UAE Switchgear Market Report by Voltage Type (Low-Voltage, Medium-Voltage, High-Voltage), Insulation (Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), and Others), Installation (Indoor, Outdoor), End Use (Commercial, Residential, Industrial), and Emirates 2025-2033

Market Overview:

The UAE switchgear market size reached USD 1.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. Rapid urbanization, industrial expansion, renewable energy integration, infrastructure development, and the growing need for reliable and efficient power distribution solutions are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.7 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate (2025-2033) | 4.2% |

Switchgear refers to a collection of electrical devices used to control, protect, and isolate electrical circuits and equipment. It includes circuit breakers, fuses, disconnect switches, and other components designed to manage the flow of electricity within power distribution systems. Switchgear plays an essential role in ensuring the safe and efficient operation of electrical networks by safeguarding against overloads, short circuits, and other electrical faults. It aids in regulating power distribution, minimizing downtime, and enhancing overall system reliability. In various industries, such as utilities, manufacturing, and infrastructure, reliable switchgear is indispensable for maintaining the integrity of electrical infrastructure.

The UAE switchgear market is experiencing dynamic growth driven by the nation's robust economic diversification efforts, which have propelled substantial urbanization and industrial expansion, resulting in an escalated demand for reliable and efficient electrical infrastructure. Moreover, the surge in commercial and residential construction projects is fueling the need for modern switchgear solutions that ensure seamless power distribution and enhanced safety, creating a positive outlook for the market. In addition to this, the rising emphasis on sustainable energy sources in UAE has led to the integration of renewable energy systems, necessitating advanced switchgear technologies to manage the complex energy mix, which, in turn, is contributing to the market's growth. Furthermore, the introduction of favorable government initiatives to fortify the overall power grid's resilience and efficiency has heightened the need for cutting-edge switchgear equipment, presenting remunerative opportunities for market expansion.

UAE Switchgear Market Trends/Drivers:

Rapid urbanization and industrialization

The UAE has experienced rapid urbanization and industrial expansion over the past few decades, transforming it into a global business and tourism hub. This growth is demonstrated by the proliferation of commercial buildings, residential complexes, and industrial facilities across the nation. As urban areas expand, there is an increasing need for reliable electrical infrastructure to cater to rising power consumption demands. Switchgear plays a pivotal role in managing the distribution of electricity to various urban centres, ensuring a stable power supply and preventing disruptions that can hamper economic activities and quality of life. In addition to this, the construction of new infrastructure, including smart cities and high-tech manufacturing facilities, further necessitates advanced switchgear systems that can handle complex electrical loads while maintaining safety and efficiency, thereby strengthening the market growth.

Integration of renewable energy sources

The UAE has taken significant strides towards incorporating renewable energy sources into its energy mix to broaden its energy portfolio and reduce its carbon footprint. With ample solar irradiance and wind potential, solar and wind power projects have gained traction. However, the irregular disposition of renewable energy sources poses challenges to grid stability and power distribution. Switchgear solutions equipped with advanced monitoring, control, and protection capabilities are crucial for integrating renewable energy sources seamlessly into the existing power grid. Moreover, these solutions help manage the fluctuations in power generation, balance supply and demand, and ensure grid stability. As the UAE continues to invest in renewable energy projects to meet its sustainability goals, the demand for sophisticated switchgear that can accommodate this evolving energy landscape remains high, propelling the market forward.

UAE Switchgear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the UAE switchgear market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on voltage type, insulation, installation and end use.

Breakup by Voltage Type:

- Low-Voltage

- Medium-Voltage

- High-Voltage

High-voltage represents the most widely used voltage type

The report has provided a detailed breakup and analysis of the market based on the voltage type. This includes low-voltage, medium-voltage, and high-voltage. According to the report, high-voltage represented the largest segment.

The ongoing development of mega infrastructure projects, such as large-scale industrial complexes, transportation networks, and energy-intensive facilities, necessitates robust high-voltage switchgear to handle the increased electrical loads, aiding in market expansion. Concurrently, the growing popularity of electric vehicles (EVs) and their associated charging infrastructure that requires high-voltage switchgear for efficient and safe power distribution is fueling the market growth. Additionally, the UAE's commitment to enhancing its power transmission and distribution networks to accommodate the increasing energy demands further drives the demand for high-voltage switchgear, presenting lucrative opportunities for market expansion.

Breakup by Insulation:

- Gas Insulated Switchgear (GIS)

- Air Insulated Switchgear (AIS)

- Others

Air insulated switchgear (AIS) accounts for the majority of the market share

A detailed breakup and analysis of the market based on the insulation has also been provided in the report. This includes gas insulated switchgear (GIS), air insulated switchgear (AIS), and others. According to the report, air insulated switchgear (AIS) accounted for the largest market share.

The demand for air-insulated switchgear is primarily driven by its inherent advantages. Moreover, the switchgear's environmentally friendly design, characterized by the absence of greenhouse gas-emitting materials, aligns with the UAE's sustainability commitments, creating a favorable outlook for market growth. Additionally, air-insulated switchgear's lower maintenance requirements and simplified installation contribute to its appeal in various applications, impelling the market growth. Furthermore, with the UAE continuing to prioritize efficient energy infrastructure and environmentally conscious solutions, the demand for air-insulated switchgear is propelled by its ability to offer reliable power distribution while minimizing environmental impact and operational complexities.

Breakup by Installation:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the installation has also been provided in the report. This includes indoor and outdoor.

The increasing demand for indoor switchgear due to its space-saving attributes, making it ideal for applications with limited available area, represent one of the key factors propelling the market growth. Besides this, the widespread product employment in urban developments and compact industrial facilities is contributing to the surging demand for indoor switchgears. Concurrent with this, the expanding use of outdoor switchgear in renewable energy installations and power substations, owing to its capability to withstand harsh environmental conditions and its suitability for utility-scale projects, is aiding in market expansion. Furthermore, the UAE's diverse infrastructure landscape, where both indoor and outdoor solutions play pivotal roles in ensuring seamless power distribution while adapting to specific operational requirements, is strengthening the market growth.

Breakup by End Use:

- Commercial

- Residential

- Industrial

Industrial sector accounts for the majority of the market share

A detailed breakup and analysis of the market based on the end use has also been provided in the report. This includes commercial, residential, and industrial. According to the report, industrial accounted for the largest market share.

The rising demand for switchgear in the industrial sector for maintaining uninterrupted and efficient operations is acting as a significant growth-inducing factor. In industrial settings, switchgear ensures the reliable distribution of power to critical machinery, production lines, and control systems. As the UAE continues to expand its economy and advance its industrial capabilities, there is an expanding need for robust and tailored switchgear solutions. In addition to this, the switchgear's ability to safeguard against power disruptions, prevent equipment damage, and optimize energy utilization aligns with the industrial sector's pursuit of productivity and cost-efficiency. This, coupled with the sector's growing emphasis on sustainable practices, heightens the demand for innovative switchgear solutions that contribute to operational excellence and environmental responsibility.

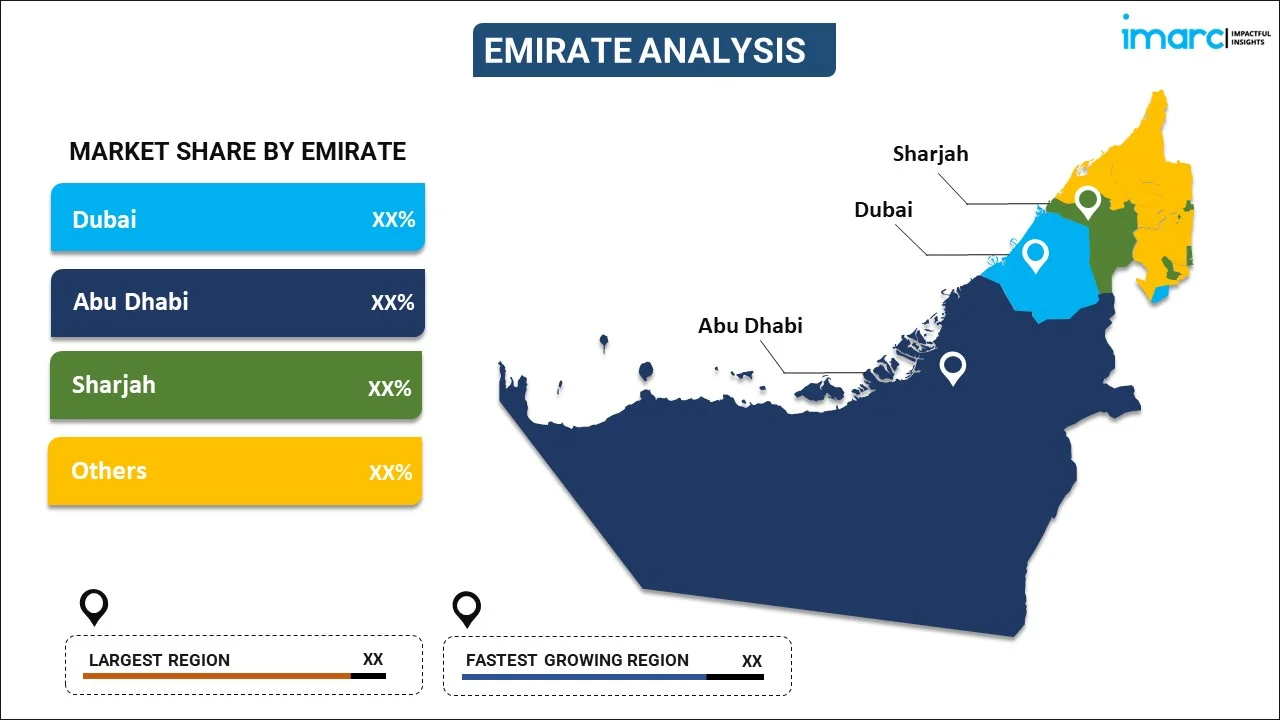

Breakup by Emirates:

- Abu Dhabi

- Dubai

- Sharjah

- Others

Abu Dhabi holds the largest share of the market

The report has also provided a comprehensive analysis of all the major regional markets, which include Abu Dhabi, Dubai, Sharjah, and others. According to the report, Abu Dhabi was the largest market for switchgear in the UAE. Some of the factors driving the market include industrial growth, government initiatives, energy diversification, technological progression, and increasing construction activities.

Competitive Landscape:

The competitive landscape of the UAE switchgear market is characterized by a dynamic interplay of established players, emerging entrants, and technological innovators. Prominent multinational corporations possessing extensive experience and a diversified product portfolio vie for market share. These companies leverage their brand reputation, global distribution networks, and economies of scale to maintain a competitive edge. Simultaneously, local manufacturers and regional players contribute to the market's vibrancy by offering specialized solutions that cater to unique customer needs and regulatory requirements. Furthermore, continuous technological advancements have introduced a new dimension to competition, with companies focusing on smart switchgear solutions that integrate digital monitoring, predictive maintenance, and remote-control capabilities. This shift has allowed tech-savvy startups to carve out niches by offering cutting-edge solutions tailored to the UAE's drive for modernization and efficiency.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

UAE Switchgear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Voltage Types Covered | Low-Voltage, Medium-Voltage, High-Voltage |

| Insulations Covered | Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), Others |

| Installations Covered | Indoor, Outdoor |

| End Uses Covered | Commercial, Residential, Industrial |

| Emirates Covered | Abu Dhabi, Dubai, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE switchgear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UAE switchgear market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE switchgear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UAE switchgear market was valued at USD 1.7 Billion in 2024.

We expect the UAE switchgear market to exhibit a CAGR of 4.2% during 2025-2033.

The continuous development of smart meters, which provide flexibility through a modular design, along with the growing demand for uninterrupted energy in the commercial and industrial, is primarily driving the UAE switchgear market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for switchgears.

Based on the voltage type, the UAE switchgear market can be segmented into low-voltage, medium-voltage, and high-voltage. Currently, high-voltage holds the majority of the total market share.

Based on the insulation, the UAE switchgear market has been divided into Gas Insulated Switchgear (GIS), Air Insulated Switchgear (AIS), and others. Among these, Air Insulated Switchgear (AIS) currently exhibits a clear dominance in the market.

Based on the end use, the UAE switchgear market can be bifurcated into commercial, residential, and industrial. Currently, industrial accounts for the largest market share.

On a regional level, the market has been classified into Abu Dhabi, Dubai, Sharjah, and others, where Abu Dhabi currently dominates the UAE switchgear market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)