UAE Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2025-2033

UAE Used Car Market Overview:

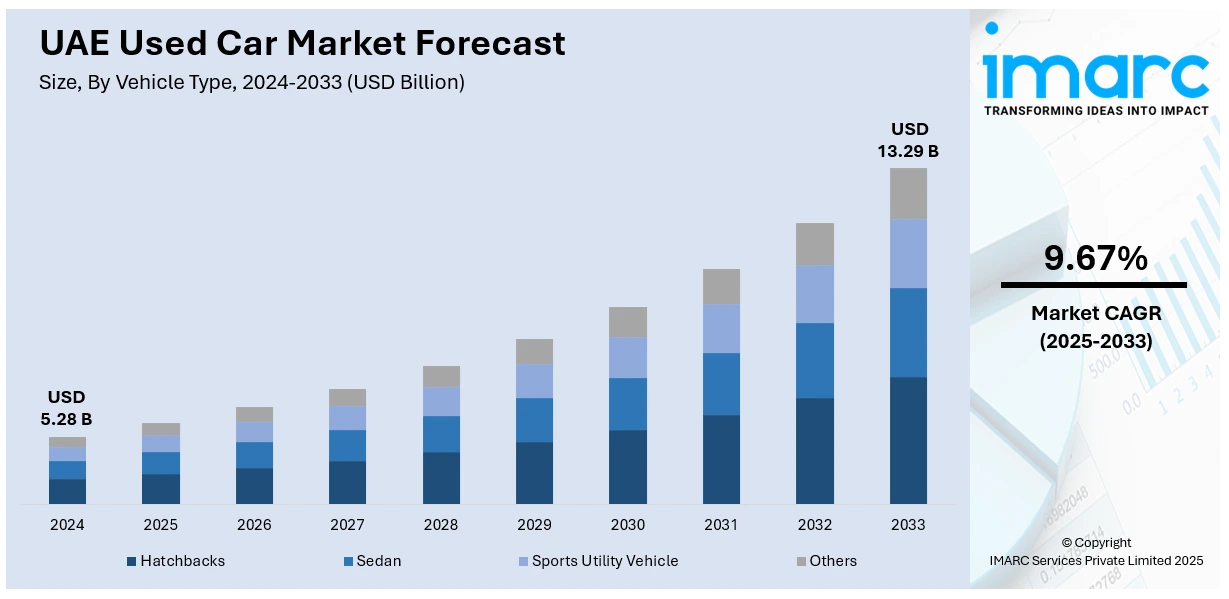

The UAE used car market size reached USD 5.28 Billion in 2024. Looking forward, the market is expected to reach USD 13.29 Billion by 2033, exhibiting a growth rate (CAGR) of 9.67% during 2025-2033. The market is fueled by a developing expatriate community, high car turnover, and a demand for value-for-money mobility solutions. Availability of luxury cars in prime condition, along with a robust resale culture, supports market appeal. State initiatives favoring electronic vehicle transactions and simple transfer processes further instill used car sales. Demand is also driven by the presence of certified pre-owned programs, liberal financing schemes, and the increasing price of new vehicles, which make the UAE used car market share stronger.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.28 Billion |

| Market Forecast in 2033 | USD 13.29 Billion |

| Market Growth Rate 2025-2033 | 9.67% |

UAE Used Car Market Trends:

Demand From Tourists, Expatriates, and Short-Term Residents

The UAE's secondhand car market survives, in part, on a unique demographic consisting of tourists, expatriates, and short-term residents, who tend to prefer purchasing inexpensive used vehicles for short-term use over new ones. The transient population generates steady demand for low-priced, properly cared-for cars that will be easy to resell at the end of their visit. According to industry reports, in 2025, the population of the UAE is predominantly composed of expatriates, comprising a substantial 88.5% of the overall population. This means there are 10.04 million expatriates residing and employed in the nation, enriching its varied and vibrant community. Dealers and private sales in emirates like Dubai and Abu Dhabi usually provide customized packages involving hassle-free transfer of registration, short-term insurance, and export-friendly documentation to suit global buyers or renters. Among other buyers, the trend is toward top-end luxury brands and models that have only been briefly used as rental fleet vehicles like luxury SUVs or sedans with light usage and premium resale value based on condition and brand status. Local buyers, on the other hand, tend to favor functional, fuel-efficient models appropriate for driving between emirates or through city traffic. This market environment, driven by the UAE's multicultural and transitory populace, maintains inventory turning rapidly and facilitates widespread availability of both every day and aspirational cars.

To get more information on this market, Request Sample

Widely Varied Car Types and Age Groups Facilitate Broad Appeal

Another significant trend in the UAE used vehicle market is its sheer variety of vehicle types and ages, everything from diesel SUVs designed for desert driving to small sedans popular in city areas such as Sharjah, and even older utility vehicles appropriate for agricultural or off-road driving in more agricultural emirates. Considering the UAE's diverse landscape and lifestyles, from wide urban highway systems to desert dune rides, purchasers have ample options specific to their purposes. Those living in the city might need dependable low-profile hatchbacks or mid-size cars, whereas thrill-seeking motorists prefer solid 4x4s or off-road pickup trucks. Conversely, budget shoppers or collectors venture into vintage models from the past, at times maintained due to the region's predominantly desert climate, which inhibits rust and deterioration. Auction sites and dealer networks are skilled at segmenting supply by vehicle, supplying separately to those seeking luxurious off-roaders, cheap urban cars, or even retired government fleet cars renowned for regular maintenance. This segmentation increases market vibrancy, such that consumers at every price level and consumer preference can locate something that meets their needs, which further contributes to the UAE used car market growth and development.

Digital Platforms and Certification Upgrade Buyer Experience

The used car market in the UAE has experienced a strong shift toward digital platforms and dealer certification programs, revolutionizing the way buyers research, assess, and buy automobiles. In contrast with the old-fashioned classifieds-only markets, UAE car buyers increasingly turn to strong online platforms with virtual showrooms, 360-degree vehicle tours, and full histories, designed to suit a technology-hardened population used to convenience through smartphone or laptop. Many of these websites collaborate with certified inspection experts who deliver condition reports with definitive judgments on engine, interior, and bodywork, supporting buyer confidence, of value among expatriates and first-time buyers unfamiliar with local conventions. In addition, leading emirate-wide dealerships in Abu Dhabi and Sharjah provide certified pre-owned programs where cars receive multi-point checks and benefit from short-term dealer warranties or service packages, further providing a layer of guarantee akin to new-car buying. These trends fit within the overall drive in the UAE toward digitization and quality control within consumer markets. By melding high-tech vehicle search technology with reliable inspection and seller disclosure, the market improves the buying experience and attracts consumers who may otherwise be reluctant to buy used cars in a new setting.

UAE Used Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, vendor type, fuel type, and sales channel.

Vehicle Type Insights:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchbacks, sedan, sports utility vehicle, and others.

Vendor Type Insights:

- Organized

- Unorganized

The report has provided a detailed breakup and analysis of the market based on the vendor type. This includes organized and unorganized.

Fuel Type Insights:

- Gasoline

- Diesel

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, diesel, and others.

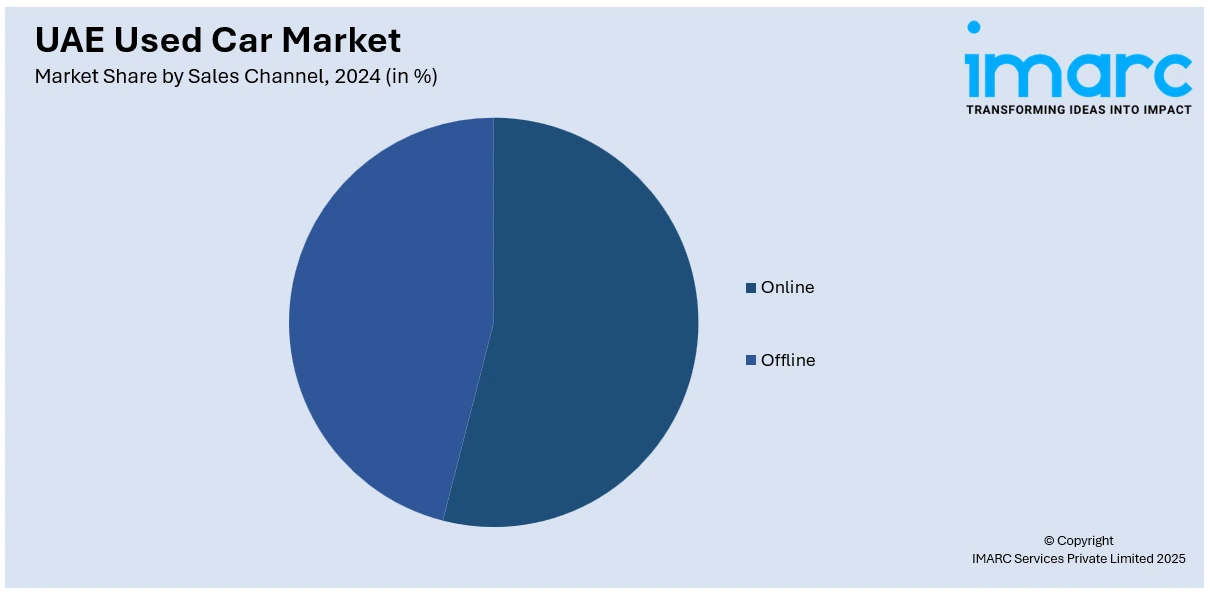

Sales Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the sales channel has also been provided in the report. This includes online and offline.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Used Car Market News:

- Twelve months ago, buying a pre-owned vehicle in the GCC frequently involved dealing with insufficient information and a scarcity of clarity. In June 2025, AutoData Middle East introduced Vehicle Report, a platform powered by AI aimed at empowering consumers with more control. In the last year, over 42,000 users have utilized the service to obtain verified information on ownership, accident records, valuation, and other details. Monthly usage has surged threefold from July 2024 to March 2025, with more than 5,000 users actively participating each month. Among them, 84% claimed no problems after purchasing, highlighting the platform’s contribution to minimizing buyer risk and enhancing trust through precise, available information.

UAE Used Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE used car market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE used car market on the basis of vehicle type?

- What is the breakup of the UAE used car market on the basis of vendor type?

- What is the breakup of the UAE used car market on the basis of fuel type?

- What is the breakup of the UAE used car market on the basis of sales channel?

- What is the breakup of the UAE used car market on the basis of region?

- What are the various stages in the value chain of the UAE used car market?

- What are the key driving factors and challenges in the UAE used car market?

- What is the structure of the UAE used car market and who are the key players?

- What is the degree of competition in the UAE used car market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE used car market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE used car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)