UAE Plywood Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

UAE Plywood Market Overview:

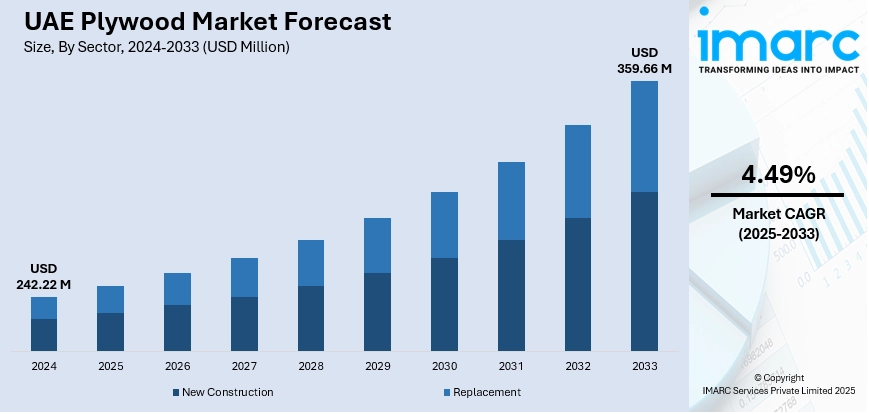

The UAE plywood market size reached USD 242.22 Million in 2024. The market is projected to reach USD 359.66 Million by 2033, exhibiting a growth rate (CAGR) of 4.49% during 2025-2033. Increasing export-driven production is creating the need for large-scale, efficient, and high-quality manufacturing. Besides this, with the government allocating resources for roads, industrial parks, schools, and hospitals, the demand for construction materials that are sturdy, lightweight, and manageable is rising, thereby fueling the UAE plywood market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 242.22 Million |

| Market Forecast in 2033 | USD 359.66 Million |

| Market Growth Rate 2025-2033 | 4.49% |

UAE Plywood Market Trends:

Rising export-driven production

Increasing export-driven manufacturing is offering a favorable market outlook. As per the WTO, in 2024, foreign trade hit AED 5.23 Trillion, resulting in a trade surplus of AED 492.3 Billion, establishing the UAE as a key export player. The UAE is placing a strong emphasis on manufacturing plywood for global markets. With international purchasers seeking trustworthy and cost-effective plywood sources, the UAE's competitive rates, proficient workforce, and consistent raw material availability are rendering it an appealing choice. Producers are putting money into advanced machinery, technology, and quality assurance for adhering to rigorous export regulations, enhancing the overall capacity and quality of the plywood sector. Manufacturing aimed at exports is promoting the utilization of certified and environment-friendly wood, since worldwide markets frequently demand sustainability criteria. The ongoing influx of international orders provides local manufacturers with economic security. It is generating employment and enhancing the UAE’s standing as a leading plywood provider. The focus on exports is resulting in specialization in various grades and kinds of plywood, including moisture-resistant and marine plywood, customized to meet user requirements. With increasing global demand, factories are expanding and innovating to remain competitive. This export-driven strategy is fostering the ongoing modernization of the industry.

To get more information on this market, Request Sample

Increasing infrastructure development

Rising infrastructure development is impelling the UAE plywood market growth. With the government's focus on developing roads, bridges, airports, industrial parks, schools, and hospitals, the demand for construction materials, such as plywood that is durable, lightweight, and manageable, is rising. Plywood is frequently utilized for formwork in concrete pouring, temporary constructions, scaffolding bases, wall coverings, and flooring. Its affordability and ability to be reused render it perfect for extensive infrastructure initiatives. With the UAE's ongoing urbanization activities and the expansion of its transport and utility systems, construction efforts are increasing significantly, leading to higher plywood employment. The swift expansion of industrial areas and public facilities is drawing in additional private investments, thereby intensifying the demand. Moreover, plywood producers are gaining from large orders and extended agreements, motivating them to expand production capabilities and enhance product quality. Rising focus on infrastructure advancement is enhancing logistics and transportation, enabling plywood factories to distribute their products more effectively nationwide. Overall, increasing construction activities in the UAE are catalyzing the demand for plywood and refining the entire wood processing sector. According to the IMARC Group, the UAE construction market size is set to exhibit a growth rate (CAGR) of 4.8% during 2025-2033.

UAE Plywood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and sector.

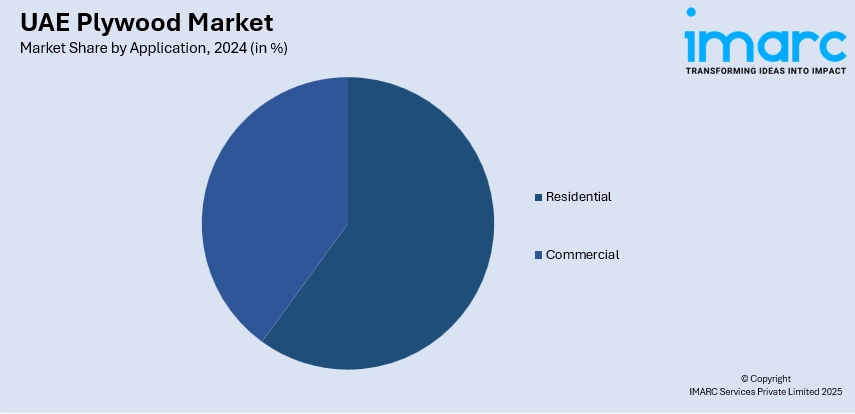

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Plywood Market News:

- In April 2025, the Dubai WoodShow was set to be conducted at the Dubai World Trade Center. At its specific booth, Sveza would display examples of film-faced plywood featuring a moisture-resistant layer and a unique grid pattern on the surface, intended for cast-in-place and high-rise buildings.

UAE Plywood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE plywood market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE plywood market on the basis of application?

- What is the breakup of the UAE plywood market on the basis of sector?

- What is the breakup of the UAE plywood market on the basis of region?

- What are the various stages in the value chain of the UAE plywood market?

- What are the key driving factors and challenges in the UAE plywood market?

- What is the structure of the UAE plywood market and who are the key players?

- What is the degree of competition in the UAE plywood market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE plywood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE plywood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE plywood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)