UAE Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

UAE Luxury Fashion Market Overview:

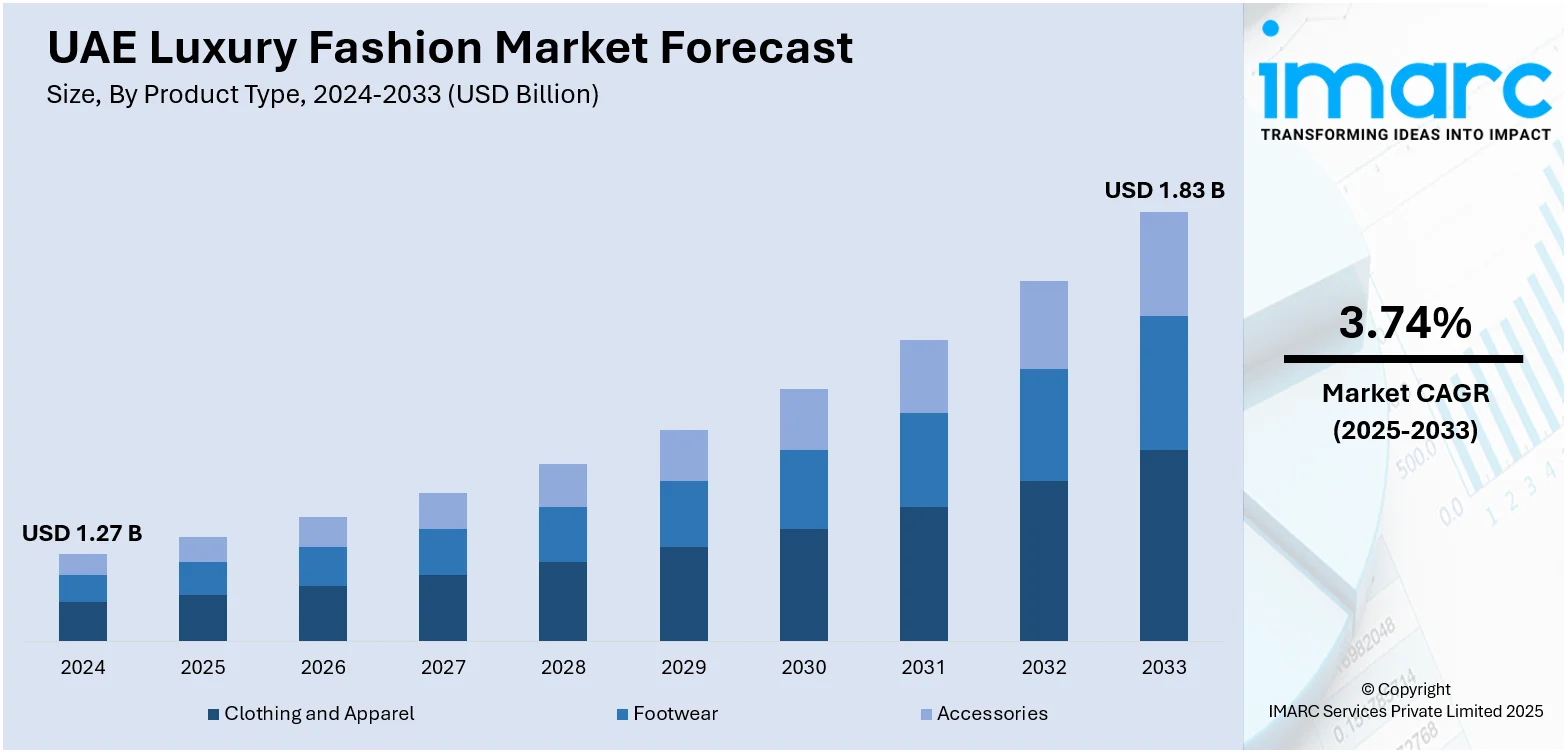

The UAE luxury fashion market size reached USD 1.27 Billion in 2024. The market is projected to reach USD 1.83 Billion by 2033, exhibiting a growth rate (CAGR) of 3.74% during 2025-2033. The market is driven by increasing disposable incomes, expanding HNWI population, and rising consumer demand for premium and designer fashion. Further, retail digitalization and expanding power of social media and celebrity endorsement are driving the growth of luxury fashion consumption, especially among younger brand-aware consumers. Apart from this, availability of luxury flagship stores and global fashion events further expands the UAE luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.27 Billion |

| Market Forecast in 2033 | USD 1.83 Billion |

| Market Growth Rate 2025-2033 | 3.74% |

UAE Luxury Fashion Market Trends:

Digital Transformation and Omnichannel Retailing

The market is undergoing a notable shift fueled by digital transformation and the growing emphasis on omnichannel retail. With one of the highest rates of smartphone penetration and internet usage globally, consumers in the UAE are increasingly interacting with luxury brands through digital touchpoints. Industry reports highlight that the country leads the world in mobile commerce, with 67% of shoppers making their most recent purchase via smartphone. This behavior is largely influenced by the reliability, convenience, and secure nature of mobile transactions, making digital engagement a critical element in the market's retail strategy. Moreover, luxury brands are increasingly investing in e-commerce platforms and digital touchpoints to meet the evolving preferences of tech-savvy consumers who demand convenience without compromising exclusivity. Additionally, online retailing, once considered incompatible with luxury's traditional emphasis on in-store experiences, is now being reimagined through immersive virtual showrooms, high-definition product displays, and AI-enabled personal shopping assistants. Besides this, social media, particularly Instagram and Snapchat, has become central to brand discovery and aspirational marketing. As a result, digital innovation is not only streamlining the path to purchase but also reshaping brand-consumer relationships across the UAE luxury fashion landscape.

To get more information on this market, Request Sample

Growing Influence of High-Net-Worth Individuals (HNWIs)

The increasing concentration of high-net-worth individuals (HNWIs) in the UAE is significantly impacting the UAE luxury fashion market growth. As a prominent wealth center in the Middle East, the UAE continues to draw affluent expatriates, international investors, and entrepreneurs, attracted by its tax advantages, economic stability, and upscale lifestyle. Industry projections indicate that the UAE is set to record the highest global net inflow of millionaires in 2024, with more than 6,700 expected to relocate, surpassing all other nations. This demographic brings substantial purchasing power and a strong inclination toward luxury spending, favoring premium fashion labels, exclusive collections, and personalized tailoring. Their presence reinforces demand for high-end retail experiences and contributes to the expansion of flagship boutiques, private client services, and invitation-only events, making this segment a core driver of market growth. Besides, luxury brands in the UAE are increasingly tailoring their strategies to meet the tastes and expectations of HNWIs. This includes offering exclusive collections, VIP clienteling services, and personalized shopping experiences designed to reinforce status and exclusivity. Additionally, luxury brands are investing in private salons and invitation-only boutiques to provide a discreet, elevated environment for elite shoppers. The influence of HNWIs extends beyond purchasing power; their brand preferences, travel patterns, and social affiliations set trends that resonate across the broader consumer base.

UAE Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

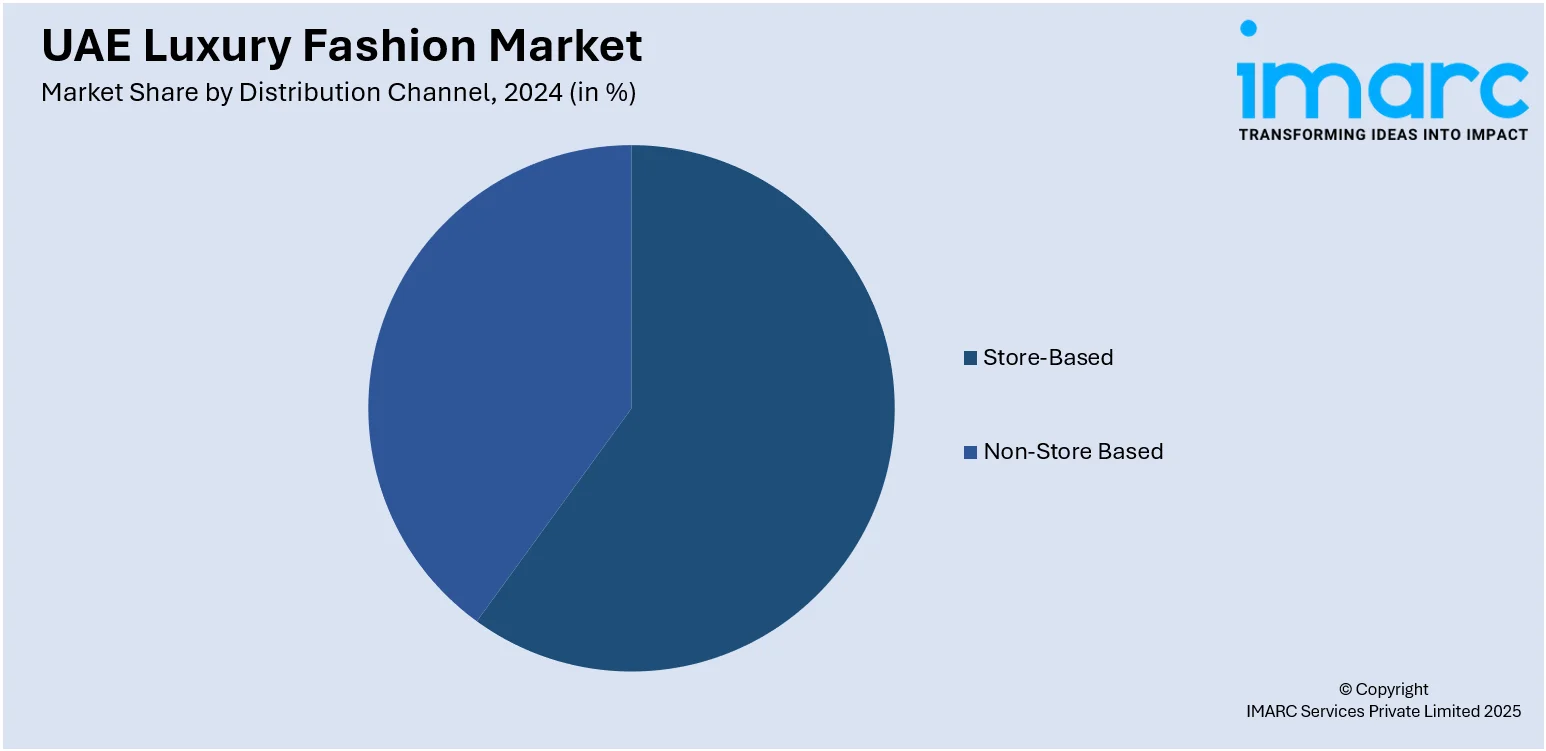

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Luxury Fashion Market News:

- July 2025: UAE-based luxury retailer Chalhoub Group announced the opening of 39 new stores across the Middle East since the beginning of the year, marking a significant expansion of its regional footprint. The group launched dedicated eyewear boutiques for Oliver Peoples and Persol in Abu Dhabi’s Galleria Mall, reinforcing its focus on premium brand positioning. Other notable openings include a flagship Devialet store in The Dubai Mall and the introduction of new luxury partnerships such as Jil Sander, reflecting Chalhoub’s ongoing strategy to diversify and strengthen its high-end retail portfolio.

- May 2025: Dubai‑based Hushday officially launched in the UAE as the Gulf region’s first invitation‑only luxury flash‑sales platform, offering steep discounts of up to 75% on curated iconic brands. The platform, having raised AED 2 million (approximately USD 550,000) in pre‑seed funding, enables luxury and premium brands to discreetly manage excess inventory while preserving brand integrity and pricing control. Designed for a digital‑savvy, younger affluent demographic, Hushday plans to host up to 50 private sales per month and expand across the GCC by 2026.

UAE Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE luxury fashion market on the basis of product type?

- What is the breakup of the UAE luxury fashion market on the basis of distribution channel?

- What is the breakup of the UAE luxury fashion market on the basis of end user?

- What is the breakup of the UAE luxury fashion market on the basis of region?

- What are the various stages in the value chain of the UAE luxury fashion market?

- What are the key driving factors and challenges in the UAE luxury fashion market?

- What is the structure of the UAE luxury fashion market and who are the key players?

- What is the degree of competition in the UAE luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)