UAE Takaful Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

UAE Takaful Market Overview:

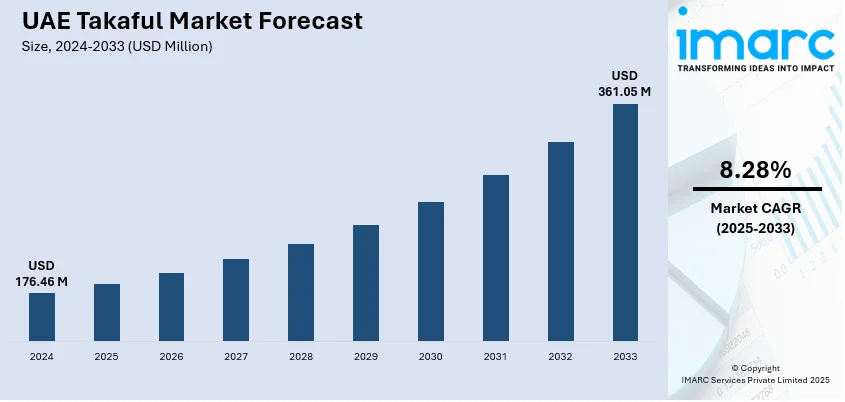

The UAE takaful market size reached USD 176.46 Million in 2024. Looking forward, the market is projected to reach USD 361.05 Million by 2033, exhibiting a growth rate (CAGR) of 8.28% during 2025-2033. The growth of the market is primarily driven by increasing consumer awareness of Sharia-compliant financial solutions, favorable regulatory frameworks, and expanding demand for insurance products in response to the country's economic diversification. These factors are enhancing the UAE takaful market share, leading to stronger market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 176.46 Million |

| Market Forecast in 2033 | USD 361.05 Million |

| Market Growth Rate 2025-2033 | 8.28% |

UAE Takaful Market Trends:

Regulatory Support and Strengthening of Legal Frameworks

By establishing legislative frameworks that support the establishment of Islamic insurance, the UAE government has significantly contributed to the development of the takaful sector. The UAE Insurance Authority (IA) ensures that takaful operators follow Sharia law and industry best practices by defining clear standards. According to article 33 of Federal Decree Law No (48) of 2023 regarding the Regulation of Insurance Activities, for example, the Central Bank of the UAE (CBUAE), in October 2024, banned a takaful insurer from issuing new health and auto insurance contracts, including renewals, in October 2024 because the insurer did not meet minimum capital requirements. The insurer remains liable for all obligations under existing contracts. The CBUAE has given the insurer six months to address its solvency position and comply with regulatory requirements. The regulatory framework has increased customer confidence and transparency, which has made it simpler for both domestic and foreign companies to enter the market. A more favorable market environment is created by proactive regulation, which benefits operators by enforcing rules consistently and establishing clearer compliance requirements. The expansion of the UAE takaful market and its long-term viability depend heavily on this stability.

To get more information on this market, Request Sample

Technological Advancements and Digital Transformation

The UAE takaful market is changing significantly as a result of technological advancements. The emergence of digital platforms has made it possible for takaful businesses to provide their clients with more accessible and convenient services. Digital tools, internet portals, and mobile applications have made customer service, claims processing, and the purchasing process more efficient. These technologies' adoption is especially attractive to younger, tech-savvy consumers who value efficiency and convenience. Furthermore, takaful organizations can enhance their service offerings by improving pricing models, risk assessments, and underwriting procedures through the integration of artificial intelligence (AI) and sophisticated analytics. These technological advancements are fostering the UAE takaful market growth by improving operational efficiency and customer satisfaction. For instance, in June 2025, Milliman, which provides Takaful solutions, won two 2025 InsuranceERM Awards for its software, Milliman Mind: "End-user computing risk management solution of the year" and "Best use of cloud technology." This no-code solution simplifies financial modeling for actuaries, enhancing productivity without writing code. The awards recognize Milliman Mind's innovative approach to actuarial processes .

UAE Takaful Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type.

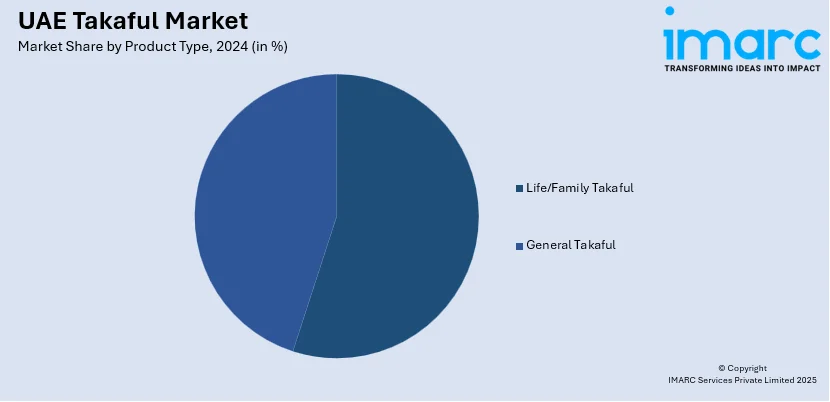

Product Type Insights:

- Life/Family Takaful

- General Takaful

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life/family takaful and general takaful.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Takaful Market News:

- In January 2025, Watania Takaful Family (WTF) partnered with Aura, a health insurance platform, to offer faster and more customized services to small and medium enterprises (SMEs) in the UAE. This strategic alliance aims to enhance the delivery of health insurance solutions, specifically tailored for the growing SME sector.

- In December 2024, AM Best affirmed the Financial Strength Rating of A- (Excellent) and the Long-Term Issuer Credit Rating of “a-” (Excellent) for Abu Dhabi National Takaful Company. The ratings reflect strong balance sheet strength and operating performance, supported by risk-adjusted capitalisation, with a stable outlook.

UAE Takaful Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life/Family Takaful, General Takaful |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE takaful market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE takaful market on the basis of product type?

- What is the breakup of the UAE takaful market on the basis of region?

- What are the various stages in the value chain of the UAE takaful market?

- What are the key driving factors and challenges in the UAE takaful market?

- What is the structure of the UAE takaful market and who are the key players?

- What is the degree of competition in the UAE takaful market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE takaful market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE takaful market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE takaful industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)