UAE Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UAE Vegan Cosmetics Market Overview:

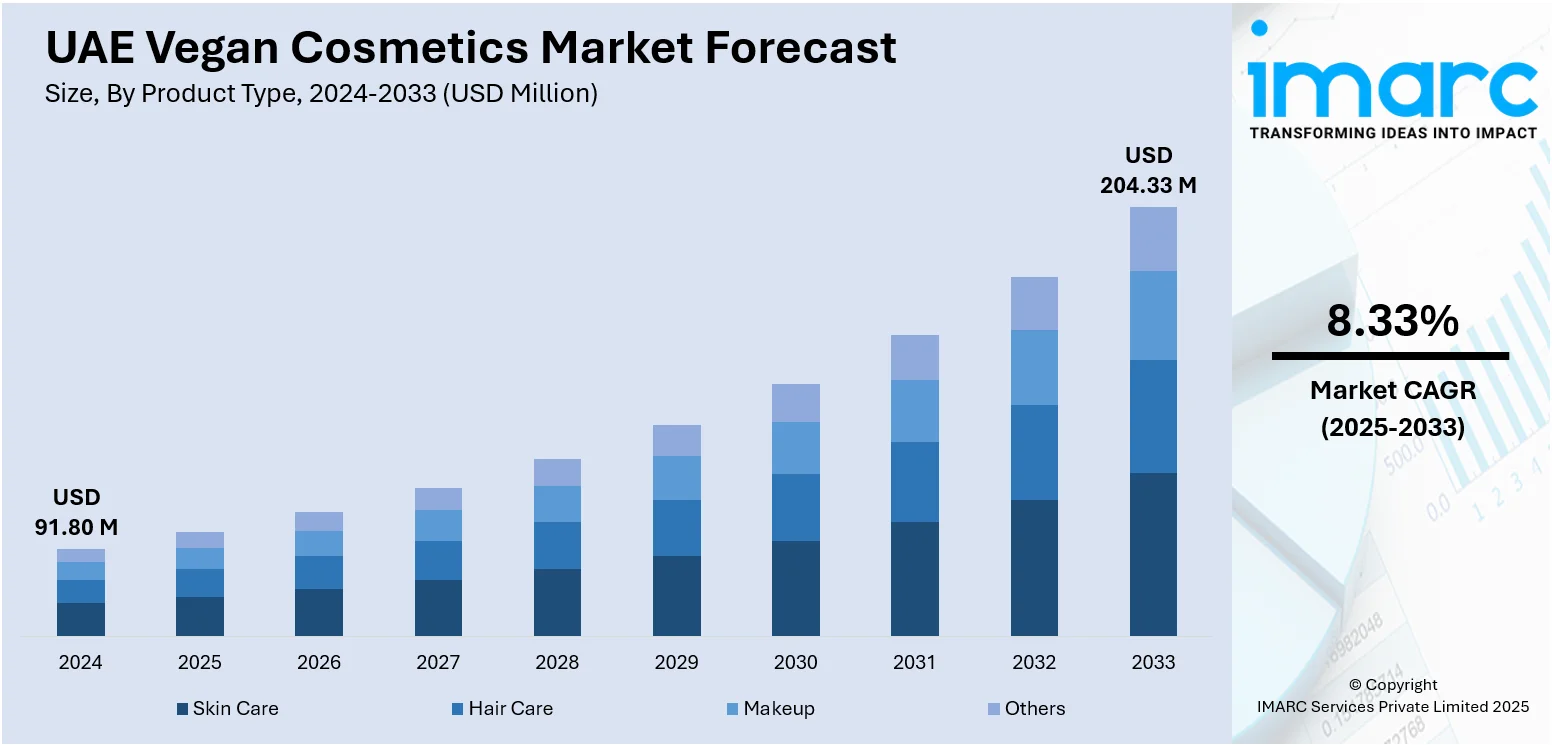

The UAE vegan cosmetics market size reached USD 91.80 Million in 2024. Looking forward, the market is expected to reach USD 204.33 Million by 2033, exhibiting a growth rate (CAGR) of 8.33% during 2025-2033. The market is fueled by growing consumer awareness about ethical beauty, higher demand for cruelty-free and plant-based products, and compatibility with halal lifestyle choices. Government initiatives toward sustainability and the focus of the region on environmentally friendly living continue to drive demand for vegan products. High disposable income and a fashion-conscious, multicultural population sustain the expansion of premium, clean beauty brands. Region-specific requirements generate demand for natural, skin-safe formulations, fueling the growth of UAE vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 91.80 Million |

| Market Forecast in 2033 | USD 204.33 Million |

| Market Growth Rate 2025-2033 | 8.33% |

UAE Vegan Cosmetics Market Trends:

Ethical and Sustainable Consumer Shift in the Emirates

In the UAE, a pronounced consumer shift toward ethical beauty is reshaping how people select their cosmetics, and vegan products have emerged at the forefront of that change. Across Dubai and Abu Dhabi’s multicultural, high‑income population, shoppers increasingly demand cruelty‑free and plant‑based formulations that align with values of environmental responsibility and social conscience. The region's drive to embrace sustainable lifestyles supports the vegan cosmetics trend, echoing national targets such as lowering carbon emissions and encouraging green consumption. Time-honored beauty rituals in the Emirates, including the application of rose water, camel milk, and henna, now converge with advanced vegan ingredients to produce hybrid products that are both local and ethical in feel. Brands that emphasize halal‑certified and vegan credentials are especially relevant, as they support both faith‑based needs and worldwide clean beauty trends. These values fuel demand in both skincare, hair care, and makeup products as consumers prioritize transparency, eco‑friendly sourcing, and animal‑friendly processes. In a traditionally dominated market by synthetic or high‑end options, vegan beauty is an alternative based on integrity and traceable ethics, which contributes to the UAE vegan cosmetics market growth.

To get more information on this market, Request Sample

Hybrid Skincare‑Makeup Products Appropriate for the Gulf Climate

Vegan cosmetics in the UAE are moving away from mere novelty to become highly ingrained in everyday skincare routines specifically designed for the desert environment. The region's harsh heat, sun intensity, and dry air impose special skin demands, making hybrid products like tinted SPF moisturizer or antioxidant serum with low pigmentation very appealing. Younger consumers, particularly Gen Z and millennials, are most attracted to multi‑functional clean beauty products that combine vegan ingredients such as aloe vera, plant oils, and botanical extracts with UV protection and hydration. These have both skincare and light makeup effects in one and represent a general regional trend of focusing on formulations that provide functional benefits along with aesthetic considerations. The concurrence of climate demands and moral consumer values has also driven regional innovation in vegan cosmetics that are designed to withstand sweat, heat, and environmental stressors, while maintaining halal compliance and not using animal-derived products.

Social Media, E‑Commerce, and Influencer‑Driven Vegan Beauty Awareness

In the UAE, a socially connected and digitally literate population has pushed vegan cosmetics into the spotlight through digital media, particularly through influencer marketing and e‑commerce websites. Beauty bloggers in Dubai and Abu Dhabi include vegan face care and makeup items in tutorials and reviews, emphasizing authenticity and sustainability as the main selling points, which is a strategy that strongly appeals to younger, values‑oriented consumers. Channels such as Instagram, TikTok, and regional apps including Noon.com and Powder bring vegan brands closer than ever before, and user‑generated content (UGC) contributes to trust with expatriate and Emirati markets as well. Clean beauty specialty retailers and e‑commerce boutiques dedicated to vegan products are emerging as go‑to places for halal‑certified and plant‑based makeup, frequently both online and experientially via pop‑ups and salons. Trade events like Beautyworld Dubai have vegan and sustainable beauty areas, enabling consumers to find local and global vegan brands with halal certifications, further mainstreaming vegan cosmetics within the larger beauty space. Such highly visual and socially interactive settings facilitate quick adoption and awareness of vegan, natural, and ethically branded offerings within the UAE market.

UAE Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

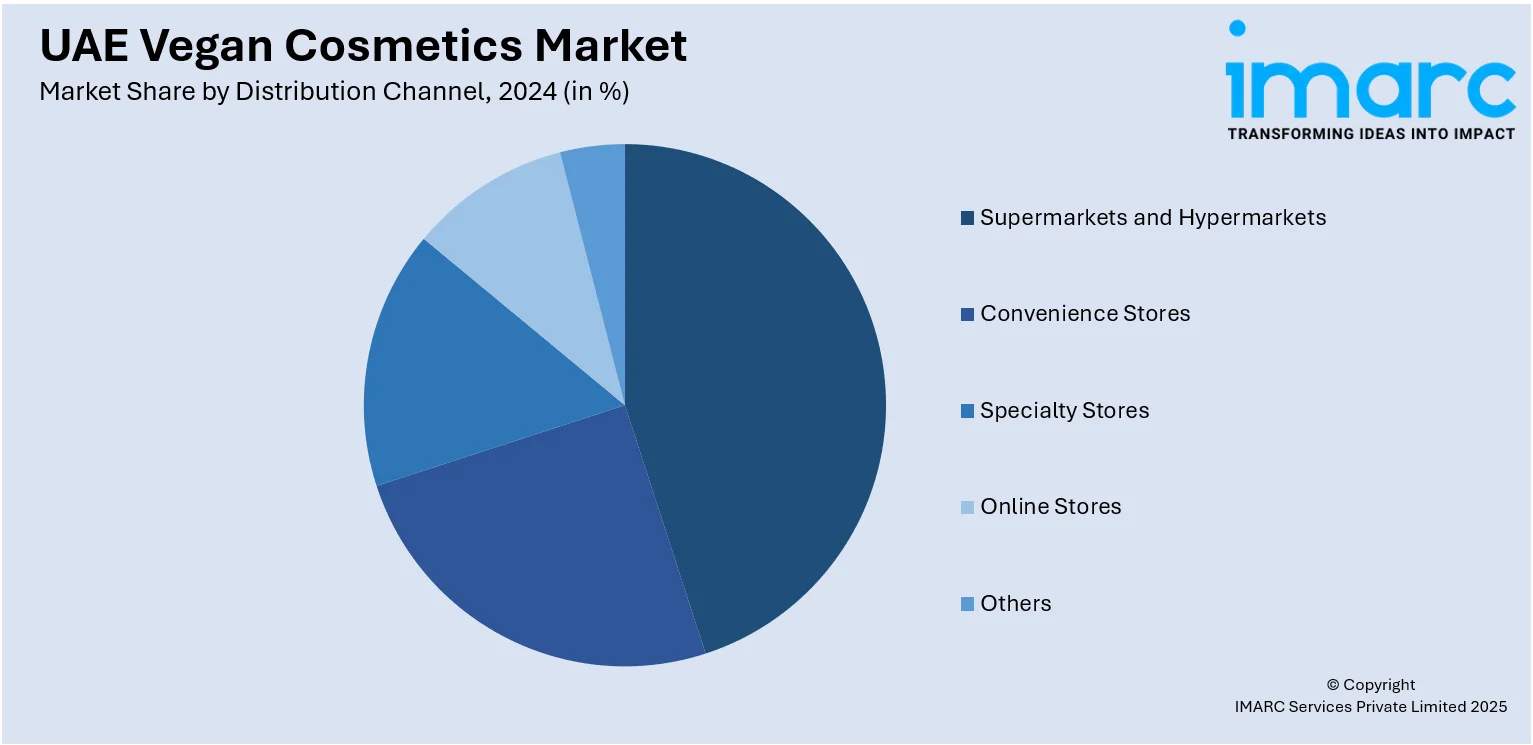

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE vegan cosmetics market on the basis of product type?

- What is the breakup of the UAE vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the UAE vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the UAE vegan cosmetics market?

- What are the key driving factors and challenges in the UAE vegan cosmetics market?

- What is the structure of the UAE vegan cosmetics market and who are the key players?

- What is the degree of competition in the UAE vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)