UK AI in Healthcare Market Size, Share, Trends and Forecast by Offering, Technology, Application, End User, and Region, 2026-2034

UK AI in Healthcare Market Summary:

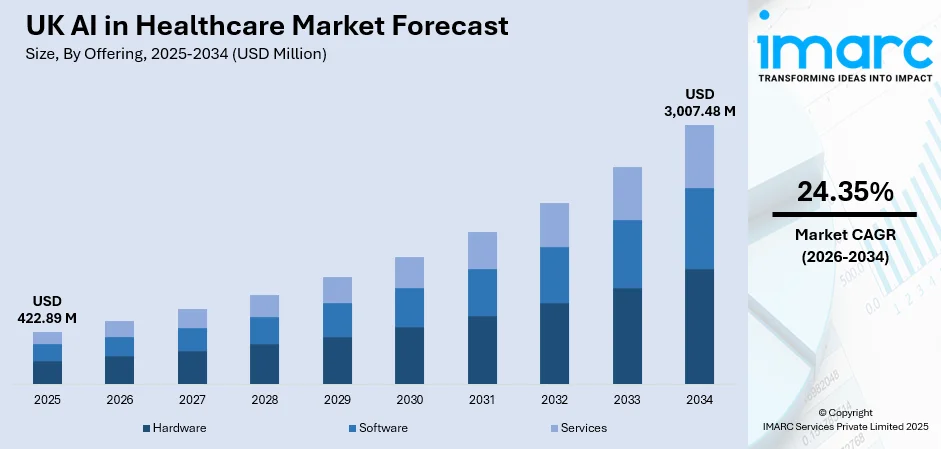

The UK AI in healthcare market size was valued at USD 422.89 Million in 2025 and is projected to reach USD 3,007.48 Million by 2034, growing at a compound annual growth rate of 24.35% from 2026-2034.

The market is driven by the increasing adoption of digital health technologies, rising demand for precision medicine, and government initiatives supporting healthcare innovation. The integration of artificial intelligence (AI) across diagnostic systems, treatment planning, and administrative operations is transforming healthcare delivery. Growing investments in machine learning (ML) applications and natural language processing tools are enabling enhanced clinical decision-making and patient engagement, contributing to the expansion of UK AI in healthcare market share.

Key Takeaways and Insights:

-

By Offering: Software dominates the market with a share of 46.04% in 2025, driven by the widespread deployment of AI-powered diagnostic platforms, clinical decision support systems, and healthcare management applications across NHS facilities and private healthcare providers.

-

By Technology: Machine learning leads the market with a share of 49.05% in 2025, owing to its superior capability in pattern recognition, predictive analytics, and diagnostic accuracy enhancement across medical imaging and treatment optimization applications.

-

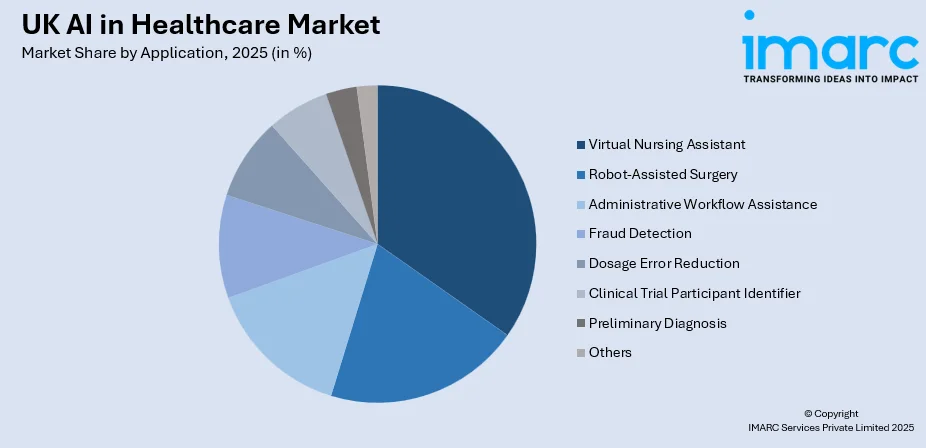

By Application: Virtual nursing assistant represents the largest segment with a market share of 18.06% in 2025, driven by rising demand for patient engagement solutions, remote monitoring capabilities, and automated healthcare support services that reduce clinical workload.

-

By End User: Pharmaceutical and biotechnology companies dominate the market with a share of 35.03% in 2025, owing to extensive AI adoption in drug discovery processes, clinical trial optimization, and personalized medicine development initiatives.

-

By Region: South East leads the market with a share of 14% in 2025, driven by he concentration of leading healthcare institutions, technology hubs, and pharmaceutical companies alongside strong government-backed digital health initiatives.

-

Key Players: The UK AI in healthcare market is moderately fragmented, with established tech firms and startups forming partnerships with NHS trusts and private providers to expand offerings, enhance solutions, and strengthen market positions through collaborative research initiatives.

To get more information on this market Request Sample

The UK AI in healthcare market is experiencing substantial growth propelled by multiple converging factors. Government support through initiatives like the NHS Long Term Plan and dedicated AI funding programs is accelerating the integration of intelligent systems across healthcare facilities. As per sources, in October 2025, seven emerging AI healthcare technologies were selected for the MHRA’s AI Airlock programme, enabling safe trials for early disease detection and accelerating NHS clinical AI adoption. Moreover, the increasing burden on healthcare professionals, combined with rising patient expectations for personalized care, is driving the adoption of AI-powered solutions for diagnostics, treatment planning, and administrative automation. Furthermore, the availability of extensive healthcare datasets through NHS digital infrastructure provides a robust foundation for machine learning applications. The growing emphasis on precision medicine and early disease detection is encouraging healthcare providers to implement predictive analytics and imaging analysis tools that enhance clinical outcomes while optimizing operational efficiency.

UK AI in Healthcare Market Trends:

Integration of AI in Medical Imaging and Diagnostics

Healthcare providers across the UK are increasingly deploying AI tools to enhance radiology workflows and diagnostic accuracy. AI-powered imaging analysis systems are being integrated into hospital networks to automate image interpretation, enabling faster identification of conditions including tumors, fractures, and cardiovascular abnormalities. As per sources, in July 2025, the Cheshire and Merseyside Radiology Imaging Network introduced transformational AI diagnostic technology, enabling faster lung cancer detection across nine NHS trusts and improving radiology accuracy and patient outcomes. Furthermore, these technologies are reducing clinician burden while shortening patient turnaround times significantly. The deployment of intelligent screening tools through government-funded programs is expanding access to early detection capabilities across NHS trusts, improving care quality and clinical outcomes throughout the healthcare system.

Expansion of Virtual Health Assistants and Patient Engagement Tools

Healthcare organizations are implementing AI-powered virtual assistants and chatbots to transform patient engagement and streamline administrative processes. As per sources, in October 2025, Coventry and Warwickshire Partnership NHS Trust’s AI-powered chatbot managed 30% of Talking Therapies referrals, streamlining patient intake, reducing repetition, and becoming the second most used referral route. These intelligent systems handle appointment scheduling, symptom triage, prescription reminders, and post-operative follow-up calls, improving patient access to services while reducing operational costs. Virtual nursing assistants are becoming increasingly vital in supporting patients outside traditional healthcare settings, enhancing monitoring capabilities and care continuity. The adoption of these technologies is particularly strong in high-volume hospital environments where automation enables clinical staff to focus on complex patient care requirements.

Advancement of AI in Drug Discovery and Precision Medicine

Pharmaceutical and biotechnology organizations are leveraging AI to revolutionize drug discovery processes and accelerate the development of personalized treatments. Machine learning algorithms analyse genomic data, patient histories, and treatment outcomes to design tailored therapeutic approaches that improve efficacy and minimize adverse effects. AI platforms are identifying promising drug candidates, simulating biological responses, and optimizing clinical trial design, significantly reducing research timelines and development costs. According to sources, in June 2025, the UK’s OpenBind consortium was launched to create the world’s largest AI-driven drug–protein dataset, accelerating drug discovery and positioning the UK as a global leader. Moreover, this trend is particularly evident in oncology and rare disease research, where precision medicine approaches require sophisticated molecular-level analysis capabilities.

Market Outlook 2026-2034:

The UK AI in healthcare market is projected to experience robust revenue growth throughout the forecast period, driven by continued government investment in digital health infrastructure and accelerating adoption across healthcare facilities. Rising demand for precision medicine, enhanced diagnostic capabilities, and operational efficiency improvements will sustain market expansion. The integration of AI with cloud computing platforms, wearable health devices, and electronic health record systems is enabling real-time analytics and remote care delivery models that expand market opportunities. The market generated a revenue of USD 422.89 Million in 2025 and is projected to reach a revenue of USD 3,007.48 Million by 2034, growing at a compound annual growth rate of 24.35% from 2026-2034.

UK AI in Healthcare Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Offering | Software | 46.04% |

| Technology | Machine Learning | 49.05% |

| Application | Virtual Nursing Assistant | 18.06% |

| End User | Pharmaceutical and Biotechnology Companies | 35.03% |

| Region | South East | 14% |

Offering Insights:

- Hardware

- Software

- Services

Software dominates with a market share of 46.04% of the total UK AI in healthcare market in 2025.

Software leads the UK AI in healthcare market, commanding the largest revenue share among all offering categories. This leadership position is attributed to the widespread deployment of AI-powered platforms across healthcare facilities for clinical decision support, diagnostic assistance, and operational management applications. Healthcare providers are increasingly investing in sophisticated solutions that enhance treatment planning accuracy and improve patient outcomes through intelligent data analysis capabilities and automated workflow optimization across clinical environments.

The growing demand for integrated healthcare management systems and predictive analytics platforms continues to drive expansion within this category. NHS digital transformation initiatives are accelerating the adoption of AI software applications across the primary and secondary care settings. As per sources, in October 2025, an NHS trial of Microsoft 365 Copilot across 90 organisations demonstrated AI could save up to 400,000 staff hours monthly, streamlining administration and enabling focus on frontline patient care. Further, the development of specialized tools for medical imaging analysis, natural language processing for clinical documentation, and patient engagement automation is creating a substantial growth opportunity as healthcare organizations seek comprehensive digital solutions.

Technology Insights:

- Machine Learning

- Context-Aware Computing

- Natural Language Processing

- Others

Machine learning leads with a share of 49.05% of the total UK AI in healthcare market in 2025.

Machine learning held the UK AI in healthcare market with the dominant share among all technology categories. This prominence stems from the superior capability of algorithms in analysing complex healthcare datasets, identifying patterns in medical imaging, and generating accurate predictive models for disease progression and treatment response. Healthcare institutions are leveraging machine learning to enhance diagnostic accuracy while reducing the time required for clinical decision-making processes across diverse medical specialties and treatment pathways.

The technology continues gaining traction across diverse healthcare applications including radiology, pathology, and personalized medicine development initiatives. Models trained on extensive NHS datasets are demonstrating significant improvements in early disease detection and treatment optimization across facilities. As per sources, in May 2025, UCL and King’s College London trained an AI model on de-identified NHS data from 57 Million people in England to predict health outcomes and enable early interventions. Moreover, the ongoing advancement of deep learning architectures and availability of substantial computing resources are strengthening adoption across pharmaceutical research, clinical trial design, and population health management applications throughout the broader healthcare ecosystem nationwide.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Robot-Assisted Surgery

- Virtual Nursing Assistant

- Administrative Workflow Assistance

- Fraud Detection

- Dosage Error Reduction

- Clinical Trial Participant Identifier

- Preliminary Diagnosis

- Others

Virtual nursing assistant exhibits a clear dominance with a 18.06% share of the total UK AI in healthcare market in 2025.

Virtual nursing assistant holds the leading position within the UK AI in healthcare market application category. These intelligent systems provide patients with a continuous support through automated check-ins, medication reminders, symptom monitoring, and health guidance outside traditional clinical settings. According to sources, in July 2025, NHS 111 Wales launched an AI-powered virtual assistant, developed with Robotics AI and DRUID AI, to provide real-time health advice and improve patient access to digital services. Further, healthcare providers are deploying virtual nursing solutions to extend care capabilities, enhance patient engagement, and reduce the burden on clinical staff facing workforce constraints across NHS trusts and private healthcare facilities.

The rising emphasis on community-based care and remote patient monitoring is accelerating adoption across healthcare facilities nationwide significantly. These applications improve care continuity for patients managing chronic conditions while enabling early intervention when health concerns arise unexpectedly. The integration of natural language processing capabilities allows virtual nursing assistants to conduct meaningful patient interactions, gather relevant health information, and appropriately escalate concerns to healthcare professionals when immediate clinical attention becomes necessary.

End User Insights:

- Healthcare Providers

- Pharmaceutical and Biotechnology Companies

- Patients

- Others

Pharmaceutical and biotechnology companies lead with a market share of 35.03% of the total UK AI in healthcare market in 2025.

Pharmaceutical and biotechnology companies represent the dominant end-user category in the UK AI in healthcare market currently. These organizations are extensively integrating AI across drug discovery pipelines, clinical trial processes, and precision medicine development initiatives. AI technologies enable pharmaceutical firms to identify promising therapeutic targets, optimize molecular structures, and predict drug interactions more efficiently than traditional research methodologies, thereby accelerating the overall pace of therapeutic innovation significantly across the industry.

The category continues to expand as pharmaceutical and biotechnology companies are leveraging AI for genomic analysis, biomarker identification, and personalized treatment development programs. ML platforms are significantly reducing the drug development timelines while improving success rates in clinical trials through better patient selection and trial optimization strategies. Strategic partnerships between pharmaceutical organizations and AI technology providers are driving innovation and accelerating commercialization of AI-enabled therapeutic solutions across the UK healthcare landscape.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

South East dominates with a market share of 14% of the total UK AI in healthcare market in 2025.

South East maintains a leading position in the UK AI in healthcare market, capturing the largest regional revenue share among all regions nationwide currently. This dominance is attributed to the concentration of prominent healthcare institutions, leading academic research centers, and major pharmaceutical companies within the region. Strong connectivity to London's thriving technology ecosystem and substantial ongoing investment in robust digital health infrastructure effectively support the advanced adoption of AI-powered healthcare solutions across regional facilities and diverse clinical settings.

Government-backed innovation programs and favorable regulatory environments are further accelerating AI integration across South East healthcare organizations on a continuous basis. The region benefits significantly from established strategic partnerships between NHS trusts, leading universities, and prominent technology developers that facilitate pilot programs and rapid deployment of validated AI solutions across healthcare facilities. Higher healthcare spending levels and greater access to specialized medical services create substantial demand for advanced diagnostic and treatment optimization technologies within the rapidly growing South East market.

Market Dynamics:

Growth Drivers:

Why is the UK AI in Healthcare Market Growing?

Government Investment and Policy Support for Digital Health Innovation

The UK government is actively driving AI adoption in healthcare through substantial funding programs, regulatory frameworks, and strategic initiatives designed to modernize the national health system. Dedicated investment in AI research projects, digital infrastructure development, and workforce training is creating favorable conditions for technology deployment across healthcare facilities. Policy support through agencies including the NHS AI Lab and MHRA regulatory sandbox programs provides clear pathways for AI solution validation and implementation. According to source, in September 2025, the UK established the National Commission on the Regulation of AI in Healthcare, advising the MHRA to accelerate safe NHS AI adoption and develop a new regulatory rulebook. Moreover, these government-backed initiatives reduce adoption barriers for healthcare providers while establishing quality and safety standards that build confidence in AI technologies. The commitment to transforming the UK into a leading AI-enabled healthcare system continues attracting investment and innovation across the sector.

Rising Demand for Precision Medicine and Personalized Treatment

The growing emphasis on precision medicine is significantly driving AI adoption across the UK healthcare sector as providers seek technologies capable of analyzing complex patient data for individualized treatment approaches. AI enables the integration of genomic information, clinical histories, and treatment outcomes to develop tailored therapeutic strategies that improve efficacy while minimizing adverse effects. As per sources, in August 2025, UK Biobank launched a three-year initiative to develop a multi-modal AI model integrating health records, medical images, and genomic data to advance precision medicine. Further, healthcare organizations are investing in AI platforms that support molecular-level analysis and predictive modeling for personalized care pathways. The shift from generalized treatment protocols toward precision approaches requires sophisticated analytical capabilities that only AI technologies can provide at scale. This transformation in healthcare delivery philosophy creates sustained demand for machine learning applications across diagnostics, treatment planning, and therapeutic monitoring domains.

Healthcare Workforce Constraints and Operational Efficiency Requirements

Persistent workforce shortages across the UK healthcare system are accelerating the adoption of AI technologies that automate routine tasks and augment clinical decision-making capabilities. Healthcare organizations face increasing pressure to deliver high-quality care with constrained resources, driving investment in solutions that enhance operational efficiency without compromising patient outcomes. AI-powered tools for administrative automation, diagnostic support, and patient engagement reduce the burden on clinical staff while improving service delivery speed and accuracy. According to reports, in December 2025, an AI A&E demand forecasting tool was deployed across 50 NHS organisations in England, enabling smarter staff planning, reducing bottlenecks, and accelerating patient treatment times. Moreover, the growing imbalance between healthcare demand and available workforce capacity makes AI adoption essential for maintaining care quality standards. These operational pressures combined with rising patient expectations create compelling incentives for healthcare providers to implement intelligent systems across clinical and administrative functions.

Market Restraints:

What Challenges the UK AI in Healthcare Market is Facing?

Data Privacy and Security Concerns

Healthcare organizations face significant challenges regarding patient data privacy and security when implementing AI systems that require access to sensitive health information. Compliance with UK GDPR and healthcare-specific data protection regulations creates complexity in AI deployment and data sharing arrangements. Concerns about algorithmic transparency, data breach risks, and potential misuse of patient information can slow adoption decisions.

Integration with Legacy Healthcare Systems

Many NHS facilities and healthcare providers operate with outdated information technology infrastructure that presents significant barriers to AI implementation. Legacy systems often lack interoperability with modern AI platforms, creating technical bottlenecks that delay deployment and limit functionality. The substantial investment required for infrastructure modernization, system integration, and staff training constrains AI adoption particularly in resource-limited healthcare settings.

Shortage of Skilled AI and Healthcare Technology Professionals

The effective deployment and maintenance of AI systems in healthcare requires professionals with combined expertise in data science, machine learning, and clinical applications. The UK faces a significant shortage of such specialized talent, creating dependencies on external vendors and limiting in-house innovation capabilities. This skills gap increases implementation costs and can delay AI projects as organizations compete for limited expertise.

Competitive Landscape:

The UK AI in healthcare market features a dynamic competitive landscape characterized by active participation from established technology corporations, specialized healthcare AI developers, and innovative startup ventures. Market participants are pursuing diverse strategies including strategic partnerships with NHS trusts, academic collaborations for research and development, and targeted acquisitions to expand capabilities. The competitive environment emphasizes innovation in machine learning algorithms, diagnostic accuracy improvement, and integration capabilities with existing healthcare workflows. Organizations are differentiating through specialized applications in medical imaging, drug discovery, and virtual care delivery.

Recent Developments:

-

In December 2025, The MHRA has launched a Call for Evidence to guide AI regulation in healthcare. Supporting the National Commission on AI Regulation, the initiative invites patients, clinicians, and industry stakeholders to provide input, ensuring safe, effective, and innovation-driven deployment of AI across the NHS.

UK AI In Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Hardware, Software, Services |

| Technologies Covered | Machine Learning, Context-Aware Computing, Natural Language Processing, Others |

| Applications Covered | Robot-Assisted Surgery, Virtual Nursing Assistant, Administrative Workflow Assistance, Fraud Detection, Dosage Error Reduction, Clinical Trial Participant Identifier, Preliminary Diagnosis, Others |

| End Users Covered | Healthcare Providers, Pharmaceutical and Biotechnology Companies, Patients, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK AI in healthcare market size was valued at USD 422.89 Million in 2025.

The UK AI in healthcare market is expected to grow at a compound annual growth rate of 24.35% from 2026-2034 to reach USD 3,007.48 Million by 2034.

Software held the largest market share, driven by widespread deployment of AI-powered platforms across healthcare facilities for clinical decision support, diagnostic assistance, operational management applications, and patient engagement automation throughout NHS trusts and private healthcare providers.

Key factors driving the UK AI in healthcare market include government investment in digital health initiatives, rising demand for precision medicine and personalized treatments, healthcare workforce constraints requiring operational efficiency improvements, and extensive NHS healthcare data availability for machine learning applications.

Major challenges include data privacy and security concerns related to sensitive patient information, integration difficulties with legacy healthcare IT systems, shortage of skilled AI and healthcare technology professionals, regulatory compliance complexity, and building clinical trust in AI-driven decision-making systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)