UAE Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2025-2033

UAE Watch Market Overview:

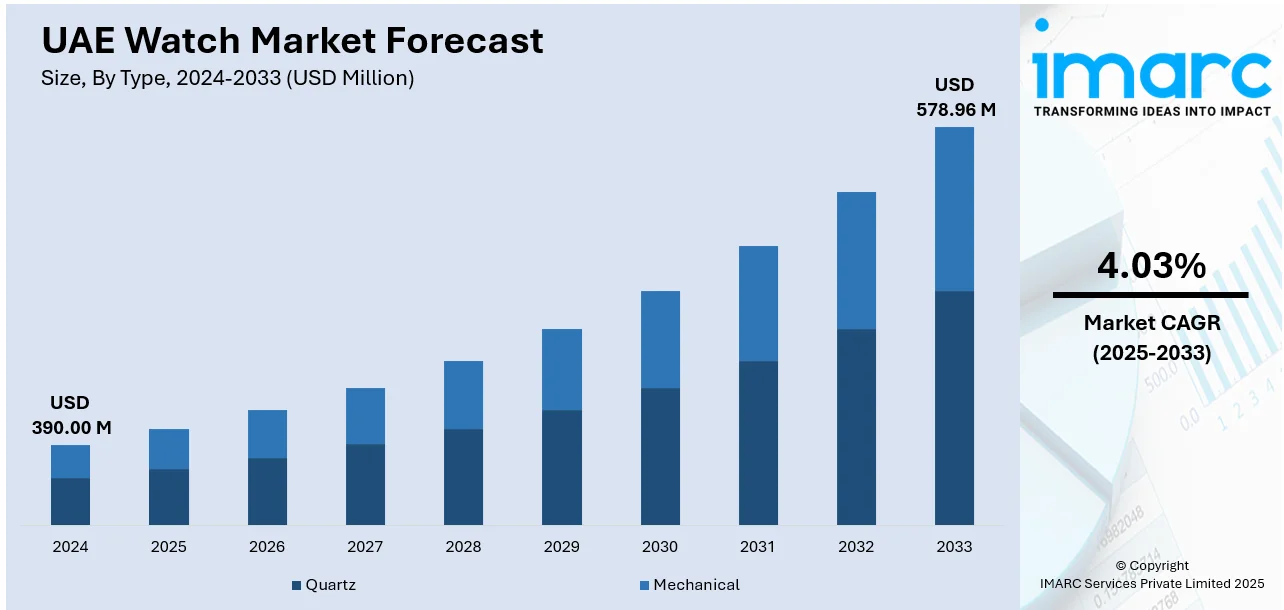

The UAE watch market size reached USD 390.00 Million in 2024. The market is projected to reach USD 578.96 Million by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The market is witnessing steady growth, fueled by increasing consumer demand for luxury as well as smartwatches. Featuring a wide variety of styles, price points, and distribution channels, the market attracts a wide base of consumers from high-end collectors to those technologically inclined. The growth of e-commerce and the rising adoption of wearable technology are changing buying habits, especially among younger consumers. With changing consumer tastes, the UAE watch market share is growing in most categories and price ranges.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 390.00 Million |

| Market Forecast in 2033 | USD 578.96 Million |

| Market Growth Rate 2025-2033 | 4.03% |

UAE Watch Market Trends:

Increasing Tourism Activities

Rising tourism activities are playing a significant role in driving the growth of the market in the UAE, as the country has become a global hub for luxury shopping and lifestyle experiences. As per the government data, tourism remained a key driver of Dubai’s economic growth, accounting for more than 12% of GDP and sustaining millions of jobs in 2024. Tourists, especially from Europe, Asia, and neighboring Gulf countries, often view the UAE as a destination to purchase premium and luxury watches due to its reputation for tax-free shopping, international brands availability, and attractive pricing compared to other regions. High-end malls, duty-free outlets, and exclusive boutiques in cities like Dubai and Abu Dhabi attract travelers who see watches as both functional items and symbols of prestige or souvenirs of their visit.

To get more information on this market, Request Sample

Growth of E-commerce and Digital Retailing

The rapid expansion of e-commerce platforms in the UAE has transformed how people purchase watches, making the market more accessible and competitive. As per the IMARC Group, the UAE e-commerce market size reached USD 125.0 Billion in 2024. Online luxury retailers, brand-owned websites, and marketplaces provide people with a wide selection of watches, ranging from affordable to high-end. The convenience of browsing collections online, combined with secure payment gateways and fast delivery, has accelerated sales. Additionally, digital platforms frequently offer exclusive collections and discounts that attract tech-savvy buyers. Social media and influencer marketing also play a critical role, with watch brands leveraging digital platforms to engage younger audiences and promote limited editions. Virtual try-on technologies and augmented reality (AR) tools are further enhancing the online buying experience.

Rising Disposable Incomes and Luxury Spending

The UAE watch market is strongly driven by the region’s high disposable income levels and the growing appetite for luxury goods. In 2024, the United Arab Emirates secured the second position in the Middle East and Africa for average gross income, experiencing a 2.9% real increase in per capita disposable income. People in the UAE often view premium watches as a long-term investment. With Dubai and Abu Dhabi being global hubs for luxury shopping, people are increasingly inclined towards high-end Swiss, French, and Italian watch brands. The strong culture of gifting watches during weddings, corporate events, and religious festivals is further catalyzing the demand. Additionally, tourists visiting the UAE, drawn by tax-free shopping and renowned luxury malls, contribute significantly to watch sales.

Key Growth Drivers of UAE Watch Market:

Presence of International Watch Brands

The presence of international brands is a major factor driving the market growth, as it enhances user trust, choice, and purchasing confidence. Global luxury and premium watchmakers view the UAE as a prime market due to its affluent population, high spending power, and reputation as a luxury retail hub. Their presence in flagship stores, malls, and exclusive boutiques creates a sense of prestige and attracts both local buyers and international tourists who associate these brands with quality, status, and heritage. Additionally, international brands frequently launch limited-edition collections and exclusive collaborations in the UAE, boosting desirability and market visibility. Their established marketing strategies, after-sales services, and global recognition also help strengthen user loyalty.

Cultural Preferences for Watches as Status Symbols

In the UAE, watches are not just functional timekeeping devices but symbols of prestige, success, and personal style. Culturally, residents place strong emphasis on luxury goods that signify wealth and achievement, and premium watches fit seamlessly into this narrative. Many Emiratis and expatriates regard branded watches as heritage items that can be passed down generations, adding sentimental value to ownership. The growing trend of collecting watches, particularly limited editions and luxury Swiss brands, reflects this cultural inclination. In addition, watches are often exchanged as high-value gifts during Eid, weddings, and corporate events, further cementing their cultural importance. This perception of watches as both lifestyle accessories and markers of social standing is driving continuous user interest.

Impact of Social Media and Digital Marketing

Social media platforms and digital marketing play a critical role in bolstering the market growth in the UAE, shaping user preferences. Brands use social media channels to showcase new collections, feature product highlights, and engage audiences through interactive content. Influencers, bloggers, and content creators demonstrate styling tips, unboxings, and product reviews, which significantly influence buying decisions. Online campaigns promote seasonal sales, limited-edition releases, and personalized offers, increasing consumer engagement and brand awareness. Social media also enables direct interaction with potential buyers, allowing brands to respond to queries and provide purchase guidance. This continuous digital presence ensures that watches remain top-of-mind for people and encourages exploration of new trends and models.

UAE Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

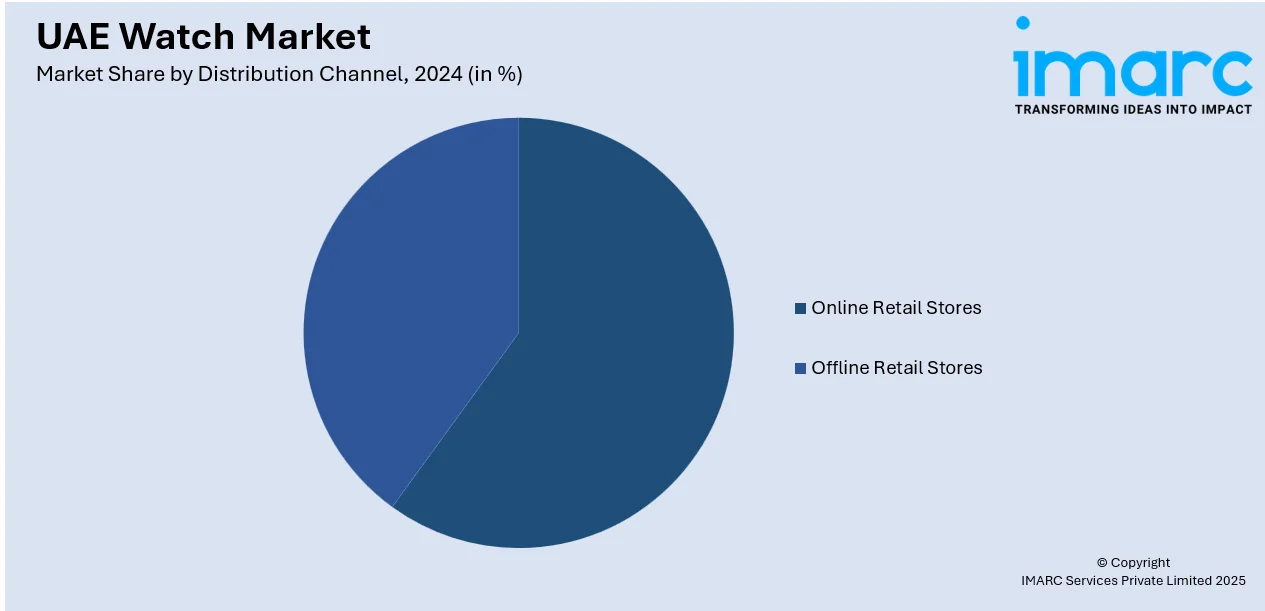

Distribution Channel Insights:

- Online Retail Stores

- Offline Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Watch Market News:

- February 2025: Nomadic Watches revealed its inaugural retail collaboration in the UAE with the esteemed Perpétuel Gallery, situated in the core of Dubai. The brand views this alliance as a perfect match with Perpétuel Gallery, a hub for luxury watch lovers that provided a curated environment for collectors to delve into the craftsmanship and technology of timekeeping.

- November 2024: In anticipation of the 53rd UAE National Day, the Swiss luxury watch brand Hublot teamed up with distinguished retailer Ahmed Seddiqi & Sons to unveil a Classic Fusion Abu Dhabi Edition, honoring the Emirate’s cultural and natural legacy. Hublot unveiled another remarkable creation with this latest limited edition series. Each watch was secured with a sand-hued camel leather strap, a style selection that encapsulated the essence of Abu Dhabi’s dunes on the wrist.

UAE Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The watch market in the UAE was valued at USD 390.00 Million in 2024.

The UAE watch market is projected to exhibit a CAGR of 4.03% during 2025-2033, reaching a value of USD 578.96 Million by 2033.

UAE’s status as a shopping hub is attracting both residents and tourists who are seeking premium and luxury timepieces. Smartwatches are also gaining traction among younger demographics for their health-tracking and connectivity features. The presence of global watch retailers, exclusive boutiques, and duty-free outlets in domestic airports is strengthening the accessibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)