UAE Paneer Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2025-2033

UAE Paneer Market Overview:

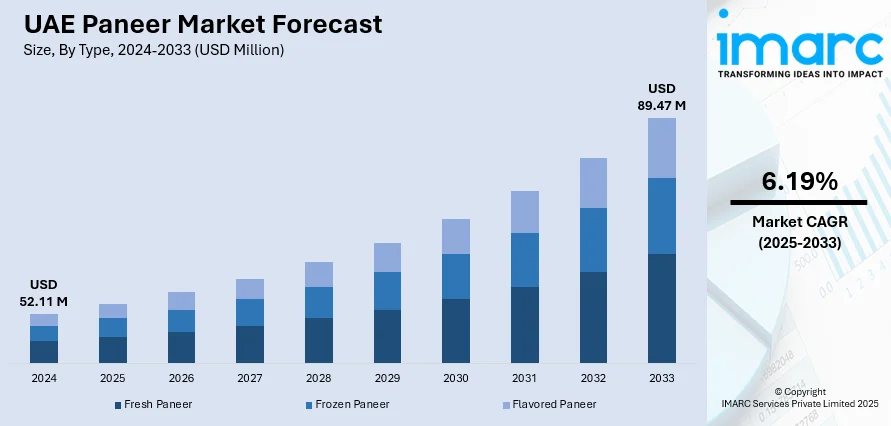

The UAE paneer market size reached USD 52.11 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 89.47 Million by 2033, exhibiting a growth rate (CAGR) of 6.19% during 2025-2033. Rising health awareness, growing expatriate population, expanding retail chains, increasing demand for vegetarian protein, aggressive product placement by Indian dairy brands, rising disposable incomes, and the influence of Indian cuisine in foodservice channels are some of the factors contributing to the UAE paneer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.11 Million |

| Market Forecast in 2033 | USD 89.47 Million |

| Market Growth Rate 2025-2033 | 6.19% |

UAE Paneer Market Trends:

Rising Demand for Functional Dairy in Retail

Consumer preference in the UAE is shifting toward dairy products that offer added health benefits. Retail shelves are seeing more probiotic-rich options, including items designed for lactose-intolerant shoppers and children. This shift is most visible in the growing selection of kefir-based beverages and high-protein cultured cheeses now available in major supermarkets. Imported products from health-conscious markets like the US are being prioritized, signaling strong demand for digestive wellness and functional nutrition. The appeal of convenience, gut health, and premium quality is pulling more buyers toward refrigerated dairy with active cultures. As UAE consumers become more selective, the market is becoming a launchpad for international brands offering differentiated, health-forward dairy lines. These factors are intensifying the UAE paneer market growth. For example, in November 2024, Lifeway Foods expanded its presence in the UAE, starting Q4 2024, with exports of 32oz kefir, 8oz lactose-free kefir, ProBugs, and farmer cheese. These US-made probiotic products hit shelves in Dubai supermarkets and hypermarkets across the Emirates. Announced during the Gulfood Manufacturing trade show, the move supports Lifeway’s global growth plans, led by CEO Julie Smolyansky, who emphasized the opportunity to scale and share health-focused products internationally.

To get more information on this market, Request Sample

Paneer Gaining Ground in Fine Dining

A shift is underway in how paneer is perceived and served in the UAE. No longer confined to traditional curries or casual meals, it's entering the upscale dining space as a main-course feature. A notable example is its use in a Sunday Roast format, merging Western dining customs with Indian flavors. With service at luxury venues in Abu Dhabi and Dubai, this signals a rise in consumer interest for refined, meat-free options rooted in Indian cuisine. The presence of paneer in such formats indicates a broader push to elevate vegetarian dishes and cater to diverse dietary preferences in premium settings, appealing to both local and international diners seeking familiar ingredients with elevated presentation. For example, in February 2025, Punjab Grill introduced the UAE’s first Indian-style Sunday Roast, featuring a vegetarian option with paneer as the star. Served every Sunday at The Ritz-Carlton, Abu Dhabi and Anantara Hotel, Downtown Dubai, the dish blends British roast tradition with rich Indian flavours. This move positions paneer as a gourmet centerpiece in the fine-dining scene, reflecting growing demand for premium Indian vegetarian offerings in the UAE market.

UAE Paneer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, end user, and distribution channel.

Type Insights:

- Fresh Paneer

- Frozen Paneer

- Flavored Paneer

The report has provided a detailed breakup and analysis of the market based on the type. This includes fresh paneer, frozen paneer, and flavored paneer.

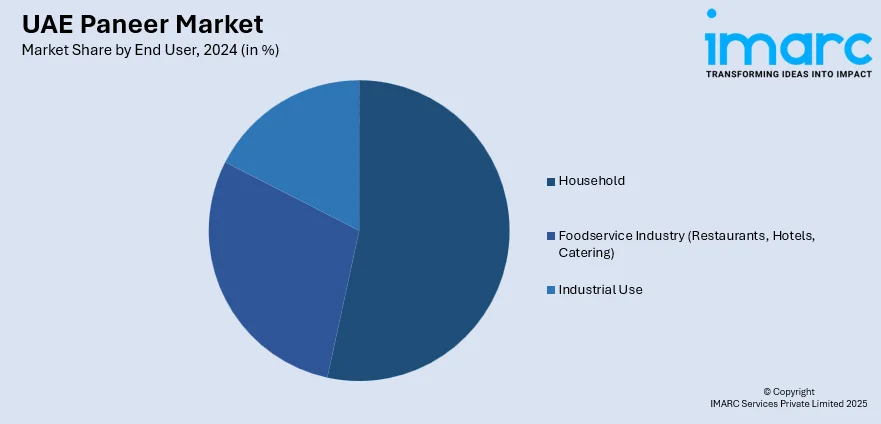

End User Insights:

- Household

- Foodservice Industry (Restaurants, Hotels, Catering)

- Industrial Use

The report has provided a detailed breakup and analysis of the market based on the end user. This includes household, foodservice industry (restaurants, hotels, catering), and industrial use.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Paneer Market News:

- In June 2025, Russia’s H&N entered the UAE dairy market with a trial export of 700 kg of cream and UHT milk under the Prostokvashino brand. The products, made at the halal-certified Yalutorovsk Dairy Plant, aim to establish Russian dairy in the Gulf's premium segment. H&N sees the UAE as a key market with rising demand for high-quality dairy and plans to expand its exports in the region.

UAE Paneer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fresh Paneer, Frozen Paneer, Flavored Paneer |

| End Users Covered | Household, Foodservice Industry (Restaurants, Hotels, Catering), Industrial Use |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE paneer market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE paneer market on the basis of type?

- What is the breakup of the UAE paneer market on the basis of end user?

- What is the breakup of the UAE paneer market on the basis of distribution channel?

- What is the breakup of the UAE paneer market on the basis of region?

- What are the various stages in the value chain of the UAE paneer market?

- What are the key driving factors and challenges in the UAE paneer market?

- What is the structure of the UAE paneer market and who are the key players?

- What is the degree of competition in the UAE paneer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE paneer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE paneer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE paneer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)