UAE Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

UAE Paper Packaging Market Overview:

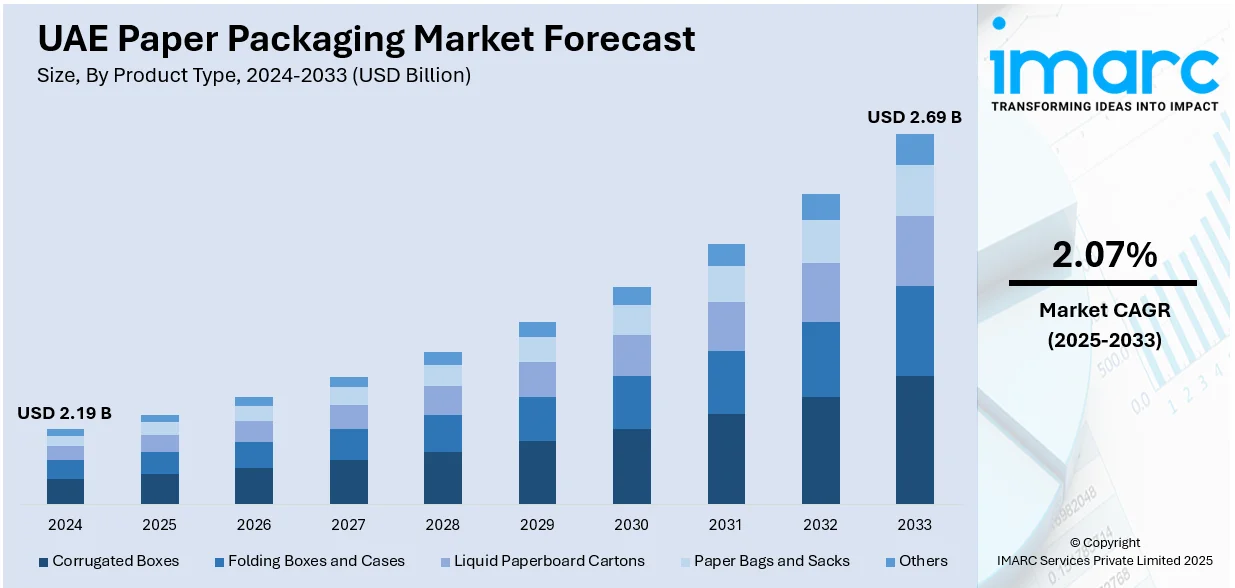

The UAE paper packaging market size reached USD 2.19 Billion in 2024. The market is projected to reach USD 2.69 Billion by 2033, exhibiting a growth rate (CAGR) of 2.07% during 2025-2033. The market is driven by strong sustainability regulations, including nationwide bans on single‑use plastics, pushing businesses toward recyclable and biodegradable alternatives. Moreover, the rapid expansion of the e‑commerce and retail enlargement have further increased the need for durable, customizable paper packaging for shipping and in‑store use, meeting consumer demand for eco‑friendly and visually appealing options thus supporting the UAE paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.19 Billion |

| Market Forecast in 2033 | USD 2.69 Billion |

| Market Growth Rate 2025-2033 | 2.07% |

UAE Paper Packaging Market Trends:

Boom in e‑commerce and retail expansion

The rapid growth of e‑commerce and the expansion of the retail sector are significantly boosting the UAE paper packaging market growth. Online shopping platforms require durable, lightweight packaging solutions that protect goods during shipping while reflecting brand quality, making paper-based solutions like corrugated boxes and pouches essential. Meanwhile, brick‑and‑mortar retailers are adopting eco‑friendly paper bags and cartons to provide customers with sustainable alternatives to plastic. These trends are also influenced by changing consumer preferences, as buyers increasingly value environmentally responsible packaging and a high-quality unboxing experience. Investments in logistics, warehousing, and last‑mile delivery further reinforce the need for high‑quality, versatile packaging. As retail experiences diversify spanning supermarkets, boutique stores, and online platforms the demand for customized, functional, and sustainable paper packaging continues to rise, cementing its role as a vital part of the UAE’s evolving retail landscape.

To get more information on this market, Request Sample

Regulatory push and sustainability mandates

The UAE government’s focus on sustainability has become a key UAE paper packaging market trend. With nationwide bans on single‑use plastics and the implementation of circular economy policies, businesses are under increasing pressure to adopt eco‑friendly alternatives. In Abu Dhabi alone, enforcing the ban on plastic bags reduced their usage by up to 95% within the first year, underscoring the impact of such measures. Paper packaging has emerged as the preferred solution because it is recyclable, biodegradable, and aligns with the country’s vision for reducing environmental impact. Retailers, food service providers, and manufacturers are rapidly shifting toward paper-based solutions to meet regulatory requirements and appeal to environmentally conscious consumers. These changes are accelerating innovation in packaging, encouraging the development of stronger, more versatile materials like corrugated boards, kraft paper, and folding cartons, solidifying paper packaging’s role in the UAE’s commercial ecosystem.

Growth in food & beverage, tourism, and industrial sectors

The expansion of the F&B industry, combined with growth in tourism and industrial activities, is a key driver for paper packaging in the UAE. Restaurants, cafes, and quick‑service outlets are increasingly adopting paper‑based containers, wraps, and bags to align with sustainability goals and meet customer expectations for eco‑friendly options. The tourism sector also contributes significantly, as hotels, resorts, and event organizers prioritize recyclable and visually appealing packaging to enhance their guests’ experience. Additionally, the country’s expanding industrial sector depends on kraft and corrugated paper solutions for transporting and storing goods efficiently. These sectors collectively create a consistent and diverse demand for different types of paper packaging, from food‑grade containers to heavy‑duty cartons. This synergy between consumer‑facing industries and industrial applications positions paper packaging as an essential component of the UAE’s economic and environmental development strategy.

UAE Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

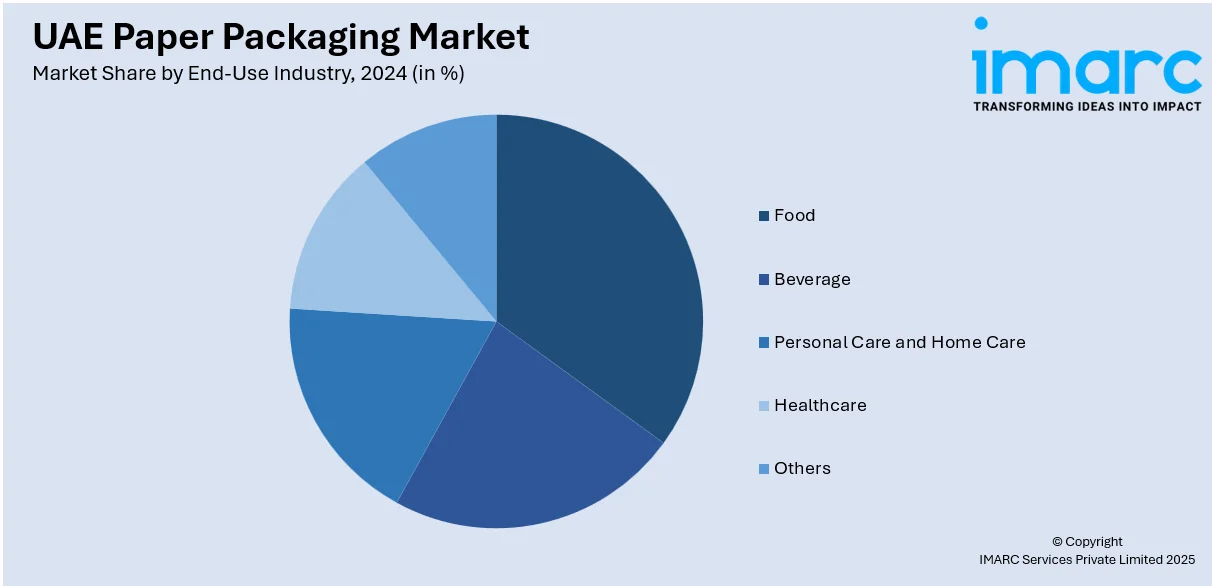

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Paper Packaging Market News:

- In July 2025, The UAE launched the region’s first extended producer responsibility (EPR) pilot to enhance management of electronic and packaging waste. Rolled out in Abu Dhabi and Dubai, the initiative requires manufacturers and brand owners to take accountability for post-consumer waste. Implemented through a Memorandum of Understanding, it encourages private-sector engagement and investment in sustainable waste solutions, reinforcing the nation’s commitment to advancing circular economy practices and reducing environmental impact.

- In November 2024, Tetra Pak, in partnership with Union Paper Mills (UPM), launched the UAE’s first recycling line for carton packages, investing AED 2.5 million. Located in Dubai, the facility can recycle 10,000 tonnes of post-consumer cartons annually, diverting waste from landfills and supporting circular economy goals. The initiative aligns with the UAE Green Agenda 2030 and upcoming Extended Producer Responsibility (EPR) regulations, enhancing recycling infrastructure and promoting sustainability in the food and beverage packaging sector.

- In September 2024, A new business group, DuPAT, been launched under the Dubai Chamber of Commerce and Industry to promote ‘Made in UAE’ paper and tissue products locally and globally. Announced at the ProPaper exhibition, DuPAT aims to boost the UAE’s $2 billion corrugated board and tissue paper industry, enhance exports, and support Net Zero 2050 goals. The group will also ensure compliance with GCC and ESMA standards, fostering sustainability and fair competition in the sector.

UAE Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE paper packaging market on the basis of product type?

- What is the breakup of the UAE paper packaging market on the basis of grade?

- What is the breakup of the UAE paper packaging market on the basis of packaging level?

- What is the breakup of the UAE paper packaging market on the basis of end-use industry?

- What is the breakup of the UAE paper packaging market on the basis of region?

- What are the various stages in the value chain of the UAE paper packaging market?

- What are the key driving factors and challenges in the UAE paper packaging market?

- What is the structure of the UAE paper packaging market and who are the key players?

- What is the degree of competition in the UAE paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)