UAE Travel Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

UAE Travel Insurance Market Overview:

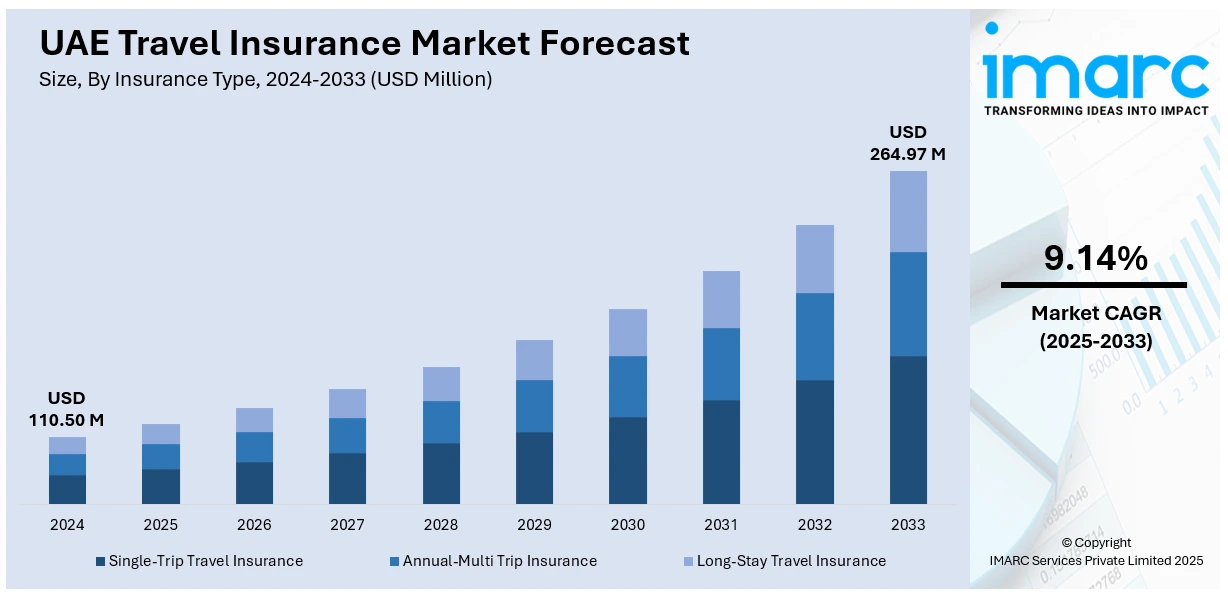

The UAE travel insurance market size reached USD 110.50 Million in 2024. The market is projected to reach USD 264.97 Million by 2033, exhibiting a growth rate (CAGR) of 9.14% during 2025-2033. The market is propelled by the country's fast-growing tourism sector, underpinned by government efforts to establish the country as an international travel destination. Furthermore, increasing awareness of money protection against unexpected medical costs, holiday cancellations, and travel-related hazards is increasing demand for full-coverage insurance solutions. Apart from this, the rising number of travelers abroad, along with mandatory travel insurance policies for some countries, also continues to augment the UAE travel insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 110.50 Million |

| Market Forecast in 2033 | USD 264.97 Million |

| Market Growth Rate 2025-2033 | 9.14% |

UAE Travel Insurance Market Trends:

Growing Need for All-Inclusive Travel Insurance

The industry is seeing high demand growth for all-inclusive policies going beyond conventional medical cover. The growing global tourism by UAE residents, coupled with the high expatriate population of about 11.06 million as of June 2025, has boosted the need for insurance policies that include trip cancellations, lost luggage, flight delays, and foreign medical emergencies. The increased trend of high-value business tourists seeking customized packages has also been a part of this trend. Further, as the UAE is an international transit point, insurers are adding region-specific benefits as well as flexible options for short-term and long-term travel coverage. Most of these policies now extend protection for non-refundable reservations as well as high medical bills, especially for countries that have expensive healthcare systems. This shift is supported by increased consumer consciousness for financial protection in the event of unexpected disruptions. UAE insurers are keeping pace by creating products that balance extensive coverage with online accessibility so customers can buy, claim, and service policies effectively.

To get more information on this market, Request Sample

Utilization of Digital Platforms and InsurTech Solutions

Adoption of technology is radically transforming UAE travel insurance market growth, with insurers making the most of digital platforms and InsurTech solutions to enhance customer interaction. Mobile apps and websites enable travelers to compare plans, tailor coverage, and buy policies in minutes without relying as heavily on traditional agents. Emerging technologies in artificial intelligence, machine learning, and big data analytics help insurers accurately evaluate risks, enhance underwriting, and identify fraudulent claims. Chatbots and automated support functions also improve customer service through instant policy information and claims support. In addition, coupling blockchain and safe digital payment systems enhances transparency and trust in payments. Since the population of the UAE is highly technologically inclined and has been exposed to online financial services, insurers are going all out for mobile-led platforms. This digitalization not only enhances operational efficiency but also enables insurers to serve the increasing share of millennial and Gen Z travelers who expect easy, intuitive, and responsive insurance solutions.

Greater Emphasis on Travel Health and Pandemic Benefits

Pandemic disruptions and health-related risks have been at the heart of market evolution. Since the COVID-19 pandemic, travelers are more likely to be aware of the importance of obtaining insurance for emergency medical care, hospitalization, and evacuation outside their home country. Most places today require evidence of travel health insurance as a condition of entry, further boosting demand for policies with pandemic benefits. UAE insurers are reacting by adding COVID-19 tests, quarantine costs, and telemedicine calls to policy coverage, giving international air travelers even more confidence. The emphasis on pandemic preparedness has also extended to offering protection against future health emergencies, given the increasing uncertainty of global travel. Corporate travel policies are also placing greater importance on employee wellness, adding extra benefits like global medical networks. The move towards health-focused travel insurance reflects an increased level of consumer awareness of vulnerabilities, with the insurers converging offerings to promote endurance in a market where health threats are an enduring consideration in the planning of travel.

UAE Travel Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on insurance type, coverage, distribution channel, and end user.

Insurance Type Insights:

- Single-Trip Travel Insurance

- Annual-Multi Trip Insurance

- Long-Stay Travel Insurance

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes single-trip travel insurance, annual-multi trip insurance, and long-stay travel insurance.

Coverage Insights:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes medical expenses, trip cancellation, trip delay, property damage, and others.

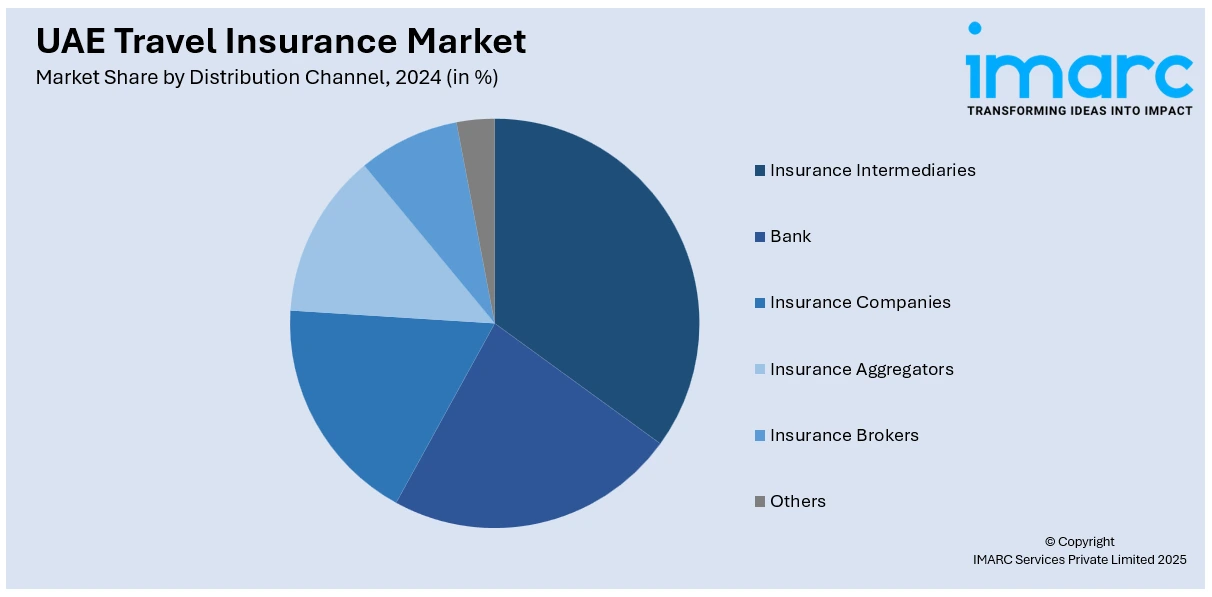

Distribution Channel Insights:

- Insurance Intermediaries

- Bank

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes insurance intermediaries, bank, insurance companies, insurance aggregators, insurance brokers, and others.

End User Insights:

- Senior Citizens

- Educational Travelers

- Business Travelers

- Family Travelers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes senior citizens, educational travelers, business travelers, family travelers, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Travel Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Single-Trip Travel Insurance, Annual-Multi Trip Insurance, Long-Stay Travel Insurance |

| Coverages Covered | Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others |

| Distribution Channels Covered | Insurance Intermediaries, Bank, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others |

| End Users Covered | Senior Citizens, Educational Travelers, Business Travelers, Family Travelers, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE travel insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE travel insurance market on the basis of insurance type?

- What is the breakup of the UAE travel insurance market on the basis of coverage?

- What is the breakup of the UAE travel insurance market on the basis of distribution channel?

- What is the breakup of the UAE travel insurance market on the basis of end user?

- What is the breakup of the UAE travel insurance market on the basis of region?

- What are the various stages in the value chain of the UAE travel insurance market?

- What are the key driving factors and challenges in the UAE travel insurance market?

- What is the structure of the UAE travel insurance market and who are the key players?

- What is the degree of competition in the UAE travel insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE travel insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE travel insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE travel insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)