UAE Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

UAE Pallet Market Overview:

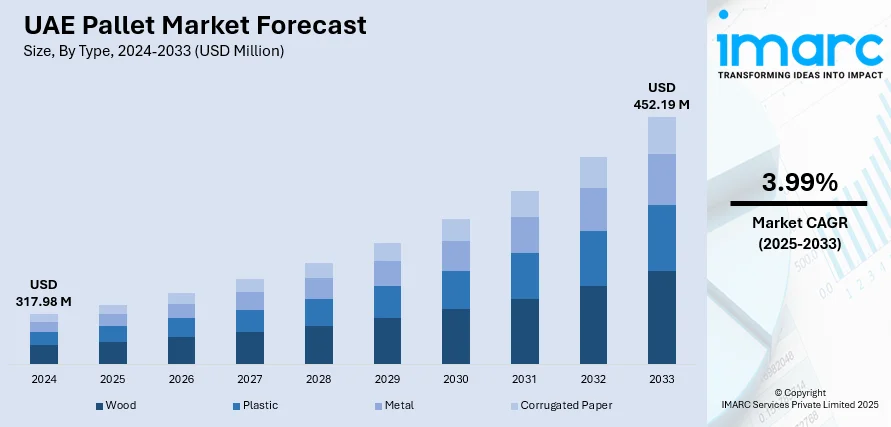

The UAE pallet market size reached USD 317.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 452.19 Million by 2033, exhibiting a growth rate (CAGR) of 3.99% during 2025-2033. The market is driven by robust national sustainability mandates compelling industries to adopt eco-friendly pallets made from recycled plastics and certified wood. Significant investments in automated logistics infrastructure necessitate pallets with precise dimensions, rigidity, and compatibility with robotic handling systems. Furthermore, the critical need for real-time tracking, inventory accuracy, and condition monitoring within complex supply chains accelerates the adoption of RFID and IoT-enabled smart pallets, further augmenting the UAE pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 317.98 Million |

| Market Forecast in 2033 | USD 452.19 Million |

| Market Growth Rate 2025-2033 | 3.99% |

UAE Pallet Market Trends:

Increasing Demand for Sustainable and Eco-Friendly Pallet Solutions

The market is experiencing a significant shift driven by robust national sustainability agendas like UAE Net Zero 2050, Dubai Industrial Strategy 2030 and growing corporate Environmental, Social, and Governance (ESG) commitments. Businesses across logistics, retail, and manufacturing are actively seeking alternatives to traditional wooden pallets to reduce their carbon footprint and waste. This is fueling substantial demand for pallets made from recycled materials (particularly recycled plastic) and sustainably sourced wood with certifications like FSC or PEFC. Plastic pallets, known for durability, reusability, hygiene, and longer lifespans, are gaining strong traction despite higher initial costs, as their lifecycle economics and environmental benefits become clearer. The UAE banking assets grew to AED 4.6 Trillion (USD 1.251 Trillion) in 2024, up by 12%. Retail credit increased by a significant 16.8%, while deposits grew by 12.9% due to strong demand and liquidity. Real estate loans increased by 3.5%, now making up 20% of the total bank lending. Non-performing loans also dropped to 4.7%, which is positive to finance and stability for the pallet industry. With 4.4% GDP growth forecast for 2025 and expansion of the Jaywan card scheme, UAE's financial infrastructure and pallet logistics are likely to benefit from a robust credit and payment infrastructure. Furthermore, pallet pooling services, which optimize pallet utilization and drastically reduce single-use pallet waste, are witnessing accelerated adoption. Regulatory pressures, such as Emirates Authority for Standardisation & Metrology (ESMA) standards, and customer demands for greener supply chains are compelling companies to integrate sustainable pallet choices as a core component of their logistics strategy, making eco-conscious pallets a dominant market trend.

To get more information on this market, Request Sample

Integration of Smart Technologies and Automation-Driven Pallet Design

The UAE's aggressive push towards becoming a global logistics and technology hub, exemplified by initiatives like Dubai's Silk Road Strategy and massive investments in automated ports (Jebel Ali) and warehouses, is profoundly impacting the UAE pallet market growth. There's a rising demand for pallets specifically designed for seamless integration with automated material handling systems (AMHS) like robotic forklifts (AGVs/AMRs) and automated storage and retrieval systems (AS/RS). This necessitates pallets with exceptional dimensional consistency, structural rigidity, and standardized features for reliable robotic handling. Concurrently, the adoption of smart pallets embedded with RFID tags, QR codes, or IoT sensors is accelerating. These technologies enable real-time pallet tracking throughout the supply chain, providing granular data on location, condition (temperature, shock, tilt), and inventory levels. This enhances visibility, improves inventory accuracy, optimizes asset utilization, reduces loss, and enables predictive maintenance. As UAE warehouses rapidly automate to boost efficiency and handle growing e-commerce volumes, the demand for both automation-compatible and sensor-equipped smart pallets is becoming a defining trend, moving pallets beyond simple platforms to active data nodes.

UAE Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

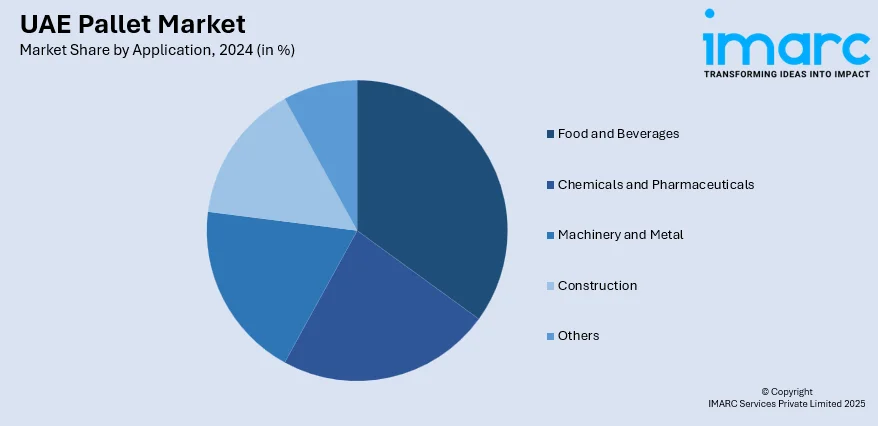

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE pallet market on the basis of type?

- What is the breakup of the UAE pallet market on the basis of application?

- What is the breakup of the UAE pallet market on the basis of structural design?

- What is the breakup of the UAE pallet market on the basis of region?

- What are the various stages in the value chain of the UAE pallet market?

- What are the key driving factors and challenges in the UAE pallet market?

- What is the structure of the UAE pallet market and who are the key players?

- What is the degree of competition in the UAE pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)