UAE Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

UAE Private Equity Market Overview:

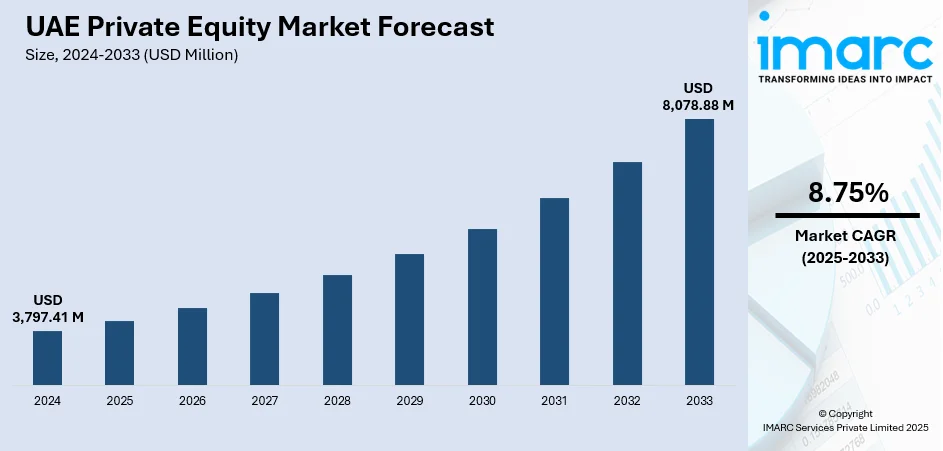

The UAE private equity market size reached USD 3,797.41 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 8,078.88 Million by 2033, exhibiting a growth rate (CAGR) of 8.75% during 2025-2033. Economic diversification, strong sovereign backing, and tax-friendly policies are key drivers. Strategic investments in fintech, logistics, and health sectors also enhance attractiveness. High liquidity and government-led reform agendas significantly contribute to expanding UAE private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,797.41 Million |

| Market Forecast in 2033 | USD 8,078.88 Million |

| Market Growth Rate 2025-2033 | 8.75% |

UAE Private Equity Market Trends:

Diversification into Non-Oil Sectors

The UAE’s strategic shift from oil dependence to a knowledge-driven economy is creating fertile ground for private equity. Investments are increasingly flowing into sectors such as renewable energy, healthcare, education, and logistics. Government initiatives like Vision 2030 and the Abu Dhabi Industrial Strategy are catalyzing sectoral diversification and innovation. Private equity plays a pivotal role by financing scalable businesses aligned with these national priorities. This structural reallocation of capital enhances long-term returns and underpins sustainable UAE private equity market growth. For instance, as of July 2025, EQT and Eurazeo are leading a wave of over USD 700 billion in private equity and asset managers expanding into the UAE. These firms, including EQT, Eurazeo, Pollen Street Capital, Baron Capital, Silver Point, are setting up offices in Abu Dhabi and Dubai, launching regional funds, and partnering with sovereign wealth funds like Mubadala and ADQ. The expansion is driven by the UAE’s deep capital pools, business-friendly regulations, advanced infrastructure, and a push into sectors like infrastructure, clean energy, and technology.

To get more information on this market, Request Sample

Rise of Sovereign Co-Investments

Sovereign wealth funds, particularly Mubadala and ADQ, are actively co-investing with private equity firms in both domestic and international deals. These collaborations offer deep market knowledge, operational synergies, and long-term capital commitment. Co-investment strategies are gaining traction as they reduce risk and maximize control over assets. The presence of sovereign partners also improves credibility and access to strategic sectors. This institutional framework positions the UAE as a hub for sophisticated, high-value transactions, fostering enduring UAE private equity market growth. For instance, in May 2024, Abu Dhabi-based Eshraq Investments unveiled a new strategy focused on building directly-held private equity (PE) investments in high-growth GCC companies, targeting 5–7 year investment horizons. This shift emphasizes long-term value creation and is supported by cash flow from minority equity stakes, fixed-income assets, and real estate. The move marks a strategic realignment as Eshraq seeks to deepen its role in the region’s PE landscape, leveraging local market opportunities while maintaining diversified income sources.

UAE Private Equity Market Segmentation:

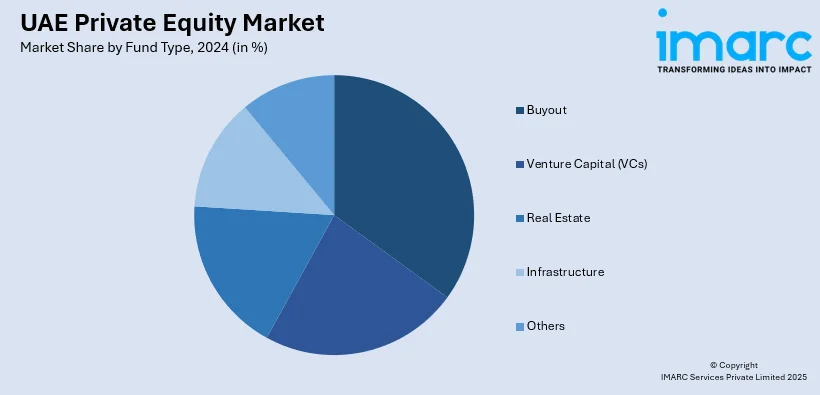

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on fund type.

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Private Equity Market News:

- In July 2025, private equity firm Permira announced that it will open a Dubai office in 2025 to deepen ties with Middle Eastern investors, particularly sovereign wealth funds. This expansion into the UAE aligns with growing regional interest in alternative assets and private equity. The new office, located in DIFC, will focus on strategic partnerships and local investment. Permira joins peers like General Atlantic and PGIM in strengthening their Gulf presence. With €80 billion in capital, its portfolio includes Klarna, Flix, and Golden Goose.

UAE Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE private equity market on the basis of fund type?

- What is the breakup of the UAE private equity market on the basis of region?

- What are the various stages in the value chain of the UAE private equity market?

- What are the key driving factors and challenges in the UAE private equity market?

- What is the structure of the UAE private equity market and who are the key players?

- What is the degree of competition in the UAE private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)