UK Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

UK Advertising Market Overview:

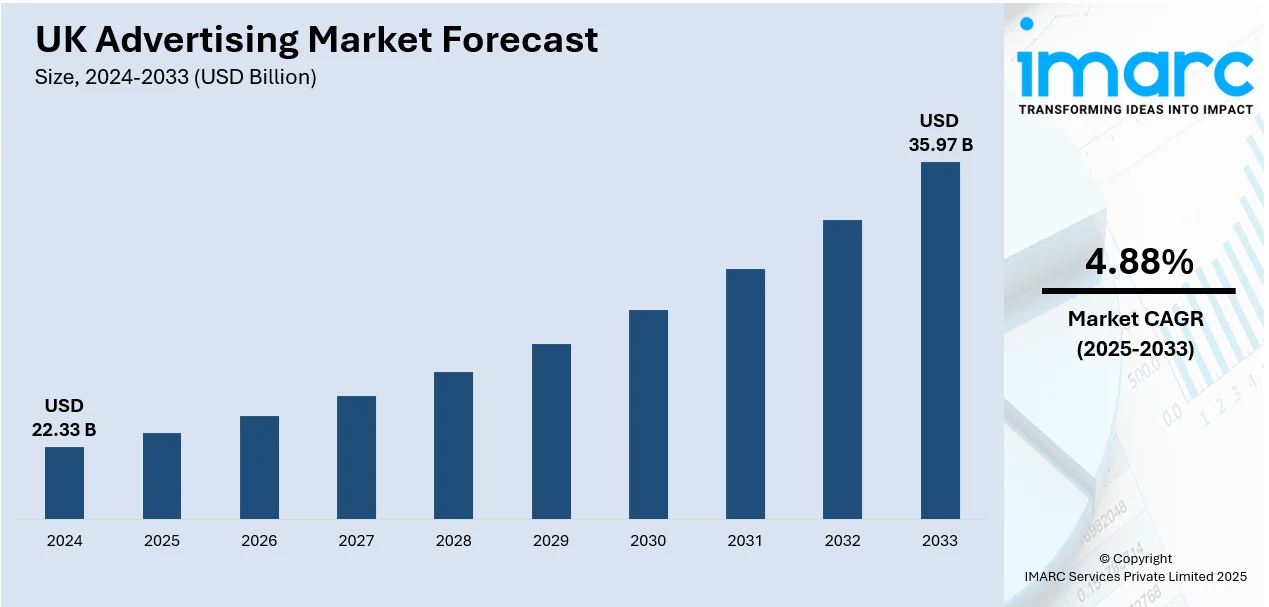

The UK advertising market size reached USD 22.33 Billion in 2024. The market is projected to reach USD 35.97 Billion by 2033, exhibiting a growth rate (CAGR) of 4.88% during 2025-2033. The market is undergoing a major transformation, driven by a shift from conventional channels like television and print to digital experiences. Social media, programming, and digital video formats dominate newer campaigns, offering precise targeting and creative flexibility. Brands are increasingly leveraging data analytics, AI-powered solutions, and immersive content to deepen engagement. Meanwhile, regulatory changes and privacy rules are prompting advertisers to adopt privacy-first approaches. These interconnected factors help shape a sophisticated and evolving ecosystem that defines the UK advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.33 Billion |

| Market Forecast in 2033 | USD 35.97 Billion |

| Market Growth Rate 2025-2033 | 4.88% |

UK Advertising Market Trends:

Rise of Connected TV and Streaming Advertising

In January 2025, data from the industry pointed to the increasing primacy of connected TV (CTV) in digital media consumption in the UK. With increased audiences moving from linear broadcasting to on-demand platforms, advertisers are refocusing their strategies to reach people where they spend time on streaming platforms and smart TVs. Today, CTV provides the digital targeting accuracy with the scale and storytelling richness of traditional TV. Marketers are leveraging this with sequential, data-driven campaigns that mature across devices from mobile to TV with common creative. The focus has shifted from media placement to delivering relevance, tailoring messaging to viewer behavior and preferences in real time. With improved cross-device tracking, brands can now to take consumers from awareness to action across devices without disrupting continuity. This format is also working particularly well at reaching traditionally harder-to-reach households through digital-only media. As streaming becomes further embedded in consumer behavior, its place in media planning will only become deeper. This change is a robust sign of long-term UK advertising market growth.

To get more information on this market, Request Sample

Influencer-Led Engagement and Creator Storytelling

Across 2024, emerging surveys reveal that a growing share of UK consumers report trusting and acting on content from creators whose values match their own. Creators who speak authentically and align with social or cultural interests are now instrumental in influencing perception and purchase intent. Marketers are increasingly partnering with creators to deliver narrative-driven ads in formats like short-form video, social-first storytelling, and contextual content that avoids overt sponsorship tone. These campaigns often resonate more because they feel less commercial and more human echoing values around identity, creativity, and social awareness. The result is deeper emotional connection and stronger recall across younger and value-conscious audiences. Over time, long-term alignment with trusted creators is becoming preferable to transactional influencer deals, elevating the creator’s role from broadcaster to storyteller. This embrace of creator-led media is reshaping how budgets and creative strategies are formed. Authentic, creator-driven content is becoming a defining feature in UK advertising market trends.

Purpose-Driven Advertising with Transparency

In April 2025, consumer feedback across the UK pointed strongly toward authenticity in sustainability messaging, with educational ad content receiving significantly greater trust than traditional slogans. Audiences now expect brands to demonstrate real-world action sharing insights into supply chain transparency, carbon initiatives, or community impact delivered through engaging storytelling with measurable substance. Advertisers are responding by structuring campaigns around clear, purpose-built narratives: from visual journeys through responsible sourcing to interactive media that invites consumer exploration of sustainable credentials. QR codes and digital dashboards offering external validation are used increasingly to back claims and build credibility. These campaigns emphasize narrative depth over surface-level eco‑themes, helping to build trust in a climate increasingly wary of greenwashing. As regulatory frameworks like the UK’s evolving advertising standard tighten, the emphasis on accountability and clarity in messaging becomes strategic. Purpose-led creative not only resonates emotionally but also bridges brand values with measurable outcomes and audience demand for genuine impact.

UK Advertising Market Segmentation:

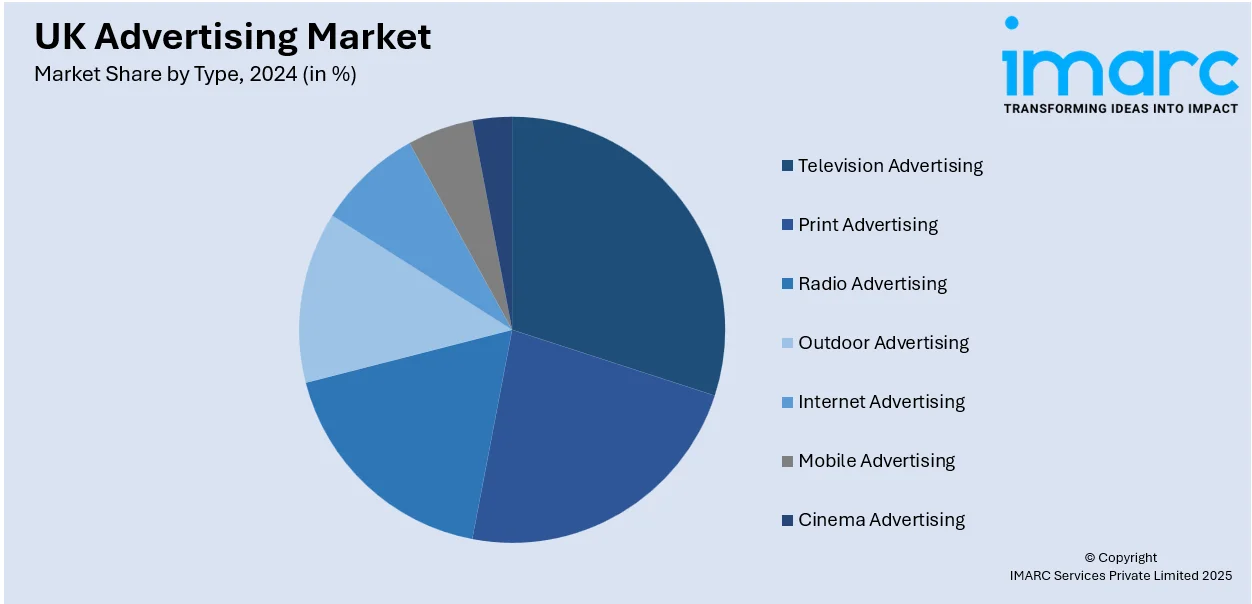

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Other

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands and other.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Advertising Market News:

- July 2025: Campaign agency WPP has been engaged by the UK Treasury and a consortium of City institutions comprising major banks and asset managers to develop a high‑impact advertising campaign. Announced by Chancellor Rachel Reeves, this initiative aims to encourage UK savers to transition their cash into stocks and shares as part of a broader economic growth push. The multichannel drive, inspired by the historic “Tell Sid “Campaign, seeks to reinvigorate British share ownership and support London’s stock market. UK broadcasters and online platforms will deliver the campaign in coordination with financial regulators and industry leaders.

- July 2025: UK broadcaster ITV delivered stronger-than-expected first-half results, buoyed by more resilient advertising revenue than anticipated. Despite a slowdown in ad sales compared with a high-growth period last year, the company reported a solid performance that exceeded forecasts. ITV’s leadership emphasized the importance of stabilizing revenues while continuing strategic efforts across digital streaming, content investment, and cost optimization to adapt to evolving market dynamics.

UK Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Other |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the UK advertising market on the basis of type?

- What is the breakup of the UK advertising market on the basis of region?

- What are the various stages in the value chain of the UK advertising market?

- What are the key driving factors and challenges in the UK advertising market?

- What is the structure of the UK advertising market and who are the key players?

- What is the degree of competition in the UK advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)