UAE Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Region, 2026-2034

UAE Mushroom Market Summary:

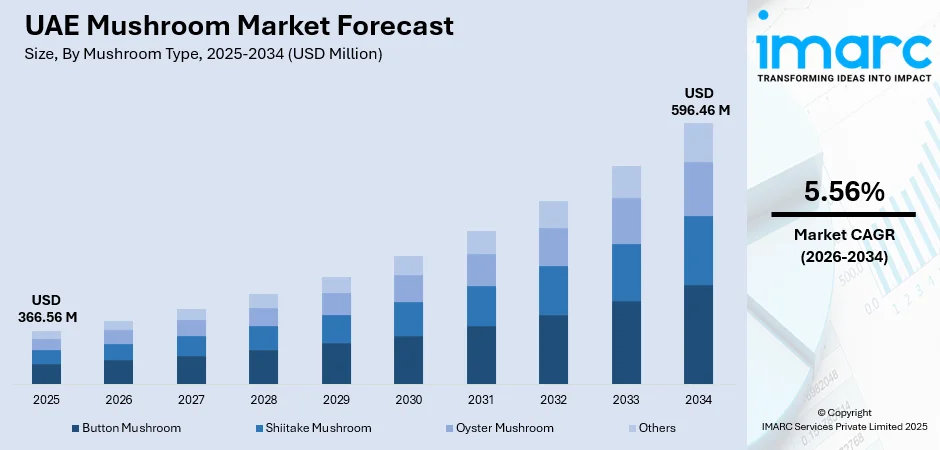

The UAE mushroom market size was valued at USD 366.56 Million in 2025 and is projected to reach USD 596.46 Million by 2034, growing at a compound annual growth rate of 5.56% from 2026-2034.

The UAE mushroom market is witnessing robust expansion driven by evolving consumer preferences toward health-conscious and sustainable food choices. Rising adoption of plant-based diets, coupled with increasing awareness of mushrooms' nutritional benefits, including high protein content and essential vitamins, is fueling demand across retail and foodservice sectors. Advances in controlled-environment agriculture and vertical farming technologies are enabling year-round local production, reducing import dependency, and ensuring fresher produce reaches consumers.

Key Takeaways and Insights:

-

By Mushroom Type: Button mushroom dominates the market with a share of 40.8% in 2025, owing to its widespread consumer acceptance, mild flavor profile, versatility in culinary applications, and cost-effective large-scale cultivation capabilities.

-

By Form: Fresh mushroom leads the market with a share of 61.9% in 2025, driven by growing consumer preference for fresh, minimally processed produce, shorter supply chains from local farms, and increasing availability through modern retail channels.

-

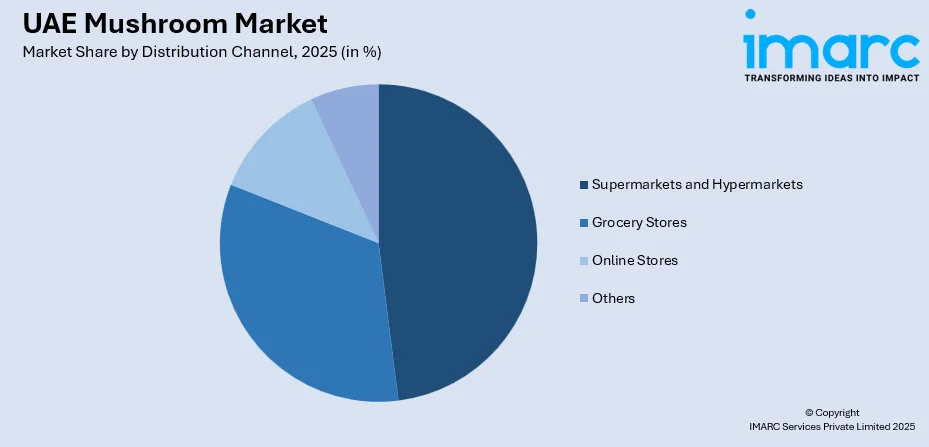

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 47.96% in 2025, attributed to organized retail expansion, dedicated fresh produce sections, year-round product availability, and consumer trust in quality assurance standards.

-

By End Use: The food processing industry leads the market with a share of 32.88% in 2025, supported by mushrooms' functional properties as flavor enhancers, meat alternatives in processed foods, and growing demand from convenience food manufacturers.

-

By Region: Dubai dominated the market with 36% revenue share in 2025, driven by its position as the commercial hub, concentration of hospitality establishments, diverse expatriate population, and advanced retail infrastructure.

-

Key Players: The UAE mushroom market exhibits moderate competitive intensity characterized by a mix of established local cultivators, regional distributors, and emerging agritech startups. Market participants are increasingly focusing on sustainable cultivation practices, vertical farming technologies, and circular economy principles to differentiate their offerings and capture growing consumer interest in locally sourced, environmentally responsible produce.

To get more information on this market Request Sample

The UAE mushroom market is experiencing transformative growth underpinned by strategic national initiatives targeting food security and agricultural self-sufficiency. The country's National Food Security Strategy 2051 has catalyzed significant investments in controlled-environment agriculture, enabling mushroom cultivation despite challenging climatic conditions. Local producers are leveraging innovative technologies including indoor vertical farming, automated climate control systems, and circular economy practices such as utilizing agricultural byproducts like date palm leaves as cultivation substrates. The emergence of specialty mushroom varieties including shiitake, oyster, and lion's mane, is diversifying the product landscape beyond traditional button mushrooms. The food service sector, particularly the hospitality industry and airline catering services, represents a substantial demand driver as establishments increasingly incorporate mushroom-based dishes into their menus. The UAE food service market size was valued at USD 16.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 50.21 Billion by 2033, exhibiting a CAGR of 12.20% from 2025-2033. This trend aligns with broader consumer shifts toward plant-forward dining experiences and sustainable food choices across the Emirates.

UAE Mushroom Market Trends:

Rising Adoption of Sustainable Local Cultivation Practices

The UAE is witnessing accelerated investment in sustainable mushroom cultivation as part of broader food security initiatives. For instance, Themar Al Emarat Group manages the largest mushroom farm in the United Arab Emirates, producing between 7 and 7.5 tonnes of mushrooms per day. The UMDIS Mushroom Agency met with Mohammed Abdelhay of Themar Al Emarat to understand how the facility operates, how it overcomes the region’s harsh climatic conditions, and what enables it to rank among the most efficient mushroom farms in the Middle East. Innovations in indoor agriculture and resource-efficient growing techniques enable farmers to cultivate mushrooms year-round despite challenging desert conditions. Vertical farming methods and closed-loop processes minimize land, water, and chemical consumption while improving yield quality. These systems produce mushrooms without synthetic pesticides, attracting health-conscious consumers. Local farming reduces supply chain complexity, ensuring fresher products reach retailers quickly, boosting shelf appeal and reducing spoilage losses.

Expansion of E-Commerce and Digital Retail Channels

Online grocery services and specialty produce platforms are significantly enhancing mushroom availability throughout the UAE, promoting wider consumer access and consistent household usage. The UAE e-commerce market size reached USD 125.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 776.2 Billion by 2033, exhibiting a growth rate (CAGR) of 21.4% during 2025-2033. As consumers become increasingly familiar with online purchasing, mushrooms are showcased through targeted promotions, recipe-based packages, and flexible subscription options. These platforms emphasize freshness guarantees, swift delivery, and transparent product information, building confidence in purchasing perishable items online. Digital channels enable smaller farmers and niche brands to reach urban buyers without traditional retail barriers.

Growing Integration of Mushrooms in Plant-Based Culinary Innovations

The evolving trend toward plant-based and flexitarian diets has positioned mushrooms as essential ingredients in innovative culinary applications. With their meaty texture, savory umami flavor, and nutritional richness, mushrooms serve as versatile components in meat-alternative formulations. The hospitality sector and airline catering services are expanding mushroom-based offerings across premium dining experiences. This culinary versatility enables producers to tap into the growing demand for sophisticated plant-forward cuisine while positioning mushrooms as staple ingredients across diverse food applications.

Market Outlook 2026-2034:

The UAE mushroom market outlook remains positive, supported by sustained government commitment to agricultural modernization and food security enhancement. Strategic investments in large-scale production facilities, including new mushroom farms utilizing artificial intelligence-based cultivation systems, are expected to significantly reduce import dependency for both fresh and processed mushrooms. The growing emphasis on circular economy principles, where agricultural byproducts serve as cultivation substrates, aligns with national sustainability objectives. Consumer awareness of mushrooms' health benefits, including immune support and cognitive wellness properties, continues to expand the addressable market. The market generated a revenue of USD 366.56 Million in 2025 and is projected to reach a revenue of USD 596.46 Million by 2034, growing at a compound annual growth rate of 5.56% from 2026-2034.

UAE Mushroom Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Mushroom Type |

Button Mushroom |

40.8% |

|

Form |

Fresh Mushroom |

61.9% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

47.96% |

|

End Use |

Food Processing Industry |

32.88% |

|

Region |

Dubai |

36% |

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The button mushroom dominates with a market share of 40.8% of the total UAE mushroom market in 2025.

Button mushrooms maintain their dominant position in the UAE market owing to their exceptional consumer acceptance, mild and adaptable flavor profile, and extensive culinary versatility across diverse cuisines. These mushrooms are cultivated on a large scale due to their short growing cycles and adaptability to controlled environment conditions, making them staples in both traditional cooking and processed food applications. The segment benefits from robust supply chain infrastructure and relatively lower production costs, supporting mass market appeal among price-conscious consumers and institutional buyers throughout the Emirates.

The established presence of button mushrooms in local supermarket chains, grocery stores, and foodservice operations ensures consistent demand and availability. Their neutral taste profile makes them ideal for incorporation across various culinary traditions represented in the UAE's multicultural consumer base. Local cultivation initiatives are increasingly focusing on button mushroom production to meet domestic demand while reducing dependence on imports, aligning with national food security objectives and sustainability goals.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

The fresh mushroom leads with a share of 61.9% of the total UAE mushroom market in 2025.

Fresh mushrooms command the largest market share, driven by growing consumer preference for minimally processed, whole food ingredients that retain maximum nutritional value and culinary appeal. The expansion of local cultivation facilities utilizing indoor farming and controlled environment technologies ensures year-round availability of fresh produce despite the UAE's challenging climate conditions. Shorter supply chains from farm to retail enable fresher products with extended shelf life, enhancing consumer confidence and repeat purchases.

The proliferation of modern retail formats including supermarkets with dedicated fresh produce sections and specialty grocers, has significantly improved fresh mushroom accessibility. Quick commerce platforms and same-day delivery services are further boosting fresh mushroom consumption by addressing the convenience requirements of time-pressed urban consumers. The foodservice sector's emphasis on fresh ingredients for premium dining experiences creates sustained demand across hotels, restaurants, and catering establishments throughout the Emirates.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The supermarkets and hypermarkets exhibit a clear dominance with a 47.96% share of the total UAE mushroom market in 2025.

Supermarkets and hypermarkets continue to dominate the market, leveraging wide geographic reach, diverse product selections, and strong consumer confidence in quality. Leading retail chains have established specialized fresh produce sections with advanced cold chain systems, ensuring consistent availability and quality of mushrooms. Direct sourcing from local farms allows these retailers to offer competitive pricing while differentiating their products through locally grown options. This approach strengthens supply reliability, enhances consumer trust, and reinforces the position of organized retail as the primary channel for fresh produce.

Organized retail invests heavily in initiatives that boost consumer engagement, including product education, cooking demonstrations, and promotional campaigns, which increase mushroom visibility and encourage trial among cautious buyers. Loyalty programs and targeted marketing strategies drive repeat purchases, strengthening customer retention. Collaborations between major retailers and local mushroom cultivators are becoming increasingly common, supporting domestic agriculture while providing traceable and sustainably produced fresh produce. These strategies collectively enhance market penetration and reinforce consumer preference for organized retail channels.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

The food processing industry dominates with a market share of 32.88% of the total UAE mushroom market in 2025.

The food processing industry's dominance reflects mushrooms' versatility as functional ingredients in diverse manufactured food applications. Processors leverage mushrooms' natural umami flavor, meat-like texture, and nutritional profile to develop innovative products addressing health-conscious and flexitarian consumer segments. The growing demand for plant-based convenience foods and ready-to-eat meals incorporating mushroom-based ingredients drives sustained procurement from domestic and import sources.

Food companies are also finding ways to use mushrooms in foodstuffs such as soups, sauces, and gravies, as well as meat-free and functional food formulations. The segment has the advantage of mushrooms increasing the flavor profiles and provides nutritional benefits such as B vitamins, minerals, and dietary fiber. The facilities, which are equipped with built-in value-added facilities such as canning, freezing, and drying, enable the year-long availability of products and the long shelf life of its products in the export markets.

Region Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai leads with a share of 36% of the total UAE mushroom market in 2025.

The mushroom market in Dubai is experiencing a surge in demand for fresh, healthy, and plant-based foods. The increasing number of health-aware locals, expatriates, and tourists is driving the demand for mushrooms as they have low-calorie content, high nutritional value, and can be used in most of the world's dishes. Consumption has been further reinforced by the growth of vegan and flexitarian diets at the household, restaurant, and hospitality establishment levels. The rising demand in the retail and food service serves is being boosted by the increased whatever of mushroom dishes that are being served in premium dining outlets and airline catering services.

Another key growth driver is rising investment in locally grown, sustainable mushroom production using climate-controlled and indoor farming technologies suited to Dubai’s arid conditions. These methods ensure year-round supply, reduced import dependence, and improved freshness. Simultaneously, the strong presence of supermarkets, hypermarkets, and online grocery platforms has enhanced product availability and visibility. Organized retail emphasizes quality assurance, cold-chain efficiency, and locally sourced produce, while digital channels enable convenient access, promotions, and subscription-based purchasing, collectively accelerating market growth in Dubai. For instance, in October 2025, CBD Life Sciences Inc., via its fully owned subsidiary CBD Vault, officially introduced its Mushroom-Infused Chocolate Bar in Dubai, combining the benefits of functional wellness with a luxurious, indulgent experience.

Market Dynamics:

Growth Drivers:

Why is the UAE Mushroom Market Growing?

Strategic Government Initiatives Supporting Agricultural Self-Sufficiency

The UAE government's comprehensive food security framework is creating favorable conditions for domestic mushroom production expansion. For instance, in February 2024, Masdar City, a sustainability and innovation hub in Abu Dhabi, partnered with agricultural technology firm Alesca Technologies to launch its first indoor vertical farm. The initiative aims to strengthen the local community while showcasing vertical farming as a practical solution to food security challenges, highlighting the role of advanced, localized agricultural technologies in sustainable urban development. National strategies prioritize reducing import dependency through investments in advanced agricultural technologies suited to arid climate conditions. Financial incentives, regulatory support, and infrastructure development initiatives are attracting both domestic entrepreneurs and international investors to establish mushroom cultivation facilities. Public-private partnerships are facilitating knowledge transfer and technology adoption, accelerating the development of commercially viable cultivation operations. These coordinated efforts are establishing the foundation for a robust domestic mushroom industry capable of meeting growing consumer demand while contributing to broader food security objectives.

Evolving Consumer Preferences Toward Health-Conscious and Plant-Based Diets

Shifting dietary patterns among UAE residents are driving increased mushroom consumption as health awareness intensifies across demographic segments. Consumers are increasingly recognizing mushrooms' nutritional benefits including high protein content, essential vitamins, minerals, and bioactive compounds associated with immune support and cognitive health. The growing popularity of flexitarian, vegetarian, and vegan lifestyles positions mushrooms as essential ingredients providing meat-like textures and savory flavors without animal-derived content. Social media influence, health and wellness content creators, and culinary programming are amplifying awareness of mushrooms' versatility and nutritional value. This evolving consumer consciousness creates sustained demand growth opportunities across retail, foodservice, and direct-to-consumer channels.

Technological Advancements in Controlled-Environment Agriculture

Innovations in indoor farming technologies are transforming mushroom cultivation possibilities in the UAE's challenging desert environment. Controlled-environment agriculture systems utilizing vertical farming configurations, automated climate control, and precision growing technologies enable year-round production independent of external weather conditions. These systems optimize resource utilization, achieving significant water savings compared to traditional farming methods while maintaining consistent product quality and yield. Advances in substrate innovation, including utilization of locally available agricultural byproducts, support circular economy principles while reducing production costs. The integration of artificial intelligence and data analytics enhances cultivation efficiency through real-time monitoring and predictive management capabilities.

Market Restraints:

What Challenges the UAE Mushroom Market is Facing?

High Initial Capital Requirements for Cultivation Infrastructure

Establishing commercial mushroom cultivation facilities in the UAE requires substantial capital investment in specialized infrastructure, including climate-controlled growing environments, automated systems, and cold chain logistics. The technical complexity of maintaining optimal growing conditions in extreme climate zones increases operational costs and expertise requirements. These barriers limit market entry for smaller entrepreneurs and constrain the pace of domestic production capacity expansion.

Limited Consumer Awareness of Specialty Mushroom Varieties

While button mushrooms enjoy widespread recognition, consumer familiarity with specialty varieties including shiitake, oyster, and lion's mane remains limited. Educational gaps regarding taste profiles, nutritional benefits, and culinary applications constrain demand growth for premium mushroom products. The multicultural consumer base presents diverse preference patterns requiring targeted marketing approaches to effectively build awareness and trial across different demographic segments.

Import Dependency and Supply Chain Vulnerabilities

Despite growing domestic cultivation capacity, the UAE remains significantly dependent on imports for processed mushroom products and certain specialty varieties. This reliance exposes the market to international supply chain disruptions, currency fluctuations, and quality consistency challenges. Transportation complexities for perishable products and import regulatory requirements add cost layers that can impact retail pricing and market competitiveness.

Competitive Landscape:

The UAE mushroom market competitive landscape is characterized by a dynamic mix of established local cultivators, regional agricultural enterprises, and innovative agritech startups. Market participants are differentiating through technology adoption, sustainable cultivation practices, and product innovation targeting health-conscious and environmentally aware consumers. The competitive environment is intensifying as new entrants leverage controlled-environment agriculture technologies to establish domestic production capabilities, challenging traditional import-dependent supply models. Strategic partnerships between local producers and retail chains are creating preferential distribution arrangements that enhance market access. The emergence of specialty mushroom producers focusing on premium varieties for foodservice applications is diversifying the competitive landscape beyond commodity-focused button mushroom suppliers. Investment activity from both domestic and international sources signals confidence in market growth potential.

Recent Developments:

-

In October 2025, MIRAK Group and Astoria announced the development of a mushroom production facility in Al Ain valued at approximately USD 49.5 million. The facility, supported by Abu Dhabi Agriculture and Food Safety Authority and Abu Dhabi Investment Office, will utilize AI-based production systems in climate-controlled environments to produce substantial volumes of fresh and processed mushrooms annually.

-

In January 2025, Emirates airline expanded its vegan menu across all cabin classes and lounges, featuring innovative plant-based dishes incorporating mushroom-based options. The airline serves over four hundred thousand plant-based meals annually, sourcing fresh produce from local hydroponic farms.

UAE Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE mushroom market size was valued at USD 366.56 Million in 2025.

The UAE mushroom market is expected to grow at a compound annual growth rate of 5.56% from 2026-2034 to reach USD 596.46 Million by 2034.

Button mushroom dominated with a 40.8% market share in 2025, attributed to its widespread consumer acceptance, versatile culinary applications, and cost-effective cultivation processes that support mass market availability.

Key factors driving the UAE mushroom market include government initiatives supporting food security and agricultural self-sufficiency, rising consumer health consciousness driving plant-based diet adoption, and technological advancements in controlled-environment agriculture enabling year-round local production.

Major challenges include high initial capital requirements for establishing cultivation infrastructure in desert conditions, limited consumer awareness of specialty mushroom varieties and their benefits, continued import dependency for processed products, and supply chain complexities affecting perishable product quality and availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)