UAE Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

UAE Steel Market Overview:

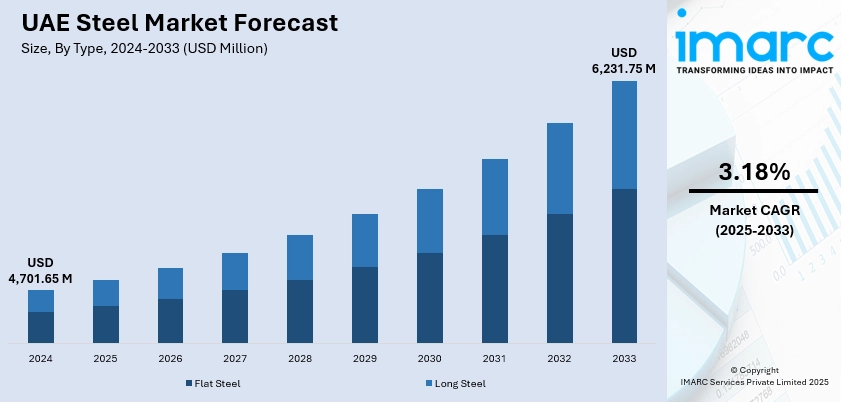

The UAE steel market size reached USD 4,701.65 Million in 2024. The market is projected to reach USD 6,231.75 Million by 2033, exhibiting a growth rate (CAGR) of 3.18% during 2025-2033. The market is driven by rapid urbanization, large-scale infrastructure projects, and government-led development initiatives like Vision 2030. Demand for sustainable construction materials and green steel is rising as environmental regulations tighten. Technological advancements such as automation, smart fabrication, and energy-efficient processes enhance production efficiency. Additionally, increasing scrap availability supports the shift toward recycled steel, reducing costs and carbon footprint. Growing export potential to eco-conscious markets also motivates local producers to innovate and adopt sustainable, high-quality steel production methods thus strengthening the UAE steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,701.65 Million |

| Market Forecast in 2033 | USD 6,231.75 Million |

| Market Growth Rate 2025-2033 | 3.18% |

UAE Steel Market Trends:

Green & Low‑Carbon Steel Production

One of the major UAE steel market trends is the strong shift towards sustainable and environmentally responsible production practices. Producers are prioritizing carbon emission reduction by integrating cleaner energy sources such as hydrogen and solar power into their operations. The adoption of Electric Arc Furnace technology is also growing, allowing the recycling of scrap steel and supporting a circular economy. Notably, companies like EMSTEEL have achieved 84% clean electricity use and a 45% reduction in carbon intensity compared to the global average, showcasing real progress in green transformation. Green steel production not only aligns with national net-zero targets but also enhances the UAE’s competitiveness in global markets that increasingly demand low-carbon materials. Government initiatives and industry collaborations are accelerating this shift, positioning the UAE steel sector to meet both domestic sustainability goals and international environmental standards.

To get more information on this market, Request Sample

Capacity Expansion & Infrastructure Boom

The UAE’s steel market is expanding rapidly in response to ongoing mega-projects across infrastructure, construction, and transportation. Ambitious national development plans are fueling demand for steel products, especially in structural and prefabricated steel segments. From airports and railways to commercial skyscrapers and residential complexes, large-scale projects require high volumes of steel components. To meet this demand, local steel producers are increasing production capacity and adopting faster, more efficient fabrication methods such as off-site modular construction. This not only accelerates project completion but also ensures consistent quality and cost control. As the government continues to invest heavily in modernizing its cities and industrial zones, the steel industry is becoming a cornerstone of national progress, supporting UAE steel market, economic diversification, and technological advancement across the Emirates.

Scrap Recycling & Technological Innovation

Recycling and technological innovation are transforming the UAE steel industry, as producers focus on utilizing scrap metal as a primary raw material. This move supports environmental goals by reducing waste and conserving natural resources while ensuring cost-effective steel production. Scrap-based manufacturing also aligns with the global shift toward a circular economy, where materials are continuously reused. Alongside this, steel producers are adopting advanced technologies like robotic fabrication, smart machining, and digital modeling to enhance efficiency, precision, and product quality. These innovations reduce human error, lower production costs, and enable faster project turnaround. As sustainability and technology merge, the UAE steel market is positioning itself as a modern, forward-thinking sector capable of meeting the demands of both local development and international competitiveness, all while minimizing its environmental footprint.

UAE Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

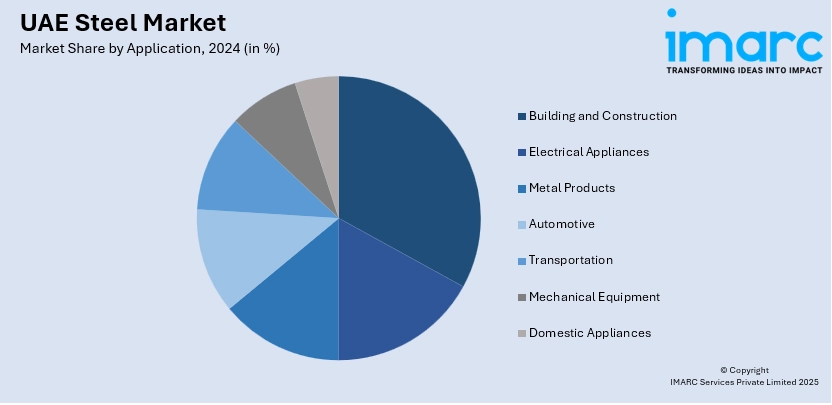

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Steel Market News:

- In October 2024, Masdar and EMSTEEL launched the UAE’s first green steel project using green hydrogen to produce low-carbon steel in Abu Dhabi. This pioneering initiative supports the country’s Net Zero by 2050 strategy and the National Green Certificates Program. EMSTEEL has already reduced its carbon intensity by 45% compared to global averages, while Masdar expands its renewable energy and green hydrogen goals. The project aligns with Abu Dhabi’s Low Carbon Hydrogen Policy for sustainable industry growth.

- In September 2024, Emirates Steel Arkan changed their name to EMSTEEL in order to promote global expansion and operational change. As the largest steel and building materials company in the United Arab Emirates, the new name represents the successful merger of Emirates Steel and Arkan Building Materials. Enhancing sustainability, cutting carbon emissions, and setting the standard for low-carbon steel production are the goals of EMSTEEL. Operating 16 plants, the group serves over 70 global markets through its Emirates Steel and Emirates Cement divisions.

UAE Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE steel market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE steel market on the basis of type?

- What is the breakup of the UAE steel market on the basis of product?

- What is the breakup of the UAE steel market on the basis of application?

- What is the breakup of the UAE steel market on the basis of region?

- What are the various stages in the value chain of the UAE steel market?

- What are the key driving factors and challenges in the UAE steel market?

- What is the structure of the UAE steel market and who are the key players?

- What is the degree of competition in the UAE steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)