (CMA CGM S.A.)

- DGL Group

- Emirates Logistics LLC

- Global Shipping & Logistics LLC

- Hellman Worldwide Logistics

- Jenae Logistics LLC

- Mac World Logistic LLC

- Masstrans Freight LLC

- Modern Freight Company LLC

- Move One Inc.

- Platinum Shipping & Logistics LLC

- UAE Cargo Services

- Union Logistics Ltd.

Latest News and Developments:

- March 2025: Advanced Media entered into a strategic partnership with DHL Express UAE to mitigate logistics carbon emissions via DHL GoGreen Plus solutions, which allow companies to use Sustainable Aviation Fuel (SAF) for transportation in order to reduce their carbon footprint.

- March 2025: Dubai South entered into a partnership with UPS to construct a new facility in the Logistics District in Dubai South. This facility will reportedly substantially increase UPS's capacity for operations in the UAE, bolstering global commerce connections through its international network.

- February 2025: Premier Marine Engineering Services completed the delivery of its first domestically constructed cargo vessel, the ADNOC B20, to ADNOC Logistics and Services, an international oil maritime logistics organization. This was part of a long-term collaboration under a five-year agreement that will see the two companies work together to manufacture a number of multipurpose barges, which includes the shipment of eight cargo barges in 2025.

- January 2025: Federal Express Corporation (FedEx) opened a new customs processing facility in the Ras Al Khaimah Economic Zone (RAKEZ). With the warehouse's in-house clearing capabilities, FedEx announced that it can now manage shipment clearance processes more efficiently for its clients, thereby increasing operational effectiveness.

- July 2024: Dubai announced plans to develop the world's largest logistics hub dedicated to the trade of foodstuffs, fruits, and vegetables. This initiative, entrusted to DP World, is expected to enhance Dubai's role in the global food trade.

- February 2024: Dubai South and Aldar Properties partnered to form a joint venture to develop cutting-edge logistics facilities in Dubai South. The goal of the partnership is reportedly to enhance Dubai South's Logistics District by introducing new and premium offerings.

UAE Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Model Types Covered | 2PL, 3PL, 4PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Emirates Covered | Abu Dhabi, Dubai, Sharjah, Ajman, Others |

| Companies Covered | Al Furat LLC, CEVA Logistics (CMA CGM S.A.), DGL Group, Emirates Logistics LLC, Global Shipping & Logistics LLC, Hellman Worldwide Logistics, Jenae Logistics LLC, Mac World Logistic LLC, Masstrans Freight LLC, Modern Freight Company LLC, Move One Inc., Platinum Shipping & Logistics LLC, UAE Cargo Services, Union Logistics Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE logistics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UAE logistics market was valued at USD 54.5 Billion in 2024.

The UAE logistics market is projected to exhibit a CAGR of 5.7% during 2025-2033, reaching a value of USD 95.2 Billion by 2033.

Key factors driving the UAE logistics market include its strategic geographic location connecting global trade routes, strong government investment in infrastructure and free zones, and advanced technology adoption. These elements enhance connectivity, efficiency, and competitiveness, positioning the UAE as a leading regional and international logistics and supply chain hub.

Dubai dominates the UAE logistics market due to its world-class infrastructure, including Jebel Ali Port and Dubai International Airport, strategic location between East and West, and business-friendly free zones like JAFZA. Its advanced digital systems and strong government support attract global logistics firms, making it the region’s key trade hub.

Some of the major players in the UAE logistics market include Al Furat LLC, CEVA Logistics (CMA CGM S.A.), DGL Group, Emirates Logistics LLC, Global Shipping & Logistics LLC, Hellman Worldwide Logistics, Jenae Logistics LLC, Mac World Logistic LLC, Masstrans Freight LLC, Modern Freight Company LLC, Move One Inc., Platinum Shipping & Logistics LLC, UAE Cargo Services, Union Logistics Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)