UAE Protein Supplements Market Size, Share, Trends and Forecast by Type, Form, Source, Application, Distribution Channel, and Region, 2026-2034

UAE Protein Supplements Market Summary:

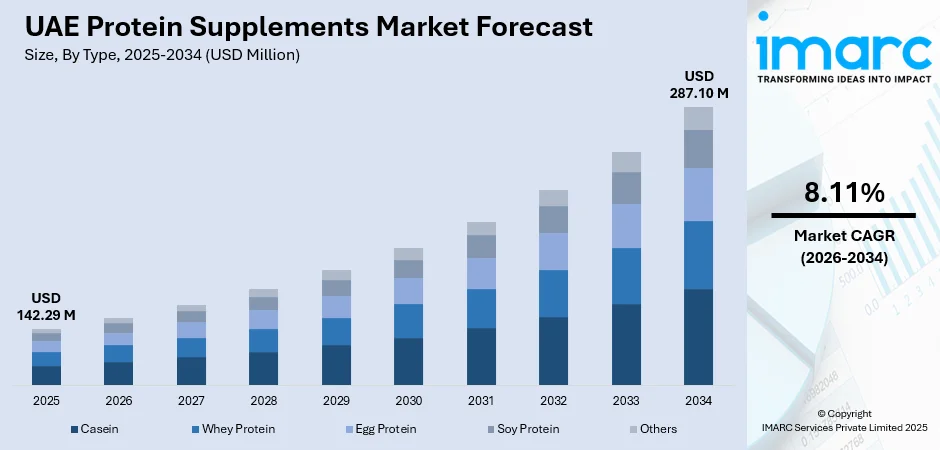

The UAE protein supplements market size was valued at USD 142.29 Million in 2025 and is projected to reach USD 287.10 Million by 2034, growing at a compound annual growth rate of 8.11% from 2026-2034.

The market is driven by increasing health consciousness among consumers, growing fitness culture, expanding gym infrastructure, and rising demand for convenient nutrition solutions. The preference for clean-label and sustainably sourced products is reshaping consumer purchasing behavior. Advanced retail networks and robust e-commerce platforms are enhancing product accessibility across urban centers, further strengthening UAE protein supplements market share.

Key Takeaways and Insights:

-

By Type: Whey protein dominates the market with a share of 48% in 2025, driven by its superior amino acid profile, rapid absorption characteristics, and strong preference among fitness enthusiasts seeking effective muscle recovery solutions.

-

By Form: Protein powder leads the market with a share of 54% in 2025, owing to its versatility in consumption methods, cost-effectiveness compared to ready-to-drink alternatives, and customizable serving sizes.

-

By Source: Animal‑based represents the largest segment with a market share of 69% in 2025, attributed to higher bioavailability, complete essential amino acid profiles, and long-standing acceptance within the sports nutrition community.

-

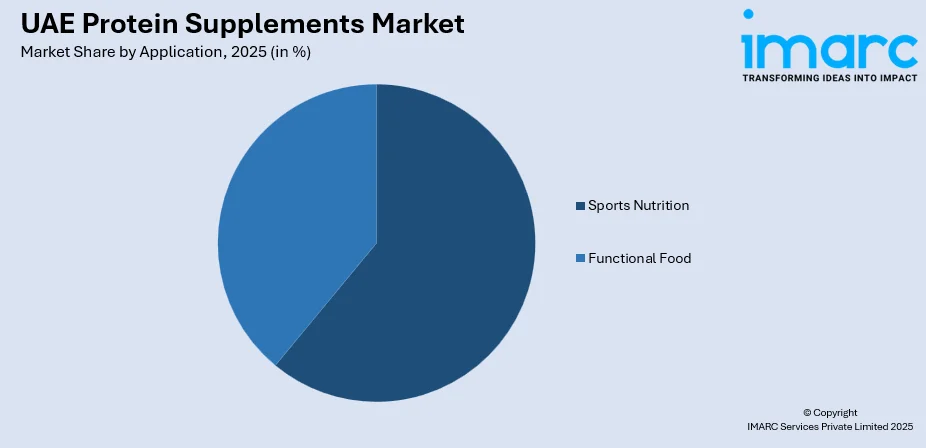

By Application: Sports nutrition dominates the market with a share of 61% in 2025, fueled by expanding gym memberships, growing participation in competitive athletics, and increasing awareness about post-workout recovery benefits.

-

By Distribution Channel: Supermarkets and hypermarkets represent the largest segment with a market share of 38% in 2025, driven by consumer preference for physical product evaluation, immediate availability, and trust associated with established retail environments.

-

Key Players: The UAE protein supplements market exhibits a dynamic competitive landscape, with international nutrition brands competing alongside regional wellness companies across premium and value segments, driving continuous product innovation and marketing differentiation.

To get more information on this market Request Sample

The UAE protein supplements market is experiencing robust expansion, propelled by evolving consumer lifestyles and heightened awareness regarding nutritional well-being. The nation's growing fitness culture, supported by extensive gym infrastructure and wellness initiatives, has cultivated a health-conscious population increasingly invested in dietary supplementation. In January 2025, GymNation’s UAE & KSA Health & Fitness Report revealed 92% aspire to healthier lives, with affordability and ‘gymtimidation’ as key barriers to gym participation. Moreover, rising disposable incomes enable consumers to prioritize premium nutrition products that align with their fitness objectives and lifestyle aspirations. Government initiatives promoting active living and combating lifestyle diseases have further reinforced demand for protein-enriched solutions. The influx of expatriate populations brings diverse dietary preferences, expanding the addressable consumer base across various demographic segments. Additionally, social media influence and fitness influencer endorsements have accelerated product awareness and adoption, particularly among younger demographics seeking performance optimization and aesthetic goals through scientifically formulated supplementation.

UAE Protein Supplements Market Trends:

Personalized Nutrition and Customized Formulations

Consumer demand for personalized nutrition solutions is reshaping the protein supplements landscape in the UAE. Individuals increasingly seek formulations tailored to their specific fitness goals, dietary restrictions, and metabolic requirements. This trend has encouraged manufacturers to develop specialized product lines addressing distinct consumer needs, including weight management, muscle building, and endurance enhancement. The integration of digital platforms offering personalized nutrition recommendations based on individual health profiles is gaining traction. In September 2025, Swiss brand Nooria launched its Personalized Supplement Program in the UAE, providing tailored, science-backed plans to enhance energy, immunity, focus, and stress management for individual health goals. Further, consumers now expect products that accommodate their unique physiological characteristics and lifestyle patterns, moving beyond one-size-fits-all solutions toward customized supplementation protocols.

Expansion of Plant-Based Protein Alternatives

The rising interest in plant-based nutrition is significantly influencing product development within the UAE protein supplements market. Consumers motivated by environmental sustainability, ethical considerations, and digestive wellness are increasingly exploring alternatives derived from peas, rice, hemp, and other botanical sources. As per sources, Switzerland-based Planted, Europe’s fastest-growing alternative protein startup, entered the UAE through a FoodService partnership, bringing plant-based meat alternatives to hotels, restaurants, and retail outlets. Moreover, this shift reflects broader dietary trends favoring reduced animal product consumption while maintaining adequate protein intake. Manufacturers are investing in improving taste profiles, texture, and nutritional completeness of plant-based formulations to appeal to mainstream consumers. The growing availability of vegan-certified options across retail channels demonstrates the segment's expanding commercial viability and consumer acceptance.

Integration of Functional Ingredients and Enhanced Formulations

Protein supplements are increasingly incorporating functional ingredients that deliver benefits beyond basic nutrition. Consumers seek products enhanced with vitamins, minerals, probiotics, digestive enzymes, and adaptogenic compounds that support holistic wellness. In November 2025, US brand Core Nutritionals launched in the UAE through Vivandi Distribution, providing science-backed, fully transparent sports supplements for strength, endurance, recovery, and hydration to athletes and fitness enthusiasts. Moreover, this multifunctional approach addresses consumer desires for convenience and comprehensive health solutions within single products. The trend toward enhanced formulations reflects growing sophistication in consumer understanding of nutritional science and supplementation strategies. Manufacturers are responding by developing innovative products that combine protein delivery with additional health-promoting compounds, creating differentiated offerings that command premium positioning within the competitive marketplace.

Market Outlook 2026-2034:

The UAE protein supplements market is positioned for sustained revenue growth throughout the forecast period, driven by expanding health consciousness and evolving consumer preferences. Market revenue is expected to benefit from continued infrastructure development, increasing fitness facility penetration, and growing e-commerce adoption. The premiumization trend will support revenue expansion as consumers increasingly favor high-quality, scientifically formulated products. Demographic factors, including a youthful population and growing expatriate communities, will sustain demand momentum. Innovation in product formulations and distribution strategies will create additional revenue opportunities across emerging consumer segments. The market generated a revenue of USD 142.29 Million in 2025 and is projected to reach a revenue of USD 287.10 Million by 2034, growing at a compound annual growth rate of 8.11% from 2026-2034.

UAE Protein Supplements Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Whey Protein | 48% |

| Form | Protein Powder | 54% |

| Source | Animal‑Based | 69% |

| Application | Sports Nutrition | 61% |

| Distribution Channel | Supermarkets and Hypermarkets | 38% |

Type Insights:

- Casein

- Whey Protein

- Egg Protein

- Soy Protein

- Others

Whey protein dominates with a market share of 48% of the total UAE protein supplements market in 2025.

Whey protein maintains its dominant position within the UAE protein supplements market owing to its exceptional nutritional profile and proven efficacy in supporting muscle protein synthesis. Derived from milk during cheese production, whey offers a complete amino acid spectrum with high concentrations of branched-chain amino acids essential for muscle recovery and growth. The rapid absorption characteristics make it particularly valuable for post-workout consumption when nutrient uptake is optimized. According to sources, in June 2024, MuscleBlaze introduced its BIOZORB whey protein in Dubai, UAE, providing a clinically proven 50% increase in protein absorption, enhancing post-workout recovery and supporting lean muscle growth for athletes.

Consumer preference for whey protein stems from decades of scientific research validating its effectiveness for various fitness objectives. The segment benefits from extensive product variety, ranging from concentrate to isolate and hydrolysate forms, accommodating different purity requirements and price sensitivities. Manufacturing advancements have improved taste profiles and solubility, enhancing overall consumer experience and supporting sustained demand across fitness enthusiast demographics.

Form Insights:

- Protein Powder

- Protein Bars

- Ready to Drink

- Others

The protein powder leads with a share of 54% of the total UAE protein supplements market in 2025.

Protein powder dominates the UAE market through its unparalleled versatility and value proposition compared to alternative formats. Consumers appreciate the flexibility to customize serving sizes, mix with various beverages, and incorporate into recipes, enabling personalized consumption experiences. The extended shelf stability and efficient packaging minimize waste while maximizing convenience for regular users maintaining consistent supplementation regimens.

The cost efficiency of powder formats compared to ready-to-drink alternatives makes protein supplementation accessible across broader consumer segments. Storage convenience and transportation ease further enhance appeal for consumers integrating supplementation into active lifestyles. The wide availability across retail channels and diverse flavor options cater to varied taste preferences, supporting the segment's continued leadership within the overall market structure. In October 2025, Core Nutritionals and Unmatched entered the UAE market through Vivandi Distribution, debuting their protein and sports-nutrition range at the Dubai Muscle Show 2025, strengthening regional presence.

Source Insights:

- Animal-Based

- Plant-Based

Animal‑based exhibits a clear dominance with a 69% share of the total UAE protein supplements market in 2025.

Animal-based sources command the largest market share, reflecting consumer confidence in their nutritional superiority and established track record. These proteins deliver complete essential amino acid profiles with high biological value, ensuring efficient utilization for muscle tissue synthesis and repair. The familiarity and acceptance developed over decades of sports nutrition history reinforce consumer preference for animal-derived formulations.

Whey, casein, and egg proteins offer distinct absorption characteristics enabling strategic supplementation timing throughout daily nutrition protocols. As per sources, in February 2024, ProUp debuted its dairy-free egg-white protein drink at Dubai Gulfood, delivering 20g protein per 250ml and targeting healthier nutrition for lactose-intolerant Middle East consumers. Moreover, the robust scientific literature supporting animal protein efficacy for athletic performance and body composition objectives strengthens consumer confidence. Manufacturing sophistication has addressed historical concerns regarding lactose sensitivity and digestibility, expanding the addressable consumer base for animal-derived supplements.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sports Nutrition

- Functional Food

The sports nutrition dominates with a market share of 61% of the total UAE protein supplements market in 2025.

Sports nutrition applications dominate protein supplement consumption in the UAE, driven by the expanding fitness industry and growing athletic participation. As per reports, in 2023, Optimum Nutrition expanded its Middle East footprint, partnering with regional government-led fitness initiatives and achieving brand awareness in the UAE, reinforcing its leadership in sports-nutrition engagement. Furthermore, consumers engaged in resistance training, endurance sports, and recreational fitness activities recognize protein supplementation as fundamental to achieving performance and physique objectives. The category addresses specific nutritional requirements associated with exercise recovery and adaptation processes.

The professionalization of fitness culture, supported by qualified trainers and nutrition professionals, has elevated consumer understanding of sports nutrition principles. Gym environments serve as primary discovery and education channels, introducing consumers to appropriate supplementation strategies. The aspirational appeal of athletic achievement and aesthetic transformation motivates continued investment in sports nutrition products across demographic segments.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Direct to Customers (DTC)

- Others

The supermarkets and hypermarkets exhibit a clear dominance with a 38% share of the total UAE protein supplements market in 2025.

Supermarkets and hypermarkets maintain their leadership position through established consumer trust and comprehensive shopping experiences. These retail environments enable direct product evaluation, comparison shopping, and immediate purchase fulfillment that digital channels cannot fully replicate. The integration of dedicated health and wellness sections within major retail chains has elevated protein supplements from specialty products to mainstream consumer goods.

Promotional activities, loyalty programs, and competitive pricing strategies employed by major retailers enhance value perception and encourage trial among new consumers. The convenience of combining supplement purchases with regular grocery shopping reduces perceived effort and integrates nutritional supplementation into routine consumer behavior patterns. Staff assistance and in-store educational materials support informed purchasing decisions among less experienced consumers.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Dubai represents the largest regional market for protein supplements, benefiting from its cosmopolitan population, advanced retail infrastructure, and thriving fitness culture. The emirate's numerous world-class gymnasiums, fitness centers, and wellness facilities create substantial demand for nutritional supplementation. High disposable incomes among residents enable premium product purchases, while the significant expatriate population brings diverse consumption preferences and established supplementation habits from home countries.

Abu Dhabi contributes significantly to market demand, driven by government initiatives promoting healthy lifestyles and substantial investments in sports infrastructure. The emirate's growing emphasis on preventive healthcare and wellness has cultivated health-conscious consumer behavior. Corporate wellness programs and fitness facility development support sustained supplementation adoption among professional populations seeking performance optimization and health maintenance.

Sharjah demonstrates growing protein supplement consumption, supported by expanding fitness facility development and increasing health awareness among residents. The emirate's competitive cost of living attracts value-conscious consumers seeking quality supplementation at accessible price points. Retail network expansion and improving product availability are enhancing market penetration across diverse community segments within the region.

Others including Ajman, Ras Al Khaimah, Fujairah, and Umm Al Quwain collectively contribute to market demand through expanding fitness awareness and improving retail accessibility. Growing urbanization and lifestyle modernization are cultivating health-conscious behaviors among populations traditionally less engaged with structured fitness activities. Infrastructure development and retail expansion are progressively addressing historical distribution limitations within these regions.

Market Dynamics:

Growth Drivers:

Why is the UAE Protein Supplements Market Growing?

Expanding Fitness Infrastructure and Gym Culture

The UAE's rapidly expanding fitness infrastructure serves as a primary catalyst for protein supplement demand, with gymnasiums, wellness centers, and sports facilities proliferating across urban landscapes. In October 2025, 60% of fitness club operators announced plans to open new centers within two years, highlighting the nation’s growing commitment to health, wellness, and active lifestyles. This physical infrastructure development creates environments where supplementation education and product discovery naturally occur, as fitness professionals recommend appropriate nutritional strategies to members. The growing professionalization of personal training services has elevated consumer understanding of exercise nutrition principles, positioning protein supplementation as essential rather than optional for serious fitness practitioners. Additionally, the social environments cultivated within fitness facilities encourage peer-influenced purchasing behavior, as members observe and discuss supplementation practices. The integration of nutrition consultations within premium fitness memberships further reinforces supplementation adoption among engaged consumers seeking comprehensive wellness solutions.

Rising Health Consciousness and Preventive Healthcare Focus

Increasing health consciousness among UAE residents is fundamentally reshaping dietary behaviors and driving protein supplement adoption across demographic segments. Consumers are increasingly proactive regarding nutritional optimization, viewing adequate protein intake as foundational to long-term health maintenance rather than exclusive to athletic performance. Government healthcare initiatives emphasizing preventive approaches have elevated public awareness regarding nutrition's role in disease prevention and healthy aging. In October 2025, MoHAP launched a national healthy ageing campaign promoting balanced diets, regular exercise, and preventive health screenings, encouraging UAE residents to proactively manage nutrition and overall wellness. Furthermore, media coverage of nutrition science and wellness trends has educated consumers about protein's importance for metabolic health, weight management, and body composition. This broadened understanding expands the addressable market beyond traditional fitness enthusiasts to include health-conscious individuals seeking nutritional insurance through systematic supplementation practices.

E-commerce Growth and Digital Retail Convenience

The rapid expansion of e-commerce infrastructure in the UAE has transformed protein supplement accessibility, enabling convenient purchasing regardless of geographic location or time constraints. As per sources, in 2024, the UAE’s e-commerce market reached Dh32.3 Billion, according to EZDubai, reflecting rapid growth in digital retail infrastructure, online shopping adoption, and enhanced delivery services across the country. Moreover, digital platforms offer comprehensive product information, user reviews, and comparison tools that support informed purchasing decisions among increasingly sophisticated consumers. Subscription services and auto-replenishment options ensure consistent product availability while enhancing customer retention for brands successfully delivering satisfactory experiences. The integration of social commerce and influencer marketing within digital ecosystems accelerates product discovery and reduces barriers to trial among consumers unfamiliar with supplementation categories. Mobile commerce optimization addresses on-the-go purchasing preferences among time-constrained consumers, while advanced logistics networks ensure rapid delivery fulfillment across emirates.

Market Restraints:

What Challenges the UAE Protein Supplements Market is Facing?

High Product Pricing and Affordability Concerns

Premium pricing of quality protein supplements creates accessibility barriers for price-sensitive consumer segments, limiting market penetration beyond affluent demographics. Import costs, distribution margins, and brand positioning strategies contribute to elevated retail prices that may discourage trial among value-conscious shoppers. Economic fluctuations affecting disposable income availability can prompt consumers to reduce discretionary spending on supplementation, viewing such products as non-essential despite health benefits.

Consumer Skepticism and Quality Concerns

Prevalent skepticism regarding supplement efficacy and quality undermines consumer confidence and adoption among cautious populations. Historical concerns regarding product contamination, mislabeling, and unsubstantiated marketing claims create hesitancy among risk-averse consumers unfamiliar with reputable brands. Limited regulatory harmonization and inconsistent quality standards across available products complicate informed purchasing decisions for consumers unable to evaluate formulation integrity independently.

Dietary Preference and Cultural Considerations

Cultural and religious dietary requirements create limitations for certain product formulations within the UAE market. Halal certification requirements add complexity and cost to manufacturing processes, potentially limiting product variety from international suppliers unfamiliar with compliance requirements. Consumer preferences for familiar food sources over processed supplements persist among traditionally oriented populations, representing conversion challenges for market expansion efforts.

Competitive Landscape:

The UAE protein supplements market features a diverse competitive environment characterized by international sports nutrition brands, regional health product companies, and emerging direct-to-consumer ventures competing across multiple segments. Market participants differentiate through formulation innovation, brand positioning, distribution strategies, and marketing approaches tailored to distinct consumer segments. Multinational corporations leverage established brand recognition and extensive research capabilities, while regional players capitalize on localized consumer understanding and distribution relationships. The competitive intensity drives continuous product development, pricing optimization, and marketing investment as participants seek sustainable market positioning. E-commerce growth has reduced entry barriers, enabling emerging brands to challenge established players through targeted digital marketing and differentiated value propositions that resonate with specific consumer cohorts.

Recent Developments:

-

In October 2025, Core Nutritionals® and Unmatched® debuted in the UAE at the Dubai Muscle Show. Through Vivandi Distribution, the brands showcased science-backed sports nutrition products, including protein blends, pre-workouts, and hydration supplements, targeting athletes, fitness enthusiasts, and biohackers amid the region’s rapidly growing wellness and performance market.

UAE Protein Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Casein, Whey Protein, Egg Protein, Soy Protein, Others |

| Forms Covered | Protein Powder, Protein Bars, Ready to Drink, Others |

| Sources Covered | Animal-Based, Plant-Based |

| Applications Covered | Sports Nutrition, Functional Food |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Direct to Customers (DTC), Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UAE protein supplements market size was valued at USD 142.29 Million in 2025.

The UAE protein supplements market is expected to grow at a compound annual growth rate of 8.11% from 2026-2034 to reach USD 287.10 Million by 2034.

Whey protein held the largest market share due to its superior amino acid profile, rapid absorption characteristics, proven muscle recovery benefits, and widespread acceptance among fitness enthusiasts and athletes seeking performance enhancement.

Key factors driving the UAE protein supplements market include expanding fitness infrastructure, rising health consciousness, growing e-commerce accessibility, increasing disposable incomes, and heightened consumer awareness regarding nutritional supplementation benefits.

Major challenges in the UAE protein supplements market include high pricing limiting affordability, consumer doubts about quality and efficacy, cultural and dietary restrictions, competition from alternative nutrition products, and complexities in meeting evolving regulatory and compliance standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)