UAE Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

UAE Steel Tubes Market Overview:

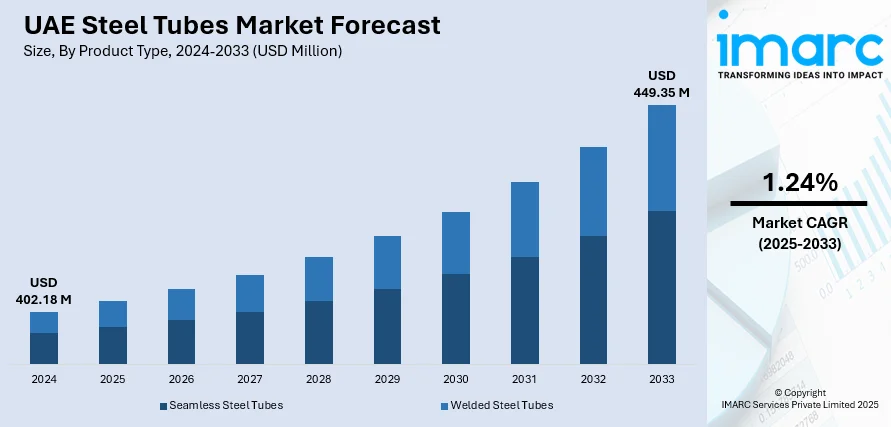

The UAE steel tubes market size reached USD 402.18 Million in 2024. The market is projected to reach USD 449.35 Million by 2033, exhibiting a growth rate (CAGR) of 1.24% during 2025-2033. The market is experiencing steady growth, underpinned by growing infrastructure, industrialization, and robust demand from construction and oil & gas sectors. The market is also gaining from rising local manufacturing investments and the adoption of eco-friendly production techniques. Seamless and welded tubes remain widely utilized across numerous applications. Through innovation and government intervention, the industry players are now putting themselves in place to reap a bigger share of the expanding UAE steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 402.18 Million |

| Market Forecast in 2033 | USD 449.35 Million |

| Market Growth Rate 2025-2033 | 1.24% |

UAE Steel Tubes Market Trends:

Expansion of Scrap-Based Tube Supply

In December 2024, AGSI announced plans to expand steel production capacity to strengthen the domestic raw material pipeline for steel tube fabrication, amid a sluggish scrap market in the UAE. That expansion reflects a clear commitment to securing feedstock availability and reducing dependency on imported raw materials for downstream tube manufacturers. As a result, local producers of welded and seamless tubes are expected to benefit from improved access to raw steel even when scrap trading volumes remain subdued due to seasonal or market-cycle pressures. Expanding production capacity supports shorter lead times, better traceability, and more consistent pricing advantages for firms relying on domestic tubing output. Buyers across infrastructure, energy, and industrial construction segments are already reporting increased interest in locally fabricated tube products that align with national sourcing strategies. This strategy also aligns with broader industrial modernization goals across the UAE's steel ecosystem. Taken together, these developments provide a solid foundation for evolving tube supply dynamics and support long-term factory-readiness. Collectively, these factors anchor UAE steel tubes market growth as local upstream and downstream alignment continues to mature.

To get more information on this market, Request Sample

Trade Agreement Enhances Market Outlook

In June 2025, UAE officials confirmed that negotiations with US counterparts will begin on a bilateral trade agreement aimed at rolling back US tariffs on Emirati steel and aluminium exports. This strategic development is expected to enhance international access and competitiveness for UAE-based steel tube producers, potentially enabling duty reductions or preferential export pathways. By alleviating the burden of high duties, domestic manufacturers may find greater scope to invest in value-added tube fabrication technologies, especially those targeting energy, infrastructure, transport, and industrial sectors. Domestically, this signals a strategic rebalancing in production allocations, where firms may redirect part of their output toward broader regional or global markets. At the same time, buyers are recalibrating sourcing strategies in response to these evolving trade dynamics, weighing delivery timelines, cost efficiencies, and origin traceability more carefully. Taken together, these shifts in both policy and procurement behavior illustrate how external trade developments are shaping the UAE steel tubes market trends as the sector prepares for new competitive opportunities on multiple fronts.

Sustainable Steel Innovation Enhances Supply

In October 2024, the UAE inaugurated the region’s first green hydrogen‑based steel production pilot, marking a significant shift toward low‑carbon metal output and enabling future steel tube fabrication from more sustainable inputs. This milestone introduces green steel derived from hydrogen instead of conventional fossil fuels, reducing emissions and positions the UAE as a leader in clean‑steel innovation within the MENA region. The pilot’s success opens the door for downstream manufacturers to access eco‑certified raw material, paving the way for production of welded and seamless tubes that meet emerging procurement criteria tied to traceability and environmental standards. With national frameworks like the Low‑Carbon Hydrogen Policy and hydrogen strategy in place, this initiative aligns upstream sustainable production with downstream demand for high-quality, certified tubing in infrastructure, energy, and transport sectors. Buyers are becoming more interested in tube offerings that combine performance with sustainability credentials. As clean-steel capacity scales up, local fabrication chains are expected to evolve toward traceable, value-added tube solutions that reflect broader green transition objectives across industries.

UAE Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

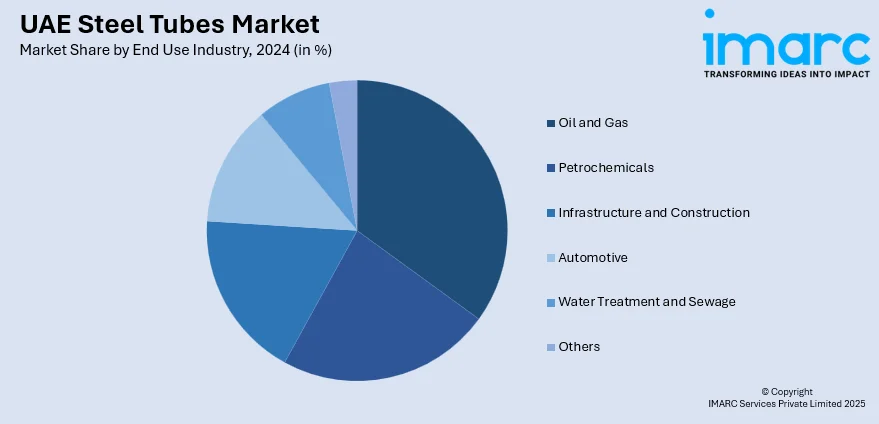

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Steel Tubes Market News:

- April 2024: Ratnamani Metals & Tubes has set up a fully owned subsidiary in Abu Dhabi, Ratnamani Middle East Pipes Trading LLC OPC. The new company will be engaged in trading and marketing steel pipes and tubes in the region. This is in line with the company's focus on enhancing its international presence and catering to the Gulf market more directly. By installing operations in the UAE, Ratnamani will be well on its way to realising an important presence in a comprehensive industrial and commercial hub in the Middle East.

- May 2025: Arabian Gulf Steel Industries (AGSI), based in Abu Dhabi, has partnered with Emirates Steel Arkan and Tadweer Group to advance sustainable steel production in the UAE. This collaboration supports the development of a circular economy by using locally sourced scrap metal as raw material. Together, the companies aim to reduce environmental impact, promote recycling, and strengthen the country’s green industrial initiatives. The partnership highlights the UAE’s commitment to innovation, sustainability, and leadership in low-emission steel manufacturing across the region.

UAE Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Type Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE steel tubes market on the basis of product type?

- What is the breakup of the UAE steel tubes market on the basis of material type?

- What is the breakup of the UAE steel tubes market on the basis of end use industry?

- What is the breakup of the UAE steel tubes market on the basis of region?

- What are the various stages in the value chain of the UAE steel tubes market?

- What are the key driving factors and challenges in the UAE steel tubes market?

- What is the structure of the UAE steel tubes market and who are the key players?

- What is the degree of competition in the UAE steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)