UK Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

UK Air Freight Market Overview:

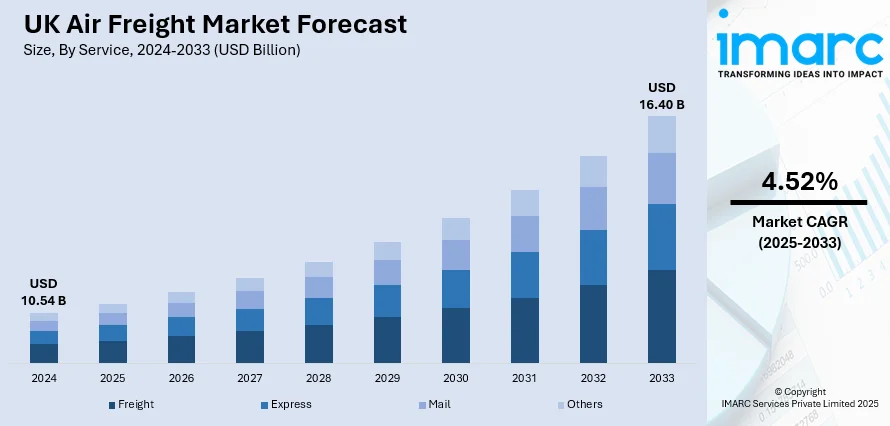

The UK air freight market size reached USD 10.54 Billion in 2024.The market is projected to reach USD 16.40 Billion by 2033, exhibiting a growth rate (CAGR) of 4.52% during 2025-2033. The market keeps growing steadily, as fueled by robust global trade flows, increasing volumes of e-commerce, and the need for time-sensitive delivery. Developments in logistics technology, such as automation and real-time tracking, continue to improve supply chain efficiency. The industry also enjoys growing transport of pharmaceutical and perishable products. Competitive strategies among major market players further drive the development of the market. Such factors combined are driving the ongoing growth of the UK air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.54 Billion |

| Market Forecast in 2033 | USD 16.40 Billion |

| Market Growth Rate 2025-2033 | 4.52% |

UK Air Freight Market Trends:

Hybrid Airships Emerging as Future Air Freight Solution

The emergence of hybrid airships is rapidly becoming a defining feature of the evolving UK air freight market. In February 2025, Hybrid Air Vehicles (HAV) announced significant progress on the Airlander 10, a hybrid airship-airplane designed to transport cargo and passengers with enhanced efficiency. The Airlander 10 can carry up to 10 tonnes of freight or 130 passengers at speeds of approximately 90 mph. Its unique capability to operate from short runways or unpaved surfaces, such as grassland airstrips enables direct access to remote or underserved regions, including parts of the Scottish Highlands, where conventional air freight services face operational limitations. Furthermore, its hybrid design, combining aerodynamic lift with buoyant support, allows for a considerable reduction in fuel consumption and emissions. The airship also holds future potential for zero-emission hydrogen propulsion, further aligning with industry decarbonisation goals. Production is scheduled to begin by 2030 in Doncaster, with a planned annual output of 24 units. As sustainability and flexibility gain priority, hybrid airships offer a transformative solution, contributing meaningfully to UK air freight market trends through innovative, low-emission regional freight capabilities.

To get more information on this market, Request Sample

SAF Adoption Accelerates in UK Air Freight

The adoption of Sustainable Aviation Fuel (SAF) is becoming a cornerstone of the UK air freight sector’s decarbonization efforts. In January 2025, the UK government launched its SAF mandate, requiring 2 percent of all fuel used for departures to come from sustainable sources, a key step toward achieving net zero aviation emissions by 2050. To support this transition, the Department for Transport initiated consultations in March 2025 on revenue certainty mechanisms aimed at encouraging domestic SAF production, securing investment, and generating employment in the green energy sector. Industry stakeholders are responding swiftly. Farnborough Airport, for instance, signed a major agreement to procure 12.5 million litres of SAF, establishing itself as an early leader in sustainable fuel adoption. Additionally, freight operators are forming strategic partnerships with fuel suppliers to build resilient SAF supply chains. These developments highlight a unified shift toward cleaner aviation fuels, reinforcing SAF’s growing role in shaping the future of UK air cargo.

Drone Networks Transforming Remote Freight Delivery

Unmanned aerial vehicles (UAVs) are emerging as a pivotal trend within the UK air freight market, particularly for remote and high-frequency delivery routes. In April 2025, the UK Civil Aviation Authority (CAA) announced reforms permitting routine beyond-visual-line-of-sight (BVLOS) drone flights, enabling nationwide commercial use including NHS medical supply delivery and logistics services to remote areas such as the Scottish Highlands. Following earlier trials like Skyports and Royal Mail’s drone services in Orkney, these regulatory changes are expected to catalyse a significant expansion of drone networks in the UK. These innovations promise rapid, predictable freight delivery for lightweight goods complementing traditional air and road transport and improving resilience during supply chain disruptions. Moreover, leading players such as Windracers have developed long-range cargo drones capable of flying up to 1,000 km and transporting 100 kg payloads, validated in challenging environments including Antarctica and Ukraine. As drone regulation matures and UAV technology proves operationally reliable, the aviation ecosystem is preparing for a hybrid freight model where air, road, and autonomous drones collaborate driving UK air freight market growth through increased accessibility, speed, and cost efficiency.

UK Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

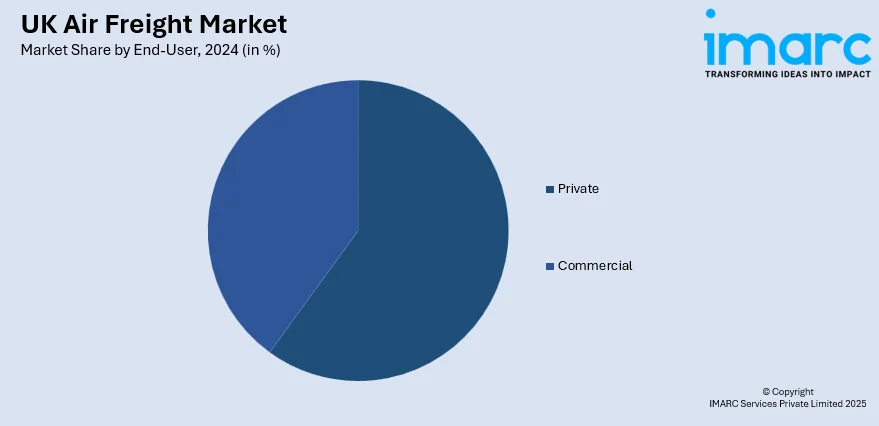

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private and commercial.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Air Freight Market News:

- In June 2025: The British International Freight Association (BIFA) has signed a Memorandum of Understanding with the Ethiopian Freight Forwarders and Shipping Agents Association (EFFSAA) in Addis Ababa. The strategic partnership focuses on strengthening EFFSAA’s institutional capacity, providing technical and commercial advisory support, and delivering specialised training programmes. The agreement also facilitates knowledge and resource exchange between the two associations. EFFSAA President Dawit Woubishet emphasised the move will foster workforce development and global trade linkages, while BIFA Director General Steve Parker highlighted its potential to open new opportunities for members of both organisations.

- In May 2025: ZeroAvia, in collaboration with RVL Aviation and aircraft lessor MONTE, announced plans to launch the world’s first hydrogen-electric cargo flights from East Midlands Airport. The project features ZeroAvia’s ZA600 hydrogen-electric powertrain, retrofitted onto Cessna Caravan aircraft, and is supported by emerging liquid hydrogen infrastructure. Targeting certification and operational launch within 2025, the initiative marks a major step toward zero-emission air freight and advances hydrogen-powered aviation for broader commercial application.

UK Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air freight market in UK was valued at USD 10.54 Billion in 2024.

The UK air freight market is projected to exhibit a (CAGR) of 4.52% during 2025-2033, reaching a value of USD 16.40 Billion by 2033.

The market is driven by growing world trade, fast-growing e-commerce, and the need for express carriage of high-value and perishable shipments. Growth in global supply chains and just-in-time logistics increases dependency on air cargo. Next-generation tracking technologies, cold chain capacity, and airport infrastructure investments also improve the efficiency and competitiveness of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)