UAE Online Food Delivery Market Size, Share, Trends and Forecast by Platform Type, Business Model, Payment Method, and Region, 2025-2033

UAE Online Food Delivery Market Size and Share:

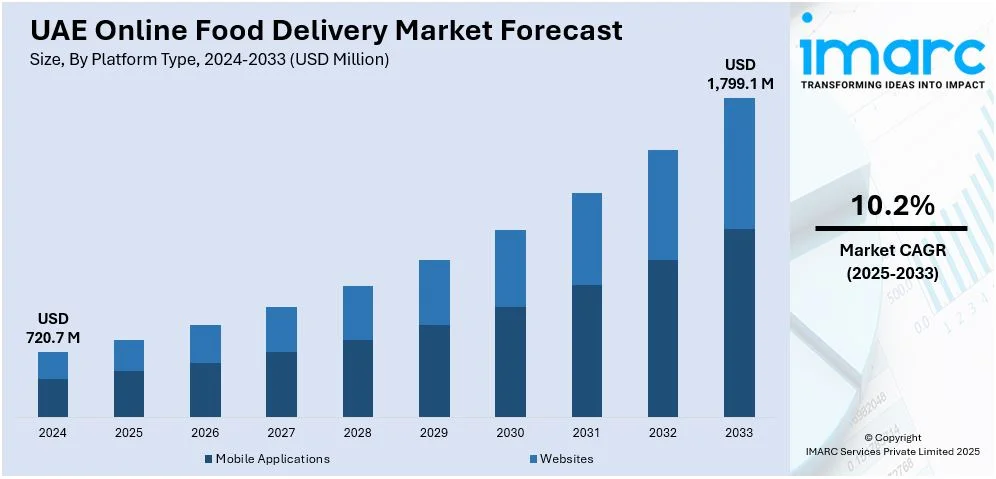

The UAE online food delivery market size was valued at USD 720.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,799.1 Million by 2033, exhibiting a CAGR of 10.2% from 2025-2033. The market is primarily driven by the escalating demand for convenient dining solutions, widespread smartphone usage with advanced internet access, and the increasing preference for international cuisines among the diverse expatriate population. Additionally, the influence of social media, availability of secure payment methods, and collaborations with local restaurants are improving consumer engagement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 720.7 Million |

| Market Forecast in 2033 | USD 1,799.1 Million |

| Market Growth Rate (2025-2033) | 10.2% |

The market in the UAE is primarily driven by the accelerating demand for convenient dining solutions among tech-savvy consumers. In line with this, the increasing adoption of smartphones with seamless internet connectivity enabling users to order food on the go is facilitating market expansion. For instance, as per a report by Digital Portal, UAE's 2024 digital landscape presented high internet penetration at 99%, with 9.46 million internet users, and widespread mobile connectivity. Social media engagement was also strong, with 10.73 million active users, accounting for 112% of the total population, reflecting multiple account usage; the median mobile internet speed in the UAE is also 324.92 Mbps, indicating the country has advanced digital infrastructure that enables seamless online experiences. Moreover, the increasing popularity towards international cuisines that get support from the multi shade expatriate communities is acting as an appropriate growth-inducing factor towards the market. Besides that, the growing impact through social media platforms related with online food delivery services drives consumer engagement and pushes the growth of the market.

Additionally, growing accessibility to several payment methods providing secure and hassle-free transactions is further improving customer satisfaction and propelling the market forward. In addition, rising partnerships between food delivery services and local restaurants are further increasing service lines and geographic presence. For instance, as per an article by QSRweb, Subway UAE has joined forces with Excellence Hot Sauce to launch localized menu items inspired by UAE cafeteria culture. The three innovative creations will combine traditional ingredients such as crispy chicken and tender beef with Excellence Hot Sauce and chips. This initiative celebrates local flavors while offering a nostalgic yet modern dining experience that resonates with the region's vibrant culinary and cultural identity. Furthermore, a significant adoption of eco-friendly packaging solutions addressing sustainability issues is also driving the market forward. In addition, inflationary disposable incomes are further giving customers the liberty to seek premium meal delivery services and increase the overall growth of the market.

UAE Online Food Delivery Market Trends:

Rise of Cloud Kitchens

The market is experiencing an escalating trend in the adoption of cloud kitchens, that focuses only on delivery, without dine-in facilities. For instance, as per industry reports, cloud kitchens, also known as dark or ghost kitchens, are rapidly transforming the UAE's food and beverage sector by allowing restaurants to expand their reach efficiently. The kitchens minimize operational costs by removing the need for dine-in facilities while capitalizing on growing demand for home delivery. With support from delivery aggregators such as Deliveroo, Chatfood, Noon, and Zomato, cloud kitchens cater to the changing consumer preference for convenience and quick service, driving significant market growth in the region. These kitchens optimize their costs of operations and meet a growing demand for online orders. With increasing urbanization and a tech-savvy population, cloud kitchens are efficiently meeting the demand for quick, affordable, and diverse cuisine options. Furthermore, these facilities are using advanced analytics to predict consumer preferences and thereby have high customer satisfaction. The flexibility of scaling operations has further attracted investments in cloud kitchens, which is making them an important part of the food delivery ecosystem.

Use of Advanced Technology

Leveraging advanced technologies are revolutionizing the market, especially with platforms integrating AI and machine learning for personalized recommendations and efficient route optimization. Real-time tracking of orders and user-friendly mobile apps are improving customer experience, driving loyalty and retention. For instance, as per a report by EIN Press wire, the UAE catering industry is experiencing drastic digital transformation through Blast Catering's innovative end-to-end platform. The platform unifies procurement, menu management, and client services in one digital solution to streamline the entire operation. This modernization will bring efficiency and customer satisfaction as the region becomes more tech-driven in its business models. Moreover, automation, in the form of robotic delivery and smart kitchen solutions, is improving operational efficiency and shortening delivery times. These technological advancements are satisfying the demand for faster, more reliable services while also catering to the expectations of a digitally connected and convenience-driven consumer base.

Growth of Healthy and Organic Food Options

Demand in the UAE is driven from growing health awareness among residents through healthy and organic food deliveries. Moreover, consumers are making their diets balanced along with sustainability in food while more platforms are catering for that trend. Most operators include a special menu in relation to low-calorie products and those with gluten-free options along with organically prepared goods to fulfill the demand and keep it in line. Agreements with specialty restaurants along with local farms serve for quality and freshness on order. This trend is in accordance with a larger global move towards wellness, making it a key factor in changing consumer behavior in the UAE food delivery market.

UAE Online Food Delivery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UAE online food delivery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on platform type, business model, and payment method.

Analysis by Platform Type:

- Mobile Applications

- Websites

Mobile applications are an integral part of the UAE food delivery market. They provide users with smooth and convenient ordering experiences. The high penetration of smartphones and strong internet speeds enable apps to deliver real-time tracking, personalized recommendations, and multiple payment options. Their user-friendly interfaces and integrations with loyalty programs enhance customer satisfaction, making them a preferred choice for consumers seeking quick and efficient service.

Websites are very important to the UAE food delivery market for providing a platform through desktop and mobile users who wish to order food items reliably. They enable consumers to peruse menus, modify their orders, and take advantage of promotions without needing app downloads. Moreover, they cover a wider range, and tourists and expatriates can also access this using multilingual options and more seamless payment gateways., accelerating market growth.

Analysis by Business Model:

.webp)

- Order Focused Food Delivery System

- Logistics-based Food Delivery System

- Full Service Food Delivery System

An order-centric food delivery system is crucial in the UAE food delivery market since it emphasizes streamlining the ordering process through user-friendly apps and platforms. This order-centric system ensures smooth interaction between customers and restaurants and enhances convenience and customer satisfaction. Other features, such as real-time tracking and customized orders, appeal to the tech-savvy population, which drives demand and repeat usage.

A logistics-based food delivery system plays a very important role in ensuring timely deliveries while maintaining food quality in the UAE's market. Advanced route optimization and delivery management technologies are used to overcome challenges posed by busy urban areas. In addition, scalable logistics solutions help restaurants and delivery platforms scale up efficiently to meet the growing need for fast delivery services that are reliable.

A full-service food delivery system is important for the UAE as it allows for end-to-end solutions, from placing an order to delivering it. With services such as food preparation, packaging, and delivery under one roof, it is a comprehensive experience for the consumer. It helps restaurants with limited infrastructure reach more customers while maintaining consistency in quality.

Analysis by Payment Method:

- Online

- Cash on Delivery

The online presence in the UAE food delivery market is crucial, offering consumers easy access to a wide variety of dining options through apps and websites. High smartphone penetration and strong internet connectivity allow users to place orders easily at any time, thus driving market growth. Online platforms also offer personalized recommendations, tracking features, and secure payment options, enhancing user experience and fostering loyalty.

Cash on Delivery (COD) is one of the main payment methods in the food delivery market of the UAE, since consumers demand ease and security. This also reduces the threat of online fraud and allows customers to pay on receipt, thereby being satisfied with the items received. Thus, COD also attracts those unfamiliar with digital payments, thereby expanding the market and increasing accessibility.

Regional Analysis:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai is a key city in the UAE food delivery market due to its cosmopolitan lifestyle and a higher concentration of tech-savvy residents. The variety of cuisines required is driven by the diversified population, encouraging platforms to serve global tastes. In addition, advanced digital infrastructure in Dubai, coupled with a growing trend of online shopping, contributes to the growth of the food delivery sector.

The affluent population and a growing urbanization rate provide a significant contribution to the UAE food delivery market from Abu Dhabi. The importance of sustainability and wellness creates a focus for the city, which matches the recent demand for organic and healthy food options. Additionally, the government's investment into smart city initiatives supports a higher adoption of advanced delivery technologies, enhancing efficiency and the satisfaction of customers in this market.

Sharjah’s role in the UAE food delivery market stems from its thriving residential communities and demand for affordable food options. The city’s strategic location connects it to major metropolitan areas, facilitating efficient delivery services. Furthermore, Sharjah’s emphasis on cultural and local cuisines creates a unique niche for food delivery platforms, catering to the city’s diverse population and fostering market expansion.

Competitive Landscape:

The UAE online food delivery market is highly competitive, characterized by the presence of numerous platforms trying to capture market share through innovation and convenience. Companies are investing heavily in technology, including AI-driven personalization, real-time tracking, and efficient logistics, to improve the customer experience. The market is also seeing rapid diversification of offerings, such as healthy and organic meal options, to cater to evolving consumer preferences. Additionally, strategic partnerships with restaurants and the integration of environmentally friendly practices, such as sustainable packaging, are differentiating key players. The growing demand for convenience and quick delivery further intensifies competition within this dynamic industry.

The report provides a comprehensive analysis of the competitive landscape in the UAE online food delivery market with detailed profiles of all major companies.

Latest News and Developments:

- On December 18, 2024, Blast Catering introduced a new end-to-end digital platform revolutionizing the UAE catering industry. This platform integrates procurement, menu management, and client services into a unified system, enhancing operational efficiency and service quality. The initiative aligns with the UAE's push for digital innovation, offering a seamless and modernized experience for both caterers and clients.

- On February 19, 2024, Dubai Silicon Oasis (DSO) launched a pilot program introducing three autonomous food delivery robots, called “talabots,” to serve Cedre Villas residents. These AI-powered robots operate within a 3-kilometer radius, ensuring a 15-minute delivery time while enhancing efficiency and reducing carbon emissions. Equipped with sensors and algorithms, the robots prioritize community safety and privacy, marking a milestone in Dubai's shift towards sustainable and innovative delivery solutions.

UAE Online Food Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile Applications, Websites |

| Business Models Covered | Order Focussed Food Delivery System, Logistics-based Food Delivery System, Full Service Food Delivery System |

| Payment Methods Covered | Online, Cash on Delivery |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE online food delivery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE online food delivery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Online food delivery market encompasses platforms that enable users to order meals through mobile applications or websites. These platforms provide convenience, real-time tracking, multiple payment options, and access to diverse cuisines, catering to a tech-savvy population and a growing demand for quick and efficient dining solutions.

The UAE online food delivery market was valued at USD 720.7 Million in 2024.

IMARC estimates the UAE online food delivery market to exhibit a CAGR of 10.2% during 2025-2033.

The market is majorly driven by rising demand for convenient dining options, increasing smartphone adoption with advanced internet connectivity, and growing popularity of international cuisines among diverse expatriate communities. Furthermore, social media influence, secure payment options, and partnerships with local restaurants enhance consumer engagement and satisfaction, propelling the market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)