UK AI in Retail Market Size, Share, Trends and Forecast by Component, Technology, Type, Application, and Region, 2026-2034

UK AI in Retail Market Summary:

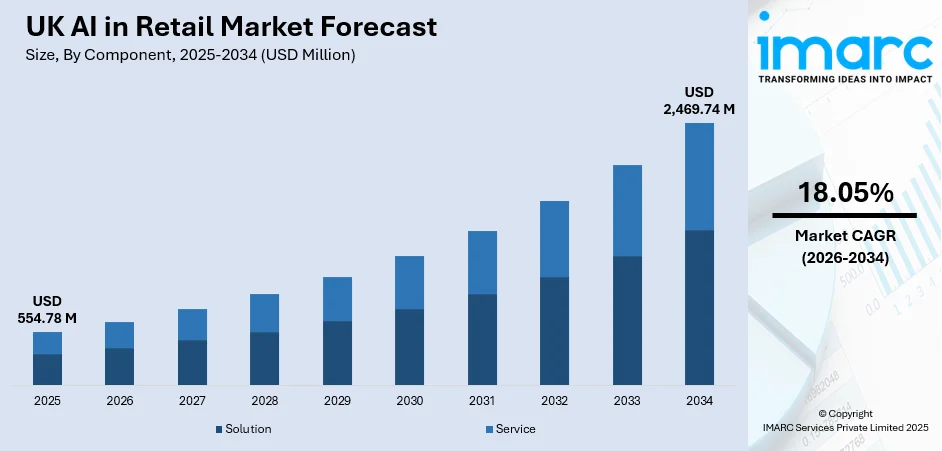

The UK AI in retail market size was valued at USD 554.78 Million in 2025 and is projected to reach USD 2,469.74 Million by 2034, growing at a compound annual growth rate of 18.05% from 2034.

The UK AI in retail market is experiencing transformative growth as retailers across the nation embrace AI to enhance user experiences and operational efficiency. The convergence of expanding e-commerce adoption, increasing individual demand for personalized shopping journeys, and significant investments in technology infrastructure is fundamentally reshaping the competitive landscape. As major retailers partner with technology providers to implement machine learning (ML) and advanced analytics solutions, the market continues to attract substantial investment, creating significant opportunities for participants in the market.

Key Takeaways and Insights:

- By Component: Solution dominates the market with a share of 70.06% in 2025, due to the increasing deployment of AI-powered platforms for personalization, inventory management, and client analytics across leading British retailers.

- By Technology: Machine learning leads the market with a share of 40.13% in 2025, owing to its widespread application in demand forecasting, recommendation engines, and predictive analytics that enable retailers to understand and anticipate individual behavior.

- By Type: Online retail represents the largest segment with a market share of 65% in 2025. This dominance reflects the rapid digital transformation of UK commerce, with AI enabling personalized product recommendations, dynamic pricing, and enhanced user engagement across digital platforms.

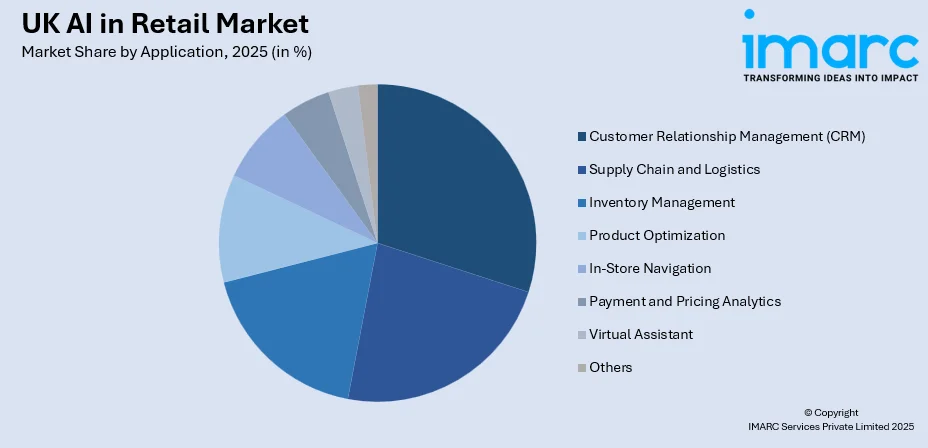

- By Application: Customer relationship management (CRM) dominates the market with a share of 18% in 2025, driven by retailers' focus on building personalized user engagement strategies, loyalty programs, and data-driven marketing campaigns.

- Key Players: The UK AI in retail market exhibits moderate competitive intensity, with established global technology corporations competing alongside innovative startups offering specialized solutions tailored to the unique requirements of British retailers across various segments and distribution channels.

To get more information on this market Request Sample

The UK AI in retail market is experiencing notable growth, driven by the increasing demand for personalized shopping experiences. Retailers are rapidly adopting AI technologies to offer customized product recommendations, dynamic pricing models, and targeted promotions based on individual preferences and behaviors. This trend is facilitated by advancements in AI algorithms that enhance demand forecasting, improve client interactions, and streamline operational efficiency. The rise of e-commerce and omnichannel strategies is further accelerating the integration of AI to ensure seamless experiences across both digital and physical retail touchpoints. Moreover, the growing need for operational efficiency, cost reduction, and real-time data analysis is encouraging UK retailers to invest in AI-powered tools for automation, inventory management, and decision-making. One such innovation is OpenAI’s "Operator," an AI tool launched in 2025, which autonomously handles online tasks like completing shopping lists, reflecting the growing role of AI in simplifying retail transactions and enhancing user convenience.

UK AI in Retail Market Trends:

Advancements in AI-Driven Demand Forecasting

Retailers are increasingly adopting AI technologies to improve inventory management by accurately predicting individual demand based on various variables like events and promotions. These systems enhance stock availability, reduce waste, and enable retailers to streamline operations. By integrating AI for demand forecasting, retailers can optimize their supply chains, improve client satisfaction, and allocate resources more effectively, supporting the market growth. For example, in 2024 Waitrose expanded its partnership with Blue Yonder, integrating AI-driven demand forecasting to enhance client satisfaction. The system analyzed individual behavior, including responses to weather, events, and promotions, for more accurate stock predictions. This AI technology aimsed to improve stock availability, reduce waste, and free up staff for more customer-focused tasks.

Focus on Enhanced Client Experience

The growing use of AI technologies like real-time item scanning and tracking is allowing retailers to offer a more seamless and personalized shopping experience. These innovations not only streamline the shopping process but also improve user satisfaction by reducing wait times and enhancing convenience. The rising adoption of such AI-driven tools is accelerating the shift towards smarter, more efficient retail environments. In 2025, Instacart and Morrisons announced a partnership to bring AI-powered shopping trolleys, known as Caper Carts, to the UK. These smart trolleys will allow customers to scan and track items in real time, enhancing the shopping experience.

Rise of AI-Driven Mobile Applications

Retailers are integrating advanced AI technologies into their apps to improve product discoverability, enhance user experience, and offer personalized shopping features. These AI-driven apps not only provide tailored recommendations but also foster user loyalty through exclusive functionalities and accessibility features. As retailers expand their digital offerings, these AI-enhanced applications are essential for attracting and retaining customers. In 2025, UK online retailer MandM launched a new AI-powered mobile app in collaboration with Valtech, integrating advanced Google Cloud and Contentstack technologies. The app features AI-driven search for better product discoverability and exclusive shopping functionalities, aiming to enhance customer loyalty. It also supports accessibility and scalable features, aligning with MandM's expansion strategy into European markets.

Market Outlook 2026-2034:

The UK AI in retail market is poised for significant growth, driven by ongoing digital transformation efforts and shifting user expectations for smarter shopping experiences. The market generated a revenue of USD 554.78 Million in 2025 and is projected to reach a revenue of USD 2,469.74 Million by 2034, growing at a compound annual growth rate of 18.05% from 2026-2034. This growth reflects the increasing adoption of AI-driven technologies in enhancing retail operations and improving customer engagement.

UK AI in Retail Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Solution | 70.06% |

| Technology | Machine Learning | 40.13% |

| Type | Online Retail | 65% |

| Application | Customer Relationship Management (CRM) | 18% |

Component Insights:

- Solution

- Service

Solution dominates with a market share of 70.06% of the total UK AI in retail market in 2025.

Solution holds the biggest market share due to the increasing demand for AI-driven technologies that enhance client experiences, streamline operations, and optimize inventory management. Retailers are adopting AI solutions for personalized recommendations, predictive analytics, and dynamic pricing.

Additionally, AI solutions are integral to automating processes, improving supply chain efficiency, and enabling real-time decision-making. The integral role of AI solutions in automating processes and enabling real-time decision-making is highlighted by Currys' 2025 launch of the "Action AI" tool in 16 UK stores, which provides managers with real-time insights on sales, footfall, and customer satisfaction for smarter operational decisions.

Technology Insights:

- Machine Learning

- Natural Language Processing

- Chatbots

- Image and Video Analytics

- Swarm Intelligence

Machine learning leads with a market share of 40.13% of the total UK AI in retail market in 2025.

Machine learning represents the largest segment, driven by its ability to analyze vast amounts of individual data and generate actionable insights. As ML models continuously improve through data-driven learning, retailers can make more accurate and timely decisions.

Furthermore, retailers use ML algorithms for personalized recommendations, demand forecasting, and user behavior prediction, enhancing client engagement. For instance, in 2024, Sainsbury's announced a five-year partnership with Microsoft to integrate AI and ML into its operations. This collaboration aims to enhance customer experiences, empower store colleagues, and streamline business processes through data and cloud technology. The goal is to create a more efficient, AI-driven shopping experience while improving service and profitability.

Type Insights:

- Online Retail

- Offline Retail

Online retail exhibits a clear dominance with a 65% share of the total UK AI in retail market in 2025.

Online retail dominates the market owing to the increasing shift toward e-commerce, where AI plays a critical role in enhancing user experiences. AI-driven technologies like personalized recommendations, chatbots, and predictive analytics are transforming how online retailers engage clients. The need for AI-driven technologies to enhance user experiences and optimize operations, is demonstrated by industry-specific platforms like Auto Trader's Co-Driver, an AI-driven platform introduced in 2024 to automate tasks for car retailers, including image management and AI-generated descriptions.

Additionally, the rapid growth of online shopping is driving the need for efficient inventory management, dynamic pricing, and fraud detection, all powered by AI. As e-commerce continues to expand, online retailers are increasingly leveraging AI to optimize operations, drive sales, and provide tailored shopping experiences, further supporting the market dominance.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Customer Relationship Management (CRM)

- Supply Chain and Logistics

- Inventory Management

- Product Optimization

- In-Store Navigation

- Payment and Pricing Analytics

- Virtual Assistant

- Others

Customer relationship management (CRM) dominates with a market share of 18% of the total UK AI in retail market in 2025.

Customer relationship management (CRM) leads the market because of its ability to enhance client engagement and loyalty. AI-powered CRM systems leverage data analytics to offer personalized experiences, track client behavior, and improve marketing strategies, fostering long-term relationships.

Moreover, AI in CRM enables retailers to provide proactive individual service through automated support channels, such as chatbots, while analyzing user feedback to refine offerings. By delivering tailored experiences, CRM systems enhance client retention and satisfaction, making it a key application driving AI adoption in retail.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London, the capital city of the UK, is a major global financial, cultural, and technological hub. It boasts a diverse economy, thriving retail sector, and strong infrastructure, making it a focal point for AI adoption and innovation in retail.

The South East is a key economic region, encompassing counties like Surrey, Hampshire, and Berkshire. Known for its strong industries in technology, manufacturing, and retail, it plays a significant role in AI-driven retail transformation across various sectors.

The North West, which includes cities like Manchester and Liverpool, has a growing digital economy. Its diverse industrial base, including retail, manufacturing, and logistics, contributes to the increasing adoption of AI technologies in retail businesses.

The East of England, including counties like Essex and Cambridgeshire, is known for its strong agricultural and technology sectors. With an expanding digital economy, this region is increasingly adopting AI in retail to optimize operations and client experiences.

The South West, home to cities like Bristol and Exeter, has a growing technology and innovation ecosystem. The region’s focus on sustainability and digital transformation is driving the adoption of AI in retail to enhance efficiency and customer engagement.

Scotland, with its robust economy centered around industries like finance, technology, and retail, is embracing AI for digital transformation. The increasing focus on data analytics and individual personalization in retail positions Scotland as a growing player in AI adoption.

The West Midlands, including Birmingham and Coventry, is a key industrial hub with a focus on manufacturing, automotive, and retail sectors. AI technologies are increasingly integrated into retail businesses in this region to optimize operations and enhance consumer experiences.

Yorkshire and The Humber, comprising cities like Leeds and Sheffield, are becoming prominent in the UK’s retail sector. With a growing tech ecosystem, AI is being widely adopted in retail for improved customer service, marketing, and operational efficiency.

The East Midlands, including cities like Nottingham and Leicester, has a diverse economy with strengths in retail, manufacturing, and logistics. The region is increasingly utilizing AI technologies to enhance customer experiences, streamline retail operations, and optimize supply chains.

Others include regions outside the main UK cities and areas with emerging digital and retail ecosystems. These regions are increasingly adopting AI in retail, driven by local innovation, government initiatives, and the growing importance of data-driven decision-making.

Market Dynamics:

Growth Drivers:

Why is the UK AI in Retail Market Growing?

Personalized Shopping Experiences through AI Assistants

The increasing use of AI-powered virtual assistants, which provide personalized product recommendations and enhance individual interaction, are revolutionizing online shopping. By leveraging advanced algorithms, retailers can offer tailored experiences based on individual preferences and trends. Integrating these AI tools with existing platforms, such as after-sales services and social media channels, improves client engagement and satisfaction, driving the demand for AI solutions in the retail sector. For example, in 2025, Mango launched an AI-powered virtual fashion assistant, Mango Stylist, for its womenswear lines in nine countries, including the UK. The tool uses advanced algorithms to provide personalized product recommendations based on user preferences and trends. It also integrates with Mango's existing after-sales assistant, Iris, enhancing the online shopping experience via chat on e-commerce and Instagram.

AI-Driven Compliance and User Engagement Solutions

As retailers face stricter regulations, AI solutions help businesses adapt by automating compliance processes and improving communication with clients. These platforms provide an efficient way to navigate complex legal frameworks while ensuring effective marketing strategies, thereby contributing to the market growth as businesses seek scalable and intelligent ways to remain compliant. In line with this trend, in 2025, ShopAi launched TalkPack, the first QR code-activated conversational AI platform in the UK, designed for high in fat, salt, or sugar (HFSS) brands. This tool helps companies navigate new UK regulations by enabling compliant consumer engagement, replacing traditional promotional methods that will be banned by 2026. TalkPack integrates conversation intelligence and digital marketing performance modeling, ensuring ASA compliance and offering scalable implementations.

In-Store Shopping Efficiency

The adoption of AI technologies, such as real-time product finders, is improving store navigation and streamlining the shopping process, especially during peak times. By optimizing efficiency and reducing client frustration, these innovations not only elevate the shopping experience but also increase individual satisfaction, thereby driving the demand for AI solutions that integrate seamlessly with physical retail environments. In 2025, Morrisons partnered with Google Cloud to launch an AI-powered Product Finder, improving in-store shopping by helping customers quickly locate products. Built using Gemini AI models and Google Cloud's BigQuery and Cloud Run, the tool provides real-time aisle and product location data. This innovation enhances efficiency, particularly during busy periods or store layout changes, with 50,000 daily uses recorded during Easter.

Market Restraints:

What Challenges the UK AI in Retail Market is Facing?

Data Privacy and Regulatory Compliance Concerns

The UK’s data protection regulations and other evolving privacy laws create significant compliance challenges for retailers deploying AI systems. These regulations impose strict requirements on how individual data is collected, stored, processed, and shared, making it complex for retailers to implement AI-driven solutions. To maintain regulatory compliance while still offering personalized shopping experiences, retailers must invest heavily in robust data governance infrastructure, advanced privacy-preserving AI techniques, and comprehensive training for staff on data protection.

High Implementation Costs and Integration Complexity

Implementing comprehensive AI retail solutions can be financially burdensome, requiring significant investments in technology infrastructure, software platforms, and specialized talent. Retailers must procure advanced AI tools, which demand considerable capital. Moreover, integrating these AI systems with existing retail infrastructure can be complex, requiring a deep understanding of both technological and operational needs. Smaller retailers, with limited resources, often struggle to compete with larger enterprises that can afford expensive, enterprise-grade AI platforms and the necessary teams of data scientists to drive implementation, optimization, and continuous improvement of these systems.

Fragmented Data Systems and Quality Issues

One of the major challenges UK retailers face when adopting AI is the fragmentation of their data systems, often due to legacy technology. Many retailers rely on outdated systems that create data silos, making it difficult to achieve a unified, 360-degree view of customers across channels. This fragmented data environment reduces the effectiveness of machine learning models, as inconsistent data quality from various sources leads to inaccurate or incomplete insights.

Competitive Landscape:

The UK AI in retail market exhibits moderate competitive intensity characterized by the presence of established global technology corporations alongside innovative startups offering specialized solutions. Market dynamics reflect strategic positioning ranging from comprehensive enterprise platforms emphasizing full-stack AI capabilities to targeted solutions addressing specific retail challenges, such as demand forecasting, client personalization, or visual search. The competitive landscape is increasingly shaped by partnership strategies, with retailers forming strategic alliances with technology providers to accelerate AI implementation timelines. Cloud-based delivery models have democratized access to sophisticated AI capabilities, enabling mid-market retailers to deploy solutions previously available only to enterprise-scale operations.

Recent Developments:

- In October 2025, Tata Consultancy Services (TCS) extended its 15-year partnership with UK retailer Kingfisher to drive AI-powered transformation. The collaboration will focus on improving operational efficiency and customer experience across Kingfisher's 1,900 stores across seven countries in the UK and Europe.

- In August 2025, Amazon launched Rufus, a generative AI-powered conversational shopping assistant for UK customers. Available in the Amazon Shopping app and on desktop, Rufus helps users with product research, comparisons, and personalized recommendations, seamlessly integrated into the shopping experience. The AI aims to enhance decision-making and simplify the shopping journey for Amazon users.

UK AI in Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Technologies Covered | Machine Learning, Natural Language Processing, Chatbots, Image and Video Analytics, Swarm Intelligence |

| Types Covered | Online Retail, Offline Retail |

| Applications Covered | Customer Relationship Management (CRM), Supply Chain and Logistics, Inventory Management, Product Optimization, In-Store Navigation, Payment and Pricing Analytics, Virtual Assistant, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK AI in retail market size was valued at USD 554.78 Million in 2025.

The market is expected to grow at a compound annual growth rate of 18.05% from 2026-2034 to reach USD 2,469.74 Million by 2034.

Solution dominates the market with a revenue share of 70.06% in 2025, driven by the growing demand for comprehensive AI platforms enabling personalization, demand forecasting, and user analytics capabilities across retail operations.

Key factors driving the UK AI in retail market include the growing adoption of AI for demand forecasting and improving inventory management. By predicting demand based on factors like events and promotions, AI optimizes stock availability, reduces waste, and enhances operational efficiency. In 2024, Waitrose expanded its AI-driven forecasting partnership with Blue Yonder to improve client satisfaction and streamline operations.

Major challenges include stringent data privacy regulations requiring robust compliance frameworks, high implementation costs and integration complexity, fragmented legacy data systems limiting AI effectiveness, talent shortages in specialized AI and data science roles, and the need for organizational change management to fully leverage AI capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)